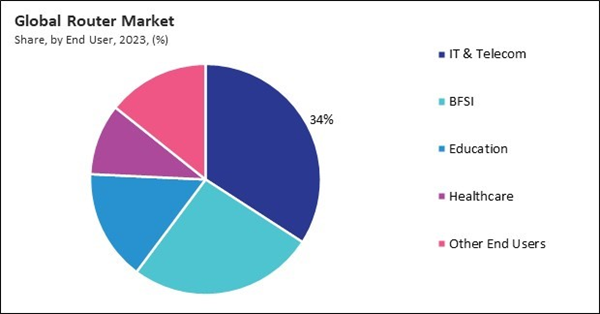

The rapid growth of digital transformation, cloud services, and the expansion of 5G networks have driven the need for high-performance routers to support large-scale data transmission, internet connectivity, and network reliability. Telecom providers, in particular, rely heavily on routers to manage network traffic and ensure uninterrupted communication services, which has significantly contributed to the dominance of this segment. The IT & telecom segment recorded 34% revenue share in the market in 2023. In terms of volume, 196.70 million units of routers are expected to be utilized in IT & Telecom by the year 2031. This can be attributed to the increasing demand for robust and efficient networking infrastructure within the IT and telecom industries.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September, 2021, Linksys, a subsidiary of Belkin, unveiled Linksys (AX5400) WiFi 6 EasyMesh router (E9450) in India. The new router allows customers to enjoy high-speed data transfers, higher capacity, superior connectivity performance in environments with multiple connected devices, and advanced power efficiency. Additionally, In August, 2021, Netgear introduced Nighthawk XR1000 Pro Gaming Wi-Fi 6, the latest gaming router for the Indian market. Moreover, the new router operates with a Wi-Fi 6 speed of up to 5.4 Gbps and would allow various users to connect more devices simultaneously, without impacting reliability or speed, by effectively packing and scheduling data.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Cisco Systems, Inc. is the forerunners in the Router Market. Companies such as Xiaomi Corporation and Huawei Technologies Co., Ltd. are some of the key innovators in Router Market. In June, 2021, Cisco introduced the latest portfolio of Catalyst industrial routers to extend the potential of the enterprise network to the edge with the flexibility, security, and scalability required for IoT success. This latest portfolio features 5G capabilities which allow companies to run connected operations on a scale with a choice of management tools that are suitable for both IT and operations. Moreover, the unified architecture streamlines collaboration between IT and operations and simplifies their deployments from the enterprise to the edge.Market Growth Factors

As digital experiences become integral to everyday life, consumers increasingly demand seamless, uninterrupted internet access. This shift has been accelerated by the rising number of online activities such as video streaming, online gaming, and remote work, which require high-speed, stable connections. High-definition video content, virtual reality, and other bandwidth-heavy applications push internet service providers and router manufacturers to meet these demands.Additionally, the global digital transformation trend across industries pushes for better networking solutions. Companies invest in technology to operate more efficiently and provide better customer experience. This includes adopting cloud services, big data analytics, and IoT, all of which require robust network infrastructure. In conclusion, the surge in remote work, online learning, and digital transformation propels the market's growth.

Market Restraining Factors

One of the key barriers to the widespread adoption of advanced routers is the high initial cost of these devices. Routers with the latest features, such as 5G support, Wi-Fi 6, and mesh networking capabilities, tend to be more expensive than traditional models. For consumers, especially in emerging markets, the price of these advanced routers can be a significant deterrent. Therefore, the high initial cost of advanced routers is impeding the market's growth.Driving and Restraining Factors

Drivers- Rising Consumer Demand for Seamless Internet Experience

- Surge in Remote Work, Online Learning, and Digital Transformation

- Expansion of High-Speed Internet Connectivity and 5G Networks

- High Initial Cost of Advanced Routers

- Complex Installation and Setup Processes

- Increase in Smart Homes and IoT Devices

- Government Initiatives and Investments in Digital Infrastructure

- Compatibility Issues with Older Network Infrastructure

- Short Product Lifecycle and Frequent Upgrades

Type Outlook

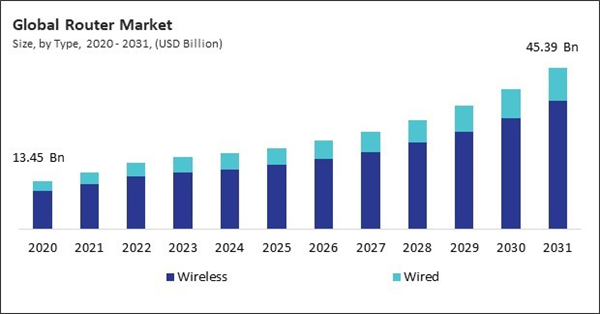

Based on type, the market is divided into wireless and wired. In 2023, the wired segment procured a 21% revenue share in the market. In terms of volume, 136.78 million units of wired routers are expected to be utilized by 2031. Wired routers are often preferred in commercial settings, such as offices, data centers, and industries where consistent performance, low latency, and minimal interference are critical. Additionally, wired routers provide more reliable connections for activities that require higher bandwidth, such as video conferencing, online gaming, and large data transfers.Wireless Outlook

The wireless segment is further subdivided into dual, single, and tri. The single segment held a 17% revenue share in the market in 2023. In terms of volume, 215.69 million units of single wireless routers are expected to be utilized by 2031.Single-band routers, which typically operate on the 2.4 GHz frequency, are more affordable and offer sufficient performance for basic internet usage.End User Outlook

On the basis of end user, the market is segmented into IT & telecom, BFSI, education, healthcare, and others. The healthcare segment held 10% revenue share in the market in 2023. In terms of volume, 68.00 million units of routers are expected to be utilized in the healthcare sector by the year 2031. With the growing adoption of telemedicine, electronic health records (EHRs), and connected medical devices, healthcare facilities require stable, fast, and secure network infrastructure.Market Competition and Attributes

The router market is highly competitive, driven by rapid technological advancements, increasing demand for high-speed internet, and growing adoption of IoT devices. Key attributes include performance, reliability, and ease of integration across diverse networks. Differentiation often hinges on security features, bandwidth efficiency, and support for emerging technologies like Wi-Fi 6 and 5G. Price sensitivity and after-sales support also play significant roles in consumer and enterprise buying decisions, with innovation and scalability being critical for maintaining a competitive edge.

By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region generated a 30% revenue share in the market in 2023. In terms of volume, the Asia Pacific region is expected to utilize 295.32 million units of routers by the year 2031. The rapid economic growth, technological advancements, and increasing internet penetration in countries such as China, India, Japan, and South Korea have significantly contributed to the region's robust demand for routers.Recent Strategies Deployed in the Market

- Feb-2024: Cisco and Viettel Military Industry and Telecoms Group have partnered to revolutionize Vietnam's digital infrastructure using Cisco 8000 Series routers with Silicon One, reducing TCO by 70% and enhancing network capacity to 800G. Automation via Cisco NSO accelerates service delivery and supports sustainable network solutions for a digital future.

- May-2022: Vietnam Posts and Telecommunications Group (VNPT) and Cisco signing a Memorandum of Understanding (MoU). The MoU outlined the cooperation in designing and bringing to market a flexible and appropriate digital transformation solution to meet the digital transformation needs of all businesses. We will combine the best capabilities of the two sides to provide a next-generation network infrastructure that are based on software-controlled optical network technology, thereby ensuring the flexibility of services and providing high-quality digital services to small, medium and big businesses in the 5G era.

- Sep-2021: Linksys, a subsidiary of Belkin, unveiled Linksys (AX5400) WiFi 6 EasyMesh router (E9450) in India. The new router allows customers to enjoy high-speed data transfers, higher capacity, superior connectivity performance in environments with multiple connected devices, and advanced power efficiency.

- Sep-2021: Linksys, a subsidiary of Belkin, joined hands with Fortinet, an American multinational corporation. The collaboration aimed to introduce Linksys HomeWRK, a wireless router that packs enterprise-grade security into a consumer-friendly package. The new router is a two-node, mesh-enabled WiFi 6 router controlled through a mobile app. The product would substitute employee’s current home router and offers separate wireless networks for personal and business traffic.

- Aug-2021: Huawei teamed up with Tiantong, China's first mobile communications satellite system. The collaboration aimed to launch a new mobile router that features various data offers, high-speed data, and sleek and easy-to-carry size.

- Aug-2021: Netgear introduced Nighthawk XR1000 Pro Gaming Wi-Fi 6, the latest gaming router for the Indian market. Moreover, the new router operates with a Wi-Fi 6 speed of up to 5.4 Gbps and would allow various users to connect more devices simultaneously, without impacting reliability or speed, by effectively packing and scheduling data.

List of Key Companies Profiled

- ASUSTeK Computer Inc.

- Belkin International, Inc. (Foxconn Interconnect Technology Limited)

- Arista Networks, Inc.

- D-Link Corporation

- Netgear, Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Xiaomi Corporation

- Juniper Networks, Inc.

- ZTE Corporation

Market Report Segmentation

By Type (Volume, Thousand Units, USD Billion, 2020-2031)- Wireless

- Dual

- Single

- Tri

- Wired

- IT & Telecom

- BFSI

- Education

- Healthcare

- Other End Users

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- ASUSTeK Computer Inc.

- Belkin International, Inc. (Foxconn Interconnect Technology Limited)

- Arista Networks, Inc.

- D-Link Corporation

- Netgear, Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Xiaomi Corporation

- Juniper Networks, Inc.

- ZTE Corporation