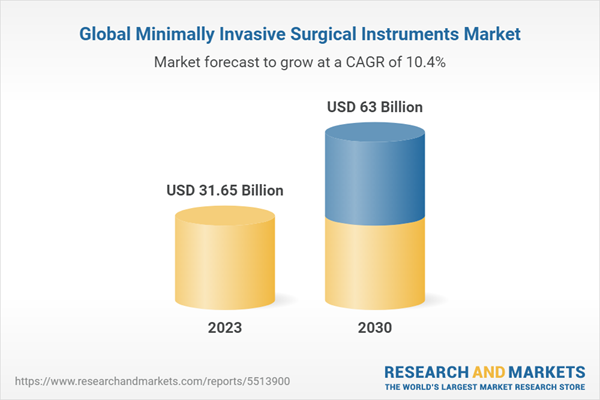

The global minimally invasive surgical instruments market size is expected to reach USD 63.0 billion by 2030, registering a CAGR of 10.4% during the forecast period, according to the report. The preference for minimally invasive surgical (MIS) procedures is rising as they are less traumatic than traditional open surgeries and they facilitate faster recover process. Patients can resume their daily activities in a shorter time after minimally invasive surgical procedures.

In addition, the costs involved in MIS procedures are significantly less than in-patient and conventional open surgeries. Therefore, MIS procedures prove to be beneficial for patients as well as payers. The benefits of MIS in various areas of orthopedics have contributed to the growing demand for less traumatic alternatives with minimum tissue disruption of bones.

Noncommunicable Diseases (NCDs), often known as chronic diseases, affect more than 41 million individuals each year, accounting for approximately 74% of all deaths worldwide. According to the same source, nearly 15 million people aged 30 to 69 die worldwide each year as a result of NCDs. As a result of the high mortality rate due to NCDs, the need for therapeutic techniques is increasing. Minimally invasive techniques are gaining traction as they offer more benefits than regular procedures. As a result, the market under consideration is anticipated to grow over the forecast period.

In addition, the costs involved in MIS procedures are significantly less than in-patient and conventional open surgeries. Therefore, MIS procedures prove to be beneficial for patients as well as payers. The benefits of MIS in various areas of orthopedics have contributed to the growing demand for less traumatic alternatives with minimum tissue disruption of bones.

Noncommunicable Diseases (NCDs), often known as chronic diseases, affect more than 41 million individuals each year, accounting for approximately 74% of all deaths worldwide. According to the same source, nearly 15 million people aged 30 to 69 die worldwide each year as a result of NCDs. As a result of the high mortality rate due to NCDs, the need for therapeutic techniques is increasing. Minimally invasive techniques are gaining traction as they offer more benefits than regular procedures. As a result, the market under consideration is anticipated to grow over the forecast period.

Minimally Invasive Surgical Instruments Market Highlights

- Minimal invasive technologies are designed to cause less trauma than traditional open surgeries, reduced blood loss, minimal scarring, and low chances of infection

- Handheld instruments dominated the device segment in terms of revenue share in 2023. On the other hand, electrosurgical devices are expected to witness the fastest growth rate during the forecast period from 2024 to 2030.

- Orthopedic segment dominated the application segment in terms of revenue share in 2023. Minimally invasive surgical procedures in various areas of orthopedics offer surgical alternatives with minimum tissue disruption

- Continuous adoption of minimally invasive surgical techniques for spine related procedures has led to the expansion of procedural volumes for orthopedic MIS

- Hospital segment held most of the end use segment share in 2023. On the other hand, ambulatory surgically centers are likely to experience fastest growth in the coming years.

- Ambulatory surgical centers offer same day surgery and discharge at lower costs. At present, over 5,500 Medicare certified ambulatory care centers are present in the U.S.

- North America held majority of the market share in 2023 due to the presence of supportive reimbursement framework for innovative MIS devices and procedures.

Table of Contents

Chapter 1 Methodology And Scope

1.1 Market Segmentation & Scope

1.1.1 Device

1.1.2 Application

1.1.3 End-use

1.1.4 Estimates And Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Internal database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details Of Primary Research

1.4 Information Or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis (Model 1)

1.6.1.1 Approach 1: Commodity Flow Approach

1.6.2 Volume Price Analysis (Model 2)

1.6.2.1 Approach 2: Volume Price Analysis

1.7 List Of Secondary Sources

1.8 Objectives

1.8.1 Objective 1

1.8.2 Objective 2

1.1.1 Device

1.1.2 Application

1.1.3 End-use

1.1.4 Estimates And Forecast Timeline

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 Internal database

1.3.3 Secondary Sources

1.3.4 Primary Research

1.3.5 Details Of Primary Research

1.4 Information Or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Validation

1.6 Model Details

1.6.1 Commodity Flow Analysis (Model 1)

1.6.1.1 Approach 1: Commodity Flow Approach

1.6.2 Volume Price Analysis (Model 2)

1.6.2.1 Approach 2: Volume Price Analysis

1.7 List Of Secondary Sources

1.8 Objectives

1.8.1 Objective 1

1.8.2 Objective 2

Chapter 2 Executive Summary

2.1 Market Outlook

2.2 Segment Outlook

2.3 Competitive Insights

2.2 Segment Outlook

2.3 Competitive Insights

Chapter 3 Minimally Invasive Surgical Instruments Market: Variables, Trends & Scope

3.1 Market Lineage Outlook

3.1.1 Related/Ancillary Market Outlook

3.2 Market Variable Analysis

3.2.1 Market Driver Analysis

3.2.1.1 Increasing Prevalence Of Chronic Diseases

3.2.1.2 Technological Advancements In Minimally Invasive Surgical Instruments

3.2.1.3 Rising Geriatric Population

3.2.1.4 Increasing Demand For Minimally Invasive Surgical Procedures

3.2.2 Market Restraint Analysis

3.2.2.1 Long Waiting Time For Surgeries

3.2.2.2 Lack Of Skilled Professionals

3.3 Penetration & Growth Prospect Mapping

3.4 Business Environment Analysis Tools

3.4.1 Swot Analysis, By Pest

3.4.2 Porter’s Five Forces Analysis

3.4.3 Major Deals & Strategic Alliances Analysis

3.4.3.1 Product Launch

3.4.3.2 Merger & Acquisition

3.4.3.3 Collaboration & Partnership

3.4.3.4 Supply And Distribution Agreement

3.4.3.5 Regulatory Approval

3.4.3.6 Product Investment

3.4.3.7 Product Diversification

3.4.4 Market Entry Strategies

3.1.1 Related/Ancillary Market Outlook

3.2 Market Variable Analysis

3.2.1 Market Driver Analysis

3.2.1.1 Increasing Prevalence Of Chronic Diseases

3.2.1.2 Technological Advancements In Minimally Invasive Surgical Instruments

3.2.1.3 Rising Geriatric Population

3.2.1.4 Increasing Demand For Minimally Invasive Surgical Procedures

3.2.2 Market Restraint Analysis

3.2.2.1 Long Waiting Time For Surgeries

3.2.2.2 Lack Of Skilled Professionals

3.3 Penetration & Growth Prospect Mapping

3.4 Business Environment Analysis Tools

3.4.1 Swot Analysis, By Pest

3.4.2 Porter’s Five Forces Analysis

3.4.3 Major Deals & Strategic Alliances Analysis

3.4.3.1 Product Launch

3.4.3.2 Merger & Acquisition

3.4.3.3 Collaboration & Partnership

3.4.3.4 Supply And Distribution Agreement

3.4.3.5 Regulatory Approval

3.4.3.6 Product Investment

3.4.3.7 Product Diversification

3.4.4 Market Entry Strategies

Chapter 4 Minimally Invasive Surgical Instruments Market: Device Estimates And Trend Analysis

4.1 Definitions And Scope

4.2 Minimally Invasive Surgical Instruments Market Share Analysis,

4.3 Segment Dashboard

4.4 Minimally Invasive Surgical Instruments Market: By Device Analysis

4.4.1 Handheld Instruments

4.4.1.1 Handheld Instruments Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

4.4.2 Inflation Devices

4.4.2.1 Inflation Devices Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

4.4.2.2 Cutter Instruments

4.4.2.2.1 Cutter Instruments Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

4.4.2.3 Guiding Devices

4.4.2.3.1 Guiding Devices Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

4.4.3 Electrosurgical Devices

4.4.3.1 Electrosurgical Devices Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

4.4.4 Auxiliary Devices

4.4.4.1 Auxiliary Devices Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

4.4.5 Monitoring And Visualization Devices

4.4.5.1 Monitoring And Visualization Devices Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

4.2 Minimally Invasive Surgical Instruments Market Share Analysis,

4.3 Segment Dashboard

4.4 Minimally Invasive Surgical Instruments Market: By Device Analysis

4.4.1 Handheld Instruments

4.4.1.1 Handheld Instruments Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

4.4.2 Inflation Devices

4.4.2.1 Inflation Devices Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

4.4.2.2 Cutter Instruments

4.4.2.2.1 Cutter Instruments Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

4.4.2.3 Guiding Devices

4.4.2.3.1 Guiding Devices Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

4.4.3 Electrosurgical Devices

4.4.3.1 Electrosurgical Devices Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

4.4.4 Auxiliary Devices

4.4.4.1 Auxiliary Devices Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

4.4.5 Monitoring And Visualization Devices

4.4.5.1 Monitoring And Visualization Devices Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

Chapter 5 Minimally Invasive Surgical Instruments Market: Application Estimates And Trend Analysis

5.1 Definitions And Scope

5.2 Minimally Invasive Surgical Instruments Market Share Analysis, 2023 & 2030

5.3 Segment Dashboard

5.4 Minimally Invasive Surgical Instruments Market: By Device Analysis

5.4.1 Cardiac

5.4.1.1 Cardiac Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.2 Gastrointestinal

5.4.1.2.1 Gastrointestinal Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.3 Orthopedic

5.4.1.3.1 Orthopedic Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.4 Vascular

5.4.1.4.1 Vascular Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.5 Gynecological

5.4.1.5.1 Gynecological Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.6 Urological

5.4.1.6.1 Urological Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.7 Thoracic

5.4.1.7.1 Thoracic Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.8 Cosmetics

5.4.1.8.1 Cosmetics Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.9 Dental

5.4.1.9.1 Dental Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.10 Others

5.4.1.10.1 Others Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.2 Minimally Invasive Surgical Instruments Market Share Analysis, 2023 & 2030

5.3 Segment Dashboard

5.4 Minimally Invasive Surgical Instruments Market: By Device Analysis

5.4.1 Cardiac

5.4.1.1 Cardiac Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.2 Gastrointestinal

5.4.1.2.1 Gastrointestinal Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.3 Orthopedic

5.4.1.3.1 Orthopedic Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.4 Vascular

5.4.1.4.1 Vascular Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.5 Gynecological

5.4.1.5.1 Gynecological Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.6 Urological

5.4.1.6.1 Urological Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.7 Thoracic

5.4.1.7.1 Thoracic Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.8 Cosmetics

5.4.1.8.1 Cosmetics Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.9 Dental

5.4.1.9.1 Dental Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

5.4.1.10 Others

5.4.1.10.1 Others Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

Chapter 6 Minimally Invasive Surgical Instruments Market: End-use Estimates And Trend Analysis

6.1 Definitions And Scope

6.2 Minimally Invasive Surgical Instruments Market Share Analysis, 2023 & 2030

6.3 Segment Dashboard

6.4 Minimally Invasive Surgical Instruments Market: By End Use Analysis

6.4.1 Hospitals

6.4.1.1 Hospitals Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

6.4.2 Ambulatory Surgical Centers

6.4.2.1 Ambulatory Surgical Centers Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

6.2 Minimally Invasive Surgical Instruments Market Share Analysis, 2023 & 2030

6.3 Segment Dashboard

6.4 Minimally Invasive Surgical Instruments Market: By End Use Analysis

6.4.1 Hospitals

6.4.1.1 Hospitals Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

6.4.2 Ambulatory Surgical Centers

6.4.2.1 Ambulatory Surgical Centers Minimally Invasive Surgical Instruments Market, 2018 - 2030 (USD Million)

Chapter 7 Regional Outlook

7.1 Minimally Invasive Surgical Instruments Market Share By Region, 2023 & 2030

7.2 North America

7.2.1 North America MIS Instruments Market, 2018 - 2030 (USD Million)

7.2.2 U.S.

7.2.2.1 Key Country Dynamics

7.2.2.2 Regulatory Scenario & Reimbursement Structure

7.2.2.3 Competitive Scenario

7.2.2.4 U.S. MIS Instruments Market, 2018 - 2030 (USD Million)

7.2.3 Canada

7.2.3.1 Key Country Dynamics

7.2.3.2 Regulatory Scenario & Reimbursement Structure

7.2.3.3 Competitive Scenario

7.2.3.1 Canada MIS Instruments Market, 2018 - 2030 (USD Million)

7.3 Europe

7.3.1 Europe MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.2 UK

7.3.2.1 Key Country Dynamics

7.3.2.2 Regulatory Scenario & Reimbursement Structure

7.3.2.3 Competitive Scenario

7.3.2.4 U.K. MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.3 Germany

7.2.3.1 Key Country Dynamics

7.2.3.2 Regulatory Scenario & Reimbursement Structure

7.2.3.3 Competitive Scenario

7.3.3.4 Germany MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.4 France

7.3.4.1 Key Country Dynamics

7.3.4.2 Regulatory Scenario & Reimbursement Structure

7.3.4.3 Competitive Scenario

7.3.4.4 France MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.5 Italy

7.3.5.1 Key Country Dynamics

7.3.5.2 Regulatory Scenario & Reimbursement Structure

7.3.5.3 Competitive Scenario

7.3.5.4 Italy MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.6 Spain

7.3.6.1 Key Country Dynamics

7.3.6.2 Regulatory Scenario & Reimbursement Structure

7.3.6.3 Competitive Scenario

7.3.6.4 Spain MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.7 Denmark

7.3.7.1 Key Country Dynamics

7.3.7.2 Regulatory Scenario & Reimbursement Structure

7.3.7.3 Competitive Scenario

7.3.7.4 Denmark MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.8 Sweden

7.3.8.1 Key Country Dynamics

7.3.8.2 Regulatory Scenario & Reimbursement Structure

7.3.8.3 Competitive Scenario

7.3.8.4 Sweden MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.9 Norway

7.3.9.1 Key Country Dynamics

7.3.9.2 Regulatory Scenario & Reimbursement Structure

7.3.9.3 Competitive Scenario

7.3.9.4 Norway MIS Instruments Market, 2018 - 2030 (USD Million)

7.4 Asia Pacific

7.4.1 Asia Pacific MIS Instruments Market, 2018 - 2030 (USD Million)

7.4.2 Japan

7.4.2.1 Key Country Dynamics

7.2 North America

7.2.1 North America MIS Instruments Market, 2018 - 2030 (USD Million)

7.2.2 U.S.

7.2.2.1 Key Country Dynamics

7.2.2.2 Regulatory Scenario & Reimbursement Structure

7.2.2.3 Competitive Scenario

7.2.2.4 U.S. MIS Instruments Market, 2018 - 2030 (USD Million)

7.2.3 Canada

7.2.3.1 Key Country Dynamics

7.2.3.2 Regulatory Scenario & Reimbursement Structure

7.2.3.3 Competitive Scenario

7.2.3.1 Canada MIS Instruments Market, 2018 - 2030 (USD Million)

7.3 Europe

7.3.1 Europe MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.2 UK

7.3.2.1 Key Country Dynamics

7.3.2.2 Regulatory Scenario & Reimbursement Structure

7.3.2.3 Competitive Scenario

7.3.2.4 U.K. MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.3 Germany

7.2.3.1 Key Country Dynamics

7.2.3.2 Regulatory Scenario & Reimbursement Structure

7.2.3.3 Competitive Scenario

7.3.3.4 Germany MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.4 France

7.3.4.1 Key Country Dynamics

7.3.4.2 Regulatory Scenario & Reimbursement Structure

7.3.4.3 Competitive Scenario

7.3.4.4 France MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.5 Italy

7.3.5.1 Key Country Dynamics

7.3.5.2 Regulatory Scenario & Reimbursement Structure

7.3.5.3 Competitive Scenario

7.3.5.4 Italy MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.6 Spain

7.3.6.1 Key Country Dynamics

7.3.6.2 Regulatory Scenario & Reimbursement Structure

7.3.6.3 Competitive Scenario

7.3.6.4 Spain MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.7 Denmark

7.3.7.1 Key Country Dynamics

7.3.7.2 Regulatory Scenario & Reimbursement Structure

7.3.7.3 Competitive Scenario

7.3.7.4 Denmark MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.8 Sweden

7.3.8.1 Key Country Dynamics

7.3.8.2 Regulatory Scenario & Reimbursement Structure

7.3.8.3 Competitive Scenario

7.3.8.4 Sweden MIS Instruments Market, 2018 - 2030 (USD Million)

7.3.9 Norway

7.3.9.1 Key Country Dynamics

7.3.9.2 Regulatory Scenario & Reimbursement Structure

7.3.9.3 Competitive Scenario

7.3.9.4 Norway MIS Instruments Market, 2018 - 2030 (USD Million)

7.4 Asia Pacific

7.4.1 Asia Pacific MIS Instruments Market, 2018 - 2030 (USD Million)

7.4.2 Japan

7.4.2.1 Key Country Dynamics

7. 4.2.2 Regulatory Scenario & Reimbursement Structure

7.4.2.3 Competitive Scenario

7.4.2.4 Japan MIS Instruments Market, 2018 - 2030 (USD Million)

7.4.3 China

7.4.3.1 Key Country Dynamics

7.4.3.2 Regulatory Scenario & Reimbursement Structure

7.4.3.3 Competitive Scenario

7.4.3.4 China MIS Instruments Market, 2018 - 2030 (USD Million)

7.4.4 India

7.4.4.1 Key Country Dynamics

7.4.4.2 Regulatory Scenario & Reimbursement Structure

7.4.2.4 Japan MIS Instruments Market, 2018 - 2030 (USD Million)

7.4.3 China

7.4.3.1 Key Country Dynamics

7.4.3.2 Regulatory Scenario & Reimbursement Structure

7.4.3.3 Competitive Scenario

7.4.3.4 China MIS Instruments Market, 2018 - 2030 (USD Million)

7.4.4 India

7.4.4.1 Key Country Dynamics

7.4.4.2 Regulatory Scenario & Reimbursement Structure

7. 4.4.3 Competitive Scenario

7.4.4.4 India MIS Instruments Market, 2018 - 2030 (USD Million)

7.4.5 Australia

7.4.5.1 Key Country Dynamics

7.4.5.2 Regulatory Scenario & Reimbursement Structure

7.4.5.3 Competitive Scenario

7.4.5.4 Australia MIS Instruments Market, 2018 - 2030 (USD Million)

7.4.6 South Korea

7.4.6.1 Key Country Dynamics

7.4.6.2 Regulatory Scenario & Reimbursement Structure

7.4.5 Australia

7.4.5.1 Key Country Dynamics

7.4.5.2 Regulatory Scenario & Reimbursement Structure

7.4.5.3 Competitive Scenario

7.4.5.4 Australia MIS Instruments Market, 2018 - 2030 (USD Million)

7.4.6 South Korea

7.4.6.1 Key Country Dynamics

7.4.6.2 Regulatory Scenario & Reimbursement Structure

7. 4.6.3 Competitive Scenario

7.4.3.4 South Korea MIS Instruments Market, 2018 - 2030 (USD Million)

7.4.7 Thailand

7.4.7.1 Key Country Dynamics

7.4.7.2 Regulatory Scenario & Reimbursement Structure

7.4.7.3 Competitive Scenario

7.4.4.4 Thailand MIS Instruments Market, 2018 - 2030 (USD Million)

7.5 Latin America

7.5.1 Latin America MIS Instruments Market, 2018 - 2030 (USD Million)

7.5.2 Brazil

7.5.2.1 Key Country Dynamics

7.5.2.2 Regulatory Scenario & Reimbursement Structure

7.5.2.3 Competitive Scenario

7.5.2.4 Brazil MIS Instruments Market, 2018 - 2030 (USD Million)

7.5.3 Mexico

7.5.3.1 Key Country Dynamics

7.5.3.2 Regulatory Scenario & Reimbursement Structure

7.5.3.3 Competitive Scenario

7.5.3.4 Mexico MIS Instruments Market, 2018 - 2030 (USD Million)

7.5.4 Argentina

7.5.4.1 Key Country Dynamics

7.5.4.2 Regulatory Scenario & Reimbursement Structure

7.5.4.3 Competitive Scenario

7.5.4.4 Argentina MIS Instruments Market, 2018 - 2030 (USD Million)

7.6 Middle East & Africa

7.6.1 Middle East & Africa MIS Instruments Market, 2018 - 2030 (USD Million)

7.6.2 South Africa

7.6.2.1 Key Country Dynamics

7.6.2.2 Regulatory Scenario & Reimbursement Structure

7.6.2.3 Competitive Scenario

7.6.2.4 South Africa MIS Instruments Market, 2018 - 2030 (USD Million)

7.6.3 Saudi Arabia

7.6.3.1 Key Country Dynamics

7.6.3.2 Regulatory Scenario & Reimbursement Structure

7.6.3.3 Competitive Scenario

7.6.3.4 Saudi Arabia MIS Instruments Market, 2018 - 2030 (USD Million)

7.6.4 UAE

7.6.4.1 Key Country Dynamics

7.6.4.2 Regulatory Scenario & Reimbursement Structure

7.6.4.3 Competitive Scenario

7.6.4.4 UAE MIS Instruments Market, 2018 - 2030 (USD Million)

7.6.5 Kuwait

7.6.5.1 Key Country Dynamics

7.6.5.2 Regulatory Scenario & Reimbursement Structure

7.6.5.3 Competitive Scenario

7.6.5.4 Kuwait MIS Instruments Market, 2018 - 2030 (USD Million)

7.4.7 Thailand

7.4.7.1 Key Country Dynamics

7.4.7.2 Regulatory Scenario & Reimbursement Structure

7.4.7.3 Competitive Scenario

7.4.4.4 Thailand MIS Instruments Market, 2018 - 2030 (USD Million)

7.5 Latin America

7.5.1 Latin America MIS Instruments Market, 2018 - 2030 (USD Million)

7.5.2 Brazil

7.5.2.1 Key Country Dynamics

7.5.2.2 Regulatory Scenario & Reimbursement Structure

7.5.2.3 Competitive Scenario

7.5.2.4 Brazil MIS Instruments Market, 2018 - 2030 (USD Million)

7.5.3 Mexico

7.5.3.1 Key Country Dynamics

7.5.3.2 Regulatory Scenario & Reimbursement Structure

7.5.3.3 Competitive Scenario

7.5.3.4 Mexico MIS Instruments Market, 2018 - 2030 (USD Million)

7.5.4 Argentina

7.5.4.1 Key Country Dynamics

7.5.4.2 Regulatory Scenario & Reimbursement Structure

7.5.4.3 Competitive Scenario

7.5.4.4 Argentina MIS Instruments Market, 2018 - 2030 (USD Million)

7.6 Middle East & Africa

7.6.1 Middle East & Africa MIS Instruments Market, 2018 - 2030 (USD Million)

7.6.2 South Africa

7.6.2.1 Key Country Dynamics

7.6.2.2 Regulatory Scenario & Reimbursement Structure

7.6.2.3 Competitive Scenario

7.6.2.4 South Africa MIS Instruments Market, 2018 - 2030 (USD Million)

7.6.3 Saudi Arabia

7.6.3.1 Key Country Dynamics

7.6.3.2 Regulatory Scenario & Reimbursement Structure

7.6.3.3 Competitive Scenario

7.6.3.4 Saudi Arabia MIS Instruments Market, 2018 - 2030 (USD Million)

7.6.4 UAE

7.6.4.1 Key Country Dynamics

7.6.4.2 Regulatory Scenario & Reimbursement Structure

7.6.4.3 Competitive Scenario

7.6.4.4 UAE MIS Instruments Market, 2018 - 2030 (USD Million)

7.6.5 Kuwait

7.6.5.1 Key Country Dynamics

7.6.5.2 Regulatory Scenario & Reimbursement Structure

7.6.5.3 Competitive Scenario

7.6.5.4 Kuwait MIS Instruments Market, 2018 - 2030 (USD Million)

Chapter 8 Competitive Analysis

8.1 Market Participation Categorization

8.2. Strategy Mapping

8.3. Company Market Share Analysis, 2023

8.4. Company Profiles/Listing

8.5 MEDTRONIC

8.5.1 Company Overview

8.5.2 Financial performance

8.5.3 Product Benchmarking

8.5.4 Strategic Initiatives

8.6 SIEMENS HEALTHINEERS AG

8.6.1 Company Overview

8.6.2 Financial performance

8.6.3 Product Benchmarking

8.6.4 Strategic Initiatives

8.7 ETHICON, INC. (JOHNSON & JOHNSON INC.)

8.7.1 Company Overview

8.7.2 Financial performance

8.7.3 Product Benchmarking

8.7.4 Strategic Initiatives

8.8 DEPUY SYNTHES

8.8.1 Company Overview

8.8.2 Product Benchmarking

8.8.3 Strategic Initiatives

8.9 GE HEALTHCARE

8.9.1 Company Overview

8.9.2 Financial performance

8.9.3 Product Benchmarking

8.9.4 Strategic Initiatives

8.10 ABBOTT LABORATORIES

8.10.1 Company Overview

8.10.2 Financial performance

8.10.3 Product Benchmarking

8.10.4 Strategic Initiatives

8.11 INTUITIVE SURGICAL, INC.

8.11.1 Company Overview

8.11.2 Financial performance

8.11.3 Product Benchmarking

8.11.4 Strategic Initiatives

8.12 ARTHROCARE CORPORATION

8.12.1 Company Overview

8.12.2 Financial performance

8.12.3 Product Benchmarking

8.12.4 Strategic Initiatives

8.13 NUVASIVE, INC.

8.13.1 Company Overview

8.13.2 Financial performance

8.13.3 Product Benchmarking

8.13.4 Strategic Initiatives

8.14 ZIMMER BIOMET

8.14.1 Company Overview

8.14.2 Financial performance

8.14.3 Product Benchmarking

8.14.4 Strategic Initiatives

8.2. Strategy Mapping

8.3. Company Market Share Analysis, 2023

8.4. Company Profiles/Listing

8.5 MEDTRONIC

8.5.1 Company Overview

8.5.2 Financial performance

8.5.3 Product Benchmarking

8.5.4 Strategic Initiatives

8.6 SIEMENS HEALTHINEERS AG

8.6.1 Company Overview

8.6.2 Financial performance

8.6.3 Product Benchmarking

8.6.4 Strategic Initiatives

8.7 ETHICON, INC. (JOHNSON & JOHNSON INC.)

8.7.1 Company Overview

8.7.2 Financial performance

8.7.3 Product Benchmarking

8.7.4 Strategic Initiatives

8.8 DEPUY SYNTHES

8.8.1 Company Overview

8.8.2 Product Benchmarking

8.8.3 Strategic Initiatives

8.9 GE HEALTHCARE

8.9.1 Company Overview

8.9.2 Financial performance

8.9.3 Product Benchmarking

8.9.4 Strategic Initiatives

8.10 ABBOTT LABORATORIES

8.10.1 Company Overview

8.10.2 Financial performance

8.10.3 Product Benchmarking

8.10.4 Strategic Initiatives

8.11 INTUITIVE SURGICAL, INC.

8.11.1 Company Overview

8.11.2 Financial performance

8.11.3 Product Benchmarking

8.11.4 Strategic Initiatives

8.12 ARTHROCARE CORPORATION

8.12.1 Company Overview

8.12.2 Financial performance

8.12.3 Product Benchmarking

8.12.4 Strategic Initiatives

8.13 NUVASIVE, INC.

8.13.1 Company Overview

8.13.2 Financial performance

8.13.3 Product Benchmarking

8.13.4 Strategic Initiatives

8.14 ZIMMER BIOMET

8.14.1 Company Overview

8.14.2 Financial performance

8.14.3 Product Benchmarking

8.14.4 Strategic Initiatives

List of Tables

Table 1 List of Abbreviation

Table 2 North America minimally invasive surgical instruments market, by region, 2018 - 2030 (USD Million)

Table 3 North America minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 4 North America minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 5 North America minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 6 U.S. minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 7 U.S. minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 8 U.S. minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 9 Canada minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 10 Canada minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 11 Canada minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 12 Europe minimally invasive surgical instruments market, by region, 2018 - 2030 (USD Million)

Table 13 Europe minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 14 Europe minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 15 Europe minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 16 UK minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 17 UK minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 18 UK minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 19 Germany minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 20 Germany minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 21 Germany minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 22 France minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 23 France minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 24 France minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 25 Italy minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 26 Italy minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 27 Italy minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 28 Spain minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 29 Spain minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 30 Spain minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 31 Denmark minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 32 Denmark minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 33 Denmark minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 34 Sweden minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 35 Sweden minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 36 Sweden minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 37 Norway minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 38 Norway minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 39 Norway minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 40 Asia Pacific minimally invasive surgical instruments market, by region, 2018 - 2030 (USD Million)

Table 41 Asia Pacific minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 42 Asia Pacific minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 43 Asia Pacific minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 44 Japan minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 45 Japan minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 46 Japan minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 47 China minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 48 China minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 49 China minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 50 India minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 51 India minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 52 India minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 53 Australia minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 54 Australia minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 55 Australia minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 56 Thailand minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 57 Thailand minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 58 Thailand minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 59 South Korea minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 60 South Korea minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 61 South Korea minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 62 Latin America minimally invasive surgical instruments market, by region, 2018 - 2030 (USD Million)

Table 63 Latin America minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 64 Latin America minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 65 Latin America minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 66 Brazil minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 67 Brazil minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 68 Brazil minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 69 Mexico minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 70 Mexico minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 71 Mexico minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 72 Argentina minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 73 Argentina minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 74 Argentina minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 75 Middle East and Africa minimally invasive surgical instruments market, by region, 2018 - 2030 (USD Million)

Table 76 Middle East and Africa minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 77 Middle East and Africa minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 78 Middle East and Africa minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 79 South Africa minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 80 South Africa minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 81 South Africa minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 82 Saudi Arabia minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 83 Saudi Arabia minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 84 Saudi Arabia minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 85 UAE minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 86 UAE minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 87 UAE minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 88 Kuwait minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 89 Kuwait minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 90 Kuwait minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 2 North America minimally invasive surgical instruments market, by region, 2018 - 2030 (USD Million)

Table 3 North America minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 4 North America minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 5 North America minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 6 U.S. minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 7 U.S. minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 8 U.S. minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 9 Canada minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 10 Canada minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 11 Canada minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 12 Europe minimally invasive surgical instruments market, by region, 2018 - 2030 (USD Million)

Table 13 Europe minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 14 Europe minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 15 Europe minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 16 UK minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 17 UK minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 18 UK minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 19 Germany minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 20 Germany minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 21 Germany minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 22 France minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 23 France minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 24 France minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 25 Italy minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 26 Italy minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 27 Italy minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 28 Spain minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 29 Spain minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 30 Spain minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 31 Denmark minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 32 Denmark minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 33 Denmark minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 34 Sweden minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 35 Sweden minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 36 Sweden minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 37 Norway minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 38 Norway minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 39 Norway minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 40 Asia Pacific minimally invasive surgical instruments market, by region, 2018 - 2030 (USD Million)

Table 41 Asia Pacific minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 42 Asia Pacific minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 43 Asia Pacific minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 44 Japan minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 45 Japan minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 46 Japan minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 47 China minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 48 China minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 49 China minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 50 India minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 51 India minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 52 India minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 53 Australia minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 54 Australia minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 55 Australia minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 56 Thailand minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 57 Thailand minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 58 Thailand minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 59 South Korea minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 60 South Korea minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 61 South Korea minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 62 Latin America minimally invasive surgical instruments market, by region, 2018 - 2030 (USD Million)

Table 63 Latin America minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 64 Latin America minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 65 Latin America minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 66 Brazil minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 67 Brazil minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 68 Brazil minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 69 Mexico minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 70 Mexico minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 71 Mexico minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 72 Argentina minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 73 Argentina minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 74 Argentina minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 75 Middle East and Africa minimally invasive surgical instruments market, by region, 2018 - 2030 (USD Million)

Table 76 Middle East and Africa minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 77 Middle East and Africa minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 78 Middle East and Africa minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 79 South Africa minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 80 South Africa minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 81 South Africa minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 82 Saudi Arabia minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 83 Saudi Arabia minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 84 Saudi Arabia minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 85 UAE minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 86 UAE minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 87 UAE minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

Table 88 Kuwait minimally invasive surgical instruments market, by device, 2018 - 2030 (USD Million)

Table 89 Kuwait minimally invasive surgical instruments market, by application, 2018 - 2030 (USD Million)

Table 90 Kuwait minimally invasive surgical instruments market, by end use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in North America

Fig. 5 Primary interviews in Europe

Fig. 6 Primary interviews in APAC

Fig. 7 Primary interviews in Latin America

Fig. 8 Primary interviews in MEA

Fig. 9 Market research approaches

Fig. 10 Value-chain-based sizing & forecasting

Fig. 11 QFD modeling for market share assessment

Fig. 12 Market formulation & validation

Fig. 13 Minimally invasive surgical instruments market: market outlook

Fig. 14 Minimally invasive surgical instruments market competitive insights

Fig. 15 Parent market outlook

Fig. 16 Related/ancillary market outlook

Fig. 17 Penetration and growth prospect mapping

Fig. 18 Industry value chain analysis

Fig. 19 Minimally invasive surgical instruments market driver impact

Fig. 20 Minimally invasive surgical instruments market restraint impact

Fig. 21 Minimally invasive surgical instruments market strategic initiatives analysis

Fig. 22 Minimally invasive surgical instruments market: device movement analysis

Fig. 23 Minimally invasive surgical instruments market: device outlook and key takeaways

Fig. 24 Handheld instruments market estimates and forecast, 2018 - 2030

Fig. 25 Inflation devices market estimates and forecast, 2018 - 2030

Fig. 26 Cutter instruments market estimates and forecast, 2018 - 2030

Fig. 27 Guiding devices market estimates and forecast, 2018 - 2030

Fig. 28 Electrosurgical devices market estimates and forecast, 2018 - 2030

Fig. 29 Auxiliary devices market estimates and forecast, 2018 - 2030

Fig. 30 Monitoring & Visualization devices market estimates and forecast, 2018 - 2030

Fig. 31 Minimally invasive surgical instruments market: application movement analysis

Fig. 32 Minimally invasive surgical instruments market: application outlook and key takeaways

Fig. 33 Cardiac market estimates and forecast, 2018 - 2030

Fig. 34 Gastrointestinal market estimates and forecast, 2018 - 2030

Fig. 35 Orthopedic market estimates and forecast, 2018 - 2030

Fig. 36 Vascular market estimates and forecast, 2018 - 2030

Fig. 37 Gynecological market estimates and forecast, 2018 - 2030

Fig. 38 Urological market estimates and forecast, 2018 - 2030

Fig. 39 Thoracic market estimates and forecast, 2018 - 2030

Fig. 40 Cosmetic market estimates and forecast, 2018 - 2030

Fig. 41 Dental market estimates and forecast, 2018 - 2030

Fig. 42 Others market estimates and forecast, 2018 - 2030

Fig. 43 Minimally invasive surgical instruments market: end use movement analysis

Fig. 44 Minimally invasive surgical instruments market: end use outlook and key takeaways

Fig. 45 Hospitals market estimates and forecast, 2018 - 2030

Fig. 46 Ambulatory surgical market estimates and forecast, 2018 - 2030

Fig. 47 Global Minimally invasive surgical instruments market: Regional movement analysis

Fig. 48 Global Minimally invasive surgical instruments market: Regional outlook and key takeaways

Fig. 49 Global market shares and leading players

Fig. 50 North America market share and leading players

Fig. 51 Europe market share and leading players

Fig. 52 Asia Pacific market share and leading players

Fig. 53 Latin America market share and leading players

Fig. 54 Middle East & Africa market share and leading players

Fig. 55 North America: SWOT

Fig. 56 Europe SWOT

Fig. 57 Asia Pacific SWOT

Fig. 58 Latin America SWOT

Fig. 59 MEA SWOT

Fig. 60 North America, by country

Fig. 61 North America

Fig. 62 North America market estimates and forecast, 2018 - 2030

Fig. 63 U.S.

Fig. 64 U.S. market estimates and forecast, 2018 - 2030

Fig. 65 Canada

Fig. 66 Canada market estimates and forecast, 2018 - 2030

Fig. 67 Europe

Fig. 68 Europe. market estimates and forecast, 2018 - 2030

Fig. 69 UK

Fig. 70 UK market estimates and forecast, 2018 - 2030

Fig. 71 Germany

Fig. 72 Germany market estimates and forecast, 2018 - 2030

Fig. 73 France

Fig. 74 France market estimates and forecast, 2018 - 2030

Fig. 75 Italy

Fig. 76 Italy market estimates and forecast, 2018 - 2030

Fig. 77 Spain

Fig. 78 Spain market estimates and forecast, 2018 - 2030

Fig. 79 Denmark

Fig. 80 Denmark market estimates and forecast, 2018 - 2030

Fig. 81 Sweden

Fig. 82 Sweden market estimates and forecast, 2018 - 2030

Fig. 83 Norway

Fig. 84 Norway market estimates and forecast, 2018 - 2030

Fig. 85 Asia Pacific

Fig. 86 Asia Pacific market estimates and forecast, 2018 - 2030

Fig. 87 Japan

Fig. 88 Japan market estimates and forecast, 2018 - 2030

Fig. 89 China

Fig. 90 China market estimates and forecast, 2018 - 2030

Fig. 91 India

Fig. 92 India market estimates and forecast, 2018 - 2030

Fig. 93 Australia

Fig. 94 Australia market estimates and forecast, 2018 - 2030

Fig. 95 Thailand

Fig. 96 Thailand market estimates and forecast, 2018 - 2030

Fig. 97 South Korea

Fig. 98 South Korea market estimates and forecast, 2018 - 2030

Fig. 99 Latin America

Fig. 100 Latin America market estimates and forecast, 2018 - 2030

Fig. 101 Brazil

Fig. 102 Brazil market estimates and forecast, 2018 - 2030

Fig. 103 Mexico

Fig. 104 Mexico market estimates and forecast, 2018 - 2030

Fig. 105 Argentina

Fig. 106 Argentina market estimates and forecast, 2018 - 2030

Fig. 107 Middle East and Africa

Fig. 108 Middle East and Africa market estimates and forecast, 2018 - 2030

Fig. 109 Saudi Arabia

Fig. 110 Saudi Arabia market estimates and forecast, 2018 - 2030

Fig. 111 South Africa

Fig. 112 South Africa market estimates and forecast, 2018 - 2030

Fig. 113 UAE

Fig. 114 UAE market estimates and forecast, 2018 - 2030

Fig. 115 Kuwait

Fig. 116 Kuwait market estimates and forecast, 2018 - 2030

Fig. 117 Participant categorization- Minimally invasive surgical instruments market

Fig. 118 Market share of key market players- Minimally invasive surgical instruments market

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Primary interviews in North America

Fig. 5 Primary interviews in Europe

Fig. 6 Primary interviews in APAC

Fig. 7 Primary interviews in Latin America

Fig. 8 Primary interviews in MEA

Fig. 9 Market research approaches

Fig. 10 Value-chain-based sizing & forecasting

Fig. 11 QFD modeling for market share assessment

Fig. 12 Market formulation & validation

Fig. 13 Minimally invasive surgical instruments market: market outlook

Fig. 14 Minimally invasive surgical instruments market competitive insights

Fig. 15 Parent market outlook

Fig. 16 Related/ancillary market outlook

Fig. 17 Penetration and growth prospect mapping

Fig. 18 Industry value chain analysis

Fig. 19 Minimally invasive surgical instruments market driver impact

Fig. 20 Minimally invasive surgical instruments market restraint impact

Fig. 21 Minimally invasive surgical instruments market strategic initiatives analysis

Fig. 22 Minimally invasive surgical instruments market: device movement analysis

Fig. 23 Minimally invasive surgical instruments market: device outlook and key takeaways

Fig. 24 Handheld instruments market estimates and forecast, 2018 - 2030

Fig. 25 Inflation devices market estimates and forecast, 2018 - 2030

Fig. 26 Cutter instruments market estimates and forecast, 2018 - 2030

Fig. 27 Guiding devices market estimates and forecast, 2018 - 2030

Fig. 28 Electrosurgical devices market estimates and forecast, 2018 - 2030

Fig. 29 Auxiliary devices market estimates and forecast, 2018 - 2030

Fig. 30 Monitoring & Visualization devices market estimates and forecast, 2018 - 2030

Fig. 31 Minimally invasive surgical instruments market: application movement analysis

Fig. 32 Minimally invasive surgical instruments market: application outlook and key takeaways

Fig. 33 Cardiac market estimates and forecast, 2018 - 2030

Fig. 34 Gastrointestinal market estimates and forecast, 2018 - 2030

Fig. 35 Orthopedic market estimates and forecast, 2018 - 2030

Fig. 36 Vascular market estimates and forecast, 2018 - 2030

Fig. 37 Gynecological market estimates and forecast, 2018 - 2030

Fig. 38 Urological market estimates and forecast, 2018 - 2030

Fig. 39 Thoracic market estimates and forecast, 2018 - 2030

Fig. 40 Cosmetic market estimates and forecast, 2018 - 2030

Fig. 41 Dental market estimates and forecast, 2018 - 2030

Fig. 42 Others market estimates and forecast, 2018 - 2030

Fig. 43 Minimally invasive surgical instruments market: end use movement analysis

Fig. 44 Minimally invasive surgical instruments market: end use outlook and key takeaways

Fig. 45 Hospitals market estimates and forecast, 2018 - 2030

Fig. 46 Ambulatory surgical market estimates and forecast, 2018 - 2030

Fig. 47 Global Minimally invasive surgical instruments market: Regional movement analysis

Fig. 48 Global Minimally invasive surgical instruments market: Regional outlook and key takeaways

Fig. 49 Global market shares and leading players

Fig. 50 North America market share and leading players

Fig. 51 Europe market share and leading players

Fig. 52 Asia Pacific market share and leading players

Fig. 53 Latin America market share and leading players

Fig. 54 Middle East & Africa market share and leading players

Fig. 55 North America: SWOT

Fig. 56 Europe SWOT

Fig. 57 Asia Pacific SWOT

Fig. 58 Latin America SWOT

Fig. 59 MEA SWOT

Fig. 60 North America, by country

Fig. 61 North America

Fig. 62 North America market estimates and forecast, 2018 - 2030

Fig. 63 U.S.

Fig. 64 U.S. market estimates and forecast, 2018 - 2030

Fig. 65 Canada

Fig. 66 Canada market estimates and forecast, 2018 - 2030

Fig. 67 Europe

Fig. 68 Europe. market estimates and forecast, 2018 - 2030

Fig. 69 UK

Fig. 70 UK market estimates and forecast, 2018 - 2030

Fig. 71 Germany

Fig. 72 Germany market estimates and forecast, 2018 - 2030

Fig. 73 France

Fig. 74 France market estimates and forecast, 2018 - 2030

Fig. 75 Italy

Fig. 76 Italy market estimates and forecast, 2018 - 2030

Fig. 77 Spain

Fig. 78 Spain market estimates and forecast, 2018 - 2030

Fig. 79 Denmark

Fig. 80 Denmark market estimates and forecast, 2018 - 2030

Fig. 81 Sweden

Fig. 82 Sweden market estimates and forecast, 2018 - 2030

Fig. 83 Norway

Fig. 84 Norway market estimates and forecast, 2018 - 2030

Fig. 85 Asia Pacific

Fig. 86 Asia Pacific market estimates and forecast, 2018 - 2030

Fig. 87 Japan

Fig. 88 Japan market estimates and forecast, 2018 - 2030

Fig. 89 China

Fig. 90 China market estimates and forecast, 2018 - 2030

Fig. 91 India

Fig. 92 India market estimates and forecast, 2018 - 2030

Fig. 93 Australia

Fig. 94 Australia market estimates and forecast, 2018 - 2030

Fig. 95 Thailand

Fig. 96 Thailand market estimates and forecast, 2018 - 2030

Fig. 97 South Korea

Fig. 98 South Korea market estimates and forecast, 2018 - 2030

Fig. 99 Latin America

Fig. 100 Latin America market estimates and forecast, 2018 - 2030

Fig. 101 Brazil

Fig. 102 Brazil market estimates and forecast, 2018 - 2030

Fig. 103 Mexico

Fig. 104 Mexico market estimates and forecast, 2018 - 2030

Fig. 105 Argentina

Fig. 106 Argentina market estimates and forecast, 2018 - 2030

Fig. 107 Middle East and Africa

Fig. 108 Middle East and Africa market estimates and forecast, 2018 - 2030

Fig. 109 Saudi Arabia

Fig. 110 Saudi Arabia market estimates and forecast, 2018 - 2030

Fig. 111 South Africa

Fig. 112 South Africa market estimates and forecast, 2018 - 2030

Fig. 113 UAE

Fig. 114 UAE market estimates and forecast, 2018 - 2030

Fig. 115 Kuwait

Fig. 116 Kuwait market estimates and forecast, 2018 - 2030

Fig. 117 Participant categorization- Minimally invasive surgical instruments market

Fig. 118 Market share of key market players- Minimally invasive surgical instruments market

Companies Profiled

- Medtronic

- Siemens Healthineers AG

- Ethicon, Inc. (Johnson & Johnson Inc.)

- Depuy Synthes

- GE Healthcare

- Abbott Laboratories

- Intuitive Surgical, Inc.

- Arthrocare Corporation

- Nuvasive, Inc.

- Zimmer Biomet

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 114 |

| Published | November 2023 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 31.65 Billion |

| Forecasted Market Value ( USD | $ 63 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |