The rising sales of electric vehicles have propelled prominent automotive component manufacturers to aggressively focus on developing essential EV components to gain a competitive edge. Prominent manufacturers in the market are primarily focusing on enhancing their facilities in countries such as Europe, China, and the U.S. For instance, in February 2020, Nidec Corporation invested around USD 1.8 billion to expand its electric vehicle powertrain business. The company’s three new facilities located in Poland, China, and Mexico would deliver up to 8.4 million electric motors every year.

Asia Pacific is projected to grow at a substantial pace over the forecast period owing to the increase in demand for electric vehicles and the rise in the per capita income of people. Countries such as China, South Korea, and India are among the prominent manufacturers of automobiles. Stringent government regulations and emission norms, including BS-VI in India and China VI, are also expected to contribute to the growth of the Asia Pacific market.

Stringent rules for monitoring CO2 emissions are becoming more demanding in the United States and Europe. North America has set the emission limit to 99g/km following corporate average fuel economy standards; similarly, Europe has set the emission limit to 9s5g/km by 2020 and a further reduction of 37.5% by 2030. To efficiently meet the emission target, OEMs are promoting and increasing sales of electric vehicles, which in turn will lead to an increase in demand for the electric vehicle powertrain market.

Electric Powertrain Market Report Highlights

- The motor/generator component segment is anticipated to witness a high CAGR of over 16.7% from 2022 to 2030 owing to the increasing penetration of BEVs and PHEVs globally

- The HEV/PHEV electric vehicle segment is anticipated to witness the highest CAGR of 15.9% over the forecast period. This can be attributed to the charging flexibility benefit that these vehicles offer

- The passenger segment dominated the market in 2022. The increasing demand for vehicles for daily transportation, along with the adoption of electric vehicles, particularly in developing countries, is fueling the electric vehicle powertrain market growth in this segment

- Asia Pacific is expected to expand at a high CAGR of more than 14.2% over the forecast period owing to the increasing adoption of electric vehicles in countries such as China and India

