The global pharmaceutical vials market valued at USD 11.03 billion in 2025, is anticipated to grow at a CAGR of 6% during the forecast period.

Pharmaceutical Vials Market: Growth and Trends

Primary packaging material such as pharmaceutical glass vials play a crucial role in preserving the stability, efficacy and safety of the drug as it is in direct contact with the packaged therapeutic. Additionally, pharmaceutical primary packaging material assists in maintaining the sterility and quality of a drug product, while also providing information related to its identity and, in certain cases, dosing instructions. Moreover, given the high demand for parenteral formulations and rising vaccination campaigns, there is an urgent need for safe and high-quality pharmaceutical vials, for storing and distributing such formulations in large quantities, across the world.

Despite being the most preferred packaging system, traditional vials are often associated with certain challenges, including chances of breakage under extreme conditions, absence of relevant information (serial or batch number) on the package and potential to delaminate. As a result, several pharmaceutical vials manufacturers are exploring novel techniques to overcome the aforementioned challenges associated with conventional pharmaceutical vials in order to create better packaging solutions. In fact, pharmaceutical vial manufacturers are constantly innovating and creating newer and better packaging solutions in order to meet the changing demands of next generation drug products. Examples of some advancements in this domain include the use of pre-sterilized vials, development of numerous coating materials and adoption of smart drug delivery technologies.

Pharmaceutical Vials Market: Key Insights

The report delves into the current state of the global pharmaceutical vials market and identifies potential growth opportunities within industry.

Some key findings from the report include:

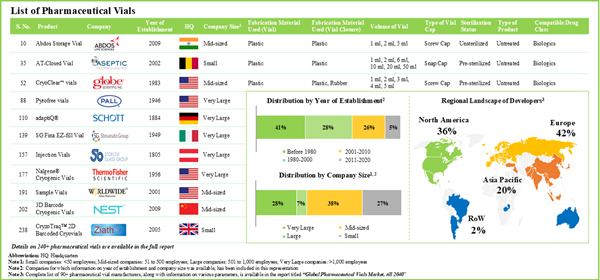

- Presently, more than 240 pharmaceutical vials are available / being developed by close to 95 manufacturers; most of these players are based in the developed such as North America and Europe.

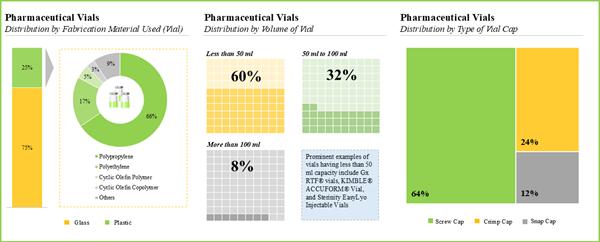

- Majority of the pharmaceutical vials are fabricated using glass and are available in a variety of volumes; screw caps are amongst the preferred type of vial caps used for such containers.

- Owing to the various benefits, glass emerged as the most preferred fabrication material used for pharmaceutical vials; common types of glass used include type I borosilicate glass (65%) and type III soda-lime glass (16%).

- Majority (60%) of the pharmaceutical vials have a capacity to hold less than 50 ml of drug product; however, very few (8%) vials are capable of storing more than 100 ml of therapeutic products.

- More than 60% of the pharmaceutical vials are designed to be used with screw caps; examples of such vials include 1-Clic® Vial System, CryoClear™ vials, NextGen™ V-Vial®, Pyrofree vials and Sterile CryoSure® Vial.

- In pursuit of building a competitive edge, industry stakeholders are actively upgrading their existing capabilities and adding new competencies in order to enhance their respective product portfolios.

- Over the years, industry players have established several deals to further advance the development / enable the improvement of their proprietary pharmaceutical vials.

- The partnership activity in this domain has increased at a CAGR of over 30% in the past few years.

- Both established players and new entrants have forged strategic partnerships in the recent past; acquisitions emerged as the prominent type of partnership model.

- Current industry trends support the growing need for innovative packaging solutions, primarily to accommodate large scale and specialized production / packaging requirements of increasingly complex drug products.

- Close to 40 players claim to provide a wide range of robotic machinery, having different degrees of freedom, offering notable productivity and cost optimization opportunities.

- Pharmaceutical vials have been in high demand during the COVID-19 pandemic to store and package the novel vaccines and experimental therapies in large quantities.

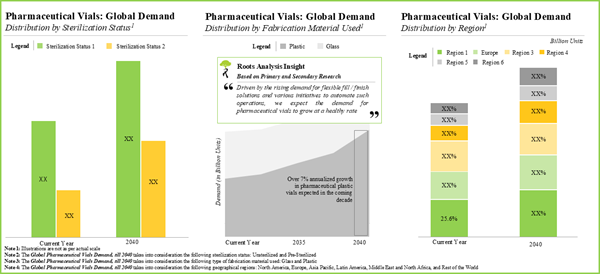

- The estimated market opportunity for pharmaceutical vials is expected to be well distributed across different types of fabrication material, sterilization status and geographical regions.

Report Scope:

Type of Fabrication Material Used

- Glass

- Plastic

Sterilization Status

- Pre-sterilized

- Unsterilized

Key Geographies

- North America

- Europe

- Asia- Pacific

- Latin America

- Middle East and North Africa

- Rest of the World

Example Players in the Pharmaceutical Vials Market Profiled in the Report Include:

- Chongqing Zhengchuan Pharmaceutical Packaging

- Corning

- Danyang Xianghe Pharmaceutical Packaging

- DWK Life Sciences

- Gerresheimer

- Ningbo Zhengli Pharmaceutical Packaging

- Nipro

- Origin Pharma Packaging

- Pacific Vial Manufacturing

- SCHOTT

- SGD Pharma

- Shandong Pharmaceutical Glass

- Stevanato Group

- Thermo Fisher Scientific

- Worldwide Glass Resources

Pharmaceutical Vials Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the pharmaceutical vials market, focusing on key market segments, including type of fabrication material used, sterilization status and key geographies.

- Market Landscape: A comprehensive evaluation of pharmaceutical vials, based on several relevant parameters, such as type of fabrication material used for container,type of fabrication material used for closure, volume of vial, type of vial cap, sterilization status, type of product, compatible drug class and type of formulation stored. Additionally, a comprehensive evaluation of pharmaceutical vial manufacturers based on several relevant parameters, including year of establishment, company size, location of headquarters and key players (in terms of number of products).

- Company Competitiveness Analysis: A comprehensive competitive analysis of pharmaceutical vial manufacturers, examining factors, such as supplier power and key product specifications.

- Company Profiles: In-depth profiles of the players engaged in the development of pharmaceutical vials, focusing on overview of the company, financial information (if available), product portfolio and recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the pharmaceutical vial domain, based on several parameters, such as year of partnership, type of partnership, type of fabrication material involved, sterilization status, type of partners and regional distribution of the partnerships.

- Upcoming Trends in Pharmaceutical Packaging: An in-depth analysis of key trends that are likely to impact the future adoption of novel primary packaging systems. Further, a Harvey ball analysis, focusing on the relative effect of each trend on the overall pharmaceutical packaging industry.

- Demand Analysis: A detailed analysis of the current and future demand for pharmaceutical vials, based on various parameters, such as type of fabrication material used, sterilization status and regions.

- Case Study: A detailed discussion on the use of robotic machinery in pharmaceutical manufacturing and fill / finish operations, describing the advantages of using automation / automated technologies in such processes.

- Case Study: A detailed discussion on pre-sterilized / RTU pharmaceutical vials that are currently available. Additionally, the section discusses various sterilization techniques used for primary packaging materials and the advantages of RTU container-closure systems.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

Table of Contents

Executive Summary

Chapter 2 is an executive summary of the key insights captured in our report. It offers a high-level view on the current state of the pharmaceutical vials market and its likely evolution in the short-mid term and long term.

Chapter 3 provides a general overview of conventional pharmaceutical packaging and the different types of packaging systems. Further, the chapter features a detailed discussion on pharmaceutical vials, its fabrication material and the different types of caps available. Further, it features a brief discussion on the recent innovations in this domain.

Chapter 4 provides a comprehensive review of the current market landscape of pharmaceutical vials, featuring information on the type of fabrication material used for container (glass and plastic), type of fabrication material used for closure (rubber, plastic and metal), volume of vial (less than 50 ml, 50 ml to 100 ml and more than 100 ml), type of vial cap (screw cap, crimp cap and snap cap), sterilization status (unsterilized and sterilized), type of product (untreated and treated), compatible drug class (biologics and small molecules) and type of formulation stored (liquid, powder and solid). In addition, the chapter includes analysis related to pharmaceutical vial manufacturers, based on various parameters, year of establishment, company size, location of headquarters and key players (in terms of number of products).

Chapter 5 presents a detailed competitiveness analysis of pharmaceutical vial manufacturers , segmented into four categories, namely small (1-50 employees), mid-sized companies (51-500 employees), and large (501-1,000 employees) and very large companies (more than 1,000 employees). Within the peer group, companies were ranked based on various relevant parameters, such as supplier power (based on the experience / expertise of the manufacturer) and key product specifications (type of fabrication material used, type of vial cap, sterilization status, type of product, compatible drug class and type of formulation stored).

Chapter 6 features detailed profiles of the prominent companies that develop pharmaceutical vials in North America. Each company profile features a brief overview of the company, details related to its financials (if available), product portfolio, recent developments and an informed future outlook.

Chapter 7 features detailed profiles of the prominent companies that develop pharmaceutical vials in Europe. Each company profile features a brief overview of the company, details related to its financials (if available), product portfolio, recent developments and an informed future outlook.

Chapter 8 features detailed profiles of the prominent companies that develop pharmaceutical vials in Asia Pacific. Each company profile features a brief overview of the company, details related to its financials (if available), product portfolio, recent developments and an informed future outlook.

Chapter 9 features an elaborate discussion and analysis of the various collaborations and partnerships that have been inked amongst stakeholders in this domain, in the period 2015 – 2021 (till September). Further, the partnership activity in this domain has been analyzed based on various parameters, such as year of partnership, type of partnership model (acquisitions, product / technology integration agreements, supply agreements, asset acquisitions, distribution agreements, product / technology development agreements, product / technology licensing agreements and others), type of fabrication material involved, sterilization status, type of partners and regional distribution of the collaborations.

Chapter 10 discusses the emerging trends in the overall pharmaceutical manufacturing and fill-finish industry. Specifically, it presents the growing demand of personalized therapies, shift towards more flexible packaging, development of modular facilities, upgrading packaging components to enhance drug product safety, increase in partnership activity, and growing adoption of smart packaging solutions.

Chapter 11 provides an overview of the current and future demand for pharmaceutical vials, in the contemporary market. In order to estimate the aforementioned demand, we considered the current supply of pharmaceutical vials and estimated their proportion that are likely to be supplied to the pharmaceutical industry till 2030. We then segregated the total demand across a number of relevant parameters, including type of fabrication material (glass and plastic), sterilization status (pre-sterilized and unsterilized) and geographical regions (North America, Europe, Asia Pacific, Middle East and North Africa, Latin America, and rest of the world).

Chapter 12 presents a comprehensive market forecast analysis, highlighting the future potential of the market till 2030, based on multiple parameters, such as current demand for pharmaceutical vials, likely adoption rates and the estimated price of components. We have segregated the current and upcoming opportunity based on [A] type of fabrication material used (glass and plastic), [B] sterilization status (pre-sterilized and unsterilized) and [C] key geographies (North America, Europe, Asia Pacific, Middle East and North Africa, Latin America and Rest of the world). It is worth mentioning that we adopted a bottom-up approach for this analysis, backing our claims with relevant datapoints and credible inputs from primary research.

Chapter 13 presents a detailed case study on the role of robots in the pharmaceutical manufacturing and fill / finish process, highlighting its benefits and capabilities. It provides a list of the various types of pharmaceutical robots, along with details on their respective manufacturer and applications. Additionally, the chapter features profiles of players that offer robotic equipment for pharmaceutical manufacturing and fill / finish operations, along with information on the key specifications of their respective machinery.

Chapter 14 provides insights on pre-sterilized / RTU pharmaceutical vials that are currently available, highlighting the pharmaceutical packaging and filling process, and the various limitations associated with the currently used container closure systems. Further, it features an elaborate discussion on the different sterilization techniques used for primary packaging materials and the advantages of RTU containers and closure systems.

Chapter 15 summarizes the overall report. In this chapter, we have provided a list of key takeaways from the report, and expressed our independent opinion related to the research and analysis described in the previous chapters.

Chapter 16 is a collection of interview transcripts of the discussions held with key stakeholders in this market. In this chapter, we have presented the details of interviews held with Julien Marechal (Business Development and Technology Director, Aseptic Technologies) and Konstantin Kazarian (Former Project Manager of Business Development, PYRAMID Laboratories).

Chapter 17 is an appendix, which provides tabulated data and numbers for all the figures provided in the report.

Chapter 18 is an appendix, which contains the list of companies and organizations mentioned in the report.

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Chongqing Zhengchuan Pharmaceutical Packaging

- Corning

- Danyang Xianghe Pharmaceutical Packaging

- DWK Life Sciences

- Gerresheimer

- Ningbo Zhengli Pharmaceutical Packaging

- Nipro

- Origin Pharma Packaging

- Pacific Vial Manufacturing

- SCHOTT

- SGD Pharma

- Shandong Pharmaceutical Glass

- Stevanato Group

- Thermo Fisher Scientific

- Worldwide Glass Resources

Methodology

LOADING...