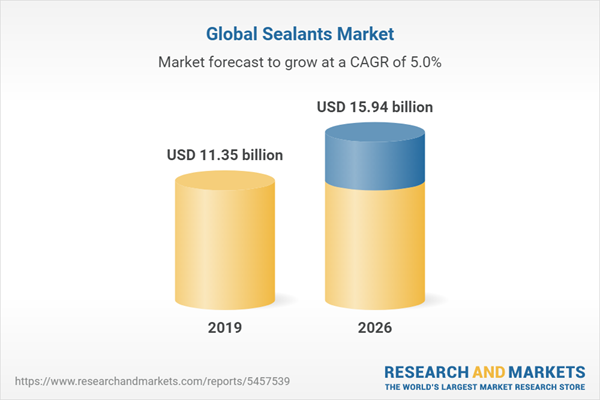

The global sealants market was valued at US$11.351 billion in 2019 and is expected to grow at a CAGR of 4.97 % over the forecast period to reach a market size of US$15.940 billion by 2026.A sealant is a substance that is applied between two surfaces in order to bind them together. More precisely, adhesives guarantee that the surfaces are permanently attached, while sealants fill in the gaps created after the application of the adhesives. Mobile phones, laptops, hard disk drives, and other end-use industries are prime examples of how sealants are used. An important function of sealants is to guarantee that no foreign particles reach the surfaces that are adhered to by adhesives. Buildings made of glass, especially commercial structures, are increasing rapidly worldwide; to achieve a weather-tight structure, large panels of glass have to be sealed. As a result, sealant growth is mainly driven by sectors such as construction, electronics, and e-commerce packaging. Throughout the forecast period, it is expected that the sealants market will increase at a progressive rate.

Asia-Pacific is expected to lead market growth for sealants, as its tremendous economic growth has greatly outpaced that of other regions. There is a growing middle-class population in the Asia-Pacific region, which is stimulating a strong demand for packing materials, specifically from the building construction industry, and the packaging materials manufacturers. Fast urbanization and rising populations in Asia-Pacific are stimulating infrastructure & construction projects, which in turn drive product demand in this region. Globally, 55% of people now live in urban areas; this figure is expected to rise to 68% by 2050. The growth of urban populations in India, China, and Nigeria will account for 35% of all projected urban population growth between 2018 and 2050. As many as 416 million Indians, 255 million Chinese, and 189 million Nigerians will live in cities by 2050. (Source: UN) . A number of localized manufacturing and R&D activities are being conducted in Asia-Pacific in order to meet customer requirements faster and more efficiently and maintain long-term competitiveness. By allocating over US$ 32.02 billion for improved transport infrastructure in India's Union Budget 2021, the Indian government is greatly boosting the infrastructure industry. By the end of July 2021, US$ 1.4 trillion had been invested in infrastructure development via the NIP. Furthermore, The online share of China's retail sales grew from 19.4% to 24.6% from August 2019 to August 2020. Additionally, businesses are also launching sealants from time to time. For instance, in July 2021, Arkema's Bostik division, the Adhesive Solutions division, developed a new program to better formulate their polyurethane (PU) sealants for use in construction sealing and bonding. These developments will boost the market growth for sealants in the forecast period.

Having an inadequate sealant in medical or dental clinics or in operating theatres could negatively affect environmental quality and people's health. It is for this reason that it is imperative to choose a sealant that doesn't emit strong odours and one that can repel bacteria. Regarding chemical and Petro-based products, Europe and North America have strict environmental laws. Epoxy resin committees (ERCs) and European Commissions (ECs) regulate the manufacture of solvent-based products in these regions.

COVID-19 presented many challenges for the sealant industry. A lack of raw materials and labour combined with social distancing measures and supply chain disruptions has forced most countries to suspend construction activities. On the one hand, the construction and manufacturing sectors suffered a great deal from the pandemic, on the other, e-commerce thrived. Although sealant markets were initially negatively affected, the situation has improved gradually with countries easing lockdown regulations.

Growth Factors

Growing demand from developing economies

Asia-Pacific is expected to lead market growth for sealants, as its tremendous economic growth has greatly outpaced that of other regions. There is a growing middle-class population in the Asia-Pacific region, which is stimulating a strong demand for packing materials, specifically from the building construction industry, and the packaging materials manufacturers. Fast urbanization and rising populations in Asia-Pacific are stimulating infrastructure & construction projects, which in turn drive product demand in this region. Globally, 55% of people now live in urban areas; this figure is expected to rise to 68% by 2050. The growth of urban populations in India, China, and Nigeria will account for 35% of all projected urban population growth between 2018 and 2050. As many as 416 million Indians, 255 million Chinese, and 189 million Nigerians will live in cities by 2050. (Source: UN) . A number of localized manufacturing and R&D activities are being conducted in Asia-Pacific in order to meet customer requirements faster and more efficiently and maintain long-term competitiveness. By allocating over US$ 32.02 billion for improved transport infrastructure in India's Union Budget 2021, the Indian government is greatly boosting the infrastructure industry. By the end of July 2021, US$ 1.4 trillion had been invested in infrastructure development via the NIP. Furthermore, The online share of China's retail sales grew from 19.4% to 24.6% from August 2019 to August 2020. Additionally, businesses are also launching sealants from time to time. For instance, in July 2021, Arkema's Bostik division, the Adhesive Solutions division, developed a new program to better formulate their polyurethane (PU) sealants for use in construction sealing and bonding. These developments will boost the market growth for sealants in the forecast period.

Restraints

Environmental impact

Having an inadequate sealant in medical or dental clinics or in operating theatres could negatively affect environmental quality and people's health. It is for this reason that it is imperative to choose a sealant that doesn't emit strong odours and one that can repel bacteria. Regarding chemical and Petro-based products, Europe and North America have strict environmental laws. Epoxy resin committees (ERCs) and European Commissions (ECs) regulate the manufacture of solvent-based products in these regions.

COVID-19 Impact

COVID-19 presented many challenges for the sealant industry. A lack of raw materials and labour combined with social distancing measures and supply chain disruptions has forced most countries to suspend construction activities. On the one hand, the construction and manufacturing sectors suffered a great deal from the pandemic, on the other, e-commerce thrived. Although sealant markets were initially negatively affected, the situation has improved gradually with countries easing lockdown regulations.

Segmentation:

By Type

- Silicone Based Sealants

- Urethane Based Sealants

- Acrylic Based Sealants

- Polysulphide Based Sealants

By Industry vertical

- Construction

- Aerospace and defense

- Automotive

- Manufacturing

- Electrical & Electronics

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- Others

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others

Table of Contents

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

5. Global Sealants Market Analysis, By Type

6. Global Sealants Market Analysis, By Industry vertical

7. Global Sealants Market Analysis, By Geography

8. Competitive Environment and Analysis

9. Company Profiles

Companies Mentioned

- The Dow Chemical Company

- 3M

- Wacker Chemie AG

- BASF SE

- Avery Dennison Corporation

- Royal Adhesives and Sealants

- Illinois Tool Works Inc.

- Carlisle Companies Inc.

- Cytec Solvay Group

- Franklin International

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | October 2021 |

| Forecast Period | 2019 - 2026 |

| Estimated Market Value ( USD | $ 11.35 billion |

| Forecasted Market Value ( USD | $ 15.94 billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |