Speak directly to the analyst to clarify any post sales queries you may have.

Demand for Mini Excavators & Small Excavators Is Growing in the Brazilian Market

- Mini and small excavators will gain a good market share in the Brazil crawler excavator market in 2024. The demand for this equipment is growing sharply due to rising government investment in public infrastructure and other repair and renovation projects across the country. These equipment are affordable and provide cutting-edge technology with operational versatility.

- Mini and small excavators are used in confined work areas such as buildings and highway and street repairs. This equipment is also used for small civil works such as house renovation, gardening, debris removal, and working in parking areas and basements of houses. These machines produce low noise and are easy to transport; therefore, they are idle for construction projects in urban locations.

- Mini excavators are also used to clean solar panels. The government is investing in various solar energy projects in 2024. According to the Brazilian Solar Energy Association, ABSolar's newly installed PV capacity reached 12 GW in 2023. Solar generation capacities rose from 13 GW in 2021 to 25 GW by 2023.

KEY HIGHLIGHTS

- The medium-sized excavators segment held the largest share of the Brazil crawler excavator market in 2023 due to its versatile uses in the construction and mining industries. Government investment in infrastructure upgrades and transport projects for better connectivity of rural parts are expected to support demand for medium excavators in the Brazilian market during the forecast period.

- The rise in public infrastructure, mining, and renewable energy projects drives the sales of crawler excavators in the Brazil crawler excavator market.

- The crawler excavator utilization in the construction industry by end-users has the largest Brazil crawler excavator market share in 2023.

- Vendors are signing exclusive partnerships with end-users to gain market share and maintain their leading position.

- Crawler excavators are one of the region’s best-sold construction equipment. The demand for this equipment is expected to grow sharply in 2024. A significant share of demand is concentrated in the 20-to-25-ton segment in the excavators segment.

SEGMENTATION ANALYSIS

Segmentation by Crawler Excavator

- Size

- Mini Excavator

- Small Excavator

- Medium Excavator

- Large Excavator

- Gross Power

- Less Than 60 HP

- 60 HP -100 HP

- 101 HP-200 HP

- Above 200 HP

- Segmentation by End Users

- Construction

- Mining

- Agriculture

- Forestry

- Others (Power Generation, Utilities Municipal Corporations, Oil & Gas, Cargo Handling, Power Generation Plants, Waste Management)

Market Developments

- OEMs in the Brazil crawler excavator market are launching new excavators and focusing on expanding distribution partners to enhance customer experience.

- SANY has created a new energy technologies division for strategic planning, research, and development. In 2021, SANY developed 34 electric products, of which 20 were launched with hybrid and electric equipment.

- In 2023, John Deere planned to invest USD 29.8 million to develop a technological development center in the region. The project aims to promote synergy between R&D teams focused on designing and validating new products and technologies.

- Volvo Construction Equipment will launch two electric excavators, the Volvo L25 and the Volvo ECR25, in the Brazil crawler excavator market in 2024. The Volvo ECR25 is used in agribusiness, such as on farms and farmyards.

MARKET TRENDS & DRIVERS

Spike in Demand for Mini Excavators Due to Rise in Civil Engineering & Redevelopment Projects in Brazilian Cities

With the rise in civil engineering & redevelopment projects in Brazilian cities in 2023, the demand for mini excavators witnessed sharp growth in the Brazil crawler excavator market. Mini excavators are agile and sturdy. They can work in congested areas such as minor buildings, wall excavations, and renovations in compact streets and roads, among other operations. This equipment also stands out for application in small civil works such as renovations. For example, where they are present in several stages: in gardening, in the opening of swimming pools, in the removal of debris, parking lots, or underground garages. In addition, they are easy to transport machines.New Product Innovation and Integration of the Latest Technologies Are Transitioning the Brazil Crawler Excavator Market

- Due to intense competition in technology and design, excavator makers are vigorously marketing their devices, focusing on technologically innovative features and a wide variety of attachments.

- Manufacturers in the Brazil crawler excavator market are adding innovations to their excavator motors, hydraulic systems, structures, tracks, and cab construction by combining telematics to stay ahead of the competition.

- OEMs are also improving their telematic software, constantly gaining popularity among excavator owners who want to improve their machines' uptime and safety.

The Rise in Mining Activities Drives the Demand for Large Excavators

- There is a surge in demand for commodities such as gold, copper, iron ore, and silver worldwide. The country's mining sector has had ample opportunity to grow recently. The region is one of the leading producers of iron ore, copper, and gold.

- The country is one of the world's largest sources of reserves and metals, including aluminum, iron ore, and nickel, and the world's largest producer of gold. Due to their use in industry and construction activities, the demand for these metals is expected to rise.

- Nickel is used to manufacture batteries for electric vehicles. So, the domestic and internal demand for electric cars will drive the demand for nickels in the market.

- Iron ore, copper, and aluminum are used in construction projects worldwide, and mining companies invest in extraction projects.

Surge in Infrastructure Investment Drives the Brazil Crawler Excavator Market

- The governments in the region announced various infrastructure development projects in 2023. There is a diverse range of infrastructure investments and opportunities across the region. In 2023, Brazil will see an 11% surge in investment in infrastructure projects.

- According to the National Transport and Logistics Observatory of Infra South America, Brazil invested USD 1.4 billion in transport infrastructure projects in the first seven months of 2023. According to Brazil's government, 172 infrastructure investment projects, ranging from airports to power distribution, mining, and urban mobility, are in progress in 2024. Such a growing number of investment projects is projected to support the growth of the Brazil crawler excavator market.

- In 2023, the Brazilian government planned to invest USD 343.6 billion across the states under the Growth Acceleration Program. The investment will be directed to developing nationwide roadways, railways, and airports.

INDUSTRY RESTRAINTS

High Inflation Rates Adversely Impact Corporate Investments

- Brazil is facing rising inflation rates. The Russian invasion of Ukraine pushed up energy prices across the globe. The disruption in the supply of raw materials such as steel, iron, and rubber further worsened the situation.

- Brazil’s annual inflation was 4.6% in 2023. The inflation rate was slightly higher than the central bank estimate, but it was in the target range set by the bank in 2020. Prices of services and goods increased in December 2023, and the drinks, foods & transportation sectors saw a high price jump in 2023.

- Rising import prices, especially fuels and other commodities, were significant factors pushing inflation rates. A weak currency also contributed to the high inflation challenge.

Redtapism and High Building Material Costs Hampering Mining & Construction Industry Growth

- Brazil's construction and mining industries face the challenge of Retapes. Bureaucracy is hampering industry growth. For instance, Environmental licensing in the country is very strict, and the federal government has been even more stringent about this.

- Vale, a significant iron ore producer in Brazil, was forced to reduce production in 2022 due to delays in securing permits for a project at Serra Norte Complex. Similar obstacles in permits and a complicated tax system hamper the growth of mining and construction industries.

- Brazil's government applies federal and state tax charges to imports that double the costs of imported products. The rise in building material costs is another major obstacle to Brazil's crawler excavator market.

VENDOR LANDSCAPE

- Caterpillar, Komatsu, XCMG, Volvo Construction Equipment, and Hitachi Construction Machinery are leaders in the Brazil crawler excavator market. These companies have strong market share and offer diverse sets of equipment.

- Yanmar, Liu Gong, Yanmar, and CNH Industrials are niche players in the Brazil crawler excavator market. These companies offer low product diversification and have a strong presence in the local Brazilian market.

- Zoomlion, SANY, JCB, Kobelco, and HD Hyundai Construction Equipment are emerging in the Brazil crawler excavator market. These companies are introducing new technologically advanced products to challenge the market share of market leaders in the country’s market.

- Bobcat and Kobelco are stragglers in the Brazil crawler excavator market; these companies generally lack innovative and advanced products.

Prominent Vendors

- Caterpillar

- Komatsu

- Xuzhou Construction Machinery Group (XCMG)

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- JCB

- SANY

- Hyundai Construction Equipment

Other Prominent Vendors

- Kobelco

- Liugong

- John Deere

- Yanmar

- CNH Industrial

- Bobcat

- Kubota

- Link-Belt Cranes

Distributor Profiles

- Noroeste Máquinas e Equipamentos LTDA

- FW Maquinas

- Mason Equipamentos

- Extra Group

- Engepecas

KEY QUESTIONS ANSWERED

1. How big is the Brazil crawler excavator market?2. What are the trends in the Brazil crawler excavator market?

3. Who are the key players in the Brazil crawler excavator market?

4. What is the growth rate of the Brazil crawler excavator market?

5. Which are the major distributor companies in the Brazil crawler excavator market?

Table of Contents

Companies Mentioned

- Caterpillar

- Komatsu

- Xuzhou Construction Machinery Group (XCMG)

- Volvo Construction Equipment

- Hitachi Construction Machinery

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- JCB

- SANY

- Hyundai Construction Equipment

- Kobelco

- Liugong

- John Deere

- Yanmar

- CNH Industrial

- Bobcat

- Kubota

- Link-Belt Cranes

- Noroeste Máquinas e Equipamentos LTDA

- FW Maquinas

- Mason Equipamentos

- Extra Group

- Engepecas

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | July 2024 |

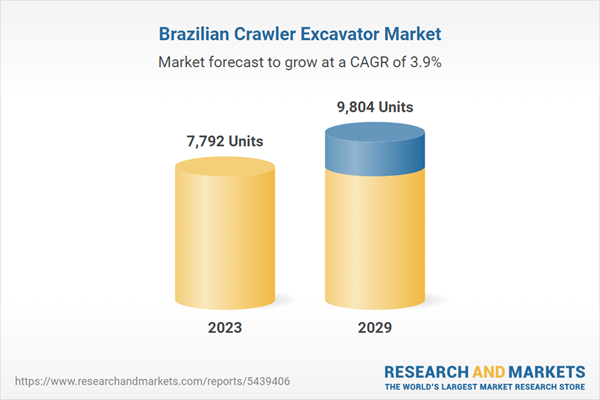

| Forecast Period | 2023 - 2029 |

| Estimated Market Value in 2023 | 7792 Units |

| Forecasted Market Value by 2029 | 9804 Units |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Brazil |

| No. of Companies Mentioned | 22 |