Chapter 1 Methodology & Scope

1.1 Market Segmentation & Scope

1.2 Market Definition

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GVR's Internal Database

1.3.3 Secondary Sources & Third Party Perspectives

1.3.4 Primary Research

1.4 Information Analysis

1.5 Market Formulation & Data Visualization

1.6 Data Validating & Publishing

Chapter 3 Market Variables, Trends, and Scope

3.1 Penetration and Growth Prospect Mapping

3.2 Automotive Smart Display - Value Chain Analysis

3.3 Automotive Smart Display Market Dynamics

3.3.1 Market Drivers Analysis

3.3.2 Market Restraint Analysis

3.4 Automotive Smart Display Industry Analysis - PESTLE

3.5 Automotive Smart Display Industry Analysis - Porter's

Chapter 4 Automotive Smart Display Market: Display Size Estimates & Trend Analysis

4.1 Display Size Movement Analysis & Market Share, 2022 & 2030

4.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

4.2.1 Less than 5''

4.2.2 5''-10''

4.2.3 Greater than 10''

Chapter 5 Automotive Smart Display Market: Display Technology Estimates & Trend Analysis

5.1 Display Technology Movement Analysis & Market Share, 2022 & 2030

5.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

5.2.1 LCD

5.2.2 TFT-LCD

5.2.3 OLED

5.2.4 Others

Chapter 6 Automotive Smart Display Market: Application Type Estimates & Trend Analysis

6.1 Application Type Movement Analysis & Market Share, 2022 & 2030

6.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

6.2.1 Digital Instrument Cluster

6.2.2 Center Stack

6.2.3 Head-Up Display (HUD)

6.2.4 Rear Seat Entertainment

Chapter 7 Automotive Smart Display Market: Regional Estimates & Trend Analysis

7.1 Regional Movement Analysis & Market Share, 2022 & 2030

7.2 Market Size & Forecasts and Trends Analysis, 2018 to 2030 for the following:

7.2.1 North America

7.2.1.1 U.S.

7.2.1.2 Canada

7.2.2 Europe

7.2.2.1 UK

7.2.2.2 Germany

7.2.2.3 Spain

7.2.3 Asia Pacific

7.2.3.1 China

7.2.3.2 Japan

7.2.3.3 India

7.2.4 Latin America

7.2.4.1 Brazil

7.2.4.2 Mexico

7.2.5 Middle East and Africa

Chapter 7 Competitive Landscape

7.1. Company Categorization

7.2. Company Heat Map Analysis

7.3. Company Market Share Analysis, 2022

7.4. Strategy Mapping

7.5. Company Profiles (Overview, Financial Performance, Product Overview, Strategic Initiatives)

7.5.1. Alps Alpine Co., Ltd.

7.5.2. Continental AG

7.5.3. Denso Corporation

7.5.4. Hyundai Mobis

7.5.5. Nippon Seiki Co., Ltd.

7.5.6. Pioneer Corporation

7.5.7. Robert Bosch GmbH

7.5.8. SAMSUNG (HARMAN International)

7.5.9. Visteon Corporation

List of Tables

Table 1: List of Abbreviation

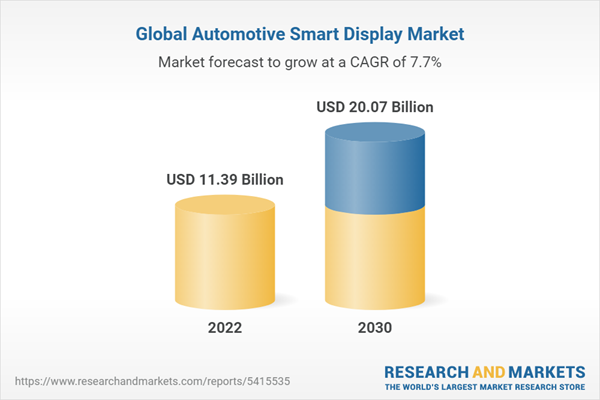

Table 2: Automotive smart display market, 2018-2030 (USD Billion)

Table 3: Automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 4: Automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 5: Automotive smart display market, by application, 2018-2030 (USD Billion)

Table 6: Automotive smart display market, by region, 2018-2030 (USD Billion)

Table 7: Less than 5'' market, by region, 2018-2030 (USD Billion)

Table 8: 5''-10'' market, by region, 2018-2030 (USD Billion)

Table 9: Greater than 10'' market, by region, 2018-2030 (USD Billion)

Table 10: LCD market, by region, 2018-2030 (USD Billion)

Table 11: TFT-LCD market, by region, 2018-2030 (USD Billion)

Table 12: OLED market, by region, 2018-2030 (USD Billion)

Table 13: Others market, by region, 2018-2030 (USD Billion)

Table 14: Digital Instrument Cluster market, by region, 2018-2030 (USD Billion)

Table 15: Center Stack market, by region, 2018-2030 (USD Billion)

Table 16: Head-up Display (HUD) market, by region, 2018-2030 (USD Billion)

Table 17: Rear Seat Entertainment market, by region, 2018-2030 (USD Billion)

Table 18: North America automotive smart display market, by country, 2018-2030 (USD Billion)

Table 19: North America automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 20: North America automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 21: North America automotive smart display market, by application, 2018-2030 (USD Billion)

Table 22: U.S. automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 23: U.S. automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 24: U.S. automotive smart display market, by application, 2018-2030 (USD Billion)

Table 25: Canada automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 26: Canada automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 27: Canada automotive smart display market, by application, 2018-2030 (USD Billion)

Table 28: Europe automotive smart display market, by country, 2018-2030 (USD Billion)

Table 29: Europe automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 30: Europe automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 31: Europe automotive smart display market, by application, 2018-2030 (USD Billion)

Table 32: Germany automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 33: Germany automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 34: Germany automotive smart display market, by application, 2018-2030 (USD Billion)

Table 35: UK automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 36: UK automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 37: UK automotive smart display market, by application, 2018-2030 (USD Billion)

Table 38: Spain automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 39: Spain automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 40: Spain automotive smart display market, by application, 2018-2030 (USD Billion)

Table 41: Asia Pacific automotive smart display market, by country, 2018-2030 (USD Billion)

Table 42: Asia Pacific automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 43: Asia Pacific automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 44: Asia Pacific automotive smart display market, by application, 2018-2030 (USD Billion)

Table 45: China automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 46: China automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 47: China automotive smart display market, by application, 2018-2030 (USD Billion)

Table 48: Japan automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 49: Japan automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 50: Japan automotive smart display market, by application, 2018-2030 (USD Billion)

Table 51: India automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 52: India automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 53: India automotive smart display market, by application, 2018-2030 (USD Billion)

Table 54: Latin America automotive smart display market, by country, 2018-2030 (USD Billion)

Table 55: Latin America automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 56: Latin America automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 57: Latin America automotive smart display market, by application, 2018-2030 (USD Billion)

Table 58: Brazil automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 59: Brazil automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 60: Brazil automotive smart display market, by application, 2018-2030 (USD Billion)

Table 61: Mexico automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 62: Mexico automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 63: Mexico automotive smart display market, by application, 2018-2030 (USD Billion)

Table 64: Middle East and Africa automotive smart display market, by display size, 2018-2030 (USD Billion)

Table 65: Middle East and Africa automotive smart display market, by display technology, 2018-2030 (USD Billion)

Table 66: Middle East and Africa automotive smart display market, by application, 2018-2030 (USD Billion)

List of Figures

Fig. 1: Automotive smart display market research methodology

Fig. 2: Automotive smart display market data triangulation technique

Fig. 3: Automotive smart display market primary research scope

Fig. 4: Automotive smart display market: Market segmentation

Fig. 5: Automotive smart display market: Market snapshot, 2022

Fig. 6: Automotive smart display market: Value chain analysis

Fig. 7: Automotive smart display market: Key company analysis, 2022

Fig. 8: Automotive smart display market: PESTEL analysis

Fig. 9: Automotive smart display market: Porter's five forces analysis

Fig. 10: Automotive smart display market: Display size segment analysis, 2018-2030 (USD Billion)

Fig. 11: Automotive smart display market: Display technology segment analysis, 2018-2030 (USD Billion)

Fig. 12: Automotive smart display market: Application segment analysis, 2018-2030 (USD Billion)

Fig. 13: Automotive smart display market: Regional segment analysis, 2018-2030 (USD Billion)

Fig. 14: Automotive smart display market: North America regional analysis, 2018-2030 (USD Billion)

Fig. 15: Automotive smart display market: Europe regional analysis, 2018-2030 (USD Billion)

Fig. 16: Automotive smart display market: Asia Pacific regional analysis, 2018-2030 (USD Billion)

Fig. 17: Automotive smart display market: Latin America regional analysis, 2018-2030 (USD Billion)