The impact of the COVID-19 pandemic was significant on the myomectomy market. With the surge of COVID-19 cases worldwide, healthcare services diverted their resources toward patients suffering from COVID-19. Guidelines and recommendations were provided for the management of patients during the pandemic. This resulted inmic. This resulted in hospitals prioritizing emergency procedures and delaying or postponing elective procedures, such as myomectomy surgery, leading to a backlog of patients waiting for their surgeries for months. For instance, according to an article published by the Lancet Rheumatology in February 2021, during the initial pandemic, many countries made the necessary decision to cancel all non-emergency surgical procedures to free up personnel and resources to care for patients with COVID-19 and extended wait times for elective surgeries was but one of the big problems that healthcare systems faced during the pandemic. However, as the pandemic conditions have returned to normal, myomectomy procedures are expected to recover gradually, and the market is expected to have stable growth during the forecast period of the study.

An increase in the number of patients suffering from uterine fibroids is anticipated to be the key factor contributing to the growth of the myomectomy market. According to an article published by the International Journal of Reproduction, Contraception, Obstetrics, and Gynecology in July 2022, a study was conducted in India which showed that the incidence of fibroids is most common in 31-40 years of age, which is around 34.9%. The most commonly observed symptom for uterine fibroids was abdominal lump (41%) and abnormal uterine bleeding (24.1%). The prevalence of submucosal fibroids was 38.6%, intramural fibroids 19.3%, submucosal polyp 14.5%, seedling fibroid 13.9%, and subserosal fibroid 10.2%. Additionally, a rise in minimally invasive surgical procedures due to fewer complications and reduced hospital stays is anticipated to grow the market. Technological advancements, such as the rise in robotic and laparoscopic-assisted surgeries to deliver quality and efficient treatment, may also contribute to the growth of the myomectomy market.

According to an article published by MIS Journal in December 2021, uterine fibroids are considered a common benign smooth muscle tumor of the uterus that affects almost 70% of women until menopause. Risk factors of uterine fibroids include ethnicity, parity, early menarche, late menopause, family history, obesity, and hypertension. The presence of uterine fibroids is rarely life-threatening. Still, they are often associated with symptoms affecting the quality of life, such as abnormal bleeding, pelvic pain, and urinary tract problems. The article also stated that robotic myomectomy has many advantages in uterine fibroid removal, such as lower blood loss, fewer complications, and shorter hospital stays over open surgery. The advantages of the wristed instruments, three-dimensional vision, and the incorporation of correct surgical techniques also emphasize the benefits of the robotic-assisted approach in large and numerous cases. Thus, the high burden of uterine fibroids and the increasing advantages of technologically advanced myomectomy procedures are also expected to boost market growth.

Hence, the factors above, such as the rising prevalence of uterine fibroids and the increasing advantages of technologically advanced myomectomy procedures, are expected to boost the market growth. However, the higher costs of new medical devices and complications associated with the procedure might restrict the growth of the studied market.

Myomectomy Market Trends

Laparoscopic Segment is Expected to Hold a Significant Market Share over the Forecast Period

Laparoscopic myomectomy is a surgical procedure where the surgeon makes a small incision in or near the belly button. Then a laparoscope is inserted, a narrow tube fitted with a camera into the abdomen. Laparoscopic myomectomy has several advantages such as less blood loss, shorter hospital stays, faster recovery, and lower complications and adhesion formation rates after surgery. Thus, the increasing advantages of laparoscopic myomectomy are expected to boost segment growth. Moreover, the increasing prevalence of uterine fibroids and the rising technological advancements in the laparoscopic myomectomy procedure are also expected to boost segment growth.According to an article published by PubMed Central in September 2022, laparoscopic myomectomy is one of the common procedures for uterine fibroids removal. Also, the article stated that a study showed that laparoscopic myomectomy combined with comprehensive rehabilitation nursing effectively reduced the postoperative stress state of patients with uterine fibroids, improved patient satisfaction, reduced adverse emotions, and promoted rehabilitation. Thus, the increasing advantages of laparoscopic myomectomy are a major factor driving the segment growth.

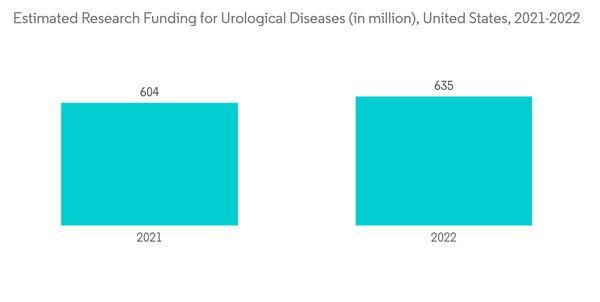

Furthermore, the rising prevalence of uterine fibroids is a major factor driving the market's growth. For instance, according to the data updated by the United Kingdom NHS in September 2022, uterine fibroids were common, with around 2 in 3 women developing at least 1 fibroid at some point in their life, and they most often occured in women aged 30 to 50. Thus, the high prevalence of uterine fibroids is expected to boost the adoption of laparoscopic myomectomy during the forecast period of the study. Moreover, the increasing research on urological diseases is also expected to boost segment growth in the forecast period.

Hence, the abovementioned factors such as the increasing advantages of laparoscopic myomectomy, the increasing research on urological diseases, and the rising prevalence of uterine fibroids are expected to enhance the segment growth over the forecast period.

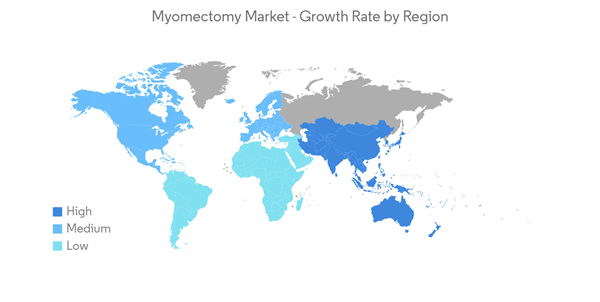

North America is Expected to Hold a Significant Share in the Myomectomy Market Over the Forecast Period

North America is expected to hold a significant share of the myomectomy market over the forecast period due to the rising prevalence of uterine fibroid and technological advancements in myomectomy procedures.According to the data updated by the United States Office on Women's Health in February 2021, it was estimated that about 20 percent to 80 percent of women developed fibroids by the time they reached age 50. Uterine fibroids are said to be most common in women in their 40s and early 50s, and not all women with fibroids have symptoms, but women who do have symptoms often find fibroids hard to live with. Thus, the high burden of uterine fibroids in the United States is expected to boost market growth.

Furthermore, according to an article published by Taylor & Francis Online in December 2022, uterine fibroids (UF) were said to be noncancerous growths of the uterus and impact the livelihood of over 26 million women in the United States. Although UF may not have accompanying symptoms, their presence leads to surgical treatment for some women. Thus, the high prevalence of uterine fibroids is expected to boost market growth.

Hence, the abovementioned factors, such as the rising prevalence of uterine fibroids, are expected to enhance the market growth in the region over the forecast period.

Myomectomy Industry Overview

The myomectomy market remains highly competitive, with major players dominating the market. Technological advancements and product innovations will likely provide new opportunities for the players to compete within the market. The rise in laparoscopic and robotic-assisted myomectomy procedures due to their advantages over traditional methods may drive the market's growth. Some of the major players include Medtronic PLC, Stryker Corporation, ConMed Corporation, INSIGHTEC Ltd, CooperSurgical Inc., Hologic Inc., KARL STORZ SE & Co. KG, B Braun, Richard Wolf Medical Instruments, and Minerva Surgical Inc.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Medtronic plc

- Stryker Corporation

- ConMed Corporation

- INSIGHTEC Ltd

- CooperSurgical Inc.

- Hologic Inc.

- Intuitive Surgical Inc.

- KARL STORZ SE & Co. KG

- B Braun

- Richard Wolf Medical Instruments

- Minerva Surgical Inc.