The Global Vegan Chocolate Confectionery Market size is expected to reach $1 billion by 2027, rising at a market growth of 12.3% CAGR during the forecast period. Dairy products like milk fat, whey, casein, and milk solids are not used in vegan chocolate, as this product does not include any ingredient obtained from animals. Vegan chocolate is made from the components that are derived from plants. They contain less amount of fat and cholesterol compared to normal chocolates. Vegan food culture is rising in the established countries, which is also helping in the growth of the vegan chocolate market.

Millennials and the working population are highly adopting the vegan culture, which is estimated to surge the demand for the product. There are number of countries which were badly influenced by the COVID-19 pandemic, due to which the supply of cocoa was hampered around the world. This has declined the production of cocoa along with the decrease in its sales. Also, there was a decline in the demand for high-end & artisanal chocolates. In contrast, the market growth of chocolates is seemed to witness a rise as there is a growth in the demand by consumers.

COVID-19 Impact Analysis

The COVID-19 pandemic had a severe impact on the customers’ pattern of shopping. They are preferring to store up products that give nutrition & energy, having private-label, and are inexpensive. The coronavirus outbreak has hampered the supply chain that has been affecting the manufacturing of vegan chocolate products, mostly in the craft and small chocolate companies.

During the pandemic, most people preferred to store up the essential products to survive. Chocolate may do not come under the list of essential products; however, it is a gratifying and pleasure-seeking item for consumers. In Europe, the supermarkets and other grocery shops were out of stock as most of the chocolates were sold. Through e-commerce facilities, these markets remain open helping in quick recovery of the market. The vegan chocolate confectionery market is estimated to get through the current lockdowns without s heavy loss.

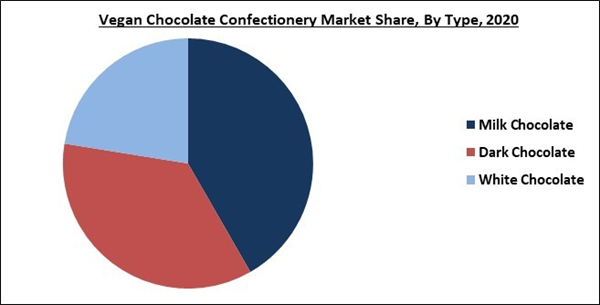

Type Outlook

Based on Type, the market is segmented into Milk Chocolate, Dark Chocolate and White Chocolate. Milk segment acquired the maximum revenue share of the global vegan chocolate confectionary market in 2020. Top companies are now introducing their famous chocolate confectionery in the vegan chocolate category. This plan of action will help the company to get appreciation from customers over the world and will also result in the rise of the product sale.

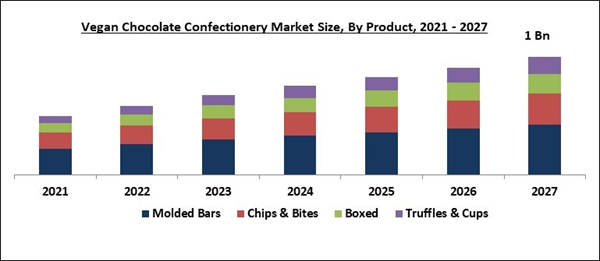

Product Outlook

Based on Product, the market is segmented into Molded Bars, Chips & Bites, Boxed and Truffles & Cups. Molded bars segment dominated the market in 2020. The segment is expected to exhibit same trend during the forecast period. Bar chocolate is considered as the most consumed chocolate category around the world. Its convenient size made it popular among consumers. Based on the annual searches by Google, the topmost chocolates titled as favorite chocolate around the world, are sold in the bar form.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. North America procured the maximum revenue share in 2020 and is expected to register a significant growth rate over the forecast period. The growing vegan population is anticipated to surge the market growth around the region. The Asia Pacific is expected to witness lucrative growth opportunities over the forecast period. Asia is the densely populated continent around the world with a greater population and therefore, it has a positive impact on the food culture across the world.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Mondelez International, Inc., Equal Exchange Coop, Endorfin Foods, Raaka Chocolate Ltd., Goodio, No Whey Chocolate, Theo Chocolate, Inc., Endangered Species Chocolate, LLC, Alter Eco, Inc., and Taza Chocolate.

Recent Strategies Deployed in Vegan Chocolate Confectionery Market

Partnerships, Collaborations, and Agreements:

- Apr-2021: Mondelēz International joined hands with Olam Food Ingredients (OFI). This collaboration aimed to make the world’s single largest sustainable commercial cocoa farm.

- May-2018: Goodio teamed up with the Ubuntu Foundation. This collaboration aimed to introduce new coffee chocolate, which is expected to support Ubuntu’s charity programs in Kenya.

Acquisition and Mergers:

- Jan-2021: Mondelez International acquired Hu Master Holdings, the parent company of Hu Products. This acquisition of Hu is expected to complement Mondelez International's snacking portfolio in North America.

Product Launches and Product Expansions:

- May-2021: Theo Chocolate launched new chocolate snack named as cookie bites. The snack is available in three flavors: Double Chocolate, Snickerdoodle and Mint Chocolate.

- Jan-2021: Alter Eco launched two super-dark chocolate bars to its Blackout range, Total Blackout, and Raspberry Blackout. These new flavor bars contain Mint Blackout, Classic Blackout, and Super Blackout.

- Jun-2020: Endangered Species launched Vegan Oat milk chocolate chips, which is prepared by using ingredients like gluten-free oats and 55-percent cocoa and also contain half the sugar of standard baking chips. The company released this at Whole Foods Markets & other retailers across the nation.

- Mar-2020: Endangered Species Chocolate launched a new Animal-Free range of Oat Milk Chocolate. This line of products contains oat milk bars that are certified vegan and gluten-free and come in three flavors: Zebra, Oat Milk, and Dark Chocolate: Bumblebee, Oat Milk, Sea Salt & Almonds & Dark Chocolate: and Gorilla, Oat Milk, Rice Crisp, and Dark Chocolate.

- Jan-2019: Alter Eco introduced its latest plant-based Super dark Truffles. This launch expands Alter Eco’s popular range of fair-trade, organic truffles by adding a decadent, vegan choice to the chocolate aisle.

- Jun-2018: Finnish chocolatier Goodio introduced a range of oat flakes-added chocolate bars, Chocoat. This range includes 60% less sugar than conventional milk chocolate, like milkybar.

- Jan-2018: Raaka Chocolate introduced new mini bars enriched with unroasted dark chocolate. These eight-gram minibars are available in the best-selling flavors of Pink Sea Salt and Coconut Milk and have made their sampling debut at the Winter Fancy Food Show.

- Dec-2017: Alter Eco unveiled new Dark Chocolate Coconut Clusters snacks. This new range of organic and fair-trade snacks comes in three new flavors: Seeds + Salt, Original, and Cherry + Almond Butter.

Scope of the Study

Market Segments Covered in the Report:

By Type

- Milk Chocolate

- Dark Chocolate

- White Chocolate

By Product

- Molded Bars

- Chips & Bites

- Boxed

- Truffles & Cups

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Mondelez International, Inc

- Equal Exchange Coop

- Endorfin Foods

- Raaka Chocolate Ltd.

- Goodio

- No Whey Chocolate

- Theo Chocolate, Inc.

- Endangered Species Chocolate, LLC

- Alter Eco, Inc.

- Taza Chocolate

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Mondelez International, Inc

- Equal Exchange Coop

- Endorfin Foods

- Raaka Chocolate Ltd.

- Goodio

- No Whey Chocolate

- Theo Chocolate, Inc.

- Endangered Species Chocolate, LLC

- Alter Eco, Inc.

- Taza Chocolate