Table of Contents

Chapter 1. Methodology and Scope1.1. Research Methodology

1.2. Information Procurement

1.2.1. Purchased Database

1.2.2. Internal Database

1.2.3. List of Primary Sources

1.2.4. List of Secondary Sources

1.3. Information Analysis

1.3.1. Data Analysis Model

1.4. Market Formulation & Data Visualization

1.5. Data Validation & Publishing

Chapter 2. Executive Summary

2.1. Market Summary

Chapter 3. Electric Vehicle Powertrain Market Variables, Trends & Scope

3.1. Market Segmentation

3.2. Market Size And Growth Prospects

3.3. Global Electric Vehicle Powertrain Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraints Analysis

3.3.3. Market Opportunity Analysis

3.4. Industry Value Chain Analysis

3.5. Penetration And Growth Prospect Mapping

3.6. Electric Vehicle Powertrain Market Key Company Ranking Analysis, 2022

3.7. Market Analysis Tools

3.7.1. Electric Vehicle Powertrain Industry Analysis - Porter’s

3.7.2. Electric Vehicle Powertrain Industry Analysis - PEST Analysis

3.8. Impact Of COVID-19 On the Electric Vehicle Powertrain Market

Chapter 4. Electric Vehicle Powertrain Market: Component Outlook

4.1. Market Size Estimates & Forecasts And Trend Analysis, 2018 - 2030 (Revenue, USD Billion)

4.2. Motor/Generator

4.2.1. Market Estimates And Forecasts By Region, 2018 - 2030 (Revenue, USD Billion)

4.3. Battery

4.3.1. Market Estimates And Forecasts By Region, 2018 - 2030 (Revenue, USD Billion)

4.4. Power Electronic Controller

4.4.1. Market Estimates And Forecasts By Region, 2018 - 2030 (Revenue, USD Billion)

4.5. Converter

4.5.1. Market Estimates And Forecasts By Region, 2018 - 2030 (Revenue, USD Billion)

4.6. Transmission

4.6.1. Market Estimates And Forecasts By Region, 2018 - 2030 (Revenue, USD Billion)

4.7. On-Board Charger

4.7.1. Market Estimates And Forecasts By Region, 2018 - 2030 (Revenue, USD Billion)

Chapter 5. Electric Vehicle Powertrain Market: Vehicle Outlook

5.1. Market Size Estimates & Forecasts And Trend Analysis, 2018 - 2030 (Revenue, USD Billion)

5.2. BEV

5.2.1. Market Estimates And Forecasts By Region, 2018 - 2030 (Revenue, USD Billion)

5.3. HEV/PHEV

Chapter 6. Electric Vehicle Powertrain Market: Regional Outlook

6.1. Electric Vehicle Powertrain Market, By Region, 2022 & 2030

6.2. North America

6.2.1. Market Estimates And Forecasts By Country, 2018 - 2030 (Revenue, USD Billion)

6.2.2. Market Estimates And Forecasts By Component, 2018 - 2030 (Revenue, USD Billion)

6.2.3. Market Estimates And Forecasts By Vehicle, 2018 - 2030 (Revenue, USD Billion)

6.2.4. U.S.

6.2.4.1. Market Estimates And Forecasts By Component, 2018 - 2030 (Revenue, USD Billion)

6.2.4.2. Market Estimates And Forecasts By Vehicle, 2018 - 2030 (Revenue, USD Billion)

6.2.5. Canada

6.2.5.1. Market Estimates And Forecasts By Component, 2018 - 2030 (Revenue, USD Billion)

6.2.5.2. Market Estimates And Forecasts By Vehicle, 2018 - 2030 (Revenue, USD Billion)

6.3. Europe

6.3.1. Market Estimates And Forecasts By Country, 2018 - 2030 (Revenue, USD Billion)

6.3.2. Market Estimates And Forecasts By Component, 2018 - 2030 (Revenue, USD Billion)

6.3.3. Market Estimates And Forecasts By Vehicle, 2018 - 2030 (Revenue, USD Billion)

6.3.4. U.K.

6.3.4.1. Market Estimates And Forecasts By Component, 2018 - 2030 (Revenue, USD Billion)

6.3.4.2. Market Estimates And Forecasts By Vehicle, 2018 - 2030 (Revenue, USD Billion)

6.3.5. Germany

6.3.5.1. Market Estimates And Forecasts By Component, 2018 - 2030 (Revenue, USD Billion)

6.3.5.2. Market Estimates And Forecasts By Vehicle, 2018 - 2030 (Revenue, USD Billion)

6.4. Asia Pacific

6.4.1. Market Estimates And Forecasts By Country, 2018 - 2030 (Revenue, USD Billion)

6.4.2. Market Estimates And Forecasts By Component, 2018 - 2030 (Revenue, USD Billion)

6.4.3. Market Estimates And Forecasts By Vehicle, 2018 - 2030 (Revenue, USD Billion)

6.4.4. China

6.4.4.1. Market Estimates And Forecasts By Component, 2018 - 2030 (Revenue, USD Billion)

6.4.4.2. Market Estimates And Forecasts By Vehicle, 2018 - 2030 (Revenue, USD Billion)

6.4.5. India

6.4.5.1. Market Estimates And Forecasts By Component, 2018 - 2030 (Revenue, USD Billion)

6.4.5.2. Market Estimates And Forecasts By Vehicle, 2018 - 2030 (Revenue, USD Billion)

6.4.6. Japan

6.4.6.1. Market Estimates And Forecasts By Component, 2018 - 2030 (Revenue, USD Billion)

6.4.6.2. Market Estimates And Forecasts By Vehicle, 2018 - 2030 (Revenue, USD Billion)

6.4.7. South Korea

6.4.7.1. Market Estimates And Forecasts By Component, 2018 - 2030 (Revenue, USD Billion)

6.4.7.2. Market Estimates And Forecasts By Vehicle, 2018 - 2030 (Revenue, USD Billion)

6.5. Latin America

6.5.1. Market Estimates And Forecasts By Country, 2018 - 2030 (Revenue, USD Billion)

6.5.2. Market Estimates And Forecasts By Component, 2018 - 2030 (Revenue, USD Billion)

6.5.3. Market Estimates And Forecasts By Vehicle, 2018 - 2030 (Revenue, USD Billion)

6.6. Middle East And Africa

6.6.1. Market Estimates And Forecasts By Country, 2018 - 2030 (Revenue, USD Billion)

6.6.2. Market Estimates And Forecasts By Component, 2018 - 2030 (Revenue, USD Billion)

6.6.3. Market Estimates And Forecasts By Vehicle, 2018 - 2030 (Revenue, USD Billion)

Chapter 7. Competitive Landscape

7.1. BorgWarner Inc.

7.1.1. Company Overview

7.1.2. Financial Performance

7.1.3. Product Benchmarking

7.1.4. Recent Developments

7.2. Gentex Corporation Continental AG

7.2.1. Company Overview

7.2.2. Financial Performance

7.2.3. Product Benchmarking

7.2.4. Recent Developments

7.3. Cummins Inc.

7.3.1. Company Overview

7.3.2. Financial Performance

7.3.3. Product Benchmarking

7.3.4. Recent Developments

7.4. Dana Incorporated

7.4.1. Company Overview

7.4.2. Financial Performance

7.4.3. Product Benchmarking

7.4.4. Recent Developments

7.5. Hitachi Ltd

7.5.1. Company Overview

7.5.2. Financial Performance

7.5.3. Product Benchmarking

7.5.4. Recent Developments

7.6. Magna International Inc.

7.6.1. Company Overview

7.6.2. Financial Performance

7.6.3. Product Benchmarking

7.6.4. Recent Developments

7.7. Marelli Holdings Co., Ltd.

7.7.1. Company Overview

7.7.2. Financial Performance

7.7.3. Product Benchmarking

7.7.4. Recent Developments

7.8. Mitsubishi Electric Corporation

7.8.1. Company Overview

7.8.2. Financial Performance

7.8.3. Product Benchmarking

7.8.4. Recent Developments

7.9. Robert Bosch GmbH

7.9.1. Company Overview

7.9.2. Financial Performance

7.9.3. Product Benchmarking

7.9.4. Recent Developments

7.10. Valeo SA

7.10.1. Company Overview

7.10.2. Financial Performance

7.10.3. Product Benchmarking

7.10.4. Recent Developments

7.11. ZF Friedrichshafen AG

7.11.1. Company Overview

7.11.2. Financial Performance

7.11.3. Product Benchmarking

7.11.4. Recent Developments

List of Tables

Table 1 List of abbreviations

Table 2 Motor/generator market, 2018 - 2030 (USD Billion)

Table 3 Battery market, 2018 - 2030 (USD Billion)

Table 4 Power electronics controller market, 2018 - 2030 (USD Billion)

Table 5 Converter market, 2018 - 2030 (USD Billion)

Table 6 Transmission market, 2018 - 2030 (USD Billion)

Table 7 On-board charger market, 2018 - 2030 (USD Billion)

Table 8 BEV market, 2018 - 2030 (USD Billion, Units)

Table 9 HEV/PHEV market, 2018 - 2030 (USD Billion, Units)

Table 10 North America electric powertrain market, by component, 2018 - 2030 (USD Billion)

Table 11 North America electric powertrain market, by electric vehicle, 2018 - 2030 (USD Billion, Units)

Table 12 The U.S. electric powertrain market, by component, 2018 - 2030 (USD Billion)

Table 13 The U.S. electric powertrain market, by electric vehicle, 2018 - 2030 (USD Billion, Units)

Table 14 Canada electric powertrain market, by component, 2018 - 2030 (USD Billion)

Table 15 Canada electric powertrain market, by electric vehicle, 2018 - 2030 (USD Billion, Units)

Table 16 Europe electric powertrain market, by component, 2018 - 2030 (USD Billion)

Table 17 Europe electric powertrain market, by electric vehicle, 2018 - 2030 (USD Billion, Units)

Table 18 The U.K. electric powertrain market, by component, 2018 - 2030 (USD Billion)

Table 19 The U.K. electric powertrain market, by electric vehicle, 2018 - 2030 (USD Billion, Units)

Table 20 Germany electric powertrain market, by component, 2018 - 2030 (USD Billion)

Table 21 Germany electric powertrain market, by electric vehicle, 2018 - 2030 (USD Billion, Units)

Table 22 Asia Pacific electric powertrain market, by component, 2018 - 2030 (USD Billion)

Table 23 Asia Pacific electric powertrain market, by electric vehicle, 2018 - 2030 (USD Billion, Units)

Table 24 China electric powertrain market, by component, 2018 - 2030 (USD Billion)

Table 25 China electric powertrain market, by electric vehicle, 2018 - 2030 (USD Billion, Units)

Table 26 India electric powertrain market, by component, 2018 - 2030 (USD Billion)

Table 27 India electric powertrain market, by electric vehicle, 2018 - 2030 (USD Billion, Units)

Table 28 South Korea electric powertrain market, by component, 2018 - 2030 (USD Billion)

Table 29 South Korea electric powertrain market, by electric vehicle, 2018 - 2030 (USD Billion, Units)

Table 30 Japan electric powertrain market, by component, 2018 - 2030 (USD Billion)

Table 31 Japan electric powertrain market, by electric vehicle, 2018 - 2030 (USD Billion, Units)

Table 32 Latin America electric powertrain market, by component, 2018 - 2030 (USD Billion)

Table 33 Latin America electric powertrain market, by electric vehicle, 2018 - 2030 (USD Billion, Units)

Table 34 Middle East and Africa electric powertrain market, by component, 2018 - 2030 (USD Billion)

Table 35 Middle East and Africa electric powertrain market, by electric vehicle, 2018 - 2030 (USD Billion, Units)

List of Figures

Fig. 1 Electric powertrain market research methodology

Fig. 2 Electric powertrain market data triangulation technique

Fig. 3 Electric powertrain market primary research scope

Fig. 4 Electric powertrain market: Market segmentation

Fig. 5 Electric powertrain market: Market snapshot, 2022

Fig. 6 Electric powertrain market: Value chain analysis

Fig. 7 Electric powertrain market: Penetration and growth prospect mapping

Fig. 8 Electric powertrain market: Key company analysis, 2022

Fig. 9 Electric powertrain market: PESTEL analysis

Fig. 10 Electric powertrain market: Porter's five forces analysis

Fig. 11 Electric powertrain market: Electric vehicle segment analysis, 2018 - 2030 (USD Billion, Units)

Fig. 12 BEV Electric powertrain market: Component segment analysis, 2018 - 2030 (USD Billion)

Fig. 13 HEV/PHEV Electric powertrain market: Component segment analysis, 2018 - 2030 (USD Billion)

Fig. 14 Electric powertrain market: Regional segment analysis, 2018 - 2030

Fig. 15 Electric powertrain market: North America regional analysis, 2018 - 2030

Fig. 16 Electric powertrain market: Europe regional analysis, 2018 - 2030

Fig. 17 Electric powertrain market: Asia Pacific regional analysis, 2018 - 2030

Fig. 18 Electric powertrain market: Latin America regional analysis, 2018 - 2030

Fig. 19 Electric powertrain market: Middle East and Africa regional analysis, 2018 - 2030

Companies Mentioned

- BorgWarner Inc.

- Gentex Corporation Continental AG

- Cummins Inc.

- Dana Incorporated

- Hitachi Ltd

- Magna International Inc.

- Marelli Holdings Co., Ltd.

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Valeo SA

- ZF Friedrichshafen AG

Table Information

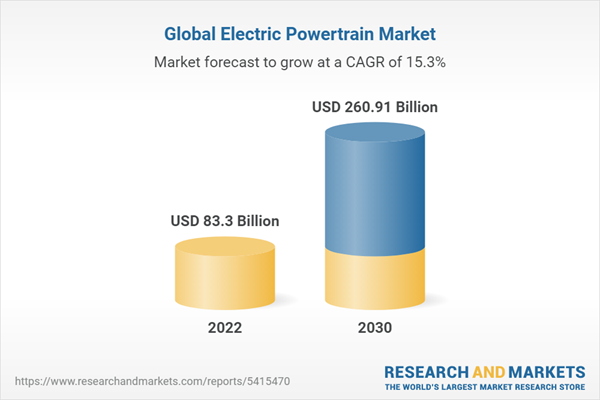

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | March 2023 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 83.3 Billion |

| Forecasted Market Value ( USD | $ 260.91 Billion |

| Compound Annual Growth Rate | 15.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |