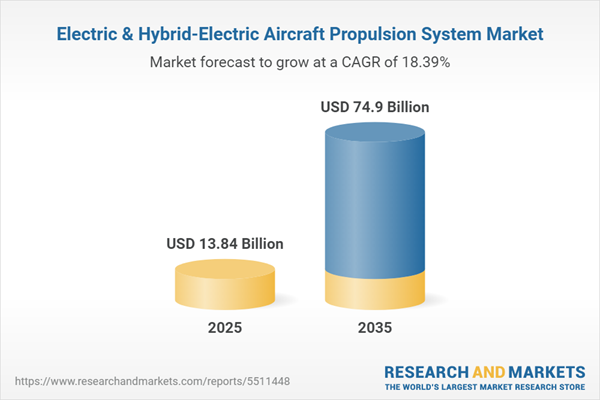

The global Electric & Hybrid-Electric Aircraft Propulsion System market is estimated to reach $74.90 billion in 2035, at a compound annual growth rate (CAGR) of 18.39% during the forecast period 2025-2035.

Market Report Coverage - Electric & Hybrid-Electric Aircraft Propulsion System

Market Segmentation

- Propulsion Type: All-Electric Propulsion, Hybrid-Electric Propulsion

Regional Segmentation

- North America: U.S. and Canada

- South America

- Europe: U.K., Germany, France, Russia, Netherlands, and Rest-of-Europe

- Middle East and Africa

- Asia-Pacific: China, Japan, India, Australia, Singapore, and Rest-of-Asia-Pacific

Key Companies Profiled

3W International GmbH, Airbus S.A.S., Boeing, Cranfield Aerospace Solutions, General Electric Company, GKN Aerospace Services Limited, Honeywell International Inc., Israel Aerospace Industries Ltd., Lockheed Martin Corporation, MagniX, Rolls-Royce Holdings plc., Safran S.A., Siemens AG, Raytheon Technologies Corporation, Leonardo S.p.A

How This Report Can Add Value

This report will help with the following objectives:

- A dedicated section focusing on start-up and investment landscape

- Detailed analysis, which includes both value and volume of electric and hybrid-electric propulsion system used on all the aircraft types

- Major Programs of Electric & Hybrid-electric Aircraft Propulsion System Market

Market by Product: Analysis and Forecast: The product section will help the reader understand the different types of electric & hybrid-electric aircraft propulsion system used in several manned, unmanned and eVTOLs aircraft. The players operating in this market are developing innovative offerings and are highly focused on testing as well as demonstrating their propulsion system capabilities.

Key Questions Answered in the Report

- What are the major drivers, challenges, and opportunities behind the demand for the electric & hybrid-electric aircraft propulsion system market during the forecast period 2025-2035?

- Who are the key players in the electric & hybrid-electric aircraft propulsion system market, and what is the competitive benchmarking?

- What are the new strategies being adopted by the existing market players to make a mark in the industry?

- How is the electric & hybrid-electric aircraft propulsion system market expected to grow during the forecast period, and what is the anticipated revenue to be generated by the end of 2035?

- What are the trends in the electric & hybrid-electric aircraft propulsion system market across different countries? What are the revenue estimates for 2025 and 2035?

- Which country is expected to contribute the most to the electric & hybrid-electric aircraft propulsion system market during the forecast period?

Electric & Hybrid-Electric Aircraft Propulsion System

Electrically powered model aircraft and unmanned aerial vehicles (UAVs) have been flying since the 1970s. Although, in 1917, the first electrically powered manned tethered helicopter was developed. Moreover, the first ever electrically powered airplane, the MB-E1 was flown in October 1973. Along with this, many other electric-powered airplane prototypes are being developed and tested to enhance the air travel experience.

Hybrid-electric propulsion combines a conventional internal combustion engine system with an electric propulsion system. This type of propulsion system does not emit harmful components in the air, which reduces the total pollution levels raised due to air travel. Hybrid-electric propulsion can be classified into series- hybrid propulsion and parallel-hybrid propulsion.

Market Segmentation

Electric & Hybrid-Electric Aircraft Propulsion System Market by Propulsion Type

Hybrid-Electric Propulsion segment is expected to dominate the global the electric & hybrid-electric aircraft propulsion system market, on account of high investments that are expected to be attained in the future due to the high adoption rate in the commercial aviation industry.

Electric & Hybrid-Electric Aircraft Propulsion System Market by Region

North America is expected to dominate the global electric & hybrid-electric aircraft propulsion system market during the forecast period. The research and development of next-gen aircraft in the region are growing at a significant pace, which in turn is expected to raise the demand for Electric & Hybrid-electric Aircraft Propulsion Systems in the coming years.

Key Market Players and Competition Synopsis

3W International GmbH, Airbus S.A.S., Boeing, Cranfield Aerospace Solutions, General Electric Company, GKN Aerospace Services Limited, Honeywell International Inc., Israel Aerospace Industries Ltd., Lockheed Martin Corporation, MagniX, Rolls-Royce Holdings plc., Safran S.A., Siemens AG, Raytheon Technologies Corporation, Leonardo S.p.A

The companies that are profiled in the report have been selected post undergoing in-depth interviews with experts and understanding details around companies such as product portfolio, annual revenues, market penetration, research and development initiatives, and domestic and international presence in the electric & hybrid-electric aircraft propulsion system market. Accordingly, a structured approach is followed which include segmenting pool of players under three mutually exclusive and collectively exhaustive parts, holding a 100% pie of the market, as mentioned below:

Top Segment Players - These are leading original equipment manufacturers (OEMs), covering ~60% of the presence in the market.

Other Segment Players - These are component providers, covering ~40% of the presence in the market.

However, if a company is not part of the above pool, it has been well represented across different sections of the report (wherever applicable).

Table of Contents

1 Markets

1.1 Industry Outlook

1.1.1 Aviation in Digital Age: An Overview

1.1.1 Technology Roadmap for Electric & Hybrid-electric Aircraft Propulsion System

1.2 Ongoing/Upcoming Programs in Top Countries for Next-Gen Aircraft Propulsion Technology

1.2.1 NASA’s Developments on Electric & Hybrid-electric Aircraft Propulsion Systems

1.2.1.1 Single Propulsor Test Stand

1.2.1.2 Leading-Edge Asynchronous Propeller Technology (LEAPTech)

1.2.1.3 Hybrid-Electric Integrated Systems Testbed (HEIST) Ironbird

1.3 Startup and Investment Landscape

2 Products

2.1 Demand Analysis of Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

2.1.1 All-Electric Propulsion

2.1.1.1 Manned Aircraft

2.1.1.1.1 Fixed Wing Aircraft

2.1.1.1.1.1 Commuter Aircraft

2.1.1.1.1.2 Regional Aircraft

2.1.1.1.2 Rotary Wing Aircraft

2.1.1.1.2.1 Rotorcraft

2.1.1.1.2.2 Multi-Copter

2.1.1.1.3 Hybrid Wing Aircraft

2.1.1.2 Unmanned Aircraft/Unmanned Aerial Vehicle (UAV)

2.1.1.2.1 Fixed Wing UAV

2.1.1.2.2 Rotary Wing UAV

2.1.1.2.3 Hybrid Wing UAV

2.1.2 Hybrid-Electric Propulsion

2.1.2.1 Manned Aircraft

2.1.2.1.1 Fixed Wing Aircraft

2.1.2.1.1.1 Commuter Aircraft

2.1.2.1.1.2 Regional Aircraft

2.1.2.1.2 Rotary Wing Aircraft

2.1.2.1.2.1 Rotorcraft

2.1.2.1.2.2 Multi-Copter

2.1.2.1.3 Hybrid Wing Aircraft

2.1.2.2 Unmanned Aircraft

2.1.3 Market Scenario for eVTOL Aircraft Propulsion System

3 Region

3.1 North America

3.1.1 Market

3.1.1.1 Key Manufacturers and Suppliers in North America

3.1.2 Product

3.1.2.1 North America Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.1.3 North America (by Country)

3.1.3.1 U.S.

3.1.3.1.1 Market

3.1.3.1.1.1 Buyer Attributes

3.1.3.1.1.2 Key Manufacturers and Suppliers in the U.S.

3.1.3.1.2 Product

3.1.3.1.2.1 U.S. Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.1.3.2 Canada

3.1.3.2.1 Market

3.1.3.2.1.1 Buyer Attributes

3.1.3.2.1.2 Key Manufacturers and Suppliers in Canada

3.1.3.2.2 Product

3.1.3.2.2.1 Canada Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.2 South America

3.2.1 Market

3.2.1.1 Key Manufacturers and Suppliers in South America

3.2.2 Product

3.2.2.1 South America Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.3 Europe

3.3.1 Market

3.3.1.1 Key Manufacturers and Suppliers in Europe

3.3.2 Product

3.3.2.1 Europe Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.3.3 Europe (by Country)

3.3.3.1 Germany

3.3.3.1.1 Market

3.3.3.1.1.1 Buyer Attributes

3.3.3.1.1.2 Key Manufacturers and Suppliers in Germany

3.3.3.1.2 Product

3.3.3.1.2.1 Germany Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.3.3.2 France

3.3.3.2.1 Market

3.3.3.2.1.1 Buyer Attributes

3.3.3.2.1.2 Key Manufacturers and Suppliers in France

3.3.3.2.2 Product

3.3.3.2.2.1 France Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.3.3.3 Russia

3.3.3.3.1 Market

3.3.3.3.1.1 Buyer Attributes

3.3.3.3.1.2 Key Manufacturers and Suppliers in Russia

3.3.3.3.2 Product

3.3.3.3.2.1 Russia Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.3.3.4 U.K.

3.3.3.4.1.1 Market

3.3.3.4.1.1.1 Buyer Attributes

3.3.3.4.1.1.2 Key Manufacturers and Suppliers in the U.K.

3.3.3.4.1.2 Product

3.3.3.4.1.2.1 U.K. Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.3.3.5 Netherlands

3.3.3.5.1.1 Market

3.3.3.5.1.1.1 Buyer Attributes

3.3.3.5.1.1.2 Key Manufacturers and Suppliers in the Netherlands

3.3.3.5.1.2 Product

3.3.3.5.1.2.1 Netherlands Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.3.3.6 Rest-of-Europe

3.3.3.6.1 Market

3.3.3.6.1.1 Buyer Attributes

3.3.3.6.1.2 Key Manufacturers and Suppliers in the Rest-of-Europe

3.3.3.6.2 Product

3.3.3.6.2.1 Rest-of-Europe Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.4 Middle East and Africa

3.4.1 Market

3.4.1.1 Buyers Attributes

3.4.1.2 Key Manufacturers and Suppliers in the Middle East and Africa

3.4.2 Product

3.4.2.1 Middle East and Africa Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.5 Asia-Pacific

3.5.1 Market

3.5.1.1 Key Manufacturers and Suppliers in Asia-Pacific

3.5.2 Product

3.5.2.1 Asia-Pacific Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.5.3 Asia-Pacific (by Country)

3.5.3.1 China

3.5.3.1.1 Market

3.5.3.1.1.1 Buyer Attributes

3.5.3.1.1.2 Key Manufacturers and Suppliers in China

3.5.3.1.2 Product

3.5.3.1.2.1 China Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.5.3.2 Japan

3.5.3.2.1 Market

3.5.3.2.1.1 Buyer Attributes

3.5.3.2.1.2 Key Manufacturers and Suppliers in Japan

3.5.3.2.2 Product

3.5.3.2.2.1 Japan Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.5.3.3 India

3.5.3.3.1 Market

3.5.3.3.1.1 Buyer Attributes

3.5.3.3.1.2 Key Manufacturers and Suppliers in India

3.5.3.3.2 Product

3.5.3.3.2.1 India Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.5.3.4 Australia

3.5.3.4.1 Market

3.5.3.4.1.1 Buyer Attributes

3.5.3.4.1.2 Key Manufacturers and Suppliers in Australia

3.5.3.4.2 Product

3.5.3.4.2.1 Australia Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.5.3.5 Singapore

3.5.3.5.1 Market

3.5.3.5.1.1 Buyer Attributes

3.5.3.5.1.2 Key Manufacturers and Suppliers in Singapore

3.5.3.5.2 Product

3.5.3.5.2.1 Singapore Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

3.5.3.6 Rest-of-Asia-Pacific

3.5.3.6.1 Market

3.5.3.6.1.1 Buyer Attributes

3.5.3.6.1.2 Key Manufacturers and Suppliers in Rest-of-Asia-Pacific

3.5.3.6.2 Product

3.5.3.6.2.1 Rest-of-Asia-Pacific Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type)

4 Markets - Competitive Benchmarking & Company Profiles

4.1 Competitive Benchmarking

4.2 3W International GmbH

4.2.1 Company Overview

4.2.2 Role of 3W International GmbH in Electric & Hybrid-electric Aircraft Propulsion System Market

4.2.2.1 Product Portfolio

4.2.3 Geographical Presence

4.2.4 Business Strategies

4.2.5 Strength and Weakness of 3W International GmbH

4.3 Airbus S.A.S.

4.3.1 Company Overview

4.3.2 Role of Airbus S.A.S. in Electric & Hybrid-electric Aircraft Propulsion System Market

4.3.2.1 Product Portfolio

4.3.3 Global Presence and R&D Analysis

4.3.4 Business Strategies

4.3.5 Strength and Weakness of Airbus S.A.S.

4.4 Boeing

4.4.1 Company Overview

4.4.2 Role of Boeing in Electric & Hybrid-electric Aircraft Propulsion System Market

4.4.2.1 Product Portfolio

4.4.3 Global Presence and R&D Analysis

4.4.4 Business Strategies

4.4.5 Strength and Weakness of Boeing

4.5 Cranfield Aerospace Solutions

4.5.1 Company Overview

4.5.2 Role of Cranfield Aerospace Solutions in Electric & Hybrid-electric Aircraft Propulsion System Market

4.5.2.1 Product Portfolio

4.5.3 Global Presence

4.5.4 Business Strategies

4.5.5 Strength and Weakness of Cranfield Aerospace Solutions

4.6 General Electric Company

4.6.1 Company Overview

4.6.2 Role of General Electric Company in Electric & Hybrid-electric Aircraft Propulsion System Market

4.6.2.1 Product Portfolio

4.6.3 Global Presence and R&D Analysis

4.6.4 Business Strategies

4.6.5 Strength and Weakness of General Electric Company

4.7 GKN Aerospace Services Limited

4.7.1 Company Overview

4.7.2 Role of GKN Aerospace Services Limited in Electric & Hybrid-electric Aircraft Propulsion System Market

4.7.2.1 Product Portfolio

4.7.3 Global Presence and R&D Analysis

4.7.4 Business Strategies

4.7.5 Strength and Weakness of GKN Aerospace Services Limited

4.8 Honeywell International Inc.

4.8.1 Company Overview

4.8.2 Role of Honeywell International Inc. in Electric & Hybrid-electric Aircraft Propulsion System Market

4.8.2.1 Product Portfolio

4.8.3 Global Presence and R&D Analysis

4.8.4 Business Strategies

4.8.5 Strength and Weakness of Honeywell International Inc.

4.9 Israel Aerospace Industries Ltd.

4.9.1 Company Overview

4.9.2 Role of Israel Aerospace Industries Ltd. in Electric & Hybrid-electric Aircraft Propulsion System Market

4.9.2.1 Product Portfolio

4.9.3 Global Presence and R&D Analysis

4.9.4 Business Strategies

4.9.5 Strength and Weakness of Israel Aerospace Industries Ltd.

4.1 Lockheed Martin Corporation

4.10.1 Company Overview

4.10.2 Role of Lockheed Martin Corporation in Electric & Hybrid-electric Aircraft Propulsion System Market

4.10.2.1 Product Portfolio

4.10.3 Global Presence and R&D Analysis

4.10.4 Business Strategies

4.10.5 Strength and Weakness of Lockheed Martin Corporation

4.11 MagniX

4.11.1 Company Overview

4.11.2 Role of MagniX in Electric & Hybrid-electric Aircraft Propulsion System Market

4.11.2.1 Product Portfolio

4.11.3 Global Presence and R&D Analysis

4.11.4 Business Strategies

4.11.5 Strength and Weakness of MagniX

4.12 Rolls-Royce Holdings plc.

4.12.1 Company Overview

4.12.2 Role of Rolls-Royce Holdings plc. in Electric & Hybrid-electric Aircraft Propulsion System Market

4.12.2.1 Product Portfolio

4.12.2.1.1 Accelerating Electrification of Flight (ACCEL)

4.12.2.1.2 E-Fan X

4.12.2.1.3 CityAirbus

4.12.2.1.4 Apus i-5

4.12.2.1.5 H3PS

4.12.3 Global Presence and R&D Analysis

4.12.4 Business Strategies

4.12.5 Strength and Weakness of Rolls-Royce Holdings plc.

4.13 Safran S.A.

4.13.1 Company Overview

4.13.2 Role of Safran S.A. in Electric & Hybrid-electric Aircraft Propulsion System Market

4.13.2.1 Product Portfolio

4.13.3 Global Presence and R&D Analysis

4.13.4 Business Strategies

4.13.5 Strength and Weakness of Safran S.A.

4.14 Siemens AG

4.14.1 Company Overview

4.14.2 Role of Siemens AG in Electric & Hybrid-electric Aircraft Propulsion System Market

4.14.2.1 Product Portfolio

4.14.3 Global Presence and R&D Analysis

4.14.4 Business Strategies

4.14.5 Strength and Weakness of Siemens AG

4.15 Raytheon Technologies Corporation

4.15.1 Company Overview

4.15.2 Role of Raytheon Technologies Corporation in Electric & Hybrid-electric Aircraft Propulsion System Market

4.15.2.1 Product Portfolio

4.15.3 Global Presence and R&D Analysis

4.15.4 Business Strategies

4.15.5 Strength and Weakness of Raytheon Technologies Corporation

4.16 Leonardo S.p.A

4.16.1 Company Overview

4.16.2 Role of Leonardo S.p.A in Electric & Hybrid-electric Aircraft Propulsion System Market

4.16.2.1 Product Portfolio

4.16.3 Global Presence and R&D Analysis

4.16.4 Business Strategies

4.16.5 Strength and Weakness of Leonardo S.p.A

4.17 Other Key Companies

4.17.1 Bellwether Industries

4.17.2 Bristol Aerospace company

4.17.3 HES Energy Systems

4.17.4 Oxis Energy

4.17.5 Skai

4.17.6 Wright Electric

4.17.7 Zero Avia

4.17.8 Bye Aerospace Inc

4.17.9 Pipistrel Aircraft

5 Research Methodology

5.1 Data Sources

5.1.1 Primary Data Sources

5.1.2 Secondary Data Sources

5.2 Data Triangulation

5.3 Market Estimation and Forecast

List of Figures

Figure 1: Current CO2 Emission Producers, 2020

Figure 2: Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 3: Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025 and 2035

Figure 4: Electric & Hybrid-electric Aircraft Propulsion System Market (by Region), Value ($Billion), 2025

Figure 5: Electric & Hybrid-electric Aircraft Propulsion System Market Coverage

Figure 6: Emerging Technologies in Aviation Industry, 2021

Figure 7: Technology Roadmap for Electric & Hybrid-electric Aircraft Propulsion System Market, 2021-2045

Figure 8: Electric & Hybrid-electric Aircraft Propulsion System Projects, by Propulsion Type, 2021

Figure 9: Major All-Electric Propulsion System Projects, 2021

Figure 10: Global Manned Next-Gen Fixed Wing Aircraft All-Electric Propulsion System Market for Commuter Aircraft, Value ($Million), 2025-2035

Figure 11: Global Manned Next-Gen Fixed Wing Aircraft All-Electric Propulsion System Market for Commuter Aircraft, Volume (Units), 2025-2035

Figure 12: Global Manned Next-Gen Fixed Wing Aircraft All-Electric Propulsion System Market for Regional Aircraft, Value ($Million), 2025-2035

Figure 13: Global Manned Next-Gen Fixed Wing Aircraft All-Electric Propulsion System Market for Regional Aircraft, Volume (Units), 2025-2035

Figure 14: Global Manned Next-Gen Rotary Wing Aircraft All-Electric Propulsion System Market for Rotorcraft, Value ($Million), 2025-2035

Figure 15: Global Manned Next-Gen Rotary Wing Aircraft All-Electric Propulsion System Market for Rotorcraft, Volume (Units), 2025-2035

Figure 16: Global Manned Next-Gen Rotary Wing Aircraft All-Electric Propulsion System Market for Multi-Copter, Value ($Million), 2025-2035

Figure 17: Global Manned Next-Gen Rotary Wing Aircraft All-Electric Propulsion System Market for Multi-Copter, Volume (Units), 2025-2035

Figure 18: Global Manned Next-Gen Hybrid Wing Aircraft All-Electric Propulsion System Market, Value ($Million), 2025-2035

Figure 19: Global Manned Next-Gen Hybrid Wing Aircraft All-Electric Propulsion System Market, Volume (Units), 2025-2035

Figure 20: Global Unmanned Next-Gen Fixed Wing Aircraft All-Electric Propulsion System Market, Value ($Million), 2025-2035

Figure 21: Global Unmanned Next-Gen Fixed Wing Aircraft All-Electric Propulsion System Market, Volume (Units), 2025-2035

Figure 22: Global Unmanned Next-Gen Rotary Wing Aircraft All-Electric Propulsion System Market, Value ($Million), 2025-2035

Figure 23: Global Unmanned Next-Gen Rotary Wing Aircraft All-Electric Propulsion System Market, Volume (Units), 2025-2035

Figure 24: Global Unmanned Next-Gen Hybrid Wing Aircraft All-Electric Propulsion System Market, Value ($Million), 2025-2035

Figure 25: Global Unmanned Next-Gen Hybrid Wing Aircraft All-Electric Propulsion System Market, Volume (Units), 2025-2035

Figure 26: Hybrid-Electric Propulsion Configuration: Series and Parallel

Figure 27: Hybrid-Electric Propulsion Projects, 2021

Figure 28: Global Manned Next-Gen Fixed Wing Aircraft Hybrid-Electric Propulsion System Market for Commuter Aircraft, Value ($Million), 2025-2035

Figure 29: Global Manned Next-Gen Fixed Wing Aircraft Hybrid-Electric Propulsion System Market for Commuter Aircraft, Volume (Units), 2025-2035

Figure 30: Global Manned Next-Gen Fixed Wing Aircraft Hybrid-Electric Propulsion System Market for Regional Aircraft, Value ($Million), 2025-2035

Figure 31: Global Manned Next-Gen Fixed Wing Aircraft Hybrid-Electric Propulsion System Market for Regional Aircraft, Volume (Units), 2025-2035

Figure 32: Global Manned Next-Gen Rotary Wing Aircraft Hybrid-Electric Propulsion System Market for Rotorcraft, Value ($Million), 2025-2035

Figure 33: Global Manned Next-Gen Rotary Wing Aircraft Hybrid-Electric Propulsion System Market for Rotorcraft, Volume (Units), 2025-2035

Figure 34: Global Manned Next-Gen Rotary Wing Aircraft Hybrid-Electric Propulsion System Market for Multi-Copter, Value ($Million), 2025-2035

Figure 35: Global Manned Next-Gen Rotary Wing Aircraft Hybrid-Electric Propulsion System Market for Multi-Copter, Volume (Units), 2025-2035

Figure 36: Global Manned Next-Gen Hybrid Wing Aircraft Hybrid-Electric Propulsion System Market, Value ($Million), 2025-2035

Figure 37: Global Manned Next-Gen Hybrid Wing Aircraft Hybrid-Electric Propulsion System Market, Volume (Units), 2025-2035

Figure 38: Global Unmanned Next-Gen Aircraft Hybrid-Electric Propulsion System Market, Value ($Million), 2025-2035

Figure 39: Global Unmanned Next-Gen Aircraft Hybrid-Electric Propulsion System Market, Volume (Units), 2025-2035

Figure 40: Aircraft Operations of Electric VTOL (eVTOL)

Figure 41: North America Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 42: North America Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 43: Growth of Airline Passengers, 2014-2019

Figure 44: U.S. Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 45: U.S. Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 46: Growth of Airline Passengers, 2014-2019

Figure 47: Canada Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 48: Canada Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 49: Countries that Joined Paris Climate Agreement, 2021

Figure 50: South America Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 51: South America Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 52: Countries that Joined Paris Climate Agreement, 2021

Figure 53: Europe Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 54: Europe Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 55: Germany Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 56: Germany Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 57: Growth of Airline Passengers, 2014-2019

Figure 58: France Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 59: France Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 60: Growth of Airline Passengers, 2014-2019

Figure 61: Russia Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 62: Russia Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 63: Growth of Airline Passengers, 2014-2019

Figure 64: U.K. Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 65: U.K. Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 66: Growth of Airline Passengers, 2014-2019

Figure 67: Netherlands Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 68: Netherlands Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 69: Rest-of-Europe Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 70: Rest-of-Europe Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 71: Countries that Joined Paris Climate Agreement, 2021

Figure 72: Middle East and Africa Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 73: Middle East and Africa Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 74: Countries that Joined Paris Climate Agreement, 2021

Figure 75: Asia-Pacific Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 76: Asia-Pacific Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 77: Growth of Airline Passengers, 2014-2019

Figure 78: China Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 79: China Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 80: Growth of Airline Passengers, 2014-2019

Figure 81: Japan Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 82: Japan Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 83: Growth of Airline Passengers, 2014-2019

Figure 84: India Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 85: India Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 86: Growth of Airline Passengers, 2014-2019

Figure 87: Australia Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 88: Australia Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 89: Growth of Airline Passengers, 2014-2019

Figure 90: Singapore Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 91: Singapore Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 92: Rest-of-Asia-Pacific Electric & Hybrid-electric Aircraft Propulsion System Market, Volume (Units), 2025-2035

Figure 93: Rest-of-Asia-Pacific Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Million), 2025-2035

Figure 94: Competitive Benchmarking, 2021

Figure 95: 3W International GmbH: Product Portfolio

Figure 96: Airbus S.A.S.: Product Portfolio

Figure 97: Airbus S.A.S. – Research and Development Expenditure, 2018-2020

Figure 98: Boeing: Product Portfolio

Figure 99: Boeing – Research and Development Expenditure, 2018-2020

Figure 100: Cranfield Aerospace Solutions: Product Portfolio

Figure 101: General Electric Company: Product Portfolio

Figure 102: General Electric Company – Research and Development Expenditure, 2018-2020

Figure 103: GKN Aerospace Services Limited: Product Portfolio

Figure 104: GKN Aerospace Services Limited – Research and Development Expenditure, 2018-2020

Figure 105: Honeywell International Inc.: Product Portfolio

Figure 106: Honeywell International Inc. – Research and Development Expenditure, 2017-2019

Figure 107: Israel Aerospace Industries Ltd.: Product Portfolio

Figure 108: Israel Aerospace Industries Ltd. – Research and Development Expenditure, 2017-2019

Figure 109: Lockheed Martin Corporation: Product Portfolio

Figure 110: Lockheed Martin Corporation – Research and Development Expenditure, 2017-2019

Figure 111: MagniX: Product Portfolio

Figure 112: Rolls-Royce Holdings plc.: Product Portfolio

Figure 113: Rolls-Royce Holdings plc. – Research and Development Expenditure, 2017-2019

Figure 114: Safran S.A.: Product Portfolio

Figure 115: Safran S.A. – Research and Development Expenditure, 2017-2019

Figure 116: Siemens AG: Product Portfolio

Figure 117: Siemens AG – Research and Development Expenditure, 2017-2019

Figure 118: Raytheon Technologies Corporation: Product Portfolio

Figure 119: Raytheon Technologies Corporation – Research and Development Expenditure, 2017-2019

Figure 120: Leonardo S.p.A: Product Portfolio

Figure 121: Leonardo S.p.A – Research and Development Expenditure, 2017-2019

Figure 122: Research Methodology

Figure 123: Data Triangulation

Figure 124: Top-Down and Bottom-Up Approach

Figure 125: Assumptions and Limitations

List of Tables

Table 1: Reduction of CO2e Emissions per Year

Table 2: Electric & Hybrid-electric Aircraft Propulsion System Market: Projects, (by Propulsion Type), 2021

Table 3: Electric & Hybrid-electric Aircraft Propulsion System Market, Value ($Billion), 2025 and 2035

Table 4: Electric & Hybrid-electric Aircraft Propulsion System Market: Major Programs

Table 5: Start-Ups Funding, January 2015-March 2021

Table 6: Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 7: Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 8: Electric & Hybrid-electric Aircraft All-Electric Propulsion System Market (by Operation), Value ($Million), 2025-2035

Table 9: Electric & Hybrid-electric Aircraft All-Electric Propulsion System Market (by Operation), Volume (Units), 2025-2035

Table 10: Global Manned Next-Gen Aircraft All-Electric Propulsion System Market (by Aircraft Architecture), Value ($Million), 2025-2035

Table 11: Global Manned Next-Gen Aircraft All-Electric Propulsion System Market (by Aircraft Architecture), Volume (Units), 2025-2035

Table 12: Global Manned Next-Gen Fixed Wing Aircraft All-Electric Propulsion System Market (by Aircraft Type), Value ($Million), 2025-2035

Table 13: Global Manned Next-Gen Fixed Wing Aircraft All-Electric Propulsion System Market (by Aircraft Type), Volume (Units), 2025-2035

Table 14: All-Electric Commuter Aircraft Model (by Manufacturer and MTOW)

Table 15: Global Manned Next-Gen Rotary Wing Aircraft All-Electric Propulsion System Market (by Aircraft Type), Value ($Million), 2025-2035

Table 16: Global Manned Next-Gen Rotary Wing Aircraft All-Electric Propulsion System Market (by Aircraft Type), Volume (Units), 2025-2035

Table 17: All-Electric Rotorcraft Aircraft Model (by Manufacturer and Capacity)

Table 18: All-Electric Multi-Copter Aircraft Model (by Manufacturer and Capacity)

Table 19: All-Electric Manned Hybrid Wing Aircraft Model (by Manufacturer and Capacity)

Table 20: Global Unmanned Next-Gen Aircraft All-Electric Propulsion System Market (by Aircraft Architecture), Value ($Million), 2025-2035

Table 21: Global Unmanned Next-Gen Aircraft All-Electric Propulsion System Market (by Aircraft Architecture), Volume (Units), 2025-2035

Table 22: Electric & Hybrid-electric Aircraft Hybrid-Electric Propulsion System Market (by Operation), Value ($Million), 2025-2035

Table 23: Electric & Hybrid-electric Aircraft Hybrid-Electric Propulsion System Market (by Operation), Volume (Units), 2025-2035

Table 24: Global Manned Next-Gen Aircraft Hybrid-Electric Propulsion System Market (by Aircraft Architecture), Value ($Million), 2025-2035

Table 25: Global Manned Next-Gen Aircraft Hybrid-Electric Propulsion System Market (by Aircraft Architecture), Volume (Units), 2025-2035

Table 26: Global Manned Next-Gen Fixed Wing Aircraft Hybrid-Electric Propulsion System Market (by Aircraft Type), Value ($Million), 2025-2035

Table 27: Global Manned Next-Gen Fixed Wing Aircraft Hybrid-Electric Propulsion System Market (by Aircraft Type), Volume (Units), 2025-2035

Table 28: Hybrid-Electric Regional Aircraft Model (by Manufacturer and Capacity)

Table 29: Global Manned Next-Gen Rotary Wing Aircraft Hybrid-Electric Propulsion System Market (by Aircraft Type), Value ($Million), 2025-2035

Table 30: Global Manned Next-Gen Rotary Wing Aircraft Hybrid-Electric Propulsion System Market (by Aircraft Type), Volume (Units), 2025-2035

Table 31: Hybrid-Electric Manned Rotorcraft Aircraft Model Specifications

Table 32: Hybrid-Electric Multi-Copter Aircraft Model Specifications

Table 33: Hybrid-Electric Manned Hybrid Wing Aircraft Model Specifications

Table 34: Hybrid-Electric UAVs Model (by Manufacturer and Type)

Table 35: Electric & Hybrid-electric eVTOL Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 36: Electric & Hybrid-electric eVTOL Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 37: Electric & Hybrid-electric Aircraft Propulsion System Market (by Region), Volume (Units), 2025-2035

Table 38: Electric & Hybrid-electric Aircraft Propulsion System Market (by Region), Value ($Million), 2025-2035

Table 39: North America Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 40: North America Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 41: U.S. Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 42: U.S. Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 43: Canada Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 44: Canada Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 45: South America Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 46: South America Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 47: Europe Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 48: Europe Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 49: Germany Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 50: Germany Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 51: France Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 52: France Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 53: Russia Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 54: Russia Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 55: U.K. Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 56: U.K. Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 57: Netherlands Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 58: Netherlands Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 59: Rest-of-Europe Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 60: Rest-of-Europe Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 61: Middle East and Africa Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 62: Middle East and Africa Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 63: Asia-Pacific Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 64: Asia-Pacific Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 65: China Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 66: China Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 67: Japan Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 68: Japan Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 69: India Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 70: India Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 71: Australia Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 72: Australia Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 73: Singapore Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 74: Singapore Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 75: Rest-of-Asia-Pacific Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Volume (Units), 2025-2035

Table 76: Rest-of-Asia-Pacific Electric & Hybrid-electric Aircraft Propulsion System Market (by Propulsion Type), Value ($Million), 2025-2035

Table 77: Comparison of Magni250 and Magni500

Table 78: Specifications of magniDrive

Table 79: Specifications of SP45D, SP55D, SP70D

Companies Mentioned

- 3W International GmbH

- Airbus S.A.S.

- Boeing

- Cranfield Aerospace Solutions

- General Electric Company

- GKN Aerospace Services Limited

- Honeywell International Inc.

- Israel Aerospace Industries Ltd.

- Lockheed Martin Corporation

- MagniX

- Rolls-Royce Holdings plc.

- Safran S.A.

- Siemens AG

- Raytheon Technologies Corporation

- Leonardo S.p.A

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 229 |

| Published | December 2021 |

| Forecast Period | 2025 - 2035 |

| Estimated Market Value ( USD | $ 13.84 Billion |

| Forecasted Market Value ( USD | $ 74.9 Billion |

| Compound Annual Growth Rate | 18.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |