Smart baby monitors are devices that enable parents to monitor their baby’s activities, such as sleeping patterns and health. Factors such as the rising number of nuclear families and working parents are anticipated to drive market growth during the forecast period.

Moreover, growing awareness and rising demand for infant protection are expected to increase the demand for smart baby monitor devices. Improvements in living standards and disposable income have bolstered the need for modern solutions to stimulate real-time interaction with babies, which is significantly driving the market expansion.

Furthermore, ongoing innovations by major market players have provided new growth prospects for the market. For instance, the Infant Optics “DXR-8 PRO” monitor, with its compact, sleek design, provides high-quality video and audio capabilities and an improved range.

Likewise, seeing its growing potential, various startups are entering the market by raising investments to develop their smart baby monitoring solutions. The growing market's lucrativeness is also acting as an additional driving factor for the overall growth.

Smart Baby Monitor Market Drivers:

Growing nuclear families are driving the market expansion.

Nowadays, both parents are working and hence need more time for themselves and their children. This has further raised the possibility that parents can provide full attention to their child’s upbringing despite their busy schedules.Hence, manufacturers worldwide have immense opportunities to manufacture smart devices like smart baby monitors that assist parents in conveniently raising their little ones. For instance, in May 2022, VTech announced the availability of its “LeapFrog” baby monitors at major retailers in the US. The products have features such as smart remote monitoring, color night vision, high-definition video, and adaptive color lights.

In many parts of the world, evidence indicates that there is a declining trend for extended households and an increasing trend for nuclear or single households. For example, as per the United Nations information, in countries like Cameroon, Ethiopia, Uganda, Nigeria, and Zambia, there is a decreasing trend in the prevalence of extended-family households, while a surge in nuclear family households was observed.

Smart Baby Monitor Market Segmentation Analysis

Wireless monitoring is expected to account for a significant share.

Based on connectivity, the smart baby monitor is segmented into wireless and wired. The former is set to show significant growth owing to its highly flexible installation and portable features. Rapid technological advancements in wireless connectivity are also expected to drive the wireless smart baby monitor segment growth.Wireless technologies such as Wi-Fi, LTE, and so forth are getting incorporated into baby monitoring technologies to establish a closer bond between parents and their children. Likewise, market players' new product innovations and launches have propelled the segment’s growth. For example, in May 2022, Vtech Communications announced the availability of its “LeapFrog” in the USA, which came in seven modules inclusive of smart video baby monitors.

Moreover, the growing adoption of 5 G globally has further bolstered the wireless connectivity requirements. For instance, Nokia, in its April 2022 press release, mentioned the launch of its 5G Open Lab to accelerate private wireless network adoption in Korea. The growing efforts to ease the portability and applicability of wireless technology in baby monitoring are anticipated to majorly drive segment growth during the forecast period.

Asia Pacific will hold a considerable market share.

Geography-wise, the Asia Pacific region is anticipated to account for a considerable market share. This is attributable to the growing population in major regional economies such as China and India, which is anticipated to drive the demand for smart baby monitoring solutions.Rapid urbanization has propelled the demand for modern technologies for looking after young ones, which has been furthered by the growing number of working women in major regional economies, namely Japan, South Korea, China, and India. As people are getting more concerned about the safety of their babies, with hectic daily life routines, the demand for smart baby monitors in China is rising at a noteworthy rate. The increasing number of people active on social media and the highly growing e-commerce industry in China are also contributing significantly to the growing smart baby monitor market in this country.

Smart Baby Monitor Market Key Developments

- January 2024: Owlet Inc. launched its smart infant monitoring solutions “DreamStock” and “BabySat,” both of which have got FDA clearance. Both the products offer parents a medical-grade accuracy for their baby’s well-being.

- September 2023: Vtech launched the “V-Care VC2105 Smart Nursery Baby Monitor,” which uses local AI capabilities to ensure parents keep a constant check on their babies. In addition to monitoring, the product features sleep analytics, which provide real-time data regarding a baby’s sleep frequency.

- August 2023: Hubble Connected formed a strategic partnership with Babies R’Us to be the latter’s key for its smart baby monitor products, including “Nursery Pal Dual Vision,” “Nursery Pal Deluxe,” “Nursey Pal Cloud,” and “Cloud Twin,” among others, at the American Dream Mall in New Jersey.

- August 2023: Masimo launched its Stock smart home baby monitoring system in the US. The system will enable caregivers and parents to have continuous and accurate views of their baby. The product is equipped with non-invasive sensing technology that provides continuous health tracking of the baby.

- September 2022: Hubble Connected launched “The Hubble Connected Nursery Pal Dual Vision Baby Monitor”, “Hubble Connected Guardian+”, “Guardian Cam”, and “Guardian Pro” among other series of products meant to protect, soothe and keep a constant check on babies.

The Smart Baby Monitor market is segmented as:

By Product Type

- Audio

- Video

- Tracking Devices

By Connectivity

- Wireless

- Wired

By Application

- Home/Family

- Commercial

- Daycare

- Hospitals

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Others

Table of Contents

Companies Mentioned

- Kuebix

- Lorex Technology Inc.

- VTech Holdings Limited

- Kids 2 Inc.

- Angelcare Monitor Inc.

- Motorola Mobility LLC.

- iBaby Labs, Inc.

- Dorel Industries Inc.

- BT Group

- Koninklijke Philips N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 105 |

| Published | July 2024 |

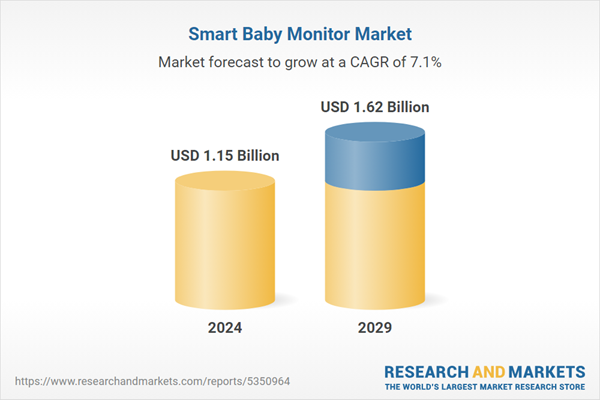

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 1.15 Billion |

| Forecasted Market Value ( USD | $ 1.62 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |