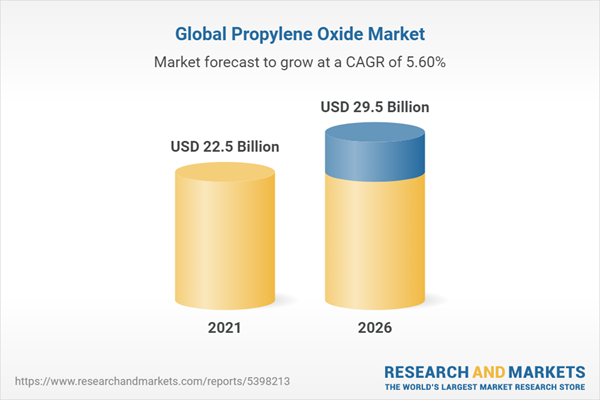

The propylene oxide market is projected to grow from USD 22.5 billion in 2021 to USD 29.5 billion by 2026, at a CAGR of 5.6% from 2021 to 2026. The increasing demand for polyether polyols for the production of polyurethane is expected to increase the demand for propylene oxide over the next few years.

Increase in demand for polyurethane from the healthcare industry is expected to open new revenue pockets for the propylene oxide market. However, the impact of COVID-19 on the automotive and construction industries may restrain the market growth.

“Polyether polyols application segment is projected to lead the propylene oxide market during the forecast period.”

Based on application, the polyether polyols segment is estimated to grow at the highest CAGR during the forecasted period. Polyether polyols are manufactured by the catalyzed addition of epoxides to propylene oxide or ethylene oxide. They are mainly used in the manufacturing of polyurethanes (flexible foams). Polyether polyols are a class of organic chemicals that contain multiple ether linkages and have multiple hydroxyl groups. The majority of polyether polyols are used in the manufacturing of urethanes and other products, such as surface-active agents, functional fluids, and synthetic lubricants.

“Building & Construction is the second-largest end-use industry segment propylene oxide market.”

Based on the end-use industry, the building & construction segment accounted for the second-largest share in the propylene oxide market. Building & construction industry is one of the major end-use industries of propylene oxide. In this end-use industry, fiber-reinforced plastics (FRPs) are used primarily for manufacturing building panels, bathroom components, fixtures, corrosion-resistant tanks, and pipes and ducts. These FRPs are produced by reinforcing nearly three-quarters of unsaturated polyester resins (UPR) with fiberglass or mineral fillers. UPR are made from monopropylene glycol (MPG), which is obtained from propylene glycol.

“Asia Pacific is projected to grow the highest CAGR in the propylene oxide market during the forecast period.”

Asia Pacific is projected to grow at the highest CAGR in the propylene oxide market from 2021 to 2026. Increasing demand for propylene oxide from the polyether polyols and propylene glycol application segments is a major factor driving the Asia Pacific propylene oxide market. China is projected to be the world’s largest consumer of propylene oxide during the forecast period. The country has witnessed capacity expansion projects by companies, such as Royal Dutch Shell plc (Netherlands) in recent times. This capacity expansion will enable the production of an additional 300 kilotons of propylene oxide and 600 kilotons of polyols in the country.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 30%, Tier 2 - 35%, and Tier 3 - 35%

- By Designation: C-level Executives - 30%, Directors - 60%, and Others - 10%

- By Region: Asia Pacific - 40%, Europe - 15%, North America - 30%, the Middle East & Africa- 10%, and South America - 5%

Furthermore, as a part of the qualitative analysis of the propylene oxide market, the research provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing the growth of the market across the globe. It also discusses competitive strategies adopted by the leading market players such as Dow Inc. (US), LyondellBasell Industries Holdings B.V. (Netherlands), Royal Dutch Shell PLC (Netherlands), BASF SE (Germany), SKC Company (South Korea), AGC Inc. (Japan), Repsol (Spain), Sumitomo Chemical Co., Ltd. (Japan), Tokuyama Corporation (Japan), Indorama Ventures Public Company (Thailand).

Research Coverage:

- The report defines, segments, and projects the size of the propylene oxide market based on application, production process, end-use industry, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments such as acquisitions, agreements, expansions, and joint ventures undertaken by them in the market.

- The report also provides a comprehensive review of market drivers, restraints, opportunities, and challenges in the propylene oxide market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them the closest approximations of revenue numbers of the propylene oxide market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Inclusions & Exclusions

Table 1 Propylene Oxide Market, by Application: Inclusions & Exclusions

Table 2 Propylene Oxide Market, by Production Process: Inclusions & Exclusions

Table 3 Propylene Oxide Market, by End-Use Industry: Inclusions & Exclusions

Table 4 Propylene Oxide Market, by Region: Inclusions & Exclusions

1.4 Market Scope

1.4.1 Propylene Oxide Market Segmentation

Figure 1 Propylene Oxide Market: Segmentation

1.4.2 Regions Covered

1.4.3 Years Considered for the Study

1.5 Currency

1.6 Unit Considered

1.7 Limitations

1.8 Stakeholders

1.9 Summary of Changes

2 Research Methodology

2.1 Research Data

Figure 2 Propylene Oxide Market: Research Design

2.1.1 Secondary Data

2.1.1.1 Key Data from Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data from Primary Sources

2.1.2.2 List of Participating Companies for Primary Research

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primary Interviews

2.2 Base Number Calculation

2.2.1 Demand-Side Approach

Figure 3 Base Number Calculation Methodology: Demand-Side Approach (Volume)

2.2.2 Supply-Side Approach

Figure 4 Base Number Calculation Methodology: Supply-Side Approach (Volume)

2.3 Market Size Estimation

Figure 5 Market Size Estimation: Bottom-Up Approach

2.3.1 Top-Down Approach

Figure 6 Market Size Estimation: Top-Down Approach

2.4 Growth Rate Assumptions/Growth Forecast

2.4.1 Supply Side

Table 5 Historical Growth Rate of Companies in the Propylene Oxide Market

2.5 Data Triangulation

2.6 Assumptions

2.7 Risk Assessment

3 Executive Summary

Table 6 Propylene Oxide Market Snapshot, 2021 & 2026

Figure 7 Polyether Polyols Application Accounted for the Largest Share of the Propylene Oxide Market in 2020

Figure 8 Asia-Pacific to be the Fastest-Growing Regional Market for Propylene Oxide

4 Premium Insights

4.1 Attractive Opportunities in the Global Propylene Oxide Market

Figure 9 the Need for Polyurethane Foam in Multiple End-Use Industries Drives Growth of the Propylene Oxide Market

4.2 Propylene Oxide Market, by Application

Figure 10 Polyether Polyols Application to Grow the Fastest

4.3 Asia-Pacific: Propylene Oxide Market, by Application and Country

Figure 11 China Accounted for the Largest Share in the Market

4.4 Propylene Oxide Market: Major Countries

Figure 12 China and India to Offer Lucrative Growth Opportunities During the Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 13 Drivers, Restraints, Opportunities, and Challenges: Propylene Oxide Market

5.2.1 Drivers

5.2.1.1 Increasing Demand for Polyether Polyols for the Production of Polyurethane

Figure 14 Global Polyurethane Demand

5.2.1.2 Demand for Propylene Oxide from End-Use Industries

5.2.2 Restraints

5.2.2.1 Impact of Covid-19 on Automotive and Construction Industries

Figure 15 Global Car Sales

Figure 16 US Construction Activity Expenditure

5.2.2.2 Toxic Nature of Propylene Oxide

5.2.3 Opportunities

5.2.3.1 Growing Opportunities in Developing Economies

Figure 17 World Population Concentration, 2020

Figure 18 Asia-Pacific Average GDP Growth, 2016-2025

5.2.3.2 Emerging Applications in Healthcare Industry

5.2.4 Challenges

5.2.4.1 Price Volatility of Raw Materials

Table 7 Global Oil & Gas Prices, Usd/Bbl (2016-2020)

5.2.4.2 Use of Bio-Based Feedstock for Polyurethane Foam Instead of Petroleum

5.3 Porter's Five Forces Analysis

Figure 19 Porter's Five Forces Analysis: Propylene Oxide Market

Table 8 Porter's Five Forces Analysis: Propylene Oxide Market

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Covid-19 Impact Analysis

5.4.1 Covid-19 Health Assessment

Figure 20 Country-Wise Spread of Covid-19

Figure 21 Impact of Covid-19 in 2020 (Q4) on Different Countries

Figure 22 Three Scenario-Based Analysis of Covid-19 Impact on Global Economy

5.5 Covid-19 Impact on Propylene Oxide Market

5.5.1 Worldwide Scenario

5.5.2 Covid-19 Impact on Raw Material - Propylene

5.5.3 Macroeconomic Indicators

5.5.3.1 Oil & Gas Industry

Table 9 Global Oil & Gas Prices, Usd/Bbl (2016-2020)

Figure 23 Global Oil Demand Growth (2016-2021)

5.5.3.2 Manufacturing Industry

Figure 24 Annual Growth Rate of World Manufacturing Output

5.5.3.3 Iron & Steel Industry

5.6 Trends/Disruptions Impacting Customer's Business

Figure 25 Revenue Shift & New Revenue Pockets for Propylene Oxide Manufacturers

5.7 Ecosystem/Market Map of Propylene Oxide

Figure 26 Ecosystem/Market Map of Propylene Oxide

Table 10 Propylene Oxide Market: Ecosystem

5.8 Patent Analysis

5.8.1 Introduction

Figure 27 Publication Trends (2010-2020)

5.8.2 Insights

Figure 28 Propylene Oxide Patents, Trend Analysis

5.8.3 Top Patent Holders

5.9 Regulatory Landscape

Table 11 Occupational Exposure Limits and Guidelines for Propylene Oxide

5.9.1 Coast Guard, Department of Homeland Security

5.9.2 Department of Transportation (Dot)

5.9.3 Environmental Protection Agency (Epa)

5.9.3.1 Clean Air Act

5.9.3.2 Federal Insecticide, Fungicide, and Rodenticide Act

5.9.4 Food and Drug Administration (Fda)

5.9.5 Occupational Safety and Health Administration (Osha)

5.10 Technology Analysis

5.10.1 Overview

5.10.2 Chlorohydrin Process (Chpo)

5.10.3 Ethylbenzene Hydroperoxide with Styrene Co-Product (Posm)

5.10.4 Cumene Hydroperoxide (Chp) Process

5.10.5 Epoxidation with Hydrogen Peroxide (Hppo)

5.11 Value Chain Analysis

5.12 Average Selling Price Trend

Figure 29 Average Prices of Propylene Oxide, by Region (Usd/Ton)

Table 12 Average Prices of Propylene Oxide, by Region (Usd/Ton)

6 Propylene Oxide Market, by Application

6.1 Introduction

Figure 30 Propylene Oxide Market, by Application, 2021 & 2026

Table 13 Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 14 Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

6.2 Polyether Polyols

6.2.1 Increased Demand for Polyether Polyols from the Polyurethane Industry Drives the Segment

Table 15 Propylene Oxide Market Size in Polyether Polyols, by Region, 2017-2026 (Kiloton)

Table 16 Propylene Oxide Market Size in Polyether Polyols, by Region, 2017-2026 (USD Million)

6.3 Propylene Glycol

6.3.1 Petroleum-Based Propylene Glycol Fueling the Growth of Propylene Oxide Market

Table 17 Propylene Oxide Market Size in Propylene Glycol, by Region, 2017-2026 (Kiloton)

Table 18 Propylene Oxide Market Size in Propylene Glycol, by Region, 2017-2026 (USD Million)

6.4 Glycol Ethers

6.4.1 Use in Various End-Use Industries to Favor Market Growth

Table 19 Propylene Oxide Market Size in Glycol Ethers, by Region, 2017-2026 (Kiloton)

Table 20 Propylene Oxide Market Size in Glycol Ethers, by Region, 2017-2026 (USD Million)

6.5 Others

Table 21 Propylene Oxide Market Size in Other Applications, by Region, 2017-2026 (Kiloton)

Table 22 Propylene Oxide Market Size in Other Applications, by Region, 2017-2026 (USD Million)

7 Propylene Oxide Market, by End-Use Industry

7.1 Introduction

Figure 31 Automotive End-Use Industry to Lead the Propylene Oxide Market

Table 23 Propylene Oxide Market Size, by End-Use Industry, 2017-2026 (Kiloton)

7.2 Automotive

7.2.1 Automotive Accounted for the Largest Share of the Market

7.3 Building & Construction

7.3.1 Building & Construction is One of the Major End-Use Industries of Propylene Oxide

7.4 Chemical & Pharmaceutical

7.4.1 Propylene Oxide is Used for Manufacturing Propylene Glycol Ethers That Are Commonly Used as Solvents and Coupling Agents in Paints

7.5 Textile & Furnishing

7.5.1 Propylene Oxide is Used to Produce Non-Toxic Textiles and in Separation of Crude Oil Emulsions

7.6 Packaging

7.6.1 Propylene Oxide is the Material of Choice for Small, Light, and Shock-Sensitive Products

7.7 Electronics

7.7.1 Propylene Glycol Ether is Required for Manufacturing and Maintenance of Electronic Components

7.8 Others

8 Propylene Oxide Market, by Production Process

8.1 Introduction

Figure 32 Chlorohydrin Process to Account for the Largest Share of the Market

Table 24 Propylene Oxide Market Size, by Production Process, 2017-2026 (Kiloton)

8.2 Chlorohydrin Process

8.2.1 a Significant Amount of Propylene Oxide Production Capacities Use this Process

8.3 Styrene Monomer Process

8.3.1 the Styrene Monomer/Propylene Production Process is Gaining Popularity, Owing to Its Superior Economics

8.4 Tba Co-Product Process

8.4.1 this is An Alternative Epoxidation Method That Uses Isobutane to Produce Tba Co-Product

8.5 Hydrogen Peroxide Process

8.5.1 Epoxidation of Hydrogen Peroxide is Carried Out to Produce Propylene Oxide

8.6 Cumene-Based Process

8.6.1 this Process Utilizes Organic Peroxides for Epoxidation of Propylene to Propylene Oxide with Only Water as By-Product

9 Propylene Oxide Market, by Region

9.1 Introduction

Figure 33 China Emerging as the New Hotspot for the Propylene Oxide Market

Table 25 Propylene Oxide Market Size, by Region, 2017-2026 (Kiloton)

Table 26 Propylene Oxide Market Size, by Region, 2017-2026 (USD Million)

9.2 Asia-Pacific

Figure 34 Asia-Pacific: Propylene Oxide Market Snapshot

Table 27 Asia-Pacific: Propylene Oxide Market Size, by Country,2017-2026 (Kiloton)

Table 28 Asia-Pacific: Propylene Oxide Market Size, by Country, 2017-2026 (USD Million)

Table 29 Asia-Pacific: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 30 Asia-Pacific: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.2.1 China

9.2.1.1 China is the Largest Market for Propylene Oxide in the World

Table 31 China: Propylene Oxide Market Size, by Application,2017-2026 (Kiloton)

Table 32 China: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.2.2 Japan

9.2.2.1 Consumption of Propylene Oxide to Increase Due to Growing Automotive and Construction Industries

Table 33 Japan: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 34 Japan: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.2.3 India

9.2.3.1 India to Witness the Highest Growth in Consumption of Propylene Oxide

Table 35 India: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 36 India: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.2.4 South Korea

9.2.4.1 One of the Leading Producers and Consumers of Propylene Oxide in the Region

Table 37 South Korea: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 38 South Korea: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.2.5 Thailand

9.2.5.1 Increasing Construction Activities in Thailand to Favor Market Growth

Table 39 Thailand: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 40 Thailand: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.2.6 Australia

9.2.6.1 Emerging Market for Consumption of Propylene Oxide

Table 41 Australia: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 42 Australia: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.2.7 Rest of Asia-Pacific

Table 43 Rest of Asia-Pacific: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 44 Rest of Asia-Pacific: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.3 North America

Figure 35 North America: Propylene Oxide Market Snapshot

Table 45 North America: Propylene Oxide Market Size, by Country, 2017-2026 (Kiloton)

Table 46 North America: Propylene Oxide Market Size, by Country, 2017-2026 (USD Million)

Table 47 North America: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 48 North America: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.3.1 US

9.3.1.1 a Leading Producer and Consumer of Propylene Oxide and Its Derivatives

Table 49 Us: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 50 Us: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.3.2 Canada

9.3.2.1 Excellent Manufacturing Facilities and Infrastructure to Drive Propylene Oxide Growth

Table 51 Canada: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 52 Canada: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.3.3 Mexico

9.3.3.1 Free Trade Agreement with Other Countries to Fuel the Market Growth

Table 53 Mexico: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 54 Mexico: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.4 Europe

Figure 36 Europe: Propylene Oxide Market Snapshot

Table 55 Europe: Propylene Oxide Market Size, by Country, 2017-2026 (Kiloton)

Table 56 Europe: Propylene Oxide Market Size, by Country, 2017-2026 (USD Million)

Table 57 Europe: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 58 Europe: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.4.1 Germany

9.4.1.1 Consumption of Propylene Oxide to Increase Due to the Growing Automotive Industry

Table 59 Germany: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 60 Germany: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.4.2 France

9.4.2.1 Presence of Foreign Investors Will Drive the Propylene Oxide Market

Table 61 France: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 62 France: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.4.3 UK

9.4.3.1 Preference for Sustainable and High-Quality Propylene Oxide to Drive the Market

Table 63 Uk: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 64 Uk: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.4.4 Italy

9.4.4.1 Developing Automotive and Construction Industries to Boost the Market

Table 65 Italy: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 66 Italy: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.4.5 Spain

9.4.5.1 Growth in the Commercial Construction Sector to Lead to Market Growth

Table 67 Spain: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 68 Spain: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.4.6 Netherlands

9.4.6.1 the Polyether Polyols Application Segment Leads the Propylene Oxide Market

Table 69 Netherlands: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 70 Netherlands: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.4.7 Russia

9.4.7.1 Investment in Unsaturated Polyester Resin and Polyurethanesto Drive the Market

Table 71 Russia: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 72 Russia: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.4.8 Rest of Europe

Table 73 Rest of Europe: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 74 Rest of Europe: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.5 Middle East & Africa

Table 75 Middle East & Africa: Propylene Oxide Market Size, by Country, 2017-2026 (Kiloton)

Table 76 Middle East & Africa: Propylene Oxide Market Size, by Country, 2017-2026 (USD Million)

Table 77 Middle East & Africa: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 78 Middle East & Africa: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.5.1 Saudi Arabia

9.5.1.1 Saudi Arabia Accounts for the Largest Share of the Middle East & African Market

Table 79 Saudi Arabia: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 80 Saudi Arabia: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.5.2 Qatar

9.5.2.1 Construction Activities in the Country to Contribute to High Market Growth

Table 81 Qatar: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 82 Qatar: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.5.3 Uae

9.5.3.1 Increasing Infrastructure Activities to Aid Market Growth

Table 83 Uae: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 84 Uae: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.5.4 Kuwait

9.5.4.1 Increased Demand for Polyurethane Foam for End-Use Industries to Spur Propylene Oxide Market

Table 85 Kuwait: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 86 Kuwait: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.5.5 South Africa

9.5.5.1 Increasing Infrastructure Projects and Automotive Manufacturing to Aid the Growth of the Propylene Oxide Market

Table 87 South Africa: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 88 South Africa: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.5.6 Rest of Middle East & Africa

Table 89 Rest of Middle East & Africa: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 90 Rest of Middle East & Africa: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.6 South America

Table 91 South America: Propylene Oxide Market Size, by Country, 2017-2026 (Kiloton)

Table 92 South America: Propylene Oxide Market Size, by Country, 2017-2026 (USD Million)

Table 93 South America: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 94 South America: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.6.1 Brazil

9.6.1.1 Largest Automobile Producer in the Region to Drive the Growth

Table 95 Brazil: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 96 Brazil: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.6.2 Argentina

9.6.2.1 Well-Developed Infrastructure to Support the Production of Propylene Oxide Market

Table 97 Argentina: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 98 Argentina: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.6.3 Chile

9.6.3.1 Growing End-Use Industries to Drive the Market

Table 99 Chile: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 100 Chile: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

9.6.4 Rest of South America

Table 101 Rest of South America: Propylene Oxide Market Size, by Application, 2017-2026 (Kiloton)

Table 102 Rest of South America: Propylene Oxide Market Size, by Application, 2017-2026 (USD Million)

10 Competitive Landscape

10.1 Key Players Strategies/Right to Win

10.1.1 Overview of Strategies Adopted by Propylene Oxide Vendors (2016-2021)

10.2 Revenue Analysis of Top Five Companies

Figure 37 Revenue Analysis for Top 5 Companies, 2016-2020

10.3 Market Share Analysis, 2020

Figure 38 Propylene Oxide: Market Share Analysis

10.3.1 Propylene Oxide Market: Degree of Competition

10.4 Company Evaluation Quadrant

10.4.1 Star

10.4.2 Pervasive

10.4.3 Emerging Leader

10.4.4 Participant

Figure 39 Propylene Oxide Market, Company Evaluation Market, 2020

10.5 Competitive Benchmarking

10.5.1 Company Product Footprint

10.5.2 Company Application Footprint

10.5.3 Company Regional Footprint

10.5.4 Company End-Use Industry Footprint

10.6 Startup/Sme Evaluation Quadrant, 2020

10.6.1 Progressive Companies

10.6.2 Responsive Companies

10.6.3 Dynamic Companies

10.6.4 Starting Blocks

Figure 40 Propylene Oxide Company Evaluation Quadrant

10.7 Recent Developments

10.7.1 Deals

10.7.2 Others

11 Company Profiles

11.1 Major Players

(Business Overview, Products Offered, Recent Developments, Deals, Analyst's View, Key Strengths/Right to Win, Strategic Choices Made, Weakness/Competitive Threats)*

11.1.1 Dow Inc.

Table 103 Dow Inc.: Company Overview

Figure 41 Dow Inc.: Company Snapshot

11.1.2 Lyondellbasell Industries Holdings B.V.

Table 104 Lyondellbasell Industries Holdings B.V.: Company Overview

Figure 42 Lyondellbasell Industries Holdings B.V.: Company Snapshot

11.1.3 Royal Dutch Shell plc

Table 105 Royal Dutch Shell plc: Company Overview

Figure 43 Royal Dutch Shell plc: Company Snapshot

11.1.4 Indorama Ventures Public Company Ltd.

Table 106 Indorama Ventures Public Company Ltd.: Company Overview

Figure 44 Indorama Ventures Public Company Ltd: Company Snapshot

11.1.5 Basf Se

Table 107 Basf Se: Company Overview

Figure 45 Basf Se: Company Snapshot

11.1.6 Agc Inc.

Table 108 Agc Inc.: Company Overview

Figure 46 Agc Inc.: Company Snapshot

11.1.7 Repsol

Table 109 Repsol: Company Overview

Figure 47 Repsol: Company Snapshot

11.1.8 Tokuyama Corporation

Table 110 Tokuyama Corporation: Company Overview

Figure 48 Tokuyama Corporation: Company Snapshot

11.1.9 Sumitomo Chemical Co. Ltd.

Table 111 Sumitomo Chemical Co. Ltd.: Company Overview

Figure 49 Sumitomo Chemical Co. Ltd.: Company Snapshot

11.1.10 Skc Company Ltd

Table 112 Skc Company Ltd.: Company Overview

Figure 50 Skc Company Ltd: Company Snapshot

11.2 Other Players

11.2.1 Ineos Oxide

11.2.2 Jishen Chemical Industry Co. Ltd. (Merged)

11.2.3 Manali Petrochemicals

11.2.4 Tianjin Dagu Chemical Co. Ltd.

11.2.5 Pjsc Nizhnekamskneftekhim

11.2.6 Pcc Rokita

11.2.7 Wudi Xinyue Chemical Co. Ltd.

11.2.8 Oltchim S.A.

11.2.9 Wanhua Chemical Group Co. Ltd.

11.2.10 S-Oil Corporation

11.2.11 Tokyo Chemical Industry Co. Ltd.

11.2.12 Befar Group

11.2.13 Merck Kgaa

*Details on Business Overview, Products Offered, Recent Developments, Deals, Analyst's View, Key Strengths/Right to Win, Strategic Choices Made, Weakness/Competitive Threats Might Not be Captured in Case of Unlisted Companies.

12 Appendix

12.1 Discussion Guide

12.2 Knowledge Store: The Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

Companies Mentioned

- AGC Inc.

- Basf Se

- Befar Group

- Dow Inc.

- Indorama Ventures Public Company Ltd.

- Ineos Oxide

- Jishen Chemical Industry Co. Ltd. (Merged)

- Lyondellbasell Industries Holdings B.V.

- Manali Petrochemicals

- Merck Kgaa

- Oltchim S.A.

- PCC Rokita

- PJSC Nizhnekamskneftekhim

- Repsol

- Royal Dutch Shell plc

- S-Oil Corporation

- SKC Company Ltd

- Sumitomo Chemical Co. Ltd.

- Tianjin Dagu Chemical Co. Ltd.

- Tokuyama Corporation

- Tokyo Chemical Industry Co. Ltd.

- Wanhua Chemical Group Co. Ltd.

- Wudi Xinyue Chemical Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | July 2021 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 22.5 Billion |

| Forecasted Market Value ( USD | $ 29.5 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |