The Global Cloud Kitchen Market size is expected to reach $118.5 billion by 2027, rising at a market growth of 13.5% CAGR during the forecast period. Cloud kitchens, also known as ghost kitchens or virtual kitchens, refer to the delivery only kitchens that are owned by any brand or third party that are collaboratively working with different brands. These kitchens have reasonable cost of operations in comparison to traditional kitchens in dine-in restaurants. This type of kitchen does not need any dine-in spaces and account for costs associated with property & location.

In addition, cloud kitchens also have relatively high profit margins than any other dine-in restaurant. Cloud kitchens offer more flexibility in operations from any location including parking spaces, warehouses, and even basements, which are contributing to the increasing popularity of cloud kitchens across the globe. There is a wide range of benefits offered by these kitchens coupled with the increasing real-estate costs and competition amongst dine-in restaurants, which are further motivating entrepreneurs and restaurateurs to adopt the concept of cloud kitchens in the coming years.

Furthermore, the growing population of youngsters across the world and the shifting taste preference of the customers have fueled the demand for online food delivery. Additionally, rising disposable income and the hectic life schedule of the consumers are among the key factors spurring the trend of ordering food from online mode. In addition, increasing literacy rate, surge in use of smartphones, and better access to the internet are some of the factors making online food ordering easier. At present, food restaurants are collaborating with online food service sites like FoodPanda for their food delivery and also to boost their sales.

COVID-19 Impact Analysis

The outbreak of the global COVID-19 pandemic has impacted various sections of society. The food industry has witnessed numerous challenges due to the pandemic. The dine-in restaurants that make the two-thirds of the food industry were negatively affected and faced huge financial losses due to the imposed restrictions like lockdown. In addition, the imposed lockdown in various nations across the globe has supported the food delivery service model to gain more momentum in the industry.

Since the cloud kitchens operate wholly on the delivery-only model, restaurant owners can easily carry on their businesses and better serve their customers. The demand for cloud kitchens around the world has increased due to the pandemic as food delivery was allowed even throughout complete lockdowns. The consumer preference has also changed from dine-in to food delivery, which is bolstering the growth of the cloud kitchen market.

Market Growth Factors:

The increasing popularity of online ordering food

With the introduction of various food delivery apps, the concept of online food delivery has gained more momentum. Customers are preferring food delivery over dine-in, which is supporting the growth of the cloud kitchen market in the coming years. In addition, these food delivery apps are motivating restaurant owners to shift to cloud kitchens from traditional kitchen locations. The rising internet penetration and high adoption of smartphones among the customers are also promoting restaurant owners to opt for cloud kitchens rather than establishing a conventional kitchen facility.

Reduction in the overall cost of running a restaurant

Establishing a traditional restaurant facility with proper infrastructure at a location is very expensive as the prices of real estate or properties are regularly increasing in the market. Additionally, the huge cost is incurred in the making and maintenance of the infrastructure of the restaurant, which can be reduced by opting for cloud kitchens. Cloud kitchens also help in eradicating the expensive part of opening a physical restaurant such as decorations, dinnerware, and branded signage.

Market Restraining Factor:

Absence of customer interaction

As everything goes online in the cloud kitchen concept, customers do not interact directly with the restaurant and lack the establishment of a connection among them. Some of the factors that connect a person with a restaurant are personal attachment, beautiful ambiance, and interaction with the restaurant staff. These factors motivate the customers to visit the restaurant again and make a personal bond with the staff, which further augments the sales of the restaurants.

Nature Outlook

Based on Nature, the market is segmented into Franchised and Standalone. The standalone segment is projected to procure a substantial growth rate during the forecast period. It is due to the low investment required, allowing total control over kitchen operations. Opening standalone kitchens as a brand need more time and hence, the adoption of these kitchens is less as compared to franchise stores.

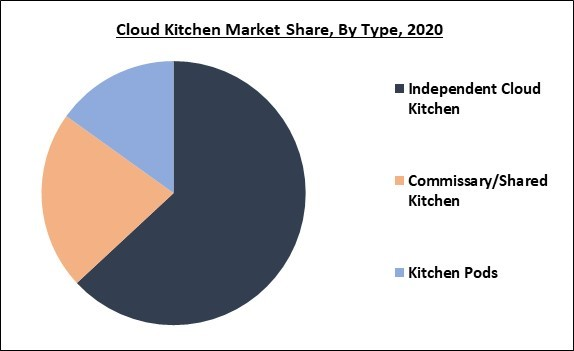

Type Outlook

Based on Type, the market is segmented into Independent Cloud Kitchen, Commissary/Shared Kitchen and Kitchen Pods. The independent cloud kitchen segment dominated the market with the maximum revenue share in 2020. This segment is anticipated to continue this trend during the forecast period due to the increasing number of standalone brands that serve customers from one location. In addition, independent cloud kitchens mainly focus on consumers that prefer one cuisine type and majorly depend on third-party channels for food delivery.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific emerged as the leading region in the cloud kitchen market with the maximum market share in 2020. The growing trend of cloud kitchens across emerging nations like China and India is propelling the growth of the regional market. The increasing disposable incomes of the consumers and the high adoption of smartphone applications by the millennials are among the major factors surging the demand for online food delivery services.

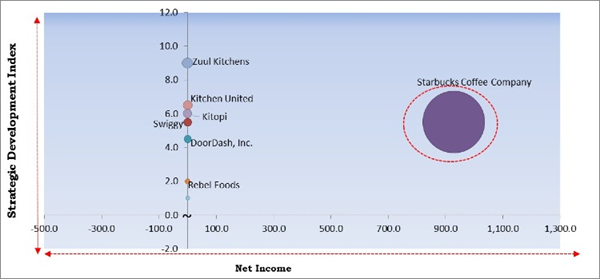

Cardinal Matrix - Cloud Kitchen Market Competition Analysis

The major strategies followed by the market participants are Partnerships. Based on the Analysis presented in the Cardinal matrix; Starbucks Coffee Company is the major forerunners in the Cloud Kitchen Market. Companies such as DoorDash, Inc., Rebel Foods, Kitopi, Kitchen United are some of the key innovators in the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Starbucks Coffee Company, DoorDash, Inc., Ghost Kitchen Orlando, Swiggy (Bundl Technologies Pvt. Ltd.), Zuul Kitchens, Rebel Foods, Kitopi, Kitchen United, Pop Meals (Dahmakan), and CloudKitchens.

Recent Strategies Deployed in Cloud Kitchen Market

Partnerships, Collaborations and Agreements:

- Aug-2021: Kitchen United joined hands with Kroger, the nation’s largest supermarket chain. This collaboration aimed to make takeout and delivery food under some of its grocery stores. In the partnership, Kitchen United is expected to open ghost kitchens at engaging Kroger locations and provide upto six local, regional or national restaurant brands.

- Jun-2021: Kitchen United signed an agreement with Camile Food Group. This agreement aimed to introduce Camile Thai in the US with Kitchen United MIX.

- May-2021: Kitopi entered into a partnership with C³, the revolutionary tech-enabled food, and beverage platform. Under this partnership, C³ is expected to introduce its popular digital restaurant brands like Sam's Crispy Chicken, Umami Burger, Sa'moto by Morimoto, and Krispy Rice to the global market. In addition, this partnership is expected to showcase C3's first international development, launching the company's popular concepts in the UAE, with additional markets to come via Kitopi's network across the Middle East and Asia.

- Apr-2021: Kitopi formed a partnership with Kuwait-based KLC Virtual Restaurants to expand KLC Virtual Restaurants in the GCC region. Together, the companies is expected to collaboratively fulfill the growing demand for online delivery of food in the region. In addition, the partnership also aimed to enable Kitopi to use its smart kitchen operating system (SKOS), which is a unique technology with KLC to optimize its kitchen efficiency along with its brand and customer experience.

- Feb-2021: Zuul came into a partnership with Aurify Brands, a brand development company that builds, operates, and owns exclusive networks of fast-casual restaurants. Delivering a tailored multi-brand online ordering solution, ZuulOS is expected to direct the way for Zuul to expand its building and office delivery model by collaboratively working with other operators.

- Feb-2021: Kitchen United came into collaboration with Westfield Valley Fair mall in Santa Clara, California. This collaboration aimed to assist diners in order food to go. Eateries at Westfield Valley Fair is expected to be capable of using Kitchen United’s technology to fulfill to-go orders and send the food to lockers for pickup or delivery from the mall’s ground floor.

- Dec-2020: Rebel Foods formed a partnership with Wendy’s Company, an American holding company for the major fast-food chain. This partnership aimed to unveil 250 cloud kitchens across India. Under this plan, Rebel Foods is expected to partner with Sierra Nevada Restaurants that acquire the India master franchisee for Wendy's, to make and manage Wendy’s cloud kitchens in the country. Through this partnership, Wendy’s is expected to get immediate access to swift scale across the nation, at far lower levels of capital.

- Sep-2020: Kitopi came into partnership with Nathan’s Famous, an American company that operates a chain of fast-food restaurants specializing in hot dogs. This partnership aimed to make its food items accessible across Dubai, UAE. In addition, the companies is expected to expand the partnership to Saudi Arabia, Kuwait, and Abu Dhabi, UAE. Under this partnership, Kitopi is expected to provide Nathan’s Famous an exciting position in the Gulf Region, enabling them to expand its service and deliver the flavor of New York to everyone in Dubai.

- Feb-2020: Swiggy came into partnership with some restaurants on its platform. Together, the entities is expected to make delivery-only brands, with a unique identity from the parent eatery. This partnership aimed to fill the gap in the food delivery requirement of specific areas. The initiative, named ‘BrandWorks,’ provides a distinct menu, images, packaging, and pricing from the restaurant's usual menu.

Acquisitions and Mergers:

- Feb-2021: DoorDash took over Chowbotics, a salad-making robot startup. This acquisition aimed to enable DoorDash to improve its range of merchant services including on-demand delivery, insights and analytics, customer acquisition, and white-label order fulfillment in a more cost-efficient way.

- Jan-2020: Zuul Kitchens took over Ontray, an online food-ordering platform. This acquisition is expected to enable Zuul to build upon Ontray's online ordering tools to deliver innovative ways for its restaurant members to get orders and deliver them.

Product Launches and Expansions:

- Sep-2020: Zuul released Zuul Market, a virtual food hall delivery experience accelerating New Yorkers' return to work. Zuul Market offers planned food deliveries to particular drop points, helping tenants, employees, and residents to order from numerous restaurants in the same delivery.

Geographical Expansions:

- Jul-2021: DoorDash expanded its global footprint by introducing a new location of its ghost kitchen operation. DoorDash Kitchens San Jose is expected to set up six different restaurant concepts from nationwide known restaurants and from the San Francisco Bay Area. Restaurants in this new location involve Canter’s Deli, Aria Korean Street Food, The Melt Express, Curry up Now, Milk Bar, and YiFang Taiwan Fruit Tea. In addition, this new location is expected to also provide delivery and pickup orders for customers in San Jose proper and Saratoga and Campbell.

- Jan-2021: Kitchen United expanded its Ghost Kitchen Network. This expansion included the latest facilities in those prevailing high-volume markets along with kitchen facilities in completely new locations such as New York City and the San Francisco Bay Area.

- Feb-2020: Starbucks expanded its geographies in its delivery program to 33 new US markets, in collaboration with UberEats. These newly located markets consist of Baltimore, Raleigh-Durham, Austin, Charleston, Cleveland, Pittsburgh, Las Vegas, Memphis, Detroit, Tampa-St. Pete, Nashville, New Orleans, Portland, San Antonio, and more. Through this expansion, Starbucks is expected to provide its services to 49 markets across 29 US states, with the aim to expand to nearly every state. The company is expected to swiftly strengthen its delivery program to the latest US markets.

Scope of the Study

Market Segments Covered in the Report:

By Nature

- Franchised

- Standalone

By Type

- Independent Cloud Kitchen

- Commissary/Shared Kitchen

- Kitchen Pods

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Starbucks Coffee Company

- DoorDash, Inc.

- Ghost Kitchen Orlando

- Swiggy (Bundl Technologies Pvt. Ltd.)

- Zuul Kitchens

- Rebel Foods

- Kitopi

- Kitchen United

- Pop Meals (Dahmakan)

- CloudKitchens

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Starbucks Coffee Company

- DoorDash, Inc.

- Ghost Kitchen Orlando

- Swiggy (Bundl Technologies Pvt. Ltd.)

- Zuul Kitchens

- Rebel Foods

- Kitopi

- Kitchen United

- Pop Meals (Dahmakan)

- CloudKitchens