Numerous trade-related agreements have been formed between developing and developed nations for the trading of goods. This has led suppliers to opt for waterways as an efficient means of transportation. According to an IBEF report, ports in India handle around 95% of the international trade volume of the country. The increase in trade activities in India is expected to boost the demand for containers over the forecast period.

Increasing automation of ships, coupled with the demonstrations and testing of autonomous ships of leading companies, has encouraged various countries to develop automated vessels for cargo and passenger transport. Furthermore, the e-commerce industry has witnessed a significant increase in the last few years. The growth of the transportation industry on account of the increasing online retail is expected to support the growth of the container market in India. However, fluctuations in transportation and inventory costs are likely to hamper market growth.

Strong growth potential, Standard Operating Procedures (SOPs) provided by the government, and favorable investment activities have encouraged domestic and foreign private players to enter the Indian port. Additionally, with the expansion of ports and terminals, private players are extensively participating in port logistics service, which is expected to drive the demand for shipping containers over the forecast period. Factors such as the special economic zones being developed near several ports and terminals and an increase in marine safety norms are anticipated to provide growth opportunities for the shipping container market.

India Container Market Report Highlights

- The food & beverage segment is expected to grow at the fastest CAGR during the forecast period. Increasing disposable income among consumers is driving higher spending on premium and healthier food options, reflecting a shift toward quality and nutrition.

- The 40 feet segment dominated the market in 2024. Factors such as increased durability and large space offered by 40 feet containers are contributing to their high adoption across various applications

- India has emerged as the world’s fastest-growing economy for the past five years owing to the rising demand for consumer goods and services

- The increasing demand for freight transport in India, owing to the growing population and improved living standards, along with high demand for consumer goods among consumers and businesses, is expected to drive the demand for India container market

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- A.P. Moller - Maersk

- COSCO SHIPPING Development Co,. Ltd.

- China International Marine Containers (Group) Co., Ltd.

- CXIC Group

- Singamas Container Holdings Limited

- Hapag-Lloyd AG

- Evergreen Marine Corporation

- MSC Mediterranean Shipping Company S.A.

- Yang Ming

- ZIM Integrated Shipping Services Ltd.

- DCM Hyundai Ltd.

- J.K. Technologies Pvt. Ltd.

- AB Sea Container Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | November 2024 |

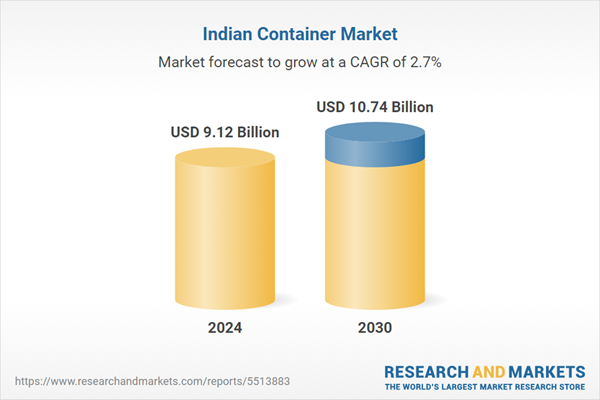

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.12 Billion |

| Forecasted Market Value ( USD | $ 10.74 Billion |

| Compound Annual Growth Rate | 2.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 13 |