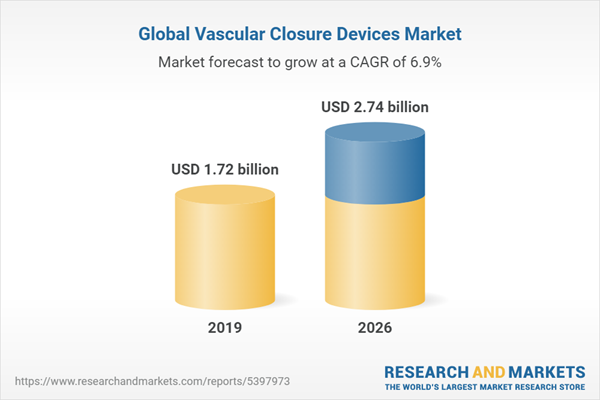

The global vascular closure devices (VCDs) market is expected to grow at a compound annual growth rate of 6.88% over the forecast period to reach a market size of US$2.744 billion in 2026 from US$1.723 billion in 2019.

A vascular closure device can be defined as a piece of collagen (a stringy protein found in skin, bone, and connective tissue), metallic clasp, or stitch (line) intended to give prompt fixing of the little cut made in a course after an angiogram. Angiography is the imaging of veins that show up on live X-beam pictures or pictures. These aides show irregularities or direct the treatment of infection. Blood vessel access is usually helped out through the femoral corridor, which is a huge course running past the locale of the crotch. Access through this supply route includes an expert specialist penetrating the conduit with a little needle through the skin and embeddings a plastic sheath or cylinder into the vein through the cut site.

Vascular closure devices (VCD) have arisen as a viable option in contrast to customary mechanical pressure for femoral course conclusion and is as a rule broadly utilized in patients going through catheterization utilizing the femoral course. These gadgets can diminish the chance of hemostasis, work with early understanding preparation, lessen patient inconvenience related to delayed bed rest, improve patient fulfillment, decline clinic length of stay (by the early assembly and decrease of intricacies), and conceivably decrease femoral vein confusions. While utilizing these gadgets may increment procedural expenses, clients of these advances say there is a ton of investment needed downstream by accomplishing quicker hemostasis. These advantages incorporate diminished draining difficulties, a decrease in post-procedural nursing care time required, expanded patient throughput, and quicker quiet ambulation. Getting patients moving around more rapidly additionally helps clinics that have same-day percutaneous coronary mediation (PCI) programs. These devices if used properly and responsibly can help in reducing the number of deaths caused by health problems like peripheral artery disease (PAD), abdominal aortic aneurysm (AAA), carotid artery disease (CAD), and more particularly stroke, which according to the CDC, causes more than 795,000 deaths in the US alone, provided the stroke is not a first-time occurrence.

Additionally, considering the vast market opportunity presented by the high demand for vascular closure devices, several new market players have emerged in the field along with the already existing pharma behemoths, leading to new product launches and collaborations between different market players, which is expected to further boost the vascular closure market growth. For instance, in April 2021, Vivasure released the PerQseal+, which aims to provide a more robust solution in reducing the potential for complications and to enhance control and tactile feedback during surgery. The company also announced the enrolment of the first patient in the Frontier V trial, a European multicentre study of the PerQseal+ device, the trial results of which will offer the operators a completely new solution for saving lives, which is expected to further push the vascular closure market growth towards expansion.

Although there are various factors aiding the growth of the vascular closure devices market issues such as those with suture-based closure devices may affect this market growth. Suture-based closure devices are increasingly being adopted by healthcare professionals for percutaneous closure of large-bore arteriotomies. However, suture-based closure devices are cumbersome and are experiencing a downtick, owing to their long learning curve and increased risk of complications, which is expected to hurt the vascular closure device market during the forecast period.

Femoral mode is in effect generally received for vascular access during coronary angiography and other interventional systems. As femoral veins are moderately less inclined to fit in correlation with outspread and grant huge size catheters, the fragment will notice striking development. In addition, the advancement of explicit gadgets giving femoral blood vessel access upgrades the fragment extension abilities. Be that as it may, a few difficulties related to femoral access-site, for example, arteriovenous (AV) fistula, pseudoaneurysm, and blood vessel analyzation limit acknowledgment to a specific degree. Accordingly, thinking about by and large factors and high procedural volume, the section is assessed to develop powerfully during the figure timetable. Moreover, specialty-focused solutions are acquiring prominence in the vascular closure devices market. For instance, a leading supplier of specialty medical devices for critical care and surgery Teleflex announced to showcase their MANTA vascular closure device at the 2019 PCR London Valves-a cross-disciplinary course being held in London, U.K. Specialty-focused solutions are helping healthcare providers to improve the health and patient quality of life worldwide. Companies are increasing efforts to develop products that simplify complex procedures and overcome barriers associated with common procedural challenges, expected to further propel market growth.

Impact of COVID – 19.

The emergence of COVID-19 has affected the procedural volume of a few cardiovascular medicines during the underlying time of pandemics. High danger of Covid contamination during such strategies with expanding hospitalizations of COVID-19 patients brought about methodology deferral. Notwithstanding, with standard working conventions and lessening the number of patients in certain nations, the business is relied upon to grandstand proceeded with development. Besides, authoritative joint efforts and government backing to keep offering successful crisis heart care to patients have supported mechanical income development. Albeit the market has encountered moderate effect during a certain period, it will keep on predicting enormous development.

The increasing demand for vascular closure devices has led to the entry of several new market players like Essential Medical, Inc. in the vascular closure devices market. The entry of these new players in a market where traditional pharma behemoths like Abbott Laboratories and Cardinal Health Inc. already exist is expected to lead to further innovation in the vascular closure devices market. Moreover, in order to further increase their clientele as well as increase their market share in the upcoming years, many of these market players have taken various strategic actions like partnerships and development of novel solutions which primarily focus on providing comfort to the patient, which is expected to keep the market competitive and constantly evolving.

A vascular closure device can be defined as a piece of collagen (a stringy protein found in skin, bone, and connective tissue), metallic clasp, or stitch (line) intended to give prompt fixing of the little cut made in a course after an angiogram. Angiography is the imaging of veins that show up on live X-beam pictures or pictures. These aides show irregularities or direct the treatment of infection. Blood vessel access is usually helped out through the femoral corridor, which is a huge course running past the locale of the crotch. Access through this supply route includes an expert specialist penetrating the conduit with a little needle through the skin and embeddings a plastic sheath or cylinder into the vein through the cut site.

Vascular closure devices (VCD) have arisen as a viable option in contrast to customary mechanical pressure for femoral course conclusion and is as a rule broadly utilized in patients going through catheterization utilizing the femoral course. These gadgets can diminish the chance of hemostasis, work with early understanding preparation, lessen patient inconvenience related to delayed bed rest, improve patient fulfillment, decline clinic length of stay (by the early assembly and decrease of intricacies), and conceivably decrease femoral vein confusions. While utilizing these gadgets may increment procedural expenses, clients of these advances say there is a ton of investment needed downstream by accomplishing quicker hemostasis. These advantages incorporate diminished draining difficulties, a decrease in post-procedural nursing care time required, expanded patient throughput, and quicker quiet ambulation. Getting patients moving around more rapidly additionally helps clinics that have same-day percutaneous coronary mediation (PCI) programs. These devices if used properly and responsibly can help in reducing the number of deaths caused by health problems like peripheral artery disease (PAD), abdominal aortic aneurysm (AAA), carotid artery disease (CAD), and more particularly stroke, which according to the CDC, causes more than 795,000 deaths in the US alone, provided the stroke is not a first-time occurrence.

Additionally, considering the vast market opportunity presented by the high demand for vascular closure devices, several new market players have emerged in the field along with the already existing pharma behemoths, leading to new product launches and collaborations between different market players, which is expected to further boost the vascular closure market growth. For instance, in April 2021, Vivasure released the PerQseal+, which aims to provide a more robust solution in reducing the potential for complications and to enhance control and tactile feedback during surgery. The company also announced the enrolment of the first patient in the Frontier V trial, a European multicentre study of the PerQseal+ device, the trial results of which will offer the operators a completely new solution for saving lives, which is expected to further push the vascular closure market growth towards expansion.

Although there are various factors aiding the growth of the vascular closure devices market issues such as those with suture-based closure devices may affect this market growth. Suture-based closure devices are increasingly being adopted by healthcare professionals for percutaneous closure of large-bore arteriotomies. However, suture-based closure devices are cumbersome and are experiencing a downtick, owing to their long learning curve and increased risk of complications, which is expected to hurt the vascular closure device market during the forecast period.

Growth Factors.

- High adoption of femoral mode for vascular access during the majority of interventional procedures.

Femoral mode is in effect generally received for vascular access during coronary angiography and other interventional systems. As femoral veins are moderately less inclined to fit in correlation with outspread and grant huge size catheters, the fragment will notice striking development. In addition, the advancement of explicit gadgets giving femoral blood vessel access upgrades the fragment extension abilities. Be that as it may, a few difficulties related to femoral access-site, for example, arteriovenous (AV) fistula, pseudoaneurysm, and blood vessel analyzation limit acknowledgment to a specific degree. Accordingly, thinking about by and large factors and high procedural volume, the section is assessed to develop powerfully during the figure timetable. Moreover, specialty-focused solutions are acquiring prominence in the vascular closure devices market. For instance, a leading supplier of specialty medical devices for critical care and surgery Teleflex announced to showcase their MANTA vascular closure device at the 2019 PCR London Valves-a cross-disciplinary course being held in London, U.K. Specialty-focused solutions are helping healthcare providers to improve the health and patient quality of life worldwide. Companies are increasing efforts to develop products that simplify complex procedures and overcome barriers associated with common procedural challenges, expected to further propel market growth.

Impact of COVID – 19.

The emergence of COVID-19 has affected the procedural volume of a few cardiovascular medicines during the underlying time of pandemics. High danger of Covid contamination during such strategies with expanding hospitalizations of COVID-19 patients brought about methodology deferral. Notwithstanding, with standard working conventions and lessening the number of patients in certain nations, the business is relied upon to grandstand proceeded with development. Besides, authoritative joint efforts and government backing to keep offering successful crisis heart care to patients have supported mechanical income development. Albeit the market has encountered moderate effect during a certain period, it will keep on predicting enormous development.

Competitive Insights.

The increasing demand for vascular closure devices has led to the entry of several new market players like Essential Medical, Inc. in the vascular closure devices market. The entry of these new players in a market where traditional pharma behemoths like Abbott Laboratories and Cardinal Health Inc. already exist is expected to lead to further innovation in the vascular closure devices market. Moreover, in order to further increase their clientele as well as increase their market share in the upcoming years, many of these market players have taken various strategic actions like partnerships and development of novel solutions which primarily focus on providing comfort to the patient, which is expected to keep the market competitive and constantly evolving.

Market Segmentation:

By Access

- Femoral Access

- Radial Access

By Type

- Passive Vascular Closure Devices

- Active Vascular Closure Devices

By End-Users

- Hospitals & Clinics

- Ambulatory Surgical Centres

By Procedure

- Interventional Vascular Surgery

- Interventional Cardiology

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- Italy

- Spain

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

5. Global Vascular Closure Devices (VCDs) Market Analysis, By Access

6. Global Vascular Closure Devices (VCDs) Market Analysis, By Type

7. Global Vascular Closure Devices (VCDs) Market Analysis, By End-Users

8. Global Vascular Closure Devices (VCDs) Market Analysis, By Procedure

9. Global Vascular Closure Devices (VCDs) Market Analysis, By Geography

10. Competitive Environment and Analysis

11. Company Profiles.

Companies Mentioned

- Medtronic

- Terumo

- Abbott

- Cordis

- Biomerics

- Cardiva Medical, Inc.

- Vasorum Ltd

- Biotronik GMBH & CO.KG

- Boston Scientific Corporation

- TZ Medical, Inc

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 115 |

| Published | July 2021 |

| Forecast Period | 2019 - 2026 |

| Estimated Market Value ( USD | $ 1.72 billion |

| Forecasted Market Value ( USD | $ 2.74 billion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |