The industrial hemp industry is witnessing a marked resurgence, driven by legal reforms, advanced genetics, and shifting consumer preferences. Governments worldwide are relaxing restrictions to tap into hemp's industrial potential. For example, the United States Department of Agriculture, under the 2018 Farm Bill, legalised hemp cultivation, giving rise to over 21,400 registered growers by 2021. In Europe, the EU Hemp Strategy supports low-THC hemp farming under CAP subsidies, helping scale production in France and the Netherlands.

Notably, modern cultivars with improved fibre yield and pest resistance are reshaping profitability, boosting the industrial hemp market revenue. In India, the Uttarakhand government has sanctioned industrial hemp cultivation for commercial use, and private players are collaborating with CSIR-IHBT on bio-based textile R&D. The market is poised to grow steadily, particularly across functional nutrition, bio-composites, and green building materials. With regulatory clarity improving globally, the sector is gaining investment traction from food, textile, and construction multinationals.

Furthermore, international agencies are now funding carbon sequestration projects using hemp in degraded soils, particularly across Eastern Europe and sub-Saharan Africa. These efforts are not only restoring land productivity but also offering rural employment. Meanwhile, smart farming innovations, like drone-led seed monitoring and blockchain-integrated crop tracking, are optimising yields and transparency, accelerating the demand for industrial hemp. Governments, recognising hemp’s dual benefit for climate and economy, are slowly incorporating it into sustainable agriculture strategies. The industry’s progress is being bolstered by such ecosystem-level alignment that blends technology, policy, and circular value chains.

Key Trends and Recent Developments

May 2025

The opening of Ukraine's largest hemp processing facility marked a significant milestone for India's developing industrial hemp sector. Located at the Ma'Ryzhany industrial park in the Zhytomyr region, the new facility of the Ma'Ryzhany Hemp Company is expected to have the capacity to process up to 14,000 tonnes of hemp per year.December 2024

India advanced in sustainable textiles by blending hemp and wool. WWEPC hosted a key event highlighting global demand, fostering collaborations, and planning MOUs with South Korea to boost exports, technology transfer, and India's leadership in eco-friendly textiles.June 2024

Curaleaf launched a new hemp-derived THC product line and e-commerce platform, TheHempCompany.com. The initiative expands distribution, ensures safety standards, and enhances consumer accessibility through retail partnerships and online sales across 25 states and Washington, D.C.November 2023

Australia launched a USD 2.5 million, five-year research program at Southern Cross University to boost industrial hemp. It focuses on seeds, production, products, and sustainability, involving industry partners to enhance hemp processing, livestock use, and sustainable farming practices.Expansion of Hempcrete in Construction

Hempcrete, a lightweight and carbon-negative building material, is fast becoming a sustainable alternative to cement. Recently, hemp building materials were officially approved in the model U.S. residential building code under the International Code Council. Canada's JustBioFiber is piloting modular hempcrete panels for cold regions. As regulatory support for net-zero construction strengthens, firms are investing in hemp-based insulation and wall systems. Such developments are propelling industrial hemp demand from construction players looking to meet ESG goals while reducing material emissions.Diversification in Hemp-Based Automotive Composites

Automotive OEMs are increasingly turning to hemp fibre composites for lightweighting vehicles, boosting the industrial hemp market dynamics. BMW and Mercedes-Benz already use hemp-reinforced door panels and dashboards. The EU’s LIFE Programme is backing automotive-grade hemp composite projects, particularly in Germany and Italy. These bioplastics reduce vehicular weight and improve fuel efficiency without compromising strength. With EV mandates tightening, especially in Europe and California, such innovations are positioning industrial hemp as a critical component for next-gen mobility solutions.Integration into Functional Foods & Beverages

Hemp-derived protein, milk, and seed snacks are entering mainstream consumer diets as per the industrial hemp market report. Canadian firm Manitoba Harvest expanded its hemp food portfolio, with new protein-fortified yoghurts and cold-pressed seed bars. In China, several provinces offer subsidies for hemp seed processing equipment, pushing local brands like Yunnan Lvke Foods to roll out hemp protein noodles. In the United States, hemp-infused energy drinks are gaining shelf presence. The rise of plant-based and allergen-free trends is unlocking new B2B opportunities in private-label food manufacturing and HoReCa sectors.Biofuel and Sustainable Aviation Fuel (SAF) Innovation

Industrial hemp is being explored as a feedstock for second-generation biofuels and SAFs, accelerating the industrial hemp market value. Curtin University has invested USD 5.2 billion to convert biomass into aviation-grade biofuel, which also included hemp. Meanwhile, the Indian Institute of Petroleum is conducting pilot trials on hemp bio-oil blends for rural generators. IATA estimates that SAF should contribute around 65% of the emissions reductions needed in 2050. Industrial hemp is also being used in decarbonising aviation is being re-evaluated with renewed urgency.Personal Care Industry’s Shift to Hemp Extracts

The skincare and personal care sector is shifting towards hemp-derived cannabinoids and seed oils for their anti-inflammatory and omega-rich properties, accelerating the industrial hemp market development. For example, L'Oréal uses cold-pressed hemp seed oil, targeting young urban users. As clean beauty expands, hemp ingredients are being used in serums, balms, and shampoos, disrupting legacy formulations across APAC and North American brands. Korean K-beauty firms are also infusing hemp seed extracts in toners and cleansers, focusing on acne-prone and sensitive skin categories, fuelling demand for high-purity hemp derivatives.Global Industrial Hemp Industry Segmentation

The report titled “Global Industrial Hemp Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Source

- Conventional

- Organic

Market Breakup by Product

- Hemp Seed

- Fiber (Bast)

- Hemp Seed Oil

- CBD Hemp Oil

- Shivs (Hurd)

Market Breakup by Application

- Food and Beverages

- Personal Care

- Animal Care

- Pharmaceuticals

- Textiles

- Construction Materials

- Automotive

- Furniture

- Biofuel

- Paper

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Industrial Hemp Market Share

By Source, the Conventional Segment Accounts for the Largest Share of the Market

Conventional hemp continues to dominate the industrial hemp industry revenue, especially through textiles, construction, and automotive composites. This subsegment benefits from lower input costs, established farming practices, and higher acreage. In Germany, over 900 producers are growing conventional hemp on 6,000 hectares. The scalability of conventional hemp, alongside tolerance to variable climate conditions, supports its growth in industrial applications. Processing infrastructure is also more aligned with this subsegment, making it more viable for bulk manufacturing and long-term contracts.Organic hemp is the fastest-growing subsegment in the industrial hemp market, fuelled by clean-label demands from nutraceutical, personal care, and food sectors. EU-based processors like Hempoint and Dutch Harvest reported a significant rise in organic hemp orders. The USDA’s National Organic Programme (NOP) has formalised compliance for hemp growers, making certification accessible. Startups like Greenfield Botanics are sourcing exclusive organic hemp for CBD extraction, citing premium pricing and export-ready certification. As awareness on chemical residues increases, organic hemp is carving a niche across wellness-focused industries, particularly in premium personal care and vegan dietary products.

By Product, Hemp Seed Registers the Dominant Share of the Market

Hemp seeds represent the dominant product subsegment in the industrial hemp market, with rising application in superfoods, granola, protein powders, and livestock feed. Canada remains a major exporter, with 5,800 MT of hemp cake globally, valued at USD 6.5 million, channelled towards the United States and Asian markets. Food processors value hemp seed for its high omega-3, protein, and fibre content. Additionally, several animal feed trials in Europe have validated hemp seed’s benefits in improving poultry and aquaculture growth, leading to its approval under EU feed regulations.CBD hemp oil is the fastest growing subsegment in the industrial hemp market owing to its rising adoption across wellness, mental health, and OTC pharma applications. Companies like Jazz Pharmaceuticals and Charlotte’s Web are scaling up CBD production facilities, targeting pain relief and sleep support categories. South Korea’s MFDS has begun granting permits for CBD in skincare and functional beverages. With increasing consumer interest in alternative therapies, this subsegment is attracting pharma and wellness investment at an unprecedented pace.

By Application, Construction Materials Secures the Bigger Share of the Market

Construction materials remain the dominant application for the global market for industrial hemp due to rapid urbanisation and the push for sustainable alternatives to concrete and insulation. Governments are encouraging hempcrete housing in low-carbon zoning plans. In Europe, hemp fibreboard and plaster are being integrated into public housing under the Horizon 2030 programme. Private players are now investing in automated mixing and spraying tools to streamline hemp-based construction. The subsegment benefits from high thermal and acoustic insulation properties, aligning with net-zero and green building certification targets.According to the industrial hemp market report, the personal care segment is the fastest-growing category due to hemp’s skin-friendly, antioxidant, and anti-inflammatory attributes. Startups like Apothecanna and India’s Boheco Life are pioneering hemp serums, body oils, and scalp treatments. In Japan, hemp extracts are being blended with fermented botanicals for anti-ageing products. Multinationals such as The Body Shop and Kiehl’s are investing in proprietary blends with hemp oil. Consumer sentiment around natural formulations is also pushing formulators towards full-spectrum extracts. E-commerce and influencer-led skincare trends are fuelling B2B ingredient partnerships, especially in the D2C clean beauty ecosystem.

Global Industrial Hemp Market Regional Analysis

By Region, North America Secures the Dominant Position of the Market

North America leads the global industrial hemp market, driven by clear federal frameworks and growing cross-sectoral demand. The United States Farm Bill 2018 legalised hemp cultivation federally, triggering a surge in acreage and downstream investment. Canada remains a global leader in hemp food exports and CBD product innovation. State-specific grants, especially in Colorado and Kentucky, have fuelled farm-to-factory supply chains. Venture capital is increasingly entering the space, supporting tech-driven processing plants. The region also boasts a robust research ecosystem, with institutions like Cornell and Alberta University working on seed genetics, pest control, and new industrial uses.The fast-paced growth of the Asia Pacific industrial hemp market is driven by China’s manufacturing edge and India’s policy opening. China holds the largest cultivation area globally, with Heilongjiang and Yunnan focusing on bast fibre and seeds, respectively. India’s state governments are issuing industrial hemp licences, encouraging startups in textiles, nutraceuticals, and biomaterials. Australia and Thailand are expanding organic hemp output, while South Korea is investing in CBD R&D and beauty exports. This regional growth is underpinned by low-cost production, skilled agro-processing, and trade-friendly pacts with EU and North American importers.

Competitive Landscape

The industrial hemp market players like Ecofibre, HempFlax, and Aurora Cannabis are leveraging proprietary genetics and sustainable farming contracts. Startups are targeting value-chain gaps, like Green Boom recycles hemp waste into oil-spill absorbents. Partnerships between pharma companies and organic hemp farmers are growing, especially in EU and Japan.Tech-driven industrial hemp companies are introducing mobile decorticators and AI-based strain selection tools. Investment in bio-refineries and blockchain-backed traceability platforms by private players, are increasing in numbers. Construction-grade hempcrete, automotive bio-composites, CBD innovations, personal care formulations, and SAF feedstock applications are some of the key trends that firms are currently focusing on. M&A activity is also increasing, particularly in CBD wellness and eco-construction verticals, as firms aim to control input-to-retail pipelines. Innovation in formulation, compliance, and end-use tailoring remains central.

Terra Tech Corp.

Founded in 2008, and established in the United States, Terra Tech Corp. had permanently merged with the Unrivaled brand in 2021. Unrivaled is a leading cannabis operator from various states and is also a parent company of multiple dominant cannabis brands spanning consumer products, cultivation, distribution, and retail. The brand markets itself by focusing on customer experience, product innovation, and organic brand building. The Unrivaled brand has currently set its bases at locations such as California, Oregon, and Nevada, and their brands are licensed in Arizona and Oklahoma.

Hemp, Inc.

Hemp, Inc., established in the United States, is a publicly traded company founded to provide eco-friendly solutions that help make the world a better place to live in. The company focuses on helping the environment by ensuring that its products remain eco-friendly, healthy, and replace the petroleum-based products. Hemp, Inc. has been a pioneer of the industrial hemp market worldwide even though it is yet to be legalised in several countries, including the United States of America.

HempFlax B.V.

Founded in 1993, HempFlax, one of the leading players in the industry, was founded with a singular aim of restoring the age-old crop back to its glory, which they’ve been successful in doing so, thereby creating a high demand for high-quality hemp products. They have their cultivation plants established at multiple locations, including the Netherlands, Germany, and Romania, and their factories have been setup at places such as Oude Pekela, Netherlands, and Alba Lulia, Romania.

Hemp Oil Canada

Founded in 1998, Hemp Oil Canada is Canada’s first hemp-exclusive seed processing unit and since then it has been able to establish itself among the market leaders globally. The company focuses on expanding the availability of hemp foods and building new markets to support its cause. The company’s export has now been established globally from their two state-of-art processing facility in Manitoba, Canada, and currently are the only available North American grown Hemp product suppliers for their customers.Other key players in the market are Hemp Growers Cooperative Ltd., CBD Biotechnology Co., Botanical Genetics, LLC, Marijuana Company of America Inc., HempMeds Brasil, American Cannabis Company, Inc., Industrial Hemp Manufacturing, LLC, American Hemp, Boring Hemp Company, Plains Industrial Hemp Processing Ltd., Ecofiber Industries Operations, Valley Bio Limited, Manitoba Harvest Hemp Foods, Bombay Hemp Company Private Limit, HPS Food & Ingredients Inc., among others.

Key Features of the Report

- In-depth analysis of Global Industrial Hemp Market Size and forecast.

- Comprehensive segmentation by source, product, application, and region.

- Market trends, drivers, and regulatory developments.

- Competitive landscape and strategic company profiling.

- Recent investments and infrastructure expansion impact.

- Technological innovations and future market outlook.

- Trusted insights backed by extensive primary research.

- Actionable data for strategic decision-making.

- Region-wise and application-specific analysis

Table of Contents

Companies Mentioned

The key companies featured in this Industrial Hemp market report include:- Parkland Industrial Hemp Growers Cooperative Ltd.

- CBD Biotechnology Co.

- Botanical Genetics, LLC

- Marijuana Company of America Inc.

- HempMeds Brasil

- Terra Tech Corp.

- American Cannabis Company, Inc.

- HempFlax B.V.

- Industrial Hemp Manufacturing, LLC

- American Hemp

- Hemp, Inc.

- Boring Hemp Company

- Plains Industrial Hemp Processing Ltd.

- Ecofiber Industries Operations

- Valley Bio Limited

- Manitoba Harvest Hemp Foods

- Bombay Hemp Company Private Limit

- HPS Food & Ingredients Inc.

- Unrivaled Brands, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 172 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

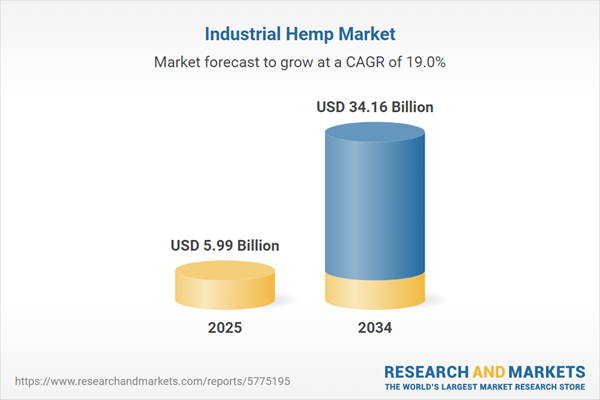

| Estimated Market Value ( USD | $ 5.99 Billion |

| Forecasted Market Value ( USD | $ 34.16 Billion |

| Compound Annual Growth Rate | 19.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |