The global crane market is being propelled by infrastructure development, rising demand for renewable energy, and rapid technological advancements. The demand for emerging technologies like automation and AI is further propelling the latest application of cranes in various sectors. The growing economies around the world and the emergence of e-commerce created the large-scale application of cranes in transportation & logistics. Moreover, growing international trade has created the large-scale application of cranes in the ports across the world, where companies and governments are investing heavily in profitable operations at the ports.

Market Trends

- Boom in Construction Activities: The global crane market is witnessing strong growth, driven by significant construction activity in major developing economies and large markets like the USA. U.S. construction spending rose from $2.13 trillion in February 2024 to $2.19 trillion in February 2025, reflecting increased expenditure on materials and services in the sector.

- Technological Advancements in Cranes: The crane industry is transforming through the adoption of artificial intelligence, automation, and advanced materials, which are revolutionizing crane operations and enhancing efficiency.

- Regional Market Dynamics: North America and Asia-Pacific are expected to hold substantial market shares, propelled by the increasing use of capital-intensive techniques in industries and robust growth in key sectors like oil & gas, logistics, and construction.

- Logistics and Infrastructure Growth: The expansion of logistics, development of ports, and rising investments in construction have significantly increased the demand for heavy machinery, such as cranes, in major regional economies.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

How can the data from this report be utilized?

Industry & Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, and Competitive Intelligence.Report Coverage

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

Global Cranes Market Segmentation:

By Type

- Tower Cranes

- Rough-terrain Cranes

- Crawler Cranes

- Floating Cranes

- Others

By Mobility

- Static

- Mobile

By Capacity

- Up to 50 Tons

- 50 to 100 Tons

- Greater than 100 Tons

By End-user Industry

- Construction

- Mining

- Transportation & Logistics

- Oil & Gas

- Manufacturing

- Others

By Region

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- France

- Germany

- Spain

- Others

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Others

- Asia-Pacific

- Japan

- China

- India

- Thailand

- Taiwan

- Indonesia

- Australia

- Others

Table of Contents

Companies Mentioned

- Terex Corporation

- Gorbel Inc.

- Mitsubishi Heavy Industries

- Hyundai Motor Company

- Sumitomo Heavy Industries, Ltd.

- Tadano Ltd.

- Mazzella Companies

- JC Bamford Excavators Ltd.

- The Volvo Group

- TIL Limited

- Liebherr Group

Table Information

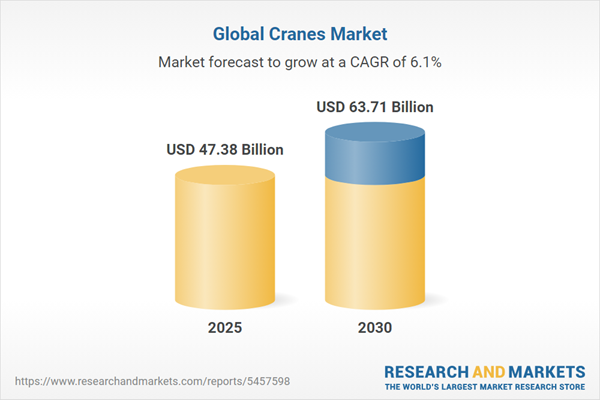

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | May 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 47.38 Billion |

| Forecasted Market Value ( USD | $ 63.71 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |