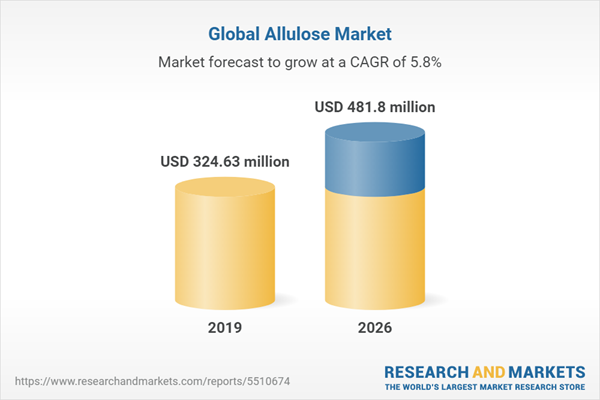

The allulose market is projected to witness a compound annual growth rate of 5.74% to grow to US$481.798 million by 2026, from US$324.627 million in 2019.

The market has been expected to surge in the coming years, due to the increase in consumer awareness to have better products for their health, ease in government restrictions, and other related factors. The significant rise in the number of health-conscious consumers, globally, has been expected to play a major role in the growth of low calorie and low sugar-related food and beverage products. In the past few years, the demand for allulose has been expected to surge at an exponential rate. It is similar to fructose and contains 70% of the total sweetness of sucrose. The rise in favorable government regulations has also been expected to surge the market growth, in the coming years. For instance, in the year 2019, The United States of Food & Drug Administration had allowed the low-calories sweetener allulose to be removed and excluded from added and total sugars count on supplement and nutrition facts labels when it had been used as an ingredient.

Moreover, in the year 2020, The FDA had announced that it had finalized allulose guidance and had been requesting information on other related sugars, that are widely different from traditional sugars. There had also been a surge in the demand for allulose in the South American region, with countries such as Chile and Colombia are being expected to have a major share in the overall market, during the forecast period. The rise in investment to develop novel, safer, and high-quality low-calorie and low-sugar sweeteners is also expected to be a major factor in the overall market growth, in the coming years.

The market has been expected to surge in the coming years, due to the rise in the demand for sugar alternatives, globally. In the past few years, there has been an increase and acceleration in the number of health-conscious and fitness freak consumers, worldwide. There had been a rise in the demand for natural and healthier sweeteners and sugar substitutes in the food and beverage industry. In May 2021, according to Tate & Lyle, the demand for allulose had exceeded the company’s current supply. The company had been planning to exceed and enhance their products to meet the product’s demand. The company had also stated that there had been an increase in the demand for low-calorie sweetener and sugar substitutes, which had been expected to propel the allulose’s market growth.

Moreover, since the FDA’s decision to remove and exclude allulose from the added and total sugar declarations on the Nutrition Facts panel, the demand had risen at an exponential rate. The product has been approved by a limited number of nations, and only a decent number of firms had been producing the product. Some of the firms such as CJ Cheiljedang, Tate & Lyle, Ingredion Incorporated, Matsukani, and others, are key players in the market. In June 2021, General Mills announced the launch of Good Measure, a novel brand of snacks with low-calorie ingredients. The company’s line includes three types of bars, Almond & Dark Chocolate, Peanut & Dark Chocolate, and Blueberry and Almond. The bars have less sugar and most of their sweetening had been derived from rare sugar allulose. These trends and developments are expected to have a positive impact on the market.

The COVID-19 pandemic has had a positive effect on the global allulose market. The sudden spread of the coronavirus pandemic at an alarming rate sent a shockwave across the planet, making people extremely health-conscious. White sugar is now well known to be a slow poison that depletes the health of an individual with time. The COVID-19 pandemic opened people’s eyes to the importance of maintaining a healthy lifestyle and strong immunity against this virus and any similar potential threat in the future. Allulose, a natural sweetener, is a healthy substitute for white processed sugar, because of which its demand has been on a rise recently.

The COVID-19 pandemic has created both a short-term as well as a long-term impact on the global allulose market. The short-term expansion has been mainly led by fear of contracting the COVID-19 infection and thus a need to cut back on all non-healthy food intake that jeopardizes the immunity of an individual. In the long run, the impact of this pandemic on the physical and psychological level has made people rethink their lifestyle choices, as a result of which they are considering healthier options across the spectrum, to be incorporated in their lives from now on.

The market has been expected to surge in the coming years, due to the increase in consumer awareness to have better products for their health, ease in government restrictions, and other related factors. The significant rise in the number of health-conscious consumers, globally, has been expected to play a major role in the growth of low calorie and low sugar-related food and beverage products. In the past few years, the demand for allulose has been expected to surge at an exponential rate. It is similar to fructose and contains 70% of the total sweetness of sucrose. The rise in favorable government regulations has also been expected to surge the market growth, in the coming years. For instance, in the year 2019, The United States of Food & Drug Administration had allowed the low-calories sweetener allulose to be removed and excluded from added and total sugars count on supplement and nutrition facts labels when it had been used as an ingredient.

Moreover, in the year 2020, The FDA had announced that it had finalized allulose guidance and had been requesting information on other related sugars, that are widely different from traditional sugars. There had also been a surge in the demand for allulose in the South American region, with countries such as Chile and Colombia are being expected to have a major share in the overall market, during the forecast period. The rise in investment to develop novel, safer, and high-quality low-calorie and low-sugar sweeteners is also expected to be a major factor in the overall market growth, in the coming years.

The rise in the demand for sugar substitutes is expected to drive the market growth during the forecasted period.

The market has been expected to surge in the coming years, due to the rise in the demand for sugar alternatives, globally. In the past few years, there has been an increase and acceleration in the number of health-conscious and fitness freak consumers, worldwide. There had been a rise in the demand for natural and healthier sweeteners and sugar substitutes in the food and beverage industry. In May 2021, according to Tate & Lyle, the demand for allulose had exceeded the company’s current supply. The company had been planning to exceed and enhance their products to meet the product’s demand. The company had also stated that there had been an increase in the demand for low-calorie sweetener and sugar substitutes, which had been expected to propel the allulose’s market growth.

Moreover, since the FDA’s decision to remove and exclude allulose from the added and total sugar declarations on the Nutrition Facts panel, the demand had risen at an exponential rate. The product has been approved by a limited number of nations, and only a decent number of firms had been producing the product. Some of the firms such as CJ Cheiljedang, Tate & Lyle, Ingredion Incorporated, Matsukani, and others, are key players in the market. In June 2021, General Mills announced the launch of Good Measure, a novel brand of snacks with low-calorie ingredients. The company’s line includes three types of bars, Almond & Dark Chocolate, Peanut & Dark Chocolate, and Blueberry and Almond. The bars have less sugar and most of their sweetening had been derived from rare sugar allulose. These trends and developments are expected to have a positive impact on the market.

Pandemic Insights

The COVID-19 pandemic has had a positive effect on the global allulose market. The sudden spread of the coronavirus pandemic at an alarming rate sent a shockwave across the planet, making people extremely health-conscious. White sugar is now well known to be a slow poison that depletes the health of an individual with time. The COVID-19 pandemic opened people’s eyes to the importance of maintaining a healthy lifestyle and strong immunity against this virus and any similar potential threat in the future. Allulose, a natural sweetener, is a healthy substitute for white processed sugar, because of which its demand has been on a rise recently.

The COVID-19 pandemic has created both a short-term as well as a long-term impact on the global allulose market. The short-term expansion has been mainly led by fear of contracting the COVID-19 infection and thus a need to cut back on all non-healthy food intake that jeopardizes the immunity of an individual. In the long run, the impact of this pandemic on the physical and psychological level has made people rethink their lifestyle choices, as a result of which they are considering healthier options across the spectrum, to be incorporated in their lives from now on.

Market Segmentation:

By Form

- Powdered

- Liquid

- Crystal

By Industry

- Food

- Beverage

- Pharmaceuticals

By Distribution Channel

- Offline

- Hypermarkets

- Others

- Online

By Country

- USA

- Mexico

- Singapore

- Columbia

- Chile

- Others

Table of Contents

1. INTRODUCTION

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

5. ALLULOSE MARKET BY FORM

6. ALLULOSE MARKET BY INDUSTRY

7. ALLULOSE MARKET BY DISTRIBUTION CHANNEL

8. ALLULOSE MARKET BY COUNTRY

9. COMPETITIVE ENVIRONMENT AND ANALYSIS

10. COMPANY PROFILES

Companies Mentioned

- Matsutani Chemical Industry Co. Ltd.

- Tate & Lyle PLC

- CJ Cheil Jedang

- Bonumose LLC

- Cargill Inc.

- Ingredion Incorporated

- Samyang Corporation

- Anderson Global Group

Methodology

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 118 |

| Published | October 2021 |

| Forecast Period | 2019 - 2026 |

| Estimated Market Value ( USD | $ 324.63 million |

| Forecasted Market Value ( USD | $ 481.8 million |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |