Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Elevator & Escalator Maintenance and Repair Services market involves the maintenance, repair, and servicing of elevators and escalators across various sectors such as residential, commercial, industrial, and institutional buildings. This market plays a crucial role in ensuring the safe and efficient operation of vertical transportation systems, which are essential for vertical mobility in modern infrastructure.

Providers in this market typically offer a range of services including regular maintenance to prevent breakdowns, emergency repairs, modernization of outdated systems to improve efficiency and safety, and installation of new equipment. The market is driven by stringent safety regulations, technological advancements in elevator and escalator systems, urbanization trends leading to increased construction of high-rise buildings, and the need for sustainable and energy-efficient solutions.

Key Market Drivers

Stringent Safety Regulations and Compliance Standards

The UAE's Elevator & Escalator Maintenance and Repair Services market is significantly influenced by stringent safety regulations and compliance standards. With a strong emphasis on safety in public and private buildings, regulatory bodies such as the Dubai Municipality and Abu Dhabi Quality and Conformity Council (QCC) enforce strict guidelines for the installation, maintenance, and operation of elevators and escalators.These regulations cover various aspects including design specifications, installation procedures, regular inspection schedules, and emergency preparedness. Service providers must adhere to these standards to obtain necessary certifications and licenses, ensuring the safety and reliability of vertical transportation systems across the UAE.

Moreover, the introduction of updated safety codes and standards, often aligned with international best practices such as those from the American Society of Mechanical Engineers (ASME) and European Committee for Standardization (CEN), further drives the demand for compliant maintenance and repair services. Compliance with these standards not only enhances safety but also instills confidence among building owners, developers, and occupants regarding the reliability of elevator and escalator systems.

Regulatory bodies periodically update safety regulations to address emerging technological advancements and potential risks associated with aging infrastructure. This dynamic regulatory environment necessitates ongoing training and certification for maintenance personnel, ensuring they remain abreast of the latest safety protocols and operational practices.

Key Market Challenges

Intense Market Competition and Price Sensitivity

The UAE Elevator & Escalator Maintenance and Repair Services market is characterized by intense competition among both local and international service providers. With the country's booming construction sector and rapid urbanization, numerous companies vie for contracts related to the installation, maintenance, and repair of vertical transportation systems.One of the primary challenges stemming from this competitive landscape is price sensitivity. Clients, including building developers, facility managers, and homeowners associations, often prioritize cost-effectiveness when selecting service providers for elevator and escalator maintenance. This price sensitivity compels maintenance companies to offer competitive pricing while striving to maintain service quality and profitability.

Price competition can lead to downward pressure on service margins, particularly in a market where many providers offer similar maintenance packages. Service differentiation becomes crucial, prompting companies to highlight factors such as reliability, response times, expertise in specific elevator brands, and value-added services like remote monitoring or predictive maintenance.

The competitive environment necessitates ongoing investments in workforce training, technology upgrades, and customer service enhancements to stay ahead. Companies must balance cost efficiencies with maintaining service excellence to retain existing clients and attract new business opportunities in a saturated market.

Additionally, the pricing dynamics are influenced by fluctuating economic conditions and market demands. During periods of economic downturn or reduced construction activity, the volume of maintenance contracts may decline, intensifying competition for available projects. Conversely, economic upswings and increased construction activities can create spikes in demand, challenging service providers to scale operations efficiently without compromising service quality.

Complex Regulatory Environment and Compliance Challenges

The UAE Elevator & Escalator Maintenance and Repair Services market faces complex regulatory requirements and compliance challenges, which can impact operational efficiency and service delivery. Regulatory oversight is stringent in the UAE, with government bodies such as the Dubai Municipality and Abu Dhabi Quality and Conformity Council (QCC) mandating strict adherence to safety, quality, and environmental standards for vertical transportation systems.One of the primary challenges for service providers is navigating the diverse regulatory landscape across different emirates within the UAE. Each emirate may have its own set of regulations, certification requirements, and inspection procedures governing the installation, maintenance, and operation of elevators and escalators. This diversity adds layers of complexity, requiring companies to stay abreast of regulatory updates and ensure compliance across various jurisdictions where they operate.

Regulatory compliance extends beyond initial installation to encompass ongoing maintenance practices and safety inspections. Service providers must maintain comprehensive records of maintenance activities, adhere to prescribed inspection schedules, and promptly address any non-compliance issues identified during inspections. Failure to comply with regulatory requirements can result in penalties, legal liabilities, and reputational damage for the service provider.

keeping pace with evolving safety standards and technological advancements poses additional compliance challenges. Regulatory bodies periodically update standards to incorporate new technologies, address emerging safety risks, and align with international best practices. Service providers must invest in continuous training for their technical teams, adopt advanced diagnostic tools, and implement preventive maintenance strategies to meet these evolving standards effectively.

Regulatory compliance often entails significant administrative burdens and costs associated with obtaining certifications, conducting inspections, and ensuring documentation accuracy. Small and medium-sized enterprises (SMEs) in the maintenance sector, in particular, may face resource constraints and operational challenges in meeting stringent regulatory requirements compared to larger competitors with greater financial and organizational capabilities.

Key Market Trends

Adoption of IoT and Smart Technologies

The UAE Elevator & Escalator Maintenance and Repair Services market is witnessing a significant trend towards the adoption of Internet of Things (IoT) and smart technologies to enhance operational efficiency, predictive maintenance capabilities, and overall service delivery. IoT-enabled sensors and connected devices are being integrated into elevator and escalator systems, allowing for real-time monitoring of performance metrics such as motor temperature, door operation, and passenger traffic patterns.These IoT devices collect data that can be analyzed to identify potential issues before they escalate into costly breakdowns, enabling service providers to implement predictive maintenance strategies. By leveraging predictive analytics and machine learning algorithms, maintenance teams can schedule proactive repairs based on actual system behavior and performance trends, rather than relying on traditional scheduled maintenance approaches.

IoT technology facilitates remote diagnostics and troubleshooting, allowing maintenance personnel to access system data and diagnostic reports from anywhere via mobile devices or cloud-based platforms. This capability not only improves response times but also reduces downtime by enabling swift identification and resolution of maintenance issues without the need for onsite visits.

The integration of IoT and smart technologies supports the implementation of energy-efficient practices in elevator and escalator operations. Features such as intelligent lighting controls, regenerative drives, and optimized scheduling algorithms contribute to reduced energy consumption and operational costs, aligning with the UAE's sustainability goals and green building initiatives.

IoT-enabled elevators and escalators enhance the overall user experience by offering personalized services such as destination control systems that optimize travel time and efficiency for passengers. These technological advancements not only differentiate service offerings but also cater to the increasing demand for smart building solutions in the UAE's rapidly evolving urban landscape.

Focus on Energy Efficiency and Sustainability

A prominent trend in the UAE Elevator & Escalator Maintenance and Repair Services market is the increasing emphasis on energy efficiency and sustainability. As the UAE strives to reduce its carbon footprint and achieve sustainable development goals, there is growing demand for eco-friendly solutions in building operations, including vertical transportation systems.Elevators and escalators are significant consumers of energy in commercial and residential buildings. Therefore, there is a strong push towards retrofitting existing systems with energy-efficient components such as LED lighting, variable frequency drives (VFDs), and regenerative braking systems. These technologies minimize energy consumption during operation, reduce heat dissipation, and contribute to lower overall building operating costs.

Service providers are offering energy audits and consultancy services to help building owners assess their current energy usage patterns and identify opportunities for efficiency improvements. This proactive approach not only enhances sustainability credentials but also positions maintenance companies as trusted partners in achieving energy efficiency goals.

Regulatory initiatives and green building certifications such as LEED (Leadership in Energy and Environmental Design) and Estidama encourage developers and facility managers to prioritize sustainable practices in building design and operations. Compliance with these standards often requires elevators and escalators to meet specific energy efficiency criteria, driving the demand for compliant maintenance and modernization services.

Advancements in renewable energy technologies, such as solar-powered elevators and energy storage solutions, are gaining traction in the UAE market. These innovations offer opportunities to further reduce reliance on grid electricity and promote sustainable practices in vertical transportation infrastructure.

Segmental Insights

End User Insights

The commercial held the largest market share in 2023. The commercial sector dominated the UAE Elevator & Escalator Maintenance and Repair Services market due to several compelling factors linked to the region's economic landscape and urban development.The UAE, particularly cities like Dubai and Abu Dhabi, has experienced rapid urbanization and economic growth, leading to a proliferation of high-rise office buildings, luxury hotels, expansive shopping malls, and mixed-use developments. These commercial properties rely heavily on elevators and escalators to facilitate smooth and efficient vertical transportation for employees, guests, and shoppers. As these structures become taller and more complex, the need for reliable maintenance and repair services escalates, driving demand in this sector.

The UAE's positioning as a global business and tourism hub amplifies the importance of the commercial sector. Dubai and Abu Dhabi host numerous international businesses, events, and conferences, necessitating the highest standards of infrastructure, including elevator and escalator systems. The influx of tourists and business travelers further intensifies the usage of these systems, underscoring the need for regular and rigorous maintenance to ensure safety, efficiency, and minimal downtime.

Commercial buildings typically have higher traffic volumes compared to residential or institutional properties. The continuous and intensive use of elevators and escalators in offices, malls, and hotels subjects these systems to greater wear and tear. Consequently, there is a heightened demand for preventive maintenance, timely repairs, and modernization services to maintain operational integrity and user safety.

Regulatory requirements and compliance standards in the UAE mandate strict adherence to safety protocols in commercial buildings. Owners and managers of commercial properties are obligated to ensure that their elevator and escalator systems are regularly inspected, maintained, and upgraded to meet these standards, driving the demand for professional maintenance services.

Commercial property owners and managers often have larger budgets allocated for maintenance compared to other sectors. This financial capacity allows for comprehensive service contracts, advanced technological integrations, and regular system upgrades, all of which contribute to the dominance of the commercial sector in the UAE Elevator & Escalator Maintenance and Repair Services market.

Regional Insights

Abu Dhabi held the largest market share in 2023. The Abu Dhabi region is dominating the UAE Elevator & Escalator Maintenance and Repair Services market due to several key factors. Abu Dhabi, as the capital city of the UAE, is experiencing rapid urbanization and significant infrastructure development. The city is home to numerous high-rise buildings, luxury hotels, expansive shopping malls, and commercial complexes, all of which require sophisticated and reliable vertical transportation systems.A major driver is Abu Dhabi's Vision 2030, a comprehensive plan aimed at diversifying the economy and promoting sustainable urban development. This vision includes substantial investments in real estate, tourism, and commercial projects, leading to an increased demand for elevators and escalators, as well as their ongoing maintenance and repair.

Abu Dhabi's commitment to developing world-class infrastructure, including iconic projects like the Louvre Abu Dhabi, Al Maryah Island, and Al Reem Island, has created a robust market for elevator and escalator services. These projects not only necessitate the installation of advanced vertical transportation systems but also their regular upkeep to ensure safety and operational efficiency.

The stringent safety regulations and standards imposed by the Abu Dhabi Quality and Conformity Council (QCC) further drive the market. These regulations mandate regular inspections, certifications, and maintenance of elevators and escalators, compelling building owners and facility managers to engage professional services to remain compliant.

The region's focus on sustainability and energy efficiency aligns with global trends, driving the demand for modern, eco-friendly elevator and escalator systems. Maintenance and repair service providers in Abu Dhabi are increasingly required to upgrade older systems to meet these evolving standards, thereby stimulating market growth.

Abu Dhabi's economic stability and high per capita income contribute to the market's expansion. The region's affluent population and thriving business environment support the continuous development and maintenance of high-end residential and commercial properties, ensuring a steady demand for elevator and escalator services.

Key Market Players

- Otis Worldwide Corporation

- Schindler Holding Ltd.

- KONE Corporation

- ThyssenKrupp AG

- Mitsubishi Electric Corporation

- Fujitec Co., Ltd.

- Hitachi, Ltd.

- Hyundai Elevator Co. Ltd.

Report Scope:

In this report, the UAE Elevator & Escalator Maintenance and Repair Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UAE Elevator & Escalator Maintenance and Repair Services Market, By Type:

- Elevator

- By Elevator Technology

Ø Hydraulic

Ø Traction

- By Elevator Door Type

Ø Automatic

Ø Manual

- Escalator

- Moving Walkways

UAE Elevator & Escalator Maintenance and Repair Services Market, By End User:

- Residential

- Commercial

- Institutional

- Infrastructural

- Others

UAE Elevator & Escalator Maintenance and Repair Services Market, By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Rest of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Elevator & Escalator Maintenance and Repair Services Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Otis Worldwide Corporation

- Schindler Holding Ltd.

- KONE Corporation

- ThyssenKrupp AG

- Mitsubishi Electric Corporation

- Fujitec Co., Ltd.

- Hitachi, Ltd.

- Hyundai Elevator Co. Ltd.

Table Information

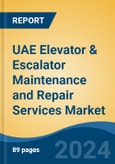

| Report Attribute | Details |

|---|---|

| No. of Pages | 89 |

| Published | December 2024 |

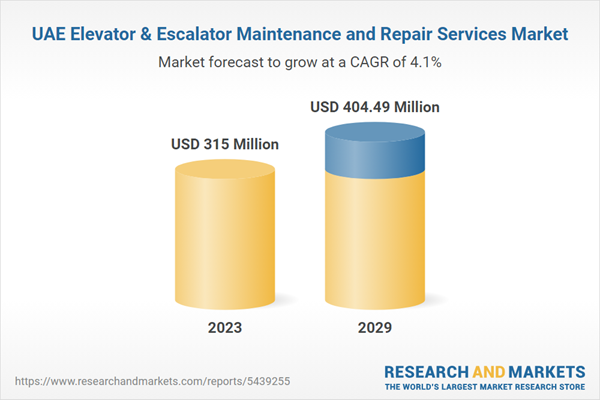

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 315 Million |

| Forecasted Market Value ( USD | $ 404.49 Million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 8 |