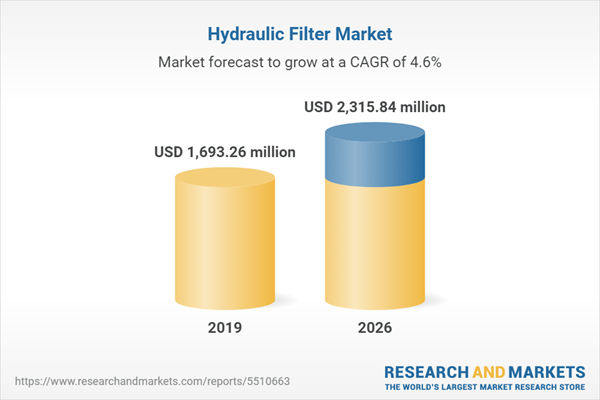

The hydraulic filter market was valued at US$1,693.258 million in 2019 and is expected to grow at a CAGR of 5.06% over the forecast period to reach US$2,315.843 million by 2026.

A Hydraulic filter is a component used by hydraulic systems to continuously remove impurities like contaminants, dust, and moisture from the hydraulic oil and protect the hydraulic system from damage caused by such impurities. These filters ensure the safe working of Hydraulic filters and improve overall efficiency and productivity.

Major industries that employ hydraulic filters are construction, mining, petrochemical, agriculture, aerospace, and transportation. The increase in the number of hydraulic projects, along with the increased sensitivity of components and systems, has also led to the increased utilization of hydraulic filters.

Recent developments which can affect the dynamic of the industry include the introduction of new micro glass materials, a unique six-layer design that delivers 50% more dirt holding capacity, and the development of new cyclone effect technology with enhancing dirt absorption capacities. Leading manufacturers of hydraulic filters are introducing industry-specific filters to suit the requirements of end-users from various sectors. Other major drivers for the market are increased production of tools used in construction, mining, and other equipment, strict government regulations for environmental pollution, and increased focus on maintenance of hydraulic equipment and systems.

The hydraulic filter market players mainly employ acquisition strategies to expand their operation while retaining their brand identity globally. For instance, In 2021, Combat Vehicles Research and Development Establishment (CVRDE) in Avadi, a unit under the Defense Research and Development Establishment (DRDE) indigenously developed and designed hydraulic lubrication and fuel filters for P75 Submarines for the Indian Navy which are now being manufactured by Indian Industries based in Hyderabad and Chennai.

In 2020, Pall Corporation formed a joint venture with Tanajib, a leading petroleum services company in GCC, called Pall Arabia. Under this venture, Pall Arabia would market and distribute Pall corporation's products in GCC.

Also in the following r March, UFI Filters, an Italian manufacturer in the hydraulic filter market, launched a new warehouse and a dedicated office to expand its aftermarket base in the UK. The new distribution center featured over 3,000 SKUs in its aftermarket catalog. The company aims to benefit from its newly appointed supply chain partner DB Schenker, a German logistics company, to gain momentum in highly fragmented Irish and UK aftermarkets in the coming years.

The hydraulic filter removes impurities from hydraulic systems, therefore protecting them from damage and increasing their service life. Good filters require infrequent changes. For instance, Caterpillar launched their new Cat M320 wheeled excavator with long-lasting filters providing 50% longer service life than previous filter designs. With improved filtration performance and 3000 hours replacement interval.

Hydraulic Filters employ various techniques of filtration, including a unique six-layer design of new micro glass materials that delivers 50% more dirt holding capacity and new cyclone effect technology with enhanced dirt-absorption capacities. Industries can also employ industry-specific filters to suit their requirements.

Due to high maintenance and replacement costs of filters and increased downtime, end-users are likely to prefer more robust and economical alternatives such as lubrication system filters. Hydraulic fluid leakages and hydraulic filter inefficiency are forcing manufacturers to introduce electric filters, which can hamper the growth of the hydraulic filter market.

The complex installation process of hydraulic filters is creating difficulty for market players to gain new customers and boost profitability.

Impact of COVID-19 on the Hydraulic Filter Market

A Hydraulic filter is a component used by hydraulic systems to continuously remove impurities like contaminants, dust, and moisture from the hydraulic oil and protect the hydraulic system from damage caused by such impurities. These filters ensure the safe working of Hydraulic filters and improve overall efficiency and productivity.

Major industries that employ hydraulic filters are construction, mining, petrochemical, agriculture, aerospace, and transportation. The increase in the number of hydraulic projects, along with the increased sensitivity of components and systems, has also led to the increased utilization of hydraulic filters.

Recent developments which can affect the dynamic of the industry include the introduction of new micro glass materials, a unique six-layer design that delivers 50% more dirt holding capacity, and the development of new cyclone effect technology with enhancing dirt absorption capacities. Leading manufacturers of hydraulic filters are introducing industry-specific filters to suit the requirements of end-users from various sectors. Other major drivers for the market are increased production of tools used in construction, mining, and other equipment, strict government regulations for environmental pollution, and increased focus on maintenance of hydraulic equipment and systems.

The hydraulic filter market players mainly employ acquisition strategies to expand their operation while retaining their brand identity globally. For instance, In 2021, Combat Vehicles Research and Development Establishment (CVRDE) in Avadi, a unit under the Defense Research and Development Establishment (DRDE) indigenously developed and designed hydraulic lubrication and fuel filters for P75 Submarines for the Indian Navy which are now being manufactured by Indian Industries based in Hyderabad and Chennai.

In 2020, Pall Corporation formed a joint venture with Tanajib, a leading petroleum services company in GCC, called Pall Arabia. Under this venture, Pall Arabia would market and distribute Pall corporation's products in GCC.

Also in the following r March, UFI Filters, an Italian manufacturer in the hydraulic filter market, launched a new warehouse and a dedicated office to expand its aftermarket base in the UK. The new distribution center featured over 3,000 SKUs in its aftermarket catalog. The company aims to benefit from its newly appointed supply chain partner DB Schenker, a German logistics company, to gain momentum in highly fragmented Irish and UK aftermarkets in the coming years.

Growth Factors

Improved efficiency and productivity

The hydraulic filter removes impurities from hydraulic systems, therefore protecting them from damage and increasing their service life. Good filters require infrequent changes. For instance, Caterpillar launched their new Cat M320 wheeled excavator with long-lasting filters providing 50% longer service life than previous filter designs. With improved filtration performance and 3000 hours replacement interval.

Improved technology

Hydraulic Filters employ various techniques of filtration, including a unique six-layer design of new micro glass materials that delivers 50% more dirt holding capacity and new cyclone effect technology with enhanced dirt-absorption capacities. Industries can also employ industry-specific filters to suit their requirements.

Restraints

High maintenance cost

Due to high maintenance and replacement costs of filters and increased downtime, end-users are likely to prefer more robust and economical alternatives such as lubrication system filters. Hydraulic fluid leakages and hydraulic filter inefficiency are forcing manufacturers to introduce electric filters, which can hamper the growth of the hydraulic filter market.

Complex installation

The complex installation process of hydraulic filters is creating difficulty for market players to gain new customers and boost profitability.

Impact of COVID-19 on the Hydraulic Filter Market

The Covid-19 pandemic negatively affected the hydraulic filter market, consequently shutting down on-premise business processes and manufacturing operations and disrupting supply chains and production schedules. Businesses, including the hydraulic filters market, are facing severe economic difficulties due to the suspension of operations or reduction of their activities. However, with the ease of restrictions globally, the market is expected to rebound during the forecast period.

Segmentation:

By Type

- Suction side filters

- Pressure side filters

- Return side filters

- Offline filters

- In Tank-breather filter

By Application

- Oil

- Metallurgy

- Mine

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- China

- India

- South Korea

- Taiwan

- Thailand

- Indonesia

- Japan

- Others

Table of Contents

1. INTRODUCTION

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

5. HYDRAULIC FILTER MARKET, BY TYPE

6. HYDRAULIC FILTER MARKET, BY APPLICATION

7. HYDRAULIC FILTER MARKET, BY GEOGRAPHY

8. COMPETITIVE ENVIRONMENT AND ANALYSIS

9. COMPANY PROFILES

Companies Mentioned

- Lenz Inc.

- Caterpillar

- HYDAC

- UFI Filters

- DTA

- Parker Hannifin Corp.

- Henan Top Environment Protection Equipment Co.

- Samuel Filter

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 118 |

| Published | October 2021 |

| Forecast Period | 2019 - 2026 |

| Estimated Market Value ( USD | $ 1693.26 million |

| Forecasted Market Value ( USD | $ 2315.84 million |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |