Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Water pumps are mechanical or electromechanical devices, which are used to create a pressure differential in order to transfer water via pipes or hoses. Electricity and other forms of power, such as gasoline engines, are used to power them. In rural settings, like the desert, they can also be powered by solar panels. Water pumps are currently widely used to deliver water across India in the municipal, industrial, agricultural, and residential sectors.

The India water pumps market is being driven by rapid urbanization, which is fueling strong development in both the home and commercial segments. The dependence on groundwater and the unpredictable nature of the monsoon are growing problems for agriculture, a key driver of economic growth. The country's use of water pumps will increase as a result of government attempts to enhance sanitation and water delivery services nationwide. The 'smart cities' initiative of the Modi administration would significantly increase India's need for water pumps.

The demand for efficient water pumps in the field to carry out different irrigation processes, including drip and sprinklers, has increased due to the rapid investments and development in India's agricultural activities. This in turn serves as one of the main drivers of the India water pumps market's expansion. Moreover ,The Government of India (GoI) has also taken positive steps to install wastewater treatment solutions across several industrial verticals for discharging wastewater, stormwater, sewage, and mechanically treated water at high speeds through pipes, which is assisting the market growth. Additionally, the rising environmental concerns have prompted these actions. India's markets are being positively stimulated by the rising demand for water pumps in the construction industry, the widespread installation of desalination plants to address water shortage issues, and the rising demand for clean water in both residential and commercial establishments. Rising investment in agriculture is expected to boost market growth in the upcoming years.

Growing investment in agricultural infrastructure is among the main drivers of the market's expansion in India. Water pumps can be used for drip, sprinkler, and hose pipe irrigation and assist in moving water from the source to the agricultural area. The Indian government is also implementing plans, changes, policies, and programmes to boost farmers' earnings and the nation's total agricultural output. The market is being driven by this as well as the increased reliance on groundwater for other agricultural uses. In addition, the construction of sewage treatment facilities (STPs) in India has increased significantly. These facilities often rely on municipal wastewater pumps, commonly referred to as sewage pumps, to move sewage, sludge, rainwater, and wastewater that has undergone mechanical treatment from treatment tanks. In addition, due to severe water shortages, the government is concentrating on expanding desalination facilities. Water pumps are also used on building sites to remove extra water that has accumulated because of a lot of rain or a high water table. This is accelerating the need for water pumps in India, together with the expanding building industry. Market expansion is projected to be fuelled by elements including rapid industrialization and the increasing need for clean drinking water.

Market Segmentation

The India Water Pumps Market is divided into Type, Application, Region and Competitive Landscape. Based on Type, the market is divided into Centrifugal and Positive Development. Based on Application, the market is divided into Agriculture, Building Services, Water & Wastewater, Power, Oil & Gas, Lift Irrigation, and Others.Market Players

Major market players in the India Water Pumps Market are Kirloskar Brothers Limited, C.R.I. Pumps Private Limited, Crompton Greaves Consumer Electricals Limited, KSB Limited, Sulzer Pumps India Pvt Ltd, Taro Pumpsets Private Limited, WILO Mather and Platt Pumps Private Limited, Grundfos Pumps India Private Limited, Shakti Pumps India Limited, and WPIL Limited.Report Scope:

In this report, the India Water Pumps Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Water Pumps Market, By Type:

- Centrifugal

- Positive Displacement

India Water Pumps Market, By Application:

- Agriculture

- Building Services

- Water and Wastewater

- Power

- Oil and Gas

- Lift Irrigation

- Others

India Water Pumps Market, By Region:

- North India

- South India

- West India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Water Pumps Market.Available Customizations:

The publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Kirloskar Brothers Limited

- C.R.I. Pumps Private Limited

- Crompton Greaves Consumer Electricals Limited

- KSB Limited

- Sulzer Pumps India Pvt Ltd

- Taro Pumpsets Private Limited

- WILO Mather and Platt Pumps Private Limited

- Grundfos Pumps India Private Limited

- Shakti Pumps India Limited

- WPIL Limited

Table Information

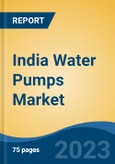

| Report Attribute | Details |

|---|---|

| No. of Pages | 75 |

| Published | September 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 10.2 Billion |

| Forecasted Market Value ( USD | $ 13.9 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |