Radio modems enable wireless data transmission over tens of kilometers via radiofrequency, offering a low-infrastructure solution for connectivity. The market is propelled by the global surge in internet connectivity, particularly the adoption of 5G technology, which enhances data transfer speeds and reliability. The shift to virtual platforms across sectors such as business and education further drives demand for radio modems, as they support seamless data exchange in low-infrastructure environments. Additionally, the rise of privately owned networks and advancements in networking technologies create lucrative opportunities for market expansion.

Key Growth Drivers

Expanding Adoption of 5G Services

The rollout of 5G technology is a significant catalyst for the radio modem market. Government initiatives worldwide are accelerating 5G adoption, fostering demand for compatible radio modems. These efforts enhance network reliability and speed, making radio modems critical for applications requiring robust connectivity. The focus on 5G infrastructure underscores the market's growth potential, as radio modems integrate seamlessly with next-generation networks.Expanding Application in Traffic Management Systems

Radio modems are increasingly integral to intelligent transport systems (ITS), which include signage, sensors, cameras, and toll booths. These systems leverage automation to reduce traffic congestion, fuel consumption, and greenhouse gas emissions. The growing adoption of technology in traffic management drives demand for wireless devices like radio modems, which enable vehicle-to-infrastructure communication. As transportation authorities upgrade infrastructure for smoother traffic flow, the radio modem market is expected to see significant growth.Geographical Outlook

North America is a key growth region for the radio modem market, driven by the high demand for efficient transportation systems amid a growing number of vehicles. The region's advanced technological infrastructure and focus on vehicular safety amplify the adoption of radio modems for vehicle-to-infrastructure applications. Prominent U.S. players, such as Digi International, FreeWave Technologies, and Motorola Solutions, contribute to market dynamics through innovative solutions. The ongoing expansion of transportation networks and intelligent transport systems in the United States further propels market growth, positioning North America as a dominant player.Competitive and Strategic Insights

The radio modem market is characterized by intense competition and continuous innovation. Key players are focusing on developing cost-effective, high-performance modems to meet the demands of 5G-enabled and ITS applications. The market benefits from the low infrastructure requirements of radio modems, making them an attractive solution for diverse industries. Strategic partnerships and investments in R&D are critical for companies to maintain a competitive edge in this evolving landscape.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Global Radio Modem Market Segmentation

By Frequency

- Ultra High Frequency (UHF)

- Very High Frequency (VHF)

By Communication Channel

- Point to Point

- Point to Multi-Point

By Application

- Vehicle to Infrastructure Communication

- Traffic Management System

- Electronic Fee Collection

- Emergency Management System

- Others

By End-User

- Transportation

- Power & Utilities

- Agriculture

- Mining

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- South America

- Argentina

- Brazil

- Others

- Europe

- Germany

- Spain

- United Kingdom

- Italy

- Others

- Middle East and Africa

- Israel

- Saudi Arabia

- Others

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Taiwan

- Thailand

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Campbell Scientific Inc.

- Schneider Electric

- SATEL

- Simrex Corporation

- Advantech Co., ltd.

- Intuicom Inc.

- Atim

- Cohda Wireless

- Harxon Corporation

- Siemens AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

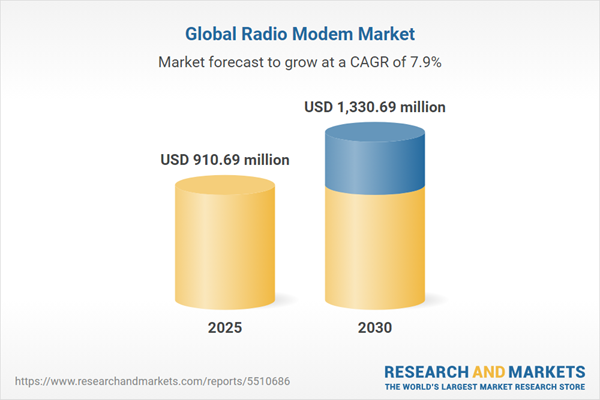

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 910.69 million |

| Forecasted Market Value ( USD | $ 1330.69 million |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |