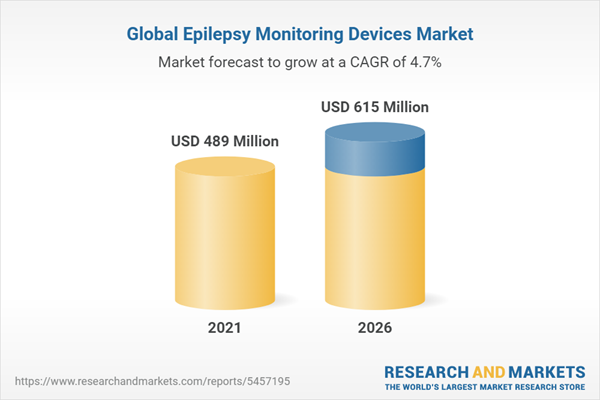

The global epilepsy monitoring devices market is projected to reach USD 615 million by 2026 from USD 489 million in 2021, at a CAGR of 4.7% during the forecast period. The growth in this market is driven by the increasing incidence and prevalence of epilepsy, growing preference for ambulatory healthcare and increasing use of wearables, growing demand for continuous monitoring, and the rising awareness of neurodegenerative diseases, including epilepsy. On the other hand, the high cost of complex epilepsy monitoring procedures and devices and the unfavorable reimbursement policies are restraining the growth of this market.

The conventional devices segment accounted for the largest share of the epilepsy monitoring devices market in 2020.

Based on products, the epilepsy monitoring devices market has been segmented into wearable devices and conventional devices. The large share of this segment is attributed to rising awareness of neurodegenerative diseases including epilepsy.

The market in Asia Pacific is projected to witness the highest growth rate during the forecast period (2021-2026).

North America accounted for the largest share of the epilepsy monitoring devices market in 2020. The high incidence of neurological disorders, a growing number of clinical trials for epilepsy monitoring devices, and a large number of end users in the US account for their larger market shares.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type (Supply-side): Tier 1: 35%, Tier 2: 45%, and Tier 3: 20%

- By Designation: C-level: 35%, Director-level: 25%, and Others: 40%

- By Region: North America: 45%, Europe: 30%, Asia-Pacific: 20%, and RoW: 5%

The major players in the Epilepsy monitoring devices market include Natus Medical, Inc. (US), Compumedics Limited (Australia), Empatica, Inc. (US), The Magstim Co. Ltd. (UK), Nihon Kohden Corporation (Japan), Medtronic Plc (Ireland), Masimo Corporation (US), Boston Scientific Corporation (US), Drägerwerk AG & Co. KGaA (Germany), mjn Neuroserveis S.L. (Spain), Abbott Laboratories, Inc. (US), LivAssured B.V. (Netherlands), BioSerenity (France), Aleva Neurotherapeutics (Switzerland), Medpage, Ltd. (UK), Neurosoft (Russia), Advanced Brain Monitoring (US), Lifelines Neuro Company, LLC (US), Mitsar Co., Ltd. (Russia), Rimed (US), Emotiv (US), CGX (A Cognionics Company) (US), Mindray Medical International Ltd. (China), Cadwell Industries, Inc. (US), NeuroWave Systems, Inc. (US), and MC10, Inc. (US).

Research Coverage:

The report analyzes the epilepsy monitoring devices market and aims at estimating the market size and future growth potential of this market based on various segments such as product, and region. The report also includes competitive analysis of the key players in this market along with their company profiles, product and service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report can help established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share. Firms purchasing the report could use one, or a combination of the below mentioned five strategies.

This report provides insights into the following pointers:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the Epilepsy monitoring devices market. The report analyzes the market based on the products and region.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the Epilepsy monitoring devices market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of Epilepsy monitoring devices solutions across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the Epilepsy monitoring devices market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the Epilepsy monitoring devices markets.

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition & Scope

1.2.1 Inclusions & Exclusions of the Study

1.2.2 Market Segmentation

Figure 1 Epilepsy Monitoring Devices Market Segmentation

1.2.3 Years Considered for the Study

1.3 Currency

Table 1 Exchange Rates Utilized for Conversion to Usd

1.4 Stakeholders

2 Research Methodology

2.1 Research Approach

2.2 Research Methodology Design

Figure 2 Epilepsy Monitoring Devices Market: Research Design

2.2.1 Secondary Research

2.2.1.1 Key Data from Secondary Sources

2.2.2 Primary Research

Figure 3 Primary Sources

2.2.2.1 Key Data from Primary Sources

2.2.2.2 Insights from Primary Experts

Figure 4 Breakdown of Primary Interviews: Supply-Side and Demand-Side Participants

Figure 5 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.3 Market Size Estimation: Epilepsy Monitoring Devices Market

Figure 6 Market Size Estimation: Epilepsy Monitoring Devices Market

Figure 7 Supply-Side Market Size Estimation: Revenue Share Analysis

Figure 8 Company Revenue Share Analysis Illustration: Epilepsy Monitoring Devices Market

Figure 9 Company Revenue Share Analysis Illustration: Eeg Market

Figure 10 Top-Down Approach

Figure 11 CAGR Projections from the Analysis of Drivers, Restraints, Opportunities, and Challenges in the Epilepsy Monitoring Devices Market (2021-2026)

Figure 12 CAGR Projections: Supply-Side Analysis

2.4 Market Breakdown & Data Triangulation

Figure 13 Data Triangulation Methodology

2.5 Market Share Estimation

2.6 Assumptions for the Study

2.7 Limitations

2.7.1 Methodology-Related Limitations

2.7.2 Scope-Related Limitations

2.8 Risk Assessment

Table 2 Risk Assessment: Epilepsy Monitoring Devices Market

3 Executive Summary

Figure 14 Epilepsy Monitoring Devices Market, by Product, 2021 Vs. 2026 (USD Million)

Figure 15 Epilepsy Monitoring Devices Market, by End-user, 2021 Vs. 2026 (USD Million)

Figure 16 Geographical Snapshot of the Epilepsy Monitoring Devices Market

4 Premium Insights

4.1 Epilepsy Monitoring Devices Market Overview

Figure 17 Increasing Incidence and Prevalence of Epilepsy and Growing Preference for Ambulatory Healthcare and Health Wearables to Drive Market Growth

4.2 Epilepsy Monitoring Devices Market: Geographic Growth Opportunities

Figure 18 China to Witness the Highest Growth in the Epilepsy Monitoring Devices Market During the Forecast Period

4.3 North America: Epilepsy Monitoring Devices Market, by Product and Country (2020)

Figure 19 Conventional Devices Segment Accounted for the Largest Share of the North American Epilepsy Monitoring Devices Market in 2020

4.4 Regional Mix: Epilepsy Monitoring Devices Market (2021-2026)

Figure 20 APAC to Register the Highest Growth During the Forecast Period (2021-2026)

4.5 Epilepsy Monitoring Devices Market: Developed Vs. Developing Markets

Figure 21 Developing Markets to Register Higher Growth During the Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 22 Epilepsy Monitoring Devices Market: Drivers, Restraints, Opportunities, and Challenges

5.2.1 Drivers

5.2.1.1 Increasing Incidence and Prevalence of Epilepsy

Figure 23 US: Rate of Death with Epilepsy as the Underlying Cause (2009-2019)

5.2.1.2 Rising Awareness of Neurodegenerative Disorders, Including Epilepsy

5.2.1.3 Growing Preference for Ambulatory Healthcare and Increasing Use of Wearables

5.2.1.4 Growing Demand for Continuous Monitoring

5.2.2 Restraints

5.2.2.1 High Cost of Complex Epilepsy Monitoring Procedures and Devices

5.2.2.2 Unfavorable Reimbursement Policies

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Non-Invasive and Minimally Invasive Devices

5.2.3.2 Expanding Therapeutic Applications of Epilepsy Monitoring Devices

5.2.3.3 High Epilepsy Incidence and Growing Healthcare Markets in Emerging Economies

Figure 24 Number of Epilepsy Cases in Select Countries (2016)

Figure 25 Global Annual Healthcare Expenditure: Developed Vs. Developing Economies (1995 Vs. 2012 Vs. 2022)

5.2.4 Challenges

5.2.4.1 Shortage of Trained Professionals

5.2.4.2 Issues Related to Product Approval and Commercialization

5.3 Impact of COVID-19 on the Epilepsy Monitoring Devices Market

5.4 Porter's Five Forces Analysis

Figure 26 Degree of Competition is High in the Epilepsy Monitoring Devices Market

Table 3 Epilepsy Monitoring Devices Market: Porter's Five Forces Analysis

5.5 Regulatory Analysis

Table 4 Key Regulations & Standards Governing Medical Devices

5.6 Ecosystem Analysis

Figure 27 Ecosystem Analysis: Epilepsy Monitoring Devices Market

5.7 Patent Analysis

5.7.1 Patent Publication Trends

Figure 28 Patent Publication Trends (January 2011-September 2021)

5.7.2 Insights: Jurisdiction and Top Applicant Analysis

Figure 29 Top Applicants & Owners (Companies/Institutions) for Epilepsy Monitoring Device Patents (January 2011-September 2021)

Figure 30 Top Applicant Countries/Regions for Epilepsy Monitoring Device Patents (January 2011-September 2021)

6 Epilepsy Monitoring Devices Market, by Product

6.1 Introduction

Table 5 Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

6.2 Conventional Devices

Table 6 Companies Providing Conventional Epilepsy Monitoring Devices

Table 7 Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 8 Conventional Devices Market, by Country, 2019-2026 (USD Million)

6.2.1 Monitoring Devices

Table 9 Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 10 Monitoring Devices Market, by Country, 2019-2026 (USD Million)

6.2.1.1 Eeg Devices

Table 11 Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 12 Eeg Devices Market, by Country, 2019-2026 (USD Million)

6.2.1.1.1 Standard Eeg Devices

6.2.1.1.1.1 Standard Eeg Devices Accounted for the Largest Share of the Eeg Devices Market

Table 13 Companies Providing Standard Eeg Devices

Table 14 Standard Eeg Devices Market, by Country, 2019-2026 (USD Million)

6.2.1.1.2 Video Eeg Devices

6.2.1.1.2.1 Video Eeg Enables Healthcare Professionals to Observe a Patient During a Seizure Event and Compare the Visuals to the Eeg Results for Better Treatment Planning

Table 15 Companies Providing Video Eeg Devices

Table 16 Video Eeg Devices Market, by Country, 2019-2026 (USD Million)

6.2.1.1.3 Other/Ambulatory Eeg Devices

6.2.1.1.3.1 Ambulatory Eeg is More Cost-Effective and Convenient in Comparison with Routine Eeg

Table 17 Companies Providing Ambulatory Eeg Devices

Table 18 Other/Ambulatory Eeg Devices Market, by Country, 2019-2026 (USD Million)

6.2.1.2 Emg Devices

6.2.1.2.1 High Demand for Emg Devices is Mainly due to the Increasing Prevalence of Neuromuscular Diseases

Table 19 Companies Providing Emg Devices

Table 20 Emg Devices Market, by Country, 2019-2026 (USD Million)

6.2.1.3 Meg Devices

6.2.1.3.1 Meg Devices are More Technologically Advanced Than Other Monitoring Devices as They Can Simultaneously Measure Data from Several Points on the Surface of the Head

Table 21 Companies Providing Meg Devices

Table 22 Meg Devices Market, by Country, 2019-2026 (USD Million)

6.2.1.4 Other Monitoring Devices

Table 23 Companies Providing Other Monitoring Devices

Table 24 Other Monitoring Devices Market, by Country, 2019-2026 (USD Million)

6.2.2 Deep Brain Stimulation Devices

6.2.2.1 Successful Dbs Allows People to Potentially Reduce Their Medications and Improve Their Quality of Life

Table 25 Deep Brain Stimulation Devices Market, by Country, 2019-2026 (USD Million)

6.3 Wearable Devices

6.3.1 High Preference for Wearable Devices due to Ease of Use is a Key Factor Driving Market Growth

Table 26 Companies Providing Wearable Epilepsy Monitoring Devices

Table 27 Wearable Devices Market, by Country, 2019-2026 (USD Million)

7 Epilepsy Monitoring Devices Market, by End-user

7.1 Introduction

Table 28 Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

7.2 Hospitals

7.2.1 Hospitals Can Invest in Expensive and Sophisticated Technologies, Owing to Which the Adoption of Epilepsy Monitoring Devices is Higher Among Hospitals

Table 29 Epilepsy Monitoring Devices Market for Hospitals, by Country, 2019-2026 (USD Million)

7.3 Neurology Centers

7.3.1 High Preference for the Diagnosis and Treatment of Brain Disorders at Neurology Centers is a Major Factor Driving Market Growth

Table 30 Epilepsy Monitoring Devices Market for Neurology Centers, by Country, 2019-2026 (USD Million)

7.4 Ambulatory Surgery Centers & Clinics

7.4.1 Patients are Increasingly Opting for Ambulatory Surgery Centers & Clinics as a More Convenient Alternative to Hospital-Based Outpatient Procedures

Table 31 Epilepsy Monitoring Devices Market for Ambulatory Surgery Centers & Clinics, by Country, 2019-2026 (USD Million)

7.5 Diagnostic Centers

7.5.1 Diagnostic Centers Offer Diagnosis and Treatment Options for Various Neurological Conditions - A Key Factor Driving Market Growth

Table 32 Epilepsy Monitoring Devices Market for Diagnostic Centers, by Country, 2019-2026 (USD Million)

7.6 Home Care Settings

7.6.1 Growing Need for Long-Term Home Care to Drive Market Growth

Table 33 Epilepsy Monitoring Devices Market for Home Care Settings, by Country, 2019-2026 (USD Million)

8 Epilepsy Monitoring Devices Market, by Region

8.1 Introduction

Table 34 Epilepsy Monitoring Devices Market, by Region, 2019-2026 (USD Million)

8.2 North America

Figure 31 North America: Epilepsy Monitoring Devices Market Snapshot

Table 35 North America: Epilepsy Monitoring Devices Market, by Country, 2019-2026 (USD Million)

Table 36 North America: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 37 North America: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 38 North America: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 39 North America: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 40 North America: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

8.2.1 US

8.2.1.1 The Us Dominates the North American Epilepsy Monitoring Devices Market

Table 41 US: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 42 US: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 43 US: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 44 US: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 45 US: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

8.2.2 Canada

8.2.2.1 Growing Number of Hospitals and Surgical Centers to Drive the Demand for Epilepsy Monitoring Devices in Canada

Table 46 Canada: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 47 Canada: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 48 Canada: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 49 Canada: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 50 Canada: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

8.3 Europe

Table 51 Europe: Epilepsy Monitoring Devices Market, by Country, 2019-2026 (USD Million)

Table 52 Europe: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 53 Europe: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 54 Europe: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 55 Europe: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 56 Europe: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

8.3.1 Germany

8.3.1.1 High Burden of Alzheimer's in the Country Will Support Market Growth

Table 57 Germany: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 58 Germany: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 59 Germany: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 60 Germany: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 61 Germany: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

8.3.2 UK

8.3.2.1 Increasing Investments by Public and Private Sectors to Drive the Growth of the Epilepsy Monitoring Devices Market in the UK

Table 62 UK: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 63 UK: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 64 UK: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 65 UK: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 66 UK: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

8.3.3 France

8.3.3.1 Increasing Geriatric Population to Drive Market Growth in France

Table 67 France: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 68 France: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 69 France: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 70 France: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 71 France: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

8.3.4 Rest of Europe

Table 72 Roe: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 73 Roe: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 74 Roe: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 75 Roe: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 76 Roe: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

8.4 Asia-Pacific

Figure 32 Asia-Pacific: Epilepsy Monitoring Devices Market Snapshot

Table 77 APAC: Epilepsy Monitoring Devices Market, by Country, 2019-2026 (USD Million)

Table 78 APAC: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 79 APAC: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 80 APAC: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 81 APAC: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 82 APAC: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

8.4.1 Japan

8.4.1.1 Incidence of Epilepsy in Japan is Expected to Increase due to the Large Geriatric Population

Table 83 Japan: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 84 Japan: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 85 Japan: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 86 Japan: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 87 Japan: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

8.4.2 China

8.4.2.1 China to Register the Highest Growth in the Epilepsy Monitoring Devices Market During the Forecast Period

Table 88 China: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 89 China: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 90 China: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 91 China: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 92 China: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

8.4.3 India

8.4.3.1 Improving Healthcare Infrastructure in the Country Will Support the Growth of the Epilepsy Monitoring Devices Market

Table 93 India: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 94 India: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 95 India: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 96 India: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 97 India: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

8.4.4 Rest of Asia-Pacific

Table 98 Roapac: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 99 Roapac: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 100 Roapac: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 101 Roapac: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 102 Roapac: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

8.5 Rest of the World

Table 103 RoW: Epilepsy Monitoring Devices Market, by Product, 2019-2026 (USD Million)

Table 104 RoW: Conventional Devices Market, by Type, 2019-2026 (USD Million)

Table 105 RoW: Monitoring Devices Market, by Type, 2019-2026 (USD Million)

Table 106 RoW: Eeg Devices Market, by Type, 2019-2026 (USD Million)

Table 107 RoW: Epilepsy Monitoring Devices Market, by End-user, 2019-2026 (USD Million)

9 Competitive Landscape

9.1 Overview

9.2 Key Player Strategies/Right to Win

9.2.1 Overview of the Strategies Adopted by Players in the Epilepsy Monitoring Devices Market

9.3 Competitive Benchmarking

Table 108 Footprint of Companies in the Epilepsy Monitoring Devices Market

Table 109 Company End-User Footprint (25 Companies)

Table 110 Company Regional Footprint (26 Companies)

9.4 Competitive Leadership Mapping

9.4.1 Stars

9.4.2 Emerging Leaders

9.4.3 Pervasive Players

9.4.4 Participants

Figure 33 Epilepsy Monitoring Devices Market: Competitive Leadership Mapping (2020)

9.5 Competitive Leadership Mapping for Other Companies

9.5.1 Progressive Companies

9.5.2 Dynamic Companies

9.5.3 Starting Blocks

9.5.4 Responsive Companies

Figure 34 Epilepsy Monitoring Devices Market: Competitive Leadership Mapping for Other Companies (2020)

9.6 Market Share Analysis

Figure 35 Epilepsy Monitoring Devices Market Share, by Key Player, 2020

Table 111 Epilepsy Monitoring Devices Market: Degree of Competition

9.7 Competitive Scenario

Table 112 Product Launches & Approvals, 2018-2021

10 Company Profiles

10.1 Key Players

(Business Overview, Products/Services/Solutions Offered, Analyst's View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

10.1.1 Natus Medical, Inc.

Table 114 Natus Medical, Inc.: Business Overview

Figure 36 Natus Medical, Inc.: Company Snapshot (2020)

10.1.2 Compumedics Limited

Table 115 Compumedics Limited: Business Overview

Figure 37 Compumedics Limited: Company Snapshot (2020)

10.1.3 Nihon Kohden Corporation

Table 116 Nihon Kohden Corporation: Business Overview

Figure 38 Nihon Kohden Corporation: Company Snapshot (2020)

10.1.4 The Magstim Co. Ltd.

Table 117 The Magstim Co. Ltd.: Business Overview

10.1.5 Medtronic plc

Table 118 Medtronic plc: Business Overview

Figure 39 Medtronic plc: Company Snapshot (2020)

10.1.6 Empatica, Inc.

Table 119 Empatica, Inc.: Business Overview

10.1.7 Masimo Corporation

Table 120 Masimo Corporation: Business Overview

Figure 40 Masimo Corporation: Company Snapshot (2020)

10.1.8 Boston Scientific Corporation

Table 121 Boston Scientific Corporation: Business Overview

Figure 41 Boston Scientific Corporation: Company Snapshot (2020)

10.1.9 Abbott Laboratories, Inc.

Table 122 Abbott Laboratories, Inc.: Business Overview

Figure 42 Abbott Laboratories, Inc.: Company Snapshot (2020)

10.1.10 Aleva Neurotherapeutics S.A.

Table 123 Aleva Neurotherapeutics S.A.: Business Overview

10.1.11 Drägerwerk AG & Co. KGaA

Table 124 Drägerwerk AG & Co. KGaA: Business Overview

Figure 43 Drägerwerk AG & Co. KGaA: Company Snapshot (2020)

10.1.12 Medpage Ltd.

Table 125 Medpage Ltd.: Business Overview

10.1.13 Livassured B.V.

Table 126 Livassured B.V.: Business Overview

10.1.14 Mjn Neuroserveis, S.L.

Table 127 Mjn Neuroserveis, S.L.: Business Overview

10.1.15 Bioserenity

Table 128 Bioserenity: Business Overview

10.1.16 Neurosoft

Table 129 Neurosoft: Business Overview

*Business Overview, Products/Services/Solutions Offered, Analyst's View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments Might Not be Captured in Case of Unlisted Companies.

10.2 Other Players

10.2.1 Advanced Brain Monitoring, Inc.

Table 130 Advanced Brain Monitoring, Inc.: Business Overview

10.2.2 Lifelines Neuro Company, LLC

10.2.3 Mitsar Co., Ltd.

10.2.4 Rimed

10.2.5 Emotiv

10.2.6 Cgx (A Cognionics Company)

10.2.7 Mindray Medical International Limited

10.2.8 Cadwell Industries, Inc.

10.2.9 Neurowave Systems, Inc.

10.2.10 Mc10, Inc.

11 Appendix

11.1 Insights from Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store

Companies Mentioned

- Natus Medical, Inc.

- Compumedics Limited

- Nihon Kohden Corporation

- The Magstim Co. Ltd.

- Medtronic plc

- Empatica, Inc.

- Masimo Corporation

- Boston Scientific Corporation

- Abbott Laboratories, Inc.

- Aleva Neurotherapeutics S.A.

- Drägerwerk AG & Co. KGaA

- Medpage Ltd.

- Livassured B.V.

- Mjn Neuroserveis, S.L.

- Bioserenity

- Neurosoft

- Advanced Brain Monitoring, Inc.

- Lifelines Neuro Company, LLC

- Mitsar Co., Ltd.

- Rimed

- Emotiv

- Cgx (A Cognionics Company)

- Mindray Medical International Limited

- Cadwell Industries, Inc.

- Neurowave Systems, Inc.

- Mc10, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | October 2021 |

| Forecast Period | 2021 - 2026 |

| Estimated Market Value ( USD | $ 489 Million |

| Forecasted Market Value ( USD | $ 615 Million |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |