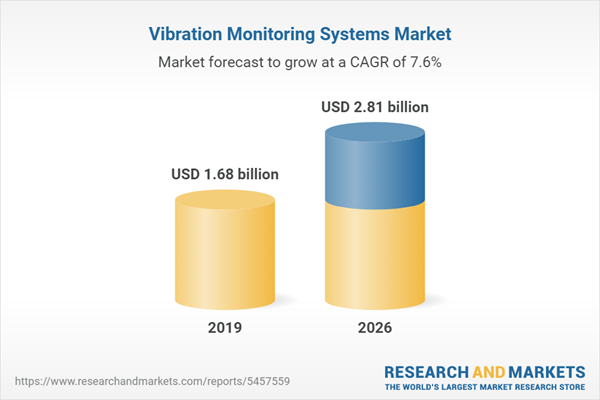

The vibration monitoring systems market is expected to grow at a compound annual growth rate of 7.62% over the forecast period to reach a market size of US$2.805 billion in 2026 from US$1.678 billion in 2019. A vibration monitoring system is a collection of instruments used to measure one or more parameters in order to detect changes in machine health. Monitoring these characteristics aids in the early detection of defects such as overload, bearing faults, looseness, malfunctions, and others.

Factors such as the increasing acceptance of wireless systems in machine condition monitoring, the growing nature of analytical care, the high demand from advancing implementations, the increasing acceptance of automated condition monitoring technologies and emergence of secure cloud computing platforms utilised in condition monitoring, as well as the penetration of the smart factory, are projected to fuel the growth of the vibration monitoring market over the forecast period.

However, the retrofitting costs for vibration monitoring solutions on existing machinery, the influence of governing norms, and the lack of qualified technical resources for data analysis are the major factors expected to further impede the growth of the vibration monitoring market in the coming years.

Because of its application in predictive analysis, vibration monitoring is widely used in the industrial, automotive, and energy & power industries. Manufacturers can use predictive analysis to boost production and improve operational efficiency. These industries use large, capital-intensive gear and rely heavily on operational efficiency to generate profits. Due to the usage of heavy gear, high power consumption, and proximity to combustible materials, it is critical to maintaining constant equipment monitoring in order to avert a disaster. Unmonitored machines can become the weakest link in the production chain, increasing the chances of failure or downtime.

Inaccuracies produced by these machines in the form of lost metrics, service interruptions, and inaccurate alerting signals, leave experienced operators sceptical of the predictions offered by vibration monitoring systems. Predictive maintenance is also a time-consuming procedure that requires a PdM schedule. Plant workers must be trained not just on how to use the equipment, but also on how to understand the analytics (or data) since predictive maintenance is a complex undertaking.

COVID-19 had an impact on overall production capacity in a number of industries, including automotive, chemicals, metals, food and beverage, and so on. As a result, the market for vibration monitoring is expected to be hampered. The outbreak has prompted nearly all industrial businesses to rethink their strategy and devise rapid solutions in order to maintain supply chain stability. Post covid, the market is expected to recover quickly.

September 2021 - Schaeffler, a leading provider of machine and system condition monitoring systems (CMS), launched its award-winning OPTIME solution in Singapore and South Korea to assist industrial clients to forecast and avoid unforeseen downtime.

September 2021 - HxGN MineMeasure, a customised solution integrating blast design software, was launched by Hexagon AB, a global pioneer in digital reality solutions. It includes a vibration monitoring system as well as a slope stability study to ensure the safety of employees as well as the planned value of the pit.

Factors such as the increasing acceptance of wireless systems in machine condition monitoring, the growing nature of analytical care, the high demand from advancing implementations, the increasing acceptance of automated condition monitoring technologies and emergence of secure cloud computing platforms utilised in condition monitoring, as well as the penetration of the smart factory, are projected to fuel the growth of the vibration monitoring market over the forecast period.

However, the retrofitting costs for vibration monitoring solutions on existing machinery, the influence of governing norms, and the lack of qualified technical resources for data analysis are the major factors expected to further impede the growth of the vibration monitoring market in the coming years.

Growth Factors

Rising interest towards predictive maintenance

Because of its application in predictive analysis, vibration monitoring is widely used in the industrial, automotive, and energy & power industries. Manufacturers can use predictive analysis to boost production and improve operational efficiency. These industries use large, capital-intensive gear and rely heavily on operational efficiency to generate profits. Due to the usage of heavy gear, high power consumption, and proximity to combustible materials, it is critical to maintaining constant equipment monitoring in order to avert a disaster. Unmonitored machines can become the weakest link in the production chain, increasing the chances of failure or downtime.

Restraints

- Reliability issues in prediction capabilities

Inaccuracies produced by these machines in the form of lost metrics, service interruptions, and inaccurate alerting signals, leave experienced operators sceptical of the predictions offered by vibration monitoring systems. Predictive maintenance is also a time-consuming procedure that requires a PdM schedule. Plant workers must be trained not just on how to use the equipment, but also on how to understand the analytics (or data) since predictive maintenance is a complex undertaking.

Covid-19 Impact

COVID-19 had an impact on overall production capacity in a number of industries, including automotive, chemicals, metals, food and beverage, and so on. As a result, the market for vibration monitoring is expected to be hampered. The outbreak has prompted nearly all industrial businesses to rethink their strategy and devise rapid solutions in order to maintain supply chain stability. Post covid, the market is expected to recover quickly.

Competitive Insights

September 2021 - Schaeffler, a leading provider of machine and system condition monitoring systems (CMS), launched its award-winning OPTIME solution in Singapore and South Korea to assist industrial clients to forecast and avoid unforeseen downtime.

September 2021 - HxGN MineMeasure, a customised solution integrating blast design software, was launched by Hexagon AB, a global pioneer in digital reality solutions. It includes a vibration monitoring system as well as a slope stability study to ensure the safety of employees as well as the planned value of the pit.

Market Segmentation:

By Sensor Type

- Displacement Sensors

- Velocity Sensors

- Accelerometers

By End-User Industry

- Manufacturing

- Construction

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- Italy

- Spain

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

5. Vibration Monitoring Systems Market Analysis, By Sensor Type

6. Vibration Monitoring Systems Market Analysis, By End-User Industry

7. Vibration Monitoring Systems Market Analysis, By Geography

8. Competitive Environment and Analysis

9. Company Profiles

Companies Mentioned

- General Electric

- ABB

- Siemens AG

- IMV Corporation

- Riverhawk Corporation

- PCB Piezotronics Inc.

- Honeywell International Inc.

- Emerson Electric Company

- National Instruments Corporation

- Rockwell Automation, Inc.

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | October 2021 |

| Forecast Period | 2019 - 2026 |

| Estimated Market Value ( USD | $ 1.68 billion |

| Forecasted Market Value ( USD | $ 2.81 billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |