Rise in Demand for Assisted Living Facilities (ALF):

As the U.S. population of seniors continues to grow, the demand for ALFs is becoming increasingly pressing. According to the RubyHome article published in September 2023, approximately 1.2 million Americans reside in nursing homes, with over 15,000 nursing facilities nationwide. In addition, more than 30,000 communities cater primarily to older adults, as half of all facility residents are 85 or older. The financial implications of these arrangements are significant, with the median monthly cost for assisted living averaging USD 4,500. In contrast, a private room in a nursing home can cost around USD 9,034/month, nearly double the assisted living rate. Notably, California, Florida, and Washington lead the nation in assisted living communities, with 5,900, 2,400, and 2,000, respectively. Moreover, according to Consumers Unified, LLC, seven out of ten individuals in the U.S. require assisted living care in their lifetime.The Growing Number of Residents in ALF:

The growing number of residents in ALFs indicates an increasing demand for these services. This trend highlights the need for high-quality assisted living facilities across the country. As this demand continues to rise, providers must evolve to address the changing needs of the aging population. The urban areas have a greater concentration of assisted living facilities for several reasons. The higher population density in cities results in a larger pool of potential residents. Moreover, the proximity to healthcare services, social amenities, and transportation makes urban settings appealing for these facilities. The market in urban areas benefits from various amenities and services, allowing facilities to offer multiple activities, dining choices, and recreational opportunities that cater to diverse residents.U.S. Assisted Living Facility Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033 The analyst has segmented the U.S. assisted living facility market report based on age, and region:Age Outlook (Revenue, USD Billion, 2021-2033)

- More than 85

- 75-84

- 65-74

- Less than 65

Regional Outlook (Revenue, USD Billion, 2021-2033)

- West

- Southeast

- Southwest

- Midwest

- Northeast

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the industry across major regions and segments.

- Competitive Landscape: Explore the market presence of key players.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segmental and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listings for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

The major companies profiled in this U.S. Assisted Living Facility market report include:- Kindred Healthcare

- Brookdale Senior Living Solutions

- Sunrise Senior Living

- Sonida Senior Living

- Atria Senior Living, Inc

- Five Star Senior Living (AlerisLife)

- Merrill Gardens

- Centers for Dialysis Care

- Integral Senior Living (ISL)

- Belmont Village, L.P.

Table Information

| Report Attribute | Details |

|---|---|

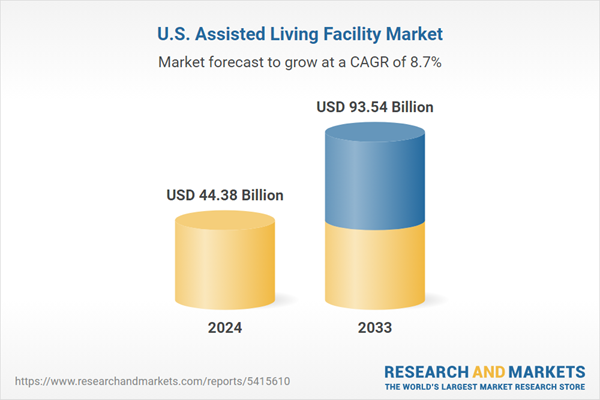

| No. of Pages | 100 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 44.38 Billion |

| Forecasted Market Value ( USD | $ 93.54 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 11 |