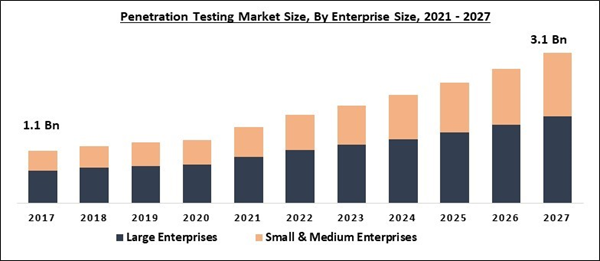

The Global Penetration Testing Market size is expected to reach $3.1 billion by 2027, rising at a market growth of 12% CAGR during the forecast period. Penetration testing, also commonly known as ethical hacking or pen testing, is performed to test a network, computer system, and web application to identify security weaknesses including the possibility to access the system’s data & features by unauthorized parties and strengths that allows a full risk assessment to be completed. Penetration testing is the method of testing, which is used to increase and measure the installed security solutions on various devices like computers, mobile phones, and other information systems.

The factors such as the rising number of cyberattacks leading to the major losses in reputation & financial of companies, growing severe regulations, and compliances mandating regular penetration testing practices are anticipated to surge the growth of the penetration testing market. In addition, massive usage of smartphones has also increased the use of mobile-based business-critical applications and growing internet penetration are some determinants that is expected to offer lucrative opportunities to the penetration testing solutions. Additionally, integration of technologies like machine learning & artificial intelligence, remote working security assessments, and growing trends of penetration testing-as-a-service (PTaaS) is anticipated to create new avenues for growth for the vendors offering penetration testing solutions.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic has severely affected various industries across the world. The disease has spread in most of the countries and WHO declared it a public health emergency. Also, the coronavirus had a negative impact on the penetration testing market. The COVID-19 outbreak affected the global economy in different ways like disrupting the supply chain and market, reduced the demand and production rate, and heavy loss of the industries. In addition, the government has imposed severe restrictions on movement due to which flights were canceled, traveling was banned and among others.

During the pandemic, many companies started working from remote areas. Employees were given instructions to follow the stringent norms of the COVID-19 pandemic to avoid face-to-face interactions and maintaining social distance. Several companies started to digitalize their business, which increased the demand for various cybersecurity solutions and penetration testing solutions. Employees got access to use the company’s data on their personal devices, which surged the chances of data breaching and data loss. All these factors are accountable to gradually surge the demand for the penetrating testing market.

Market Growth Factors:

Imposition of strict norms and compliances by the government regarding frequent penetration testing

The government has implemented certain regulations like OWASP, NIS, SOX, SOC2, PCI, DSS, and GDPR according to which, it is necessary to conduct penetration testing at regular intervals and companies will be charged, if they unable to follow the rules strictly. As stated by REdScan, companies are anticipated to adopt the process of penetration testing at regular intervals and for evaluation of the efficiency of technical and company’s measures to secure the data processing.

The trend of penetration testing-as-a-service (PTaaS) has witnessed a boost

Cloud-based penetration testing is also known as penetration testing-as-a-service (PTaaS) and the cybersecurity industry is observing a surge in the trends of PTaaS. PTaaS helps in offering the resources that are required by IT professionals to organize and act upon the penetration tests. This test includes continuous monitoring and generates reports that allow users to view results in real-time.

Market Restraining Factor:

Low availability of skilled security experts who can perform penetration tests

The major problem of the companies is to deal with the smaller number of skilled security experts and hence, is responsible for slowdown the capability of companies that face growing cybersecurity needs. Several companies hire people to identify and analyze cyber threats but these people are also highly qualified, and thus, are unable to succeed in preventing the data from cyber attackers. In addition, the installation of penetration testing solutions requires a large investment, which is another factor hampering the growth of the penetration testing market.

Offering Outlook

Based on Offering, the market is segmented into Solution and Services. The Solution market dominated the Global Penetration Testing Market by Offering 2020, growing at a CAGR of 11 % during the forecast period. The Services market is showcasing a CAGR of 14.1% during (2021 - 2027).

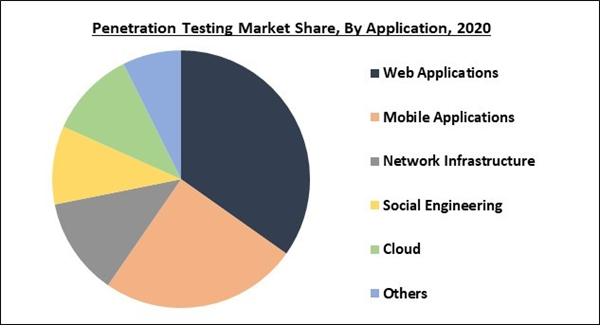

Application Outlook

Based on Application, the market is segmented into Web Applications, Mobile Applications, Network Infrastructure, Social Engineering, Cloud, and Others. The Web Applications market dominated the Global Penetration Testing Market by Application 2020. The Mobile Applications market is experiencing a CAGR of 11.2% during (2021 - 2027). Additionally, The Network Infrastructure market is estimated to grow at a CAGR of 13% during (2021 - 2027).

Deployment Type Outlook

Based on Deployment Type, the market is segmented into Cloud-based and On-premise. Like the traditional systems, cloud systems such as software-as-a-service (SaaS), infrastructure-as-a-service (IaaS), and platform-as-a-service (PaaS) are susceptible to security threats, misconfigurations, and weaknesses. Even though, cloud sellers are providing strong security controls to the companies on which companies can rely and transfer their confidential data on their cloud.

Enterprise Size Outlook

Based on Enterprise Size, the market is segmented into Large Enterprises and Small & Medium Enterprises. The Large Enterprises market dominated the Global Penetration Testing Market by Enterprise Size 2020. The Small & Medium Enterprises market is expected to witness a CAGR of 13.3% during (2021 - 2027).

End User Outlook

Based on End User, the market is segmented into IT & Telecom, BFSI, Retail, Healthcare, Manufacturing, Education and Others. The medical industry is among the extensively normalized industries because of the sensitivity and a large number of medical information in healthcare centers. The chief rule for these centers is HIPAA that commands all centers that are collecting personal health information is to strictly follow the set rules. If centers fail to obey rules like HIPAA then, they are ought to pay a penalty for it. To protect healthcare centers from several cyberattacks, these laws and regulations are playing a crucial role and driving the demand for the deployment of penetration testing solutions and services in the healthcare sector.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Based on Region, Asia-Pacific is anticipated to garner the highest growth rate over the forecasting years. Asia-Pacific is witnessed as the fastest expanding mobile market coupled with the increasing deployment of mobile devices in this region. Several countries in this region like China, Japan, and Australia are excessively deploying penetration testing solutions to prevent breaching of their sensitive data. Based on research by International Data Corporation (IDC), Asia-Pacific is the leading region in the deployment of IoT technology, which comprises nations like Japan, Australia, and South Korea.

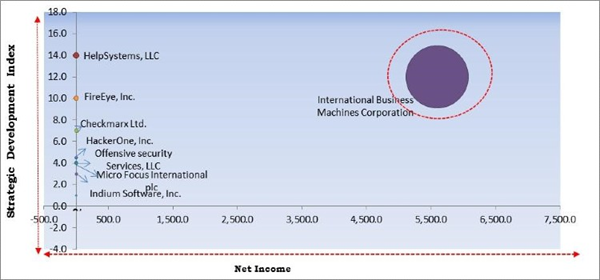

Cardinal Matrix - Penetration Testing Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; International Business Machines Corporation are the forerunners in the Penetration Testing Market. Companies such as HelpSystems, LLC, FireEye, Inc., Checkmarx Ltd. are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, Micro Focus International Plc, FireEye, Inc., HelpSystems, LLC, HackerOne, Inc., Rhino Security Labs, Inc., Indium Software, Inc., Vumetric, Inc., Offensive security Services, LLC, and Checkmarx Ltd.

Recent Strategies Deployed in Penetration Testing Market

Partnerships, Collaborations, and Agreements:

- Jul-2021: HelpSystems came into partnership with Cybellum, a leader in automotive cyber security risk assessment solutions. The companies' joint solution is expected to provide automated security scanning and a full vulnerability management analysis across the connected car lifecycle to make sure the automotive software security and compliance with road vehicle standards & regulations.

- Apr-2021: IBM Security came into partnership with HCL Technologies, a technology services firm. This partnership aimed to assist unifies and streamline threat management for customers via a modernized security operation center (SOC) platform. HCL’s Cyber security Fusion Centres is expected to be developed to take benefits of IBM’s Cloud Pak for Security, to assist in making a unified security platform to connect security teams, tools, and procedures over the threat lifecycle.

- Jul-2020: Checkmarx formed a partnership with Gaming Innovation Group (GiG). This partnership aimed to enable GiG to offer its developers a robust source code scanning tool that is expected to enable them to detect and rectify security vulnerabilities in custom code security at one point. This is expected to also improve the development process by boosting remediation time, and by producing more meaningful and actionable insight on code security.

- Jan-2020: HackerOne came into partnership with OPPO, an electronics manufacturer based in Guangdong, China. Through this partnership, OPPO is expected to enhance the security of its products & services, and deliver a safer internet by engaging the world's security research community with HackerOne.

Acquisitions and Mergers:

- May-2021: HelpSystems took over Beyond Security, a global leader in automated vulnerability assessment and compliance solutions. This acquisition aimed to offer detection across applications, networks, endpoints, and the cloud for its expanding customer base as part of HelpSystems.

- Feb-2021: HelpSystems acquired Digital Defense, a software company. In the HelpSystems' cybersecurity portfolio, Digital Defense is expected to join Core Security and Cobalt Strike to set up a comprehensive, top-class security assessment toolkit. In addition, Digital Defense is expected to continue to safeguard the ever-growing IT underpinnings of thousands of companies as part of HelpSystems.

- Jul-2020: Offensive Security took over open source security training resource hub VulnHub. This acquisition aimed to complement OffSec’s ongoing mission to deliver practical training content to aspiring cybersecurity professionals. All the VulnHub content is expected to be accessible for free in keeping with OffSec’s objective to open source.

- Mar-2020: HelpSystems took over Cobalt Strike, a leading penetration testing (pen-testing) solution. This acquisition aimed to support HelpSystems’ prevailing Core Security business unit by bringing top-class tools and integrating them with robust services to strengthen HelpSystems’ infrastructure protection portfolio.

Product Launches and Product Expansions:

- Aug-2021: FireEye introduced FireEye XDR, a unified platform. This platform is developed to assist security operations teams to strengthen threat detection, boost response offerings, and streamline investigations. The FireEye XDR platform offers native security protections for Endpoint, Email, Network, and Cloud with an aim at enhancing companies’ offerings for controlling incidents from detection to response. In addition, FireEye Helix integrates the security operations platform by offering next-generation security orchestration, automation and response (SOAR), security incident and event management (SIEM), and correlation capabilities with threat intelligence powered by Mandiant.

- Mar-2021: IBM introduced the latest and improved services. These services are developed to assist companies in managing their cloud security strategy, policies, and controls across hybrid cloud surroundings. These services is expected to bring together cloud-native, IBM, and third-party technologies with IBM expertise to assist companies in making a unified security approach over their cloud ecosystems.

- Feb-2021: Checkmarx released KICS (Keeping Infrastructure as Code Secure), an open-source static analysis solution. This solution helps developers to pen down more secure infrastructure as code (IaC). By using KICS, Checkmarx expands its AST product line, offering a single platform for open source components, securing proprietary code, and critical infrastructure for both conventional and cloud-native applications.

- Sep-2020: FireEye unveiled Mandiant Solutions, which brings together the top expertise-backed products and solutions to empower users with insights from the front lines. These offerings are developed to allow security defenders and also ensure that cyber security investments efficiently decrease organizational risk.

- Sep-2020: Indium Software released its smart unified testing platform, uphoriX. The all-in-one Smart Quality Assurance (QA)/ test automation platform combines performance testing, functional testing, security, and compatibility to surge the pace and frequency of software/application launch. This uphoriX was developed to decrease the entire complications in the testing processes by automating and boosting the test coverage thus decreasing test creation time along with maintenance efforts.

Geographical Expansions:

- Jun-2021: IBM expanded its geographical expansion by opening IBM Center for Government Cyber security, a collaborative environment aimed at helping federal agencies tackle current and future cyber security threats. This center is expected to facilitate events & learning, building on IBM's cyber security expertise from providing software and managed services to approx. 17,500 security customers across the world.

- Jun-2020: HackerOne expanded its geographical footprints by launching its penetration testing solution in Europe. This new product supported the company's prevailing offerings committed to helping companies find and fix vulnerabilities before getting exploited.

Scope of the Study

Market Segments Covered in the Report:

By Offering

- Solution

- Services

By Application

- Web Applications

- Mobile Applications

- Network Infrastructure

- Social Engineering

- Cloud

- Others

By Deployment Type

- Cloud-based

- On-premise

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End User

- IT & Telecom

- BFSI

- Retail

- Healthcare

- Manufacturing

- Education

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- IBM Corporation

- Micro Focus International Plc

- FireEye, Inc.

- HelpSystems, LLC

- HackerOne, Inc.

- Rhino Security Labs, Inc.

- Indium Software, Inc.

- Vumetric, Inc.

- Offensive security Services, LLC

- Checkmarx Ltd.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- IBM Corporation

- Micro Focus International Plc

- FireEye, Inc.

- HelpSystems, LLC

- HackerOne, Inc.

- Rhino Security Labs, Inc.

- Indium Software, Inc.

- Vumetric, Inc.

- Offensive security Services, LLC

- Checkmarx Ltd.