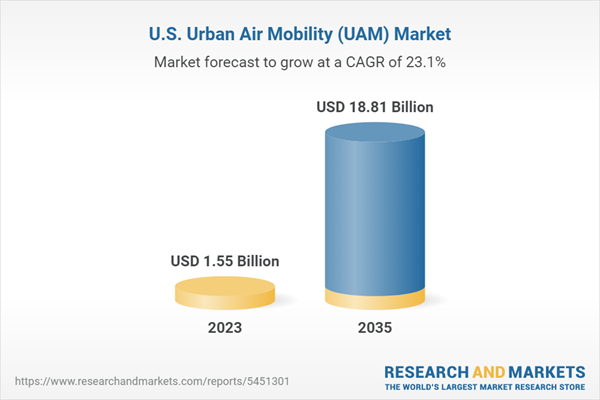

The U.S. urban air mobility market is estimated to reach $18.81 billion in 2035, at a compound annual growth rate (CAGR) of 23.12% during the forecast period 2023-2035. The major driving factors for the huge revenues generated by the companies are the growing need for an alternate mode of transportation in urban mobility and demand for an efficient mode of logistics and transportation services.

Market Report Coverage - The U.S. Urban Air Mobility (UAM)

Market Segmentation

- Range: < 20 km, 20 km – 100 km, 100 km – 400 km, and > 400 km

- Application: Passenger Transportation, Cargo Transportation, Medical and Emergency Aid Transportation, and Food Delivery

- Operation: Piloted Operation, Optionally Piloted, and Autonomous Operation

- End-Use Industry: E-Commerce, Healthcare, Food Delivery, Transportation and Logistics, Tourism, and Others

- Platform Architecture: Fixed Wing, Rotor Wing, and Others

Market Growth Drivers

- Growing Need for an Alternate Mode of Transportation in Urban Mobility

- Demand for an Efficient Mode of Logistics and Transportation Service

- Adoption of Urban Air Mobility Due to Environmental Concerns

Market Challenges

- Lack of Technology in Infrastructure in Megacities

Market Opportunities

- Increasing Demand for Air Ambulance Vehicles

Key Companies Profiled

Acubed-Airbus, Airspace Experience Technologies, Inc., Aurora Flight Sciences, Bell Textron Inc., DELOREAN AEROSPACE, LLC, EVE Air Mobility, Jaunt Air Mobility LLC, Joby Aviation, Kitty Hawk, Opener

How This Report Can Add Value

Production / Innovation Strategy: The product segment helps the reader in understanding the different types of eVTOLs and delivery drones developed by the key companies in the U.S. urban air mobility market. Moreover, the study provides the reader a detailed understanding of U.S. urban air mobility market with respect to application (i.e., passenger transportation, cargo transportation, medical and emergency aid transportation, and food delivery, among others), range (< 20 km, 20 km – 100 km, 100 km – 400 km, and > 400 km among others).

Growth / Marketing Strategy: Players operating in the U.S. urban air mobility market are developing innovative products and vehicles to enhance the capabilities of their product offerings and have been collaborating with other companies to establish a larger market presence in the industry. Growth/marketing strategies will help the readers in understanding the revenue-generating strategies adopted by the players operating in the U.S. urban air mobility market. For instance, to explore the development of hybrid-electric aircraft, Jaunt Air Mobility and VerdeGo Aero signed an MoU on 21 December 2020.

Key Questions Answered in the Report

- What are the futuristic trends in this market, and how is the market expected to change over the forecast years 2023-2035?

- What are the key drivers and challenges faced by the companies that are currently working in the U.S. urban air mobility market?

- How is the market expected to grow during the forecast period 2023-2035?

- What are the opportunities for the companies to expand their businesses in the urban air mobility market?

- What are the key developmental strategies implemented by the key players to sustain in this highly competitive market?

- What is the current and future revenue scenario of this market?

U.S. Urban Air Mobility Market

The increase in traffic congestion and rapid growth of urbanization are the significant challenges faced by some of the mobility industry in the world today, and innovative solutions in urban mobility are important for a sustainable future. There are several new mobility initiatives such as automotive transportation-as-a-service, high-speed train concepts such as hyperloop, autonomous cars, and aerial transportation. Depending on the destination, travel distance, location of transportation, and duration of the journey, a passenger can select various modes of transportation. The concept of urban air mobility (UAM) was first realized in Sao Paulo, Brazil, where air mobility was provided by helicopters, The UAM adoption level in Brazil was higher than in Tokyo and New York City together.

U.S. Urban Air Mobility Industry Overview

The urban air mobility market is expected to create an entirely new industry. The manufacturers are continuously taking initiatives to develop various innovative infrastructural concepts, such as better tracking systems and efficient connectivity. The key development focus areas in the urban air mobility industry include improvements in battery technology and other forms of propulsion systems to offer longer ranges and endurances. Based on the recent developments in the U.S. urban air mobility market, aircraft prototypes have already been manufactured and tested in several countries. However, the regulatory framework that governs the urban air mobility industry is yet to certify the vehicles for commercial usage. It is expected that the cargo delivery drones will be commercialized by 2023, but the wide acceptance of passenger transportation is expected to be a bit slow.

Impact of COVID-19 on the U.S. Urban Air Mobility Market

The COVID-19 affected the global industries, and the U.S. urban air mobility market has been affected in some regions as well. The lockdown had completely stopped the production until July 2020 in some regions, but the research and development activities were not affected significantly. The companies are slowly opening up their plants amidst the pandemic following all the safety measures. The U.S. had imposed complete lockdown to prevent the widespread of the virus. Since most of the companies are well established, they had their reserves for raw materials and other components to continue with their manufacturing processes. Due to the vaccinations, the industries are expected to function at 100%.

Market Segmentation

U.S. Urban Air Mobility Market by Range

The 20 km - 100 km Range Segment to Lead U.S. Urban Air Mobility Market during forecast period due to the increase in demand for faster mobility transport for short distances and increasing traffic congestions for daily commuters, the 20 km – 100 km segment is expected to witness huge growth over the next few years. The technological limitations such as a lack of better battery technology and higher noise pollution are currently restricting the other range segments in the industry, but the range of 20 km to 100 km is balancing the factors perfectly and is delivering the most suitable product for the market.

U.S. Urban Air Mobility Market by Operation

The passenger transportation aerial vehicles are highly regulated under the guidance of government agencies such as Federal Aviation Administration in the U.S. The drones and aerial vehicles used for passenger transportation must follow a stringent set of rules to get certified. According to some industry experts, the passenger transporting vehicles will be requiring a piloted mode of operation in the early stages of commercialization to ensure passenger safety. Thus, the market is expected to be dominated by the piloted mode of operation during the forecast period of 2023-2035.

Key Market Players and Competition Synopsis

Acubed-Airbus, Airspace Experience Technologies, Inc., Aurora Flight Sciences, Bell Textron Inc., DELOREAN AEROSPACE, LLC, EVE Air Mobility, Jaunt Air Mobility LLC, Joby Aviation, Kitty Hawk, Opener

The companies that are profiled in the report have been selected post undergoing in-depth interviews with experts and understanding of the details around companies such as product portfolio, demonstrations, annual revenues, market penetration, research and development initiatives, and key developments in the U.S. urban air mobility market.

Table of Contents

1 Markets

1.1 Industry Outlook

1.1.1 Urban Air Mobility Market: Overview

1.1.2 U.S. Regulatory Framework

1.1.2.1 Federal Aviation Administration (FAA)

1.1.3 Investment Scenario: Start-Ups and Stakeholders in UAM Market

1.1.4 U.S. Leading Manufacturers, Products, and Technical Specifications

1.2 Business Dynamics

1.2.1 Business Drivers

1.2.1.1 Growing Need for an Alternate Mode of Transportation in Urban Mobility

1.2.1.2 Demand for an Efficient Mode of Logistics and Transportation Service

1.2.1.3 Adoption of Urban Air Mobility Due to Environmental Concerns

1.2.2 Business Challenges

1.2.2.1 Short-Term Challenges

1.2.2.1.1 Impact of COVID-19 on Urban Air Mobility Market

1.2.2.2 Long-Term Challenges

1.2.2.2.1 Lack of Technology in Infrastructure in Megacities

1.2.3 Key Business Developments

1.2.4 Business Strategies

1.2.5 Corporate Strategies

1.2.6 Business Opportunities

1.2.6.1 Increasing Demand for Air Ambulance Vehicles

2 Application

2.1 Overview

2.2 U.S. Urban Air Mobility Market – By Range

2.2.1 < 20 km

2.2.2 20 km - 100 km

2.2.3 100 km - 400 km

2.2.4 >400 km

2.2.4.1 Demand Analysis for U.S. Urban Air Mobility Market (by Range)

2.3 U.S. Urban Air Mobility Market (by Application)

2.3.1 Passenger Transportation

2.3.2 Cargo Transportation

2.3.3 Medical and Emergency Aid Transportation

2.3.4 Food Delivery

2.3.4.1 Demand Analysis for U.S. Urban Air Mobility Market (by Application)

3 Products

3.1 Overview

3.2 U.S. Urban Air Mobility Market (by Ecosystem)

3.2.1 Platform

3.2.1.1 Delivery Drones

3.2.1.2 eVTOLs

3.2.1.2.1 Air Taxi

3.2.1.2.2 Personal Air Vehicles

3.2.1.2.3 Air Ambulance and Medical Transportation Vehicles

3.2.1.3 Demand Analysis for U.S. Urban Air Mobility Market (by Platform)

3.2.1.3.1 U.S. Urban Air Mobility Market (by Utilization - Flight Hours, Number of Delivery Drones/eVTOLs and Trips per Year)

3.2.2 Infrastructure

3.2.2.1 UTM

3.2.2.2 Vertiports

3.2.2.3 Charging Stations

3.3 U.S. Urban Air Mobility Market (by Operation)

3.3.1 Piloted Operation

3.3.2 Optionally Piloted

3.3.3 Autonomous Operation

3.3.3.1 Demand Analysis for U.S. Urban Air Mobility Market (by Operation)

3.4 U.S. Urban Air Mobility Market (by End-Use Industry)

3.4.1 E-commerce

3.4.2 Healthcare

3.4.3 Food Delivery

3.4.4 Transportation and Logistics

3.4.5 Tourism

3.4.6 Others

3.4.6.1 Demand Analysis for U.S. Urban Air Mobility Market, by End-Use Industry

3.5 U.S. Urban Air Mobility Market (by Platform Architecture)

3.5.1 Fixed Wing

3.5.2 Rotor Wing

3.5.3 Others

3.5.3.1 Tilt Rotor

3.5.3.2 Thrust Vector Control

3.5.3.3 Demand Analysis for U.S. Urban Air Mobility Market, by Platform Architecture

4 Markets - Competitive Benchmarking & Company Profiles

4.1 Competitive Benchmarking

4.2 Acubed-Airbus

4.2.1 Company Overview

4.2.1.1 Role of Acubed-Airbus in U.S. Urban Air Mobility Market

4.2.1.1.1 Product Portfolio

4.2.2 Business Strategies

4.2.2.1 Product Developments and Demonstrations

4.2.3 Corporate Strategies

4.2.3.1.1 Partnerships

4.2.4 Strengths and Weaknesses of Acubed-Airbus

4.2.5 R&D Analysis

4.3 Airspace Experience Technologies, Inc.

4.3.1 Company Overview

4.3.1.1 Role of Airspace Experience Technologies, Inc. in U.S. Urban Air Mobility Market

4.3.1.2 Product Portfolio

4.3.2 Business Strategies

4.3.2.1 Product Developments

4.3.3 Corporate Strategies

4.3.3.1 Memorandum of Understanding

4.3.4 Strengths and Weaknesses of Airspace Experience Technologies, Inc.

4.4 Aurora Flight Sciences

4.4.1 Company Overview

4.4.1.1 Role of Aurora Flight Sciences in U.S. Urban Air Mobility Market

4.4.1.2 Product Portfolio

4.4.2 Corporate Strategies

4.4.2.1 Corporate Strategies

4.4.3 Strengths and Weaknesses of Aurora Flight Sciences

4.5 Bell Textron Inc.

4.5.1 Company Overview

4.5.1.1 Role of Bell Textron Inc. in U.S. Urban Air Mobility Market

4.5.1.2 Product Portfolio

4.5.2 Business Strategies

4.5.2.1 Product Developments and Launches

4.5.3 Corporate Strategies

4.5.3.1 Partnership

4.5.4 Strengths and Weaknesses of Bell Textron Inc

4.6 DELOREAN AEROSPACE, LLC

4.6.1 Company Overview

4.6.1.1 Role of DELOREAN AEROSPACE, LLC in U.S. Urban Air Mobility Market

4.6.1.2 Product Portfolio

4.6.2 Strengths and Weaknesses of DELOREAN AEROSPACE, LLC

4.7 EVE Air Mobility

4.7.1 Company Overview

4.7.1.1 Role of Eve Air Mobility in U.S. Urban Air Mobility Market

4.7.1.2 Product Portfolio

4.7.2 Business Strategies

4.7.2.1 Business Expansion

4.7.3 Corporate Strategies

4.7.3.1 Collaboration

4.7.4 Strengths and Weaknesses of Eve Air Mobility

4.8 Jaunt Air Mobility LLC

4.8.1 Company Overview

4.8.1.1 Role of Jaunt Air Mobility LLC in U.S. Urban Air Mobility Market

4.8.1.2 Product Portfolio

4.8.2 Corporate Strategies

4.8.2.1 Partnerships and MoUs

4.8.2.2 Agreements and Acquisitions

4.8.2.3 Strengths and Weaknesses of Jaunt Air Mobility LLC

4.9 Joby Aviation

4.9.1 Company Overview

4.9.1.1 Role of Joby Aviation in U.S. Urban Air Mobility Market

4.9.1.2 Product Portfolio

4.9.2 Corporate Strategies

4.9.2.1 Merger, Agreement, and Acquisitions

4.9.3 Strengths and Weaknesses of Joby Aviation

4.1 Kitty Hawk

4.10.1 Company Overview

4.10.1.1 Role of Kitty Hawk in U.S. Urban Air Mobility Market

4.10.1.2 Product Portfolio

4.10.2 Corporate Strategies

4.10.2.1 Partnerships

4.10.3 Strengths and Weaknesses of Kitty Hawk

4.11 Opener

4.11.1 Company Overview

4.11.1.1 Role of Opener in U.S. Urban Air Mobility Market

4.11.1.2 Product Portfolio

4.11.2 Business Strategies

4.11.2.1 Award and Expansion

4.11.3 Strengths and Weaknesses of Opener

4.12 Other Key Players

4.12.1 Electra Aero, Inc.

4.12.2 Honeywell International Inc.

4.12.3 Overair, Inc.

4.12.4 Trek Aerospace, Inc.

4.12.5 Varon Vehicles Corporation

4.12.6 Wing Aviation LLC

4.12.7 Wisk Aero LLC

5 Research Methodology

List of Figures

Figure 1: U.S. Urban Air Mobility Market, $Million, 2023-2035

Figure 2: U.S. Urban Air Mobility Market (by Operation), $Million, 2023 and 2035

Figure 3: U.S. Urban Air Mobility Market (by Range), $Million, 2023 and 2035

Figure 4: U.S. Urban Air Mobility Market Coverage

Figure 5: U.S. Urban Air Mobility Market, Business Dynamics

Figure 6: Share of Key Business Developments, 2018-2020

Figure 7: Business Strategies by Key Players, 2018-2020

Figure 8: Corporate Strategies by Key Players, 2018-2020

Figure 9: Classification of U.S. Urban Air Mobility (by Application)

Figure 10: Classification of U.S. Urban Air Mobility (by Range)

Figure 11: Classification of U.S. Urban Air Mobility Market (by Product)

Figure 12: U.S. Urban Air Mobility Market for Delivery Drones, by Flight Hours, 2023-2035

Figure 13: U.S. Urban Air Mobility Market for eVTOLs, by Flight Hours, 2023-2035

Figure 14: Classification of U.S. Urban Air Mobility Market (by Platform Architecture)

Figure 15: U.S. Urban Air Mobility Market Competitive Benchmarking

Figure 16: Airbus R&D, $Billion, (2018-2020)

Figure 17: Research Methodology

Figure 18: Top-Down and Bottom-Up Approach

Figure 19: U.S. Urban Air Mobility Supply Market Influencing Factors

Figure 20: Assumptions and Limitations

List of Tables

Table 1: U.S. Start-ups Funding, January 2015- March 2021

Table 2: Technical Data of Key Products

Table 3: Impact Analysis of Market Drivers

Table 4: U.S. Urban Air Mobility Market (by Range), $Million, 2023-2035

Table 5: U.S. Urban Air Mobility Market (by Application through Delivery Drones), $Million, 2023-2035

Table 6: U.S. Urban Air Mobility Market (by Application through eVTOLs), $Million, 2023-2035

Table 7: U.S. Urban Air Mobility Market (by Platform), $Million, 2023-2035

Table 8: U.S. Urban Air Mobility Market for Delivery Drones, by Number of Delivery Drones and Trips Per Year, 2023-2035

Table 9: U.S. Urban Air Mobility Market for eVTOLs, by Number of eVTOLs and Trips Per Year, 2023-2035

Table 10: Classification of Aircraft Type by Mode of Operation

Table 11: U.S. Urban Air Mobility Market (by Operation), $Million, 2023-2035

Table 12: U.S. Urban Air Mobility Market, by End-use Industry (through Drones), $Million, 2023-2035

Table 13: U.S. Urban Air Mobility Market, by End-use Industry (through eVTOLs), $Million, 2023-2035

Table 14: U.S. Urban Air Mobility Market (by Platform Architecture), $Million, 2023-2035

Table 15: Benchmarking and Weightage Parameters

Table 16: Acubed-Airbus: Product Portfolio

Table 17: Acubed-Airbus Product Developments and Demonstrations

Table 18: Acubed-Airbus Partnership

Table 19: Airspace Experience Technologies, Inc. Product Portfolio

Table 20: Airspace Experience Technologies, Inc. Product Developments

Table 21: Airspace Experience Technologies, Inc. Memorandum of Understanding

Table 22: Aurora Flight Sciences: Product Portfolio

Table 23: Aurora Flight Sciences MoUs and Agreements

Table 24: Bell Textron Inc.: Product Portfolio

Table 25: Bell Textron Inc. Product Developments and Launches

Table 26: Bell Textron Inc. Partnership

Table 27: DELOREAN AEROSPACE, LLC Product Portfolio

Table 28: Eve Air Mobility Product Portfolio

Table 29: Eve Air Mobility Business Expansion

Table 30: Eve Air Mobility Collaboration

Table 31: Jaunt Air Mobility LLC: Product Portfolio

Table 32: Jaunt Air Mobility LLC Partnerships and MoUs

Table 33: Jaunt Air Mobility LLC Agreements and Acquisitions

Table 34: Joby Aviation Product Portfolio

Table 35: Joby Aviation Merger, Agreement, and Acquisitions

Table 36: Kitty Hawk: Product Portfolio

Table 37: Kitty Hawk Partnerships

Table 38: Opener: Product Portfolio

Table 39: Opener Award

Companies Mentioned

- Acubed-Airbus

- Airspace Experience Technologies, Inc.

- Aurora Flight Sciences

- Bell Textron Inc.

- DELOREAN AEROSPACE, LLC

- EVE Air Mobility

- Jaunt Air Mobility LLC

- Joby Aviation

- Kitty Hawk

- Opener

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 87 |

| Published | September 2021 |

| Forecast Period | 2023 - 2035 |

| Estimated Market Value ( USD | $ 1.55 Billion |

| Forecasted Market Value ( USD | $ 18.81 Billion |

| Compound Annual Growth Rate | 23.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |