Speak directly to the analyst to clarify any post sales queries you may have.

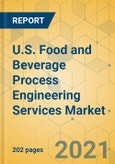

The U.S. food and beverage process engineering services market by revenue is expected to grow at a CAGR of over 5.36% during the period 2020-2026.

The food processing plants in the US are witnessing a renewed investment as these facilities are willing to modernize the existing facility to remain competitive. F&B industry is one of the largest energy-consuming industries in the US. Services specializing in energy management are expected to be in the limelight during the forecast period. Organizations can effectively address it by designing and developing simple and accountable measures to reduce the carbon footprint and environmental impact. The adoption of artificial intelligence is offering accurate and reliable results for packaging lines with greater consistency.

The following factors are likely to contribute to the growth of the U.S. food and beverage process engineering services market during the forecast period:

- Growing Automation in F&B Industries

- Increasing Opportunities in RTE and Pet Food Industries

- The rise in Wastewater Management Policies

- Adoption of Digitalization Tools in the F&B Industry

U.S. FOOD AND BEVERAGE PROCESS ENGINEERING SERVICES MARKET SEGMENTATION

The U.S. food and beverage process engineering services market research report includes a detailed segmentation by service area, end-user, geography. Process and packaging lines in a food and beverage unit are a major source of the facility’s profitability. The vendors have expertise in analyzing the packaging design requirements, prototype development, stability and compatibility testing, and cost estimations. Cost optimization is a major factor expected to boost the demand for packaging process engineering services in food and beverage facilities during the forecast period. The F&B facilities in the US actively look for service providers who can offer rapid prototyping services while addressing the essential process audits.

A broad range of engineered services is offered to meat, poultry, and seafood industries across the US. With the recent trends indicating the rise in per capita consumption of egg and seafood, the expansion of the industry can be more significant especially post 2021, owing to the pandemic impact. Food Plant Engineering offers a vast range of solutions to design, build and construct meat, poultry, and seafood plants.

Segmentation by Service Area

- Process and Packaging

- Building and Infrastructure

- Control Systems

- Energy

- Water and Waste Management

- Custom and Other Services

Segmentation by End-User

- Meat, Poultry, and Seafood

- Packaged Beverages and Liquids

- Dairy

- RTE

- Bakery & Confectionery

- Animal Food Production and Processing

- Frozen Foods, and Others

INSIGHTS BY GEOGRAPHY

Cities like Wisconsin have been recognized for their technological advancements in nutritional standards and food manufacturing practices. With over USD 67 billion revenue generation in food processing sales, dairy, cheese, frozen foods segment offering new expansion opportunities. Gonnella Baking Company, Tyson, Ferrara Pan Candy Company, Hearthside Food Solutions, Koval Distillery, and Vienna Beef are some of the major F&B establishments in Chicago. Ninth Avenue Foods is planning to invest USD 103 million to build and equip a 260,000 square foot dairy and plant-based manufacturing unit in Columbus based on market expansion strategy in the region.

Segmentation by Region

- Midwest

- West

- Northeast

- South

COMPETITIVE LANDSCAPE

Prioritizing virtualization and concept design perspective tools like digital twinning and 3D mapping creates lucrative opportunities for the players to grow in the US's food and beverage process engineering services market. Factors such as service portfolio, client satisfaction, partnership, flexibility and openness, tailored and sustainable approach, personnel management are expected to shape the market position of the service providers during the forecast period. The coordination between all stakeholders and professionals ensures the development and implementation of environmentally, socially, and economically sound design policies recommended to boom in the food and beverage industry.

Key Vendors

- POWER Engineers

- Matrix Technologies

- Pentair

- Plus Group

- Wright Process Systems

Other Prominent Vendors

- AMG

- Engineering USA

- ABM

- BSI Engineering

- Allurent Corporation

- EPIC Modular Process Systems

- Gray

- Stantec

- AFRY

- Agidens International NV

- Haskell

- Panorama Consulting & Engineers

- TAI

- Cannon

- Carmel Engineering

- Practical Engineering Solutions

- Deaton Engineering

- Fisher Construction Group

- Process Engineering Associates

- Fluor Corporation

- The Project Group Consulting

- Clayco

- Early Construction Company

- Design Group

- California Electrical Services

- Food Plant Engineering

- THE WEBBER/SMITH GROUP

- SSOE Group

- Bratney Companies

- Dennis Group

KEY QUESTIONS ANSWERED:

1. How big is the U.S. Food and Beverage Process Engineering Services Market?

2. What is the growth rate of the U.S. Food and Beverage Process Engineering Services Market?

3. What is the impact of COVID-19 on the F&B Process Engineering Services Market in the US?

4. Who are the major players in the F&B Processing Industry?

5. What are the significant market trends in US F&B Industry?

Table of Contents

Companies Mentioned

- POWER Engineers

- Matrix Technologies

- Pentair

- Plus Group

- Wright Process Systems

- AMG

- Engineering USA

- ABM

- BSI Engineering

- Allurent Corporation

- EPIC Modular Process Systems

- Gray

- Stantec

- AFRY

- Agidens International NV

- Haskell

- Panorama Consulting & Engineers

- TAI

- Cannon

- Carmel Engineering

- Practical Engineering Solutions

- Deaton Engineering

- Fisher Construction Group

- Process Engineering Associates

- Fluor Corporation

- The Project Group Consulting

- Clayco

- Early Construction Company

- Design Group

- California Electrical Services

- Food Plant Engineering

- THE WEBBER/SMITH GROUP

- SSOE Group

- Bratney Companies

- Dennis Group

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 202 |

| Published | June 2021 |

| Forecast Period | 2020 - 2026 |

| Estimated Market Value ( USD | $ 2.77 Billion |

| Forecasted Market Value ( USD | $ 3.79 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | United States |

| No. of Companies Mentioned | 35 |