Several countries such as Germany, India, France, and Canada have recognized that the expansion of the railway infrastructure is a significant factor supporting economic development. As a result, OEMs and numerous countries are investing considerably in railway infrastructure. For instance, in September 2022, Siemens mobility announced a contract with NS Groep N.V., a transportation company, to upgrade 176 ViRM trains with the most up-to-date ETCS European Train Control System (ETCS) Level 2 technology.

With the ETCS Level 2 update, the fleet will be able to function more effectively to balance its useful life while also satisfying the most recent European criteria for rail safety compatibility. Equipment for the ETCS onboard unit, installation assistance, and seven years of system maintenance services will all be supplied by Siemens Mobility.

The majority of the prominent players in the railway telematics market belong to European region. OEMs including Alstom, DB Cargo, Knorr-Bremse, and Siemens AG hold a majority of the share in the railway telematics market. Several railway operators are replacing old technologies with progressive train signaling and control systems. For instance, in May 2022, Rail Pulse announced a partnership with Railinc, a rail data services provider company.

Under this partnership, Railinc and Rail Pulse will provide sensor and telematics technology to the North American freight rail sector. Under a 10-year agreement, Railinc will create, maintain, and run the technology platform for Rail Pulse to track the current location, and condition of railcars.

The outbreak of COVID-19 has negatively impacted the market. The lockdown restrictions imposed by the various governments have hampered freight and logistics activities, globally, during the first half of 2020. This has led to a significant decline in the adoption of telematics services. However, with the ease in the lockdown restrictions imposed by various governments, globally, and the revival of logistics and freight activities along with the business resumption, the market is expected to witness significant growth during the forecast period.

The prominent players that dominated the railway telematics market globally in 2020 include Hitachi Ltd., Siemens AG, Robert Bosch GmbH, Knorr-Bremse AG, and Alstom SA. These players majorly focus on strategic partnerships and mergers & acquisitions to enhance their business operations. For instance, in January 2022, Hitachi Rail Limited partnered with Intermodal Telematics BV (IMT), a software services provider for the intermodal transport industry, to improve its rail freight market offerings.

As part of this partnership, IMT's monitoring sensors that provide real-time monitoring will be integrated into Hitachi's present digital freight service. These sensors support the accurate verification of railcar locations, loading status, door and hatch open/close conditions, cargo temperature and pressure, along with the condition of bogies and wheelsets.

Railway Telematics Market Report Highlights

- The fleet management segment is expected to dominate the railway telematics market due to the increasing freight activities, globally. The segment growth can be attributed to the rising need to manage the performance and the condition of rail assets

- The telematics control unit segment is expected to dominate the component segment and the trend is expected to continue during the forecast period. The growth can be attributed to the increased profitability, safety, and maintenance provided by the advanced telematics control unit in railcars

- North America is estimated to account for the majority share of the market during the forecast period. Growing transportation requirements of freight and logistics industries and increasing awareness about safety and accident prevention are some of the major drivers of the market growth in this region

Table of Contents

Chapter 1. Methodology & Scope1.1. Market segmentation & scope

1.2. Information procurement

1.2.1. Purchased database

1.2.2. internal database

1.2.3. Secondary sources & third-party perspectives

1.2.4. Primary research

1.3. Information analysis

1.3.1. Data analysis models

1.3.2. Market formulation & data visualization

1.4. Data validation & publishing

Chapter 2. Executive Summary

Chapter 3. Railway Telematics Market Variables, Trends, and Scope

3.1. Penetration & Growth Prospect Mapping

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Driver Analysis

3.3.2. Market Restraint Analysis

3.4. Business Environment Analysis Tools

3.4.1. Industry Analysis - Porter’s Five Forces Analysis

3.4.2. PEST Analysis

3.5. Impact of COVID-19 on Railway Telematics Market

Chapter 4. Railway Telematics Market: Solution Outlook

4.1. Market Size Estimates & Forecasts and Trend Analysis, 2018 - 2030 (USD Million)

4.1.1. Fleet Management

4.1.1.1. Market estimates and forecasts by region, 2018 - 2030 (USD Million)

4.1.2. Automatic Stock Control

4.1.2.1. Market estimates and forecasts by region, 2018 - 2030 (USD Million)

4.1.3. Remote data access

4.1.3.1. Market estimates and forecasts by region, 2018 - 2030 (USD Million)

4.1.4. Railcar tracking and tracing

4.1.4.1. Market estimates and forecasts by region, 2018 - 2030 (USD Million)

4.1.5. Others

4.1.5.1. Market estimates and forecasts by region, 2018 - 2030 (USD Million)

Chapter 5. Railway Telematics Market: Railcar Outlook

5.1. Market Size Estimates & Forecasts and Trend Analysis, 2018 - 2030 (USD Million)

5.1.1. Hoppers

5.1.1.1. Market estimates and forecasts by region, 2018 - 2030 (USD Million)

5.1.2. Tank cars

5.1.2.1. Market estimates and forecasts by region, 2018 - 2030 (USD Million)

5.1.3. Well cars

5.1.3.1. Market estimates and forecasts by region, 2018 - 2030 (USD Million)

5.1.4. Boxcars

5.1.4.1. Market estimates and forecasts by region, 2018 - 2030 (USD Million)

5.1.5. Refrigerated boxcars

5.1.5.1. Market estimates and forecasts by region, 2018 - 2030 (USD Million)

5.1.6. Others

5.1.6.1. Market estimates and forecasts by region, 2018 - 2030 (USD Million)

Chapter 6. Railway Telematics Market: Component Outlook

6.1. Market Size Estimates & Forecasts and Trend Analysis, 2018 - 2030 (USD Million)

6.1.1. Telematics Control Unit

6.1.1.1. Market estimates and forecasts by region, 2018 - 2030 (USD Million)

6.1.2. Sensors

6.1.2.1. Market estimates and forecasts by region, 2018 - 2030 (USD Million)

Chapter 7. Railway Telematics Market: Regional Outlook

7.1. Railway Telematics Market, By Region, 2022 & 2030

7.2. North America

7.2.1. North America market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.2.2. North America market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.2.3. North America market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.2.4. U.S.

7.2.4.1. U.S. market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.2.4.2. U.S. market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.2.4.3. U.S. market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.2.5. Canada

7.2.5.1. Canada market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.2.5.2. Canada market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.2.5.3. Canada market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.3. Europe

7.3.1. Europe market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.3.2. Europe market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.3.3. Europe market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.3.4. Germany

7.3.4.1. Germany market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.3.4.2. Germany market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.3.4.3. Germany market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.3.5. U.K.

7.3.5.1. U.K. market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.3.5.2. U.K. market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.3.5.3. U.K. market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.3.6. France

7.3.6.1. France market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.3.6.2. France market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.3.6.3. France market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.4.2. Asia Pacific market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.4.3. Asia Pacific market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.4.4. China

7.4.4.1. China market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.4.4.2. China market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.4.4.3. China market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.4.5. India

7.4.5.1. India market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.4.5.2. India market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.4.5.3. India market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.4.6. Japan

7.4.6.1. Japan market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.4.6.2. Japan market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.4.6.3. Japan market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.5. Latin America

7.5.1. Latin America market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.5.2. Latin America market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.5.3. Latin America market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.5.4. Brazil

7.5.4.1. Brazil market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.5.4.2. Brazil market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.5.4.3. Brazil market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.5.5. Mexico

7.5.5.1. Mexico market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.5.5.2. Mexico market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.5.5.3. Mexico market estimates and forecasts, by component, 2018 - 2030 (USD Million)

7.6. Middle East & Africa

7.6.1. MEA market estimates and forecasts, by solution, 2018 - 2030 (USD Million)

7.6.2. MEA market estimates and forecasts, by railcar, 2018 - 2030 (USD Million)

7.6.3. MEA market estimates and forecasts, by component, 2018 - 2030 (USD Million)

Chapter 8. Competitive Analysis

8.1 Recent Developments and Impact Analysis, by Key Market Participants

8.2 Company/Competition Categorization

8.3 Vendor Landscape

8.3.1 Key Company Ranking Analysis, 2022

Chapter 9. Competitive Landscape

9.1. Siemens AG

9.1.1. Company overview

9.1.2. Financial performance

9.1.3. Product benchmarking

9.1.4. Recent developments

9.2. Hitachi Ltd.

9.2.1. Company overview

9.2.2. Financial performance

9.2.3. Product benchmarking

9.2.4. Recent developments

9.3. Alstom SA

9.3.1. Company overview

9.3.2. Financial performance

9.3.3. Product benchmarking

9.3.4. Recent developments

9.4. Knorr-Bremse AG

9.4.1. Company overview

9.4.2. Financial performance

9.4.3. Product benchmarking

9.4.4. Recent developments

9.5. Hitachi Ltd.

9.5.1. Company overview

9.5.2. Financial performance

9.5.3. Product benchmarking

9.5.4. Recent developments

9.6. Robert Bosch GmbH

9.6.1. Company overview

9.6.2. Financial performance

9.6.3. Product benchmarking

9.6.4. Recent developments

9.7. A1 Digital

9.7.1. Company overview

9.7.2. Financial performance

9.7.3. Product benchmarking

9.7.4. Recent developments

9.8. Rail nova SA

9.8.1. Company overview

9.8.2. Financial performance

9.8.3. Product benchmarking

9.8.4. Recent developments

9.9. SAVVY Telematics Systems AG

9.9.1. Company overview

9.9.2. Financial performance

9.9.3. Product benchmarking

9.9.4. Recent developments

9.10. Wabtec Corporation

9.10.1. Company overview

9.10.2. Financial performance

9.10.3. Product benchmarking

9.10.4. Recent developments

9.11. Amsted Industries

9.11.1. Company overview

9.11.2. Financial performance

9.11.3. Product benchmarking

9.11.4. Recent developments

9.12. Orbcomm

9.12.1. Company overview

9.12.2. Financial performance

9.12.3. Product benchmarking

9.12.4. Recent developments

List of Tables

Table 1 Global Railway Telematics Market, 2018 - 2030 (USD Million)

TABLE 2 Global Railway Telematics Market estimates and forecasts by region, 2018 - 2030 (USD Million)

TABLE 3 Global Railway Telematics Market estimates and forecasts by solution, 2018 - 2030 (USD Million)

TABLE 4 Global Railway Telematics Market estimates and forecasts by railcar, 2018 - 2030 (USD Million)

TABLE 5 Global Railway Telematics Market estimates and forecasts by component, 2018 - 2030 (USD Million)

TABLE 6 Global fleet management market by region, 2018 - 2030 (USD Million)

TABLE 7 Global automatic stock control market by region, 2018 - 2030 (USD Million)

TABLE 8 Global remote data access market by region, 2018 - 2030 (USD Million)

TABLE 9 Global railcar tracking and tracing market by region, 2018 - 2030 (USD Million)

TABLE 10 Global others market by region, 2018 - 2030 (USD Million)

TABLE 11 Global hoppers market by region, 2018 - 2030 (USD Million)

TABLE 12 Global tank cars market by region, 2018 - 2030 (USD Million)

TABLE 13 Global well cars market by region, 2018 - 2030 (USD Million)

TABLE 14 Global boxcars market by region, 2018 - 2030 (USD Million)

TABLE 15 Global refrigerated boxcars market by region, 2018 - 2030 (USD Million)

TABLE 16 Global others market by region, 2018 - 2030 (USD Million)

TABLE 17 Global telematics control unit market by region, 2018 - 2030 (USD Million)

TABLE 18 Global sensors market by region, 2018 - 2030 (USD Million)

TABLE 19 North America Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 20 North America Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 21 North America Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 22 U.S. Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 23 U.S. Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 24 U.S. Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 25 Canada Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 26 Canada Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 27 Canada Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 28 Europe Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 29 Europe Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 30 Europe Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 31 Germany Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 32 Germany Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 33 Germany Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 34 U.K. Railway Telematics Market by solution, 2018 - 2030 (USD Million

TABLE 35 U.K. Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 36 U.K. Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 37 France Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 38 France Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 39 France Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 40 Asia Pacific Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 41 Asia Pacific Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 42 Asia Pacific Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 43 China Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 44 China Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 45 China Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 46 India Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 47 India Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 48 India Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 49 Japan Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 50 Japan Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 51 Japan Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 52 Latin America Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 53 Latin America Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 54 Latin America Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 55 Brazil Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 56 Brazil Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 57 Brazil Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 58 Mexico Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 59 Mexico Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 60 Mexico Railway Telematics Market by component, 2018 - 2030 (USD Million)

TABLE 61 Middle East & Africa Railway Telematics Market by solution, 2018 - 2030 (USD Million)

TABLE 62 Middle East & Africa Railway Telematics Market by railcar, 2018 - 2030 (USD Million)

TABLE 63 Middle East & Africa Railway Telematics Market by component, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market segmentation

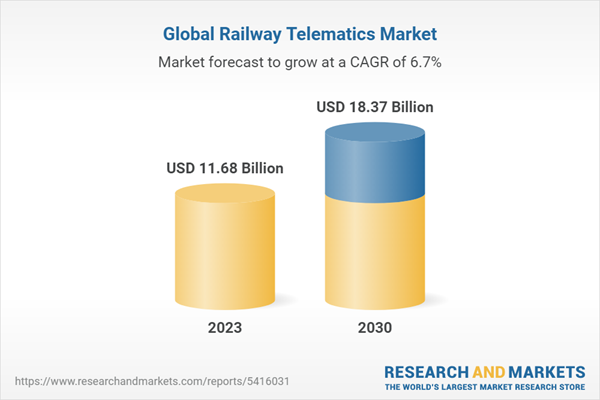

FIG. 2 Railway Telematics Market - Market size and growth prospects

FIG. 3 Railway Telematics Market - Value chain analysis

FIG. 4 Market dynamics

FIG. 5 Porter’s Five Forces Analysis

FIG. 6 Penetration & growth prospect mapping

FIG. 7 Railway Telematics Market- PESTEL analysis

FIG. 8 Railway Telematics Market share by solution, 2022 & 2030

FIG. 9 Railway Telematics Market share by railcar, 2022 & 2030

FIG. 10 Railway Telematics Market share by component, 2022 & 2030

FIG. 11 Railway Telematics Market share by region, 2022 & 2030

Companies Mentioned

- Siemens AG

- Hitachi Ltd.

- Alstom SA

- Knorr-Bremse AG

- Hitachi Ltd.

- Robert Bosch GmbH

- A1 Digital

- Rail nova SA

- SAVVY Telematics Systems AG

- Wabtec Corporation

- Amsted Industries

- Orbcomm

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | January 2023 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 11.68 Billion |

| Forecasted Market Value ( USD | $ 18.37 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |