In-depth Analysis and Data-driven Insights on the Impact of COVID-19 Included in this U.S. Glamping Market Report

Speak directly to the analyst to clarify any post sales queries you may have.

MARKET TRENDS & OPPORTUNITIES

Technological Integration

Technological integration is crucial in driving growth within the U.S. glamping market by enhancing guest experiences, operational efficiency, and marketing reach. Advanced reservation systems and online booking platforms streamline the booking process, making it easier for travelers to discover and reserve glamping accommodations. Technology-enabled amenities such as innovative heating and lighting systems, mobile app-controlled amenities, and high-speed internet connectivity elevate the comfort and convenience of glamping experiences, attracting tech-savvy guests. Furthermore, digital marketing strategies, including social media campaigns, targeted advertising, and virtual tours, allow glamping operators to reach a broader audience and showcase their unique offerings, driving demand and fostering customer engagement. Overall, technological integration empowers glamping businesses to innovate, optimize operations, and deliver exceptional guest experiences, thereby fueling the growth of the U.S. glamping market.Social Media Influence

Social media plays a pivotal role in driving the growth of the U.S. glamping market by amplifying brand visibility, engaging potential guests, and fostering a sense of community among travelers. Platforms like Instagram, Facebook, and Pinterest serve as powerful marketing tools for glamping operators, allowing them to showcase their unique accommodations, breathtaking natural settings, and immersive experiences to a global audience. Influencers and travel bloggers frequently share their glamping adventures on social media, inspiring followers to embark on luxury camping getaways. Moreover, user-generated content, such as guest photos and reviews, provides authentic endorsements and social proof, influencing the booking decisions of prospective guests. By leveraging social media as a marketing and engagement platform, glamping operators can cultivate brand loyalty, drive bookings, and ultimately contribute to the market's continued growth.INDUSTRY RESTRAINTS

Dependence on Seasonality

The dependence on seasonality poses a challenge to the growth of the U.S. glamping market, as it restricts the operational window for many glamping sites. Glamping accommodations may experience fluctuating demand in regions with distinct seasons, peak periods during favorable weather, and lower occupancy during off-peak seasons. This seasonality not only affects revenue but also presents operational challenges, as glamping operators need to manage staffing levels, maintenance, and marketing strategies to align with the cyclical nature of tourism. The limited availability during certain times of the year may also hinder the ability to attract a consistent flow of guests, impacting overall profitability. To mitigate this challenge, glamping operators may explore diversification strategies, such as offering seasonal promotions and themed events or expanding their offerings to cater to different types of travelers throughout the year.SEGMENTATION INSIGHTS

INSIGHTS BY ACCOMMODATION

The segmentation of the U.S. glamping market by accommodation type encompasses a diverse array of options catering to various preferences and travel styles. Cabins offer a cozy and rustic retreat, often equipped with modern amenities and nestled in scenic natural surroundings, and hold the maximum share. Further, safari tents provide an immersive outdoor experience with spacious interiors and luxurious furnishings, just like classic African safaris, and are expected to grow at the highest CAGR of over 16%, owing to the high demand for adventurous setups. Also, yurts offer a unique blend of tradition and comfort, featuring circular structures with canvas walls and skylights, ideal for those seeking a nomadic-inspired escape. Additionally, other accommodation options such as kitted-out shepherd huts, rustic wagons, idyllic bell tents, vintage Airstreams, futuristic domes, and uber-modern tiny houses further diversify the glamping market, catering to a wide range of tastes and preferences.Segmentation by Accommodation

- Cabins

- Safari Tents

- Yurts

- Tree Houses

- Tipis

- Others

INSIGHTS BY END-USER

The U.S. glamping market by end-users is segmented as consumers and events. Consumer-focused glamping experiences cater to individual travelers and groups seeking unique and immersive outdoor accommodations for leisure, relaxation, or adventure and hold a maximum revenue share. These glamping sites offer a range of amenities and activities tailored to the preferences of leisure travelers, including families, couples, and solo adventurers. On the other hand, event-focused glamping accommodations cater to gatherings such as weddings, corporate retreats, festivals, and wellness retreats, providing guests with luxurious accommodations and amenities tailored to the specific needs of event attendees, which are expected to grow at a higher CAGR. By catering to consumers and events, the glamping market offers diverse opportunities for travelers seeking memorable and experiential outdoor experiences, driving growth and innovation in the industry.Segmentation by End-User

- Consumers

- Events

INSIGHTS BY LAND

Segmentation of the U.S. glamping market by land ownership distinguishes accommodations based on whether they are on public or private land. Glamping sites on public land are typically situated within national parks, forests, and other federally owned areas, offering guests access to pristine natural landscapes and outdoor recreation opportunities and hold a higher share as of 2023. These sites often benefit from their proximity to iconic attractions and scenic vistas, attracting travelers seeking immersive natural experiences. In contrast, glamping accommodations on private land are owned by individuals or companies and offer a more exclusive and customizable experience. They are gaining traction and are expected to grow at a higher CAGR of over 16%. Private land sites may feature unique amenities, personalized services, and secluded settings, catering to travelers seeking luxury and privacy.Segmentation by Land Ownership

- Public Land

- Private Land

INSIGHTS BY AREA

The rural area segment holds a significant share of the U.S. glamping market. Rural glamping sites are typically situated in natural settings such as forests, mountains, or countryside, providing guests with a serene and secluded retreat surrounded by nature. These destinations attract outdoor enthusiasts seeking immersive experiences away from the hustle and bustle of urban life. On the other hand, urban glamping sites are located within or close to cities, offering a unique blend of outdoor adventure and urban convenience. They are expected to grow at a higher CAGR during the forecast period. These accommodations cater to travelers seeking a mix of city living and outdoor exploration, providing easy access to cultural attractions, dining options, and nightlife while still offering a connection to nature. By providing accommodations in rural and urban areas, the U.S. glamping market caters to diverse preferences and travel styles, driving growth and expansion in the market.Segmentation by Area

- Rural

- Urban

INSIGHTS BY SIZE

The U.S. glamping market by size can be segmented as 4-person, 2-person, and others. The 4-person category holds the maximum market size due to its versatility in catering to families, groups of friends, and small gatherings, providing ample space and comfort for multiple guests. These accommodations are popular among families seeking outdoor adventures and group travelers looking to share the glamping experience. However, the 2-person category is expected to grow at the highest CAGR due to the rising demand for romantic getaways among couples and solo travelers, as this category is now putting extra efforts into striking that work-life balance and prefers to take short breaks from their hectic work life and rejuvenate. These smaller accommodations offer a cozy and private retreat, perfect for couples or solo adventurers looking for solitude in nature. Additionally, the others segment, which includes larger group accommodations such as community bookings or glamping with extended families where the preference is high for luxury suites and specialty configurations, provides niche offerings catering to specific demographics or interests within the glamping market, contributing to its overall diversity and growth in the United States.Segmentation by Size

- 4-Person

- 2-Person

- Others

GEOGRAPHICAL ANALYSIS

The U.S. glamping market exhibits regional variations driven by geography, climate, and tourism infrastructure. Coastal regions like California and Florida boast a high concentration of glamping sites, catering to beachgoers and outdoor enthusiasts seeking luxurious accommodations near the ocean. Mountainous areas such as Colorado and Montana offer glamping experiences amidst scenic landscapes, attracting adventure seekers and nature lovers year-round. Additionally, regions with abundant national parks and natural attractions, such as the Pacific Northwest and the Rocky Mountains, see a strong presence of glamping sites catering to visitors seeking immersive outdoor experiences. Urban areas like New York City and Los Angeles also witness a rise in urban glamping offerings, targeting travelers seeking a unique blend of city living and outdoor adventure. So, the U.S. glamping market is driven by the diverse landscapes and travel preferences across the country by various age groups from varied backgrounds.Segmentation by Region

- The U.S.

COMPETITIVE LANDSCAPE

The U.S. glamping market is highly competitive, with a diverse range of players vying for market share in this rapidly growing segment of the hospitality industry. Key competitors include established glamping operators such as Huttopia, KOA, and Collective Retreats and traditional lodging providers expanding into the glamping space. These companies differentiate themselves through unique offerings, innovative accommodations, and strategic partnerships with outdoor destinations and experience providers. Additionally, the U.S. glamping market is characterized by a growing number of boutique and niche glamping operators catering to specific demographics or interests, further intensifying competition. As the demand for experiential travel and luxury camping experiences continues to rise, competition in the U.S. glamping market is expected to remain fierce, driving innovation and investment in unique offerings and guest experiences.Key Companies

- Collective Retreats

- Huttopia

- KOA

- Tentrr

- The Resort at Paws Up

- Under Canvas

Other Prominent Vendors

- Asheville Glamping

- AutoCamp

- Bellfire

- Backland

- Bodhi Farms

- Bushtec Safari

- Camp Aramoni

- Camp'd Out

- Capitol Reef Resort

- Conestoga Ranch

- Desolation Hotel

- Dunton

- El Capitan Canyon

- El Cosmico

- EXP Journeys

- Firelight Camps

- Fireside Resort

- Hoot Owl Hill

- Johnny Morris Nature Resorts

- Kestrel Camp

- Klarhet

- Little Arrow Outdoor Resort

- MENDOCINO GROVE

- MINAM RIVER LODGE

- Moose Meadow Lodge

- NOMADICS TIPI MAKERS

- Sandy Pines Campground

- Sinya

- The Mohicans

- The Ranch at Rock Creek

- The Vintages

- Timberline Glamping

- Treebones Resort

- Ventana Big Sur

- Walden Retreats

- Wigwam Motel

- West Beach Resort

- Westgate Resorts

KEY QUESTIONS ANSWERED

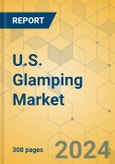

1. How big is the U.S. glamping market?2. What is the projected growth rate of the U.S. glamping market?

3. What are the rising trends in the U.S. glamping market?

4. Which region holds the most significant U.S. glamping market share?

5. Who are the key players in the U.S. glamping market?

Table of Contents

Companies Mentioned

- Collective Retreats

- Huttopia

- KOA

- Tentrr

- The Resort at Paws Up

- Under Canvas

- Asheville Glamping

- AutoCamp

- Bellfire

- Backland

- Bodhi Farms

- Bushtec Safari

- Camp Aramoni

- Camp'd Out

- Capitol Reef Resort

- Conestoga Ranch

- Desolation Hotel

- Dunton

- El Capitan Canyon

- El Cosmico

- EXP Journeys

- Firelight Camps

- Fireside Resort

- Hoot Owl Hill

- Johnny Morris Nature Resorts

- Kestrel Camp

- Klarhet

- Little Arrow Outdoor Resort

- MENDOCINO GROVE

- MINAM RIVER LODGE

- Moose Meadow Lodge

- NOMADICS TIPI MAKERS

- Sandy Pines Campground

- Sinya

- The Mohicans

- The Ranch at Rock Creek

- The Vintages

- Timberline Glamping

- Treebones Resort

- Ventana Big Sur

- Walden Retreats

- Wigwam Motel

- West Beach Resort

- Westgate Resorts

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 308 |

| Published | March 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 561.42 Million |

| Forecasted Market Value ( USD | $ 1308.15 Million |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 44 |