The reusable straw market is gaining momentum due to the increasing awareness about environmental issues, particularly plastic pollution. Bans and restrictions issued by governments and organizations regarding the use of single-use plastics propel consumers toward adopting eco-friendly alternatives such as reusable straws. Consumers increasingly began focusing on choices concerning lifestyle and sustainability, which increased demand for reusable products. Material innovation advancement expanded options to include stainless steel, silicone, bamboo, and glass straws for durability, aesthetics, and versatility. Reusability straws, mostly with accessories such as cleaning brushes and travel cases that further enhance portability and cleaning ease, further increase their attractiveness. Moreover, social media campaigns and endorsements from socially conscious influencers also raise interest among consumers. Businesses, especially those in the food and beverage industry, are taking up reusable straws for sustainability purposes, which would further fuel the reusable straw market growth.

The United States emerged as a key regional market for reusable straw. Growing awareness about environmental issues as well as government actions taken to regulate single-use plastics have given an impetus to reusable straw sales across the United States. By banning or otherwise restricting the sale of plastic straws across many states and cities, consumers and businesses alike have seen an impetus to go sustainable. Regulations have provided an impetus to use more reusable straws in all of the US. Consumers are very environmentally conscious and tend to have a lot of demand for eco-friendly, reusable products. Market factors are also driven by environmental activism and wide-scale social media advocacy regarding sustainable living. Retailers and restaurants have not been left behind either as they are providing reusable straws as part of the strategies for adopting green practices. The combination of regulatory support, consumer awareness, and business initiatives makes the United States a key market for reusable straws.

Reusable Straw Market Trends:

Rising environmental concerns

Growing concern for the environment is the most prominent factor for the growth of reusable straws market size. Single-use plastic straws are among the primary pollutants of oceans, and single-use plastic straws and other waste can destroy marine life. It is reported that plastic makes up 80% of all ocean pollution, and approximately 8 to 10 Million Metric Tons of plastic end up in the ocean annually. Others also offer reusable straws through eco-friendly materials such as stainless steel, glass, or even bamboo and silicone, and are gaining popularity owing to increased environmental awareness about the part of consumers, so demand for eco-products becomes larger. For example, recently in 2021 Mizu, a California-based company that produces stainless bottles and is exclusively distributed by Ueni Trading Company from Japan, announced the available reusable straws on the company's official online portal. Governments and organizations worldwide are also enacting bans and regulations on single-use plastics, which in turn will create a fueling factor to the market for sustainable options such as reusable straws.Regulations on single use plastics

Regulatory measures and outright bans for single-use plastics, and single-use straws in numerous regions worldwide, have been a significant driving force in the market for reusable straws. Many governments have introduced or are debating laws to ban or curtail the use of single-use plastic straws. Single-use plastic straws and drink stirrers are already banned in England from 1st October 2020. This regulatory environment is compelling businesses and consumers to shift to reusable alternatives in line with the new rules toward a cleaner environment. As a reaction to such bans, restaurants, cafes, and beverage companies are increasing the supply of reusable straws as part of their sustainability efforts. This legal framework fosters the acceptance of reusable straws, driving market growth.Technological advancements

The evolution of technologies in materials and manufacturing techniques is enhancing the development in the market for reusable straws. Now manufacturers create a variety of straws for different purposes, including a host of benefits such as longevity, flexibility, and temperature resistance. Innovative designs, such as telescopic and collapsible straws, are becoming extremely popular for on-the-go use. The market has also seen the emergence of smart straws with advanced functionalities that include temperature sensing and reminders to clean. For example, ELO is an innovative aluminum reusable straw solution with integration into a mobile application designed for creating awareness and acting toward the problem of plastic pollution. These technological inventions add more appeal and functionality to reusable straws. Consumers are attracted to it and increases market growth.Consumer demand for sustainable products

Consumers' preferences are shifting to products that are sustainable and eco-conscious, and reusable straws align with this trend. In doing so, more people go out of their way for products that have the minimum ecological footprint. McKinsey reports that 60 to 70% of its consumers say they are ready to pay a premium to accommodate a sustainable package. Reusable straws are "green" and come with long-term cost-cutting compared to single use. The demand for "green" choices is giving manufacturers and retailers a mandate to expand their offerings for reusable straws, propelling market growth. Besides, the availability of a variety of materials, sizes, and designs in reusable straws ensures the consumer can select based on specific preferences and lifestyle requirements.Reusable Straw Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global reusable straw market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, end user, and distribution channel.Analysis by Type:

- Stainless Steel Straw

- Reusable Plastic Straw

- Bamboo Straw

- Glass Straw

- Others

Analysis by End User:

- Residential

- HORECA

- Others

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In North America, for instance, environmental awareness runs high, with regulations regarding single-use plastics being at an all-time high. U.S. and Canadian consumers are on the looking for alternatives that bring them closer to sustainability and fulfill their desire to save the planet. This robust demand calls for stainless steel, silicone, and glass-based reusable straws. Restaurants, cafes, and food service establishments are growingly embracing reusable straws to be in line with sustainability initiatives and meet the local plastic straw bans. The factors that affect the market can be attributed to corporate social responsibility initiatives wherein businesses are offering brandable reusable straws as items for promotions.

The European market is fueled by rigorous environmental regulations, a deep-rooted sustainability culture, and increasing public awareness of plastic waste. Other places in Europe are at the forefront of single-use bans, which push the proliferation of reusable straws to grow amongst the consumer masses around. Thus far, consumers across Europe seek reusable alternatives as a preference to reduce plastic pollution across water, land, and air spheres and foodservice operators are emulating business as usually set toward providing reusable straws to all consumers alike to share in the design and resource variations taking precedence toward reusable straws.

Latin America is experiencing an increasing concern for reusable straws and the need to live more sustainably about environmental issues. Countries in the region are implementing plastic reduction policies and regulations, and it promotes the use of reusable straws. The market for straws is a combination of the most traditional materials, such as bamboo, and new ones such as silicone and stainless steel. Latin American consumers, especially urban ones, embrace reusable straws for their consumption and are pushing for them to be adopted in the food and beverage industry.

Emerging markets are seen in the Middle East and Africa regions, as sustainability and eco-friendly alternatives are growing in interest. Although the adoption of reusable straws is not widespread in this region, gradual steps are being taken toward reducing single-use plastics. Urban centers and tourist destinations in the Middle East, such as Dubai and Abu Dhabi, see increased use of reusable straws in hospitality establishments. In Africa, efforts to address plastic pollution are leading to the promotion of reusable straws as eco-friendly options.

Key Regional Takeaways:

United States Reusable Straw Market Analysis

In 2024, United States hold a market share of 78.80% for the reusable straw in North America. The ban of single use plastic straws in California, Maine, New Jersey, New York, Oregon, Rhode Island, Vermont, and Washington of several states of USA drives the reusable straws market. California is the first state to enact legislation that enforces a statewide ban on single-use plastics in big-box retailers. It has also been reported that the US alone uses about 500 Million straws each day. In return, the daily growth of consumption in straws keeps on enhancing. The market growth is driven by the increasing eco-friendliness of the population, particularly in urban areas, who prefer to use reusable straws. According to the Census Bureau, in 2020, around 265,149,027 people lived in urban areas of the United States, making up 80% of the population. Also, population density in urban areas rose by 9.0% from 2010 to 2020. Correspondingly, the growing trend of sustainability is forcing restaurants and cafes to replace disposable straws with reusable ones by environmentally friendly standards.Europe Reusable Straw Market Analysis

European Union policy- such as the Single Use Plastics Directive aimed at reducing plastic waste has positively influenced the market. Most EU countries also enforced a ban on plastic straws. Reusable straws are also encouraged in tourist-geared places of Spain and Italy to help minimize plastic pollution that contributes to the market's expansion in the European region. In its recent report, the Spanish government said that during the first ten months of 2024, Spain welcomed more than 82.8 Million international visitors, a growth rate of 10.8% compared to the similar time in 2023. Meanwhile, spending by tourists in October was recorded at €11.898 Billion (USD 12.610 Billion), also a rise of 15.5% year-on-year. More so, arrivals increased by 9.5%, reaching more than 8.9 Million in October. In line with this, reports show that Italy's Travel & Tourism sector contributed USD 251.55 Billion, accounting for 10.5% of the nation's total economic output in 2023, reinforcing its critical role in Italy's economy.Asia Pacific Reusable Straw Market Analysis

Rapid urbanization and a rising middle-class population are driving the reusable straw market growth across the region. As per the India Brand Equity Foundation (IBEF), Indian rich households earn more than ₹2 crore (around USD 242,709) annually. This rose from USD 1.06 Million in 2016 to 1.8 Million in 2021. To that effect, according to the Central Intelligence Agency (CIA), in 2023, the total population of India had an urbanized population of 36.4%. Further, the cities across India are mainly composed of New Delhi (32.941 Million), Mumbai (21.297 Million), Kolkata (15.333 Million), Bangalore (13.608 Million), Chennai (11.776 Million), and Hyderabad (10.801 Million). Also, reusable straws are on the rise significantly in the urban food chains and cafes of burgeoning markets like China and India.Latin America Reusable Straw Market Analysis

Increased environmental issues awareness and efforts to minimize plastic usage drive the adoption of reusable straws as alternatives in place of single-use plastic straws in urban settings throughout Latin America. The Central Intelligence Agency states that, as of 2023, urban residents represent 87.8% of the population in Brazil. Similarly, the Central Intelligence Agency (CIA) shows that in 2023, urban residents accounted for 81.6% of Mexico's total population. Moreover, local festivals are actively promoting reusable products to reduce environmental impact which is stimulating market growth.Middle East and Africa Reusable Straw Market Analysis

The region's thriving tourism industry has led to a rise in the use of reusable straws, thereby expanding the market for these products. The Ministry of Economy reported that in 2022, the travel and tourism sector accounted for approximately USD 45.09 Billion in the GDP of the UAE, thus comprising 9% of the total GDP. In the same year, the overall spending of international tourists accounted for USD 32.01 Billion. The number of hotels in the UAE increased to 1,189, and hotel capacity in the country went up to 203,000 rooms.Competitive Landscape:

Market players in the business of reusable straws have been keenly innovating, sustainably, and strategically partnering to strengthen their market presence. Companies are creating a variety of products from bamboo to stainless steel, glass, and silicone aimed at all kinds of consumer preferences. Customized engraved designs and personalized packaging are in high demand as companies look to innovate and stand out. Many manufacturers are aligning with environmental movements, stating that their products are 'eco-friendly' solutions against plastic waste. Partnerships with retail chains, e-commerce platforms, and HORECA businesses have increased the access and visibility of the product. Furthermore, targeted marketing campaigns, influencer endorsements, and competitive pricing are some of the strategies adopted to attract the environmentally conscious consumer and thereby expand their market share in the global market.The report provides a comprehensive analysis of the competitive landscape in the reusable straw market with detailed profiles of all major companies, including:

- Eco-Products, Inc

- EcoStraws Ltd

- Crate and Barrel

- Eco Imprints

- Ever Eco

- The Final Co. LLC

- Greens Steel

- Jungle Straws/Jungle Culture (Chalk & Skinner Ltd)

- Klean Kanteen

- Koffie Straw

- Simply Straw

- Steelys Drinkware

- StrawFree.org

- Shopterrain.com LLC

- U-KONSERVE

Key Questions Answered in This Report

1. What is reusable straw?2. How big is the global reusable straw market?

3. What is the expected growth rate of the global reusable straw market during 2025-2033?

4. What are the key factors driving the global reusable straw market?

5. What is the leading segment of the global reusable straw market based on type?

6. What is the leading segment of the global reusable straw market based on end user?

7. What is the leading segment of the global reusable straw market based on distribution channel?

8. What are the key regions in the global reusable straw market?

9. Who are the key players/companies in the global reusable straw market?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the Study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Reusable Straw Market

5.1 Market Overview

5.2 Market Performance

5.3 Impact of COVID-19

5.4 Market Forecast

6 Market Breakup by Type

6.1 Stainless Steel Straw

6.1.1 Market Trends

6.1.2 Market Forecast

6.2 Reusable Plastic Straw

6.2.1 Market Trends

6.2.2 Market Forecast

6.3 Bamboo Straw

6.3.1 Market Trends

6.3.2 Market Forecast

6.4 Glass Straw

6.4.1 Market Trends

6.4.2 Market Forecast

6.5 Others

6.5.1 Market Trends

6.5.2 Market Forecast

7 Market Breakup by End-User

7.1 Residential

7.1.1 Market Trends

7.1.2 Market Forecast

7.2 HORECA

7.2.1 Market Trends

7.2.2 Market Forecast

7.3 Others

7.3.1 Market Trends

7.3.2 Market Forecast

8 Market Breakup by Distribution Channel

8.1 Supermarkets and Hypermarkets

8.1.1 Market Trends

8.1.2 Market Forecast

8.2 Convenience Stores

8.2.1 Market Trends

8.2.2 Market Forecast

8.3 Online

8.3.1 Market Trends

8.3.2 Market Forecast

8.4 Others

8.4.1 Market Trends

8.4.2 Market Forecast

9 Market Breakup by Region

9.1 Asia Pacific

9.1.1 China

9.1.1.1 Market Trends

9.1.1.2 Market Forecast

9.1.2 Japan

9.1.2.1 Market Trends

9.1.2.2 Market Forecast

9.1.3 India

9.1.3.1 Market Trends

9.1.3.2 Market Forecast

9.1.4 South Korea

9.1.4.1 Market Trends

9.1.4.2 Market Forecast

9.1.5 Australia

9.1.5.1 Market Trends

9.1.5.2 Market Forecast

9.1.6 Others

9.1.6.1 Market Trends

9.1.6.2 Market Forecast

9.2 North America

9.2.1 United States

9.2.1.1 Market Trends

9.2.1.2 Market Forecast

9.2.2 Canada

9.2.2.1 Market Trends

9.2.2.2 Market Forecast

9.3 Europe

9.3.1 Germany

9.3.1.1 Market Trends

9.3.1.2 Market Forecast

9.3.2 France

9.3.2.1 Market Trends

9.3.2.2 Market Forecast

9.3.3 United Kingdom

9.3.3.1 Market Trends

9.3.3.2 Market Forecast

9.3.4 Italy

9.3.4.1 Market Trends

9.3.4.2 Market Forecast

9.3.5 Spain

9.3.5.1 Market Trends

9.3.5.2 Market Forecast

9.3.6 Russia

9.3.6.1 Market Trends

9.3.6.2 Market Forecast

9.3.7 Others

9.3.7.1 Market Trends

9.3.7.2 Market Forecast

9.4 Latin America

9.4.1 Brazil

9.4.1.1 Market Trends

9.4.1.2 Market Forecast

9.4.2 Mexico

9.4.2.1 Market Trends

9.4.2.2 Market Forecast

9.4.3 Others

9.4.3.1 Market Trends

9.4.3.2 Market Forecast

9.5 Middle East and Africa

9.5.1 Turkey

9.5.1.1 Market Trends

9.5.1.2 Market Forecast

9.5.2 Saudi Arabia

9.5.2.1 Market Trends

9.5.2.2 Market Forecast

9.5.3 Iran

9.5.3.1 Market Trends

9.5.3.2 Market Forecast

9.5.4 United Arab Emirates

9.5.4.1 Market Trends

9.5.4.2 Market Forecast

9.5.5 Others

9.5.5.1 Market Trends

9.5.5.2 Market Forecast

10 SWOT Analysis

10.1 Overview

10.2 Strengths

10.3 Weaknesses

10.4 Opportunities

10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

12.1 Overview

12.2 Bargaining Power of Buyers

12.3 Bargaining Power of Suppliers

12.4 Degree of Competition

12.5 Threat of New Entrants

12.6 Threat of Substitutes

13 Competitive Landscape

13.1 Market Structure

13.2 Key Players

13.3 Profiles of Key Players

13.3.1 Eco-Products, Inc

13.3.1.1 Company Overview

13.3.1.2 Product Portfolio

13.3.2 EcoStraws Ltd.

13.3.2.1 Company Overview

13.3.2.2 Product Portfolio

13.3.3 Crate and Barrel

13.3.3.1 Company Overview

13.3.3.2 Product Portfolio

13.3.4 Eco Imprints

13.3.4.1 Company Overview

13.3.4.2 Product Portfolio

13.3.5 Ever Eco

13.3.5.1 Company Overview

13.3.5.2 Product Portfolio

13.3.6 The Final Co. LLC

13.3.6.1 Company Overview

13.3.6.2 Product Portfolio

13.3.7 Greens Steel

13.3.7.1 Company Overview

13.3.7.2 Product Portfolio

13.3.8 Jungle Straws/Jungle Culture (Chalk & Skinner Ltd)

13.3.8.1 Company Overview

13.3.8.2 Product Portfolio

13.3.9 Klean Kanteen

13.3.9.1 Company Overview

13.3.9.2 Product Portfolio

13.3.10 Koffie Straw

13.3.10.1 Company Overview

13.3.10.2 Product Portfolio

13.3.11 Simply Straws

13.3.11.1 Company Overview

13.3.11.2 Product Portfolio

13.3.12 Steelys Drinkware

13.3.12.1 Company Overview

13.3.12.2 Product Portfolio

13.3.13 StrawFree.org

13.3.13.1 Company Overview

13.3.13.2 Product Portfolio

13.3.14 Shopterrain.com LLC

13.3.14.1 Company Overview

13.3.14.2 Product Portfolio

13.3.15 U-KONSERVE

13.3.15.1 Company Overview

13.3.15.2 Product Portfolio

List of Figures

Figure 1: Global: Reusable Straw Market: Major Drivers and Challenges

Figure 2: Global: Reusable Straw Market: Sales Value (in Billion USD), 2019-2024

Figure 3: Global: Reusable Straw Market: Breakup by Type (in %), 2024

Figure 4: Global: Reusable Straw Market: Breakup by End-User (in %), 2024

Figure 5: Global: Reusable Straw Market: Breakup by Distribution Channel (in %), 2024

Figure 6: Global: Reusable Straw Market: Breakup by Region (in %), 2024

Figure 7: Global: Reusable Straw Market Forecast: Sales Value (in Billion USD), 2025-2033

Figure 8: Global: Reusable Straw (Stainless Steel) Market: Sales Value (in Million USD), 2019 & 2024

Figure 9: Global: Reusable Straw (Stainless Steel) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 10: Global: Reusable Straw (Reusable Plastic) Market: Sales Value (in Million USD), 2019 & 2024

Figure 11: Global: Reusable Straw (Reusable Plastic) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 12: Global: Reusable Straw (Bamboo) Market: Sales Value (in Million USD), 2019 & 2024

Figure 13: Global: Reusable Straw (Bamboo) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 14: Global: Reusable Straw (Glass) Market: Sales Value (in Million USD), 2019 & 2024

Figure 15: Global: Reusable Straw (Glass) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 16: Global: Reusable Straw (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

Figure 17: Global: Reusable Straw (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 18: Global: Reusable Straw (Residential) Market: Sales Value (in Million USD), 2019 & 2024

Figure 19: Global: Reusable Straw (Residential) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 20: Global: Reusable Straw (HORECA) Market: Sales Value (in Million USD), 2019 & 2024

Figure 21: Global: Reusable Straw (HORECA) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 22: Global: Reusable Straw (Other End-Users) Market: Sales Value (in Million USD), 2019 & 2024

Figure 23: Global: Reusable Straw (Other End-Users) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 24: Global: Reusable Straw (Supermarkets and Hypermarkets) Market: Sales Value (in Million USD), 2019 & 2024

Figure 25: Global: Reusable Straw (Supermarkets and Hypermarkets) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 26: Global: Reusable Straw (Convenience Stores) Market: Sales Value (in Million USD), 2019 & 2024

Figure 27: Global: Reusable Straw (Convenience Stores) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 28: Global: Reusable Straw (Online) Market: Sales Value (in Million USD), 2019 & 2024

Figure 29: Global: Reusable Straw (Online) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 30: Global: Reusable Straw (Other Distribution Channels) Market: Sales Value (in Million USD), 2019 & 2024

Figure 31: Global: Reusable Straw (Other Distribution Channels) Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 32: Asia Pacific: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 33: Asia Pacific: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 34: China: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 35: China: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 36: Japan: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 37: Japan: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 38: India: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 39: India: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 40: South Korea: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 41: South Korea: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 42: Australia: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 43: Australia: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 44: Others: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 45: Others: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 46: North America: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 47: North America: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 48: United States: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 49: United States: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 50: Canada: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 51: Canada: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 52: Europe: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 53: Europe: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 54: Germany: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 55: Germany: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 56: France: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 57: France: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 58: United Kingdom: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 59: United Kingdom: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 60: Italy: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 61: Italy: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 62: Spain: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 63: Spain: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 64: Russia: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 65: Russia: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 66: Others: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 67: Others: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 68: Latin America: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 69: Latin America: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 70: Brazil: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 71: Brazil: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 72: Mexico: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 73: Mexico: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 74: Others: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 75: Others: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 76: Middle East and Africa: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 77: Middle East and Africa: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 78: Turkey: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 79: Turkey: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 80: Saudi Arabia: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 81: Saudi Arabia: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 82: Iran: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 83: Iran: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 84: United Arab Emirates: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 85: United Arab Emirates: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 86: Others: Reusable Straw Market: Sales Value (in Million USD), 2019 & 2024

Figure 87: Others: Reusable Straw Market Forecast: Sales Value (in Million USD), 2025-2033

Figure 88: Global: Reusable Straw Industry: SWOT Analysis

Figure 89: Global: Reusable Straw Industry: Value Chain Analysis

Figure 90: Global: Reusable Straw Industry: Porter’s Five Forces Analysis

List of Tables

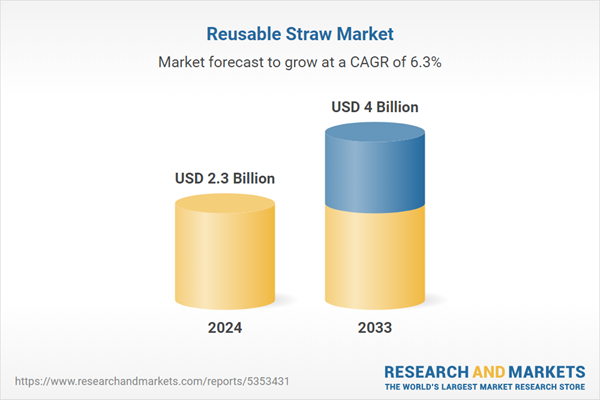

Table 1: Global: Reusable Straw Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Reusable Straw Market Forecast: Breakup by Type (in Million USD), 2025-2033

Table 3: Global: Reusable Straw Market Forecast: Breakup by End-User (in Million USD), 2025-2033

Table 4: Global: Reusable Straw Market Forecast: Breakup by Distribution Channel (in Million USD), 2025-2033

Table 5: Global: Reusable Straw Market Forecast: Breakup by Region (in Million USD), 2025-2033

Table 6: Global: Reusable Straw Market: Competitive Structure

Table 7: Global: Reusable Straw Market: Key Players

Companies Mentioned

- Eco-Products Inc

- EcoStraws Ltd

- Crate and Barrel

- Eco Imprints

- Ever Eco

- The Final Co. LLC

- Greens Steel

- Jungle Straws/Jungle Culture (Chalk & Skinner Ltd)

- Klean Kanteen

- Koffie Straw

- Simply Straws

- Steelys Drinkware

- StrawFree.org

- Shopterrain.com LLC

- U-KONSERVE

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 136 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 2.3 Billion |

| Forecasted Market Value ( USD | $ 4 Billion |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |