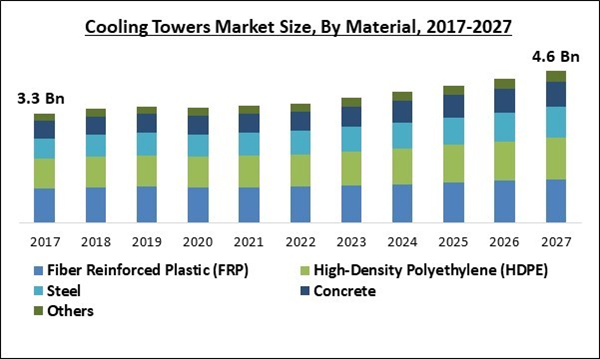

The Global Cooling Towers Market size is expected to reach $4,585.4 million by 2027, rising at a market growth of 4.4% CAGR during the forecast period.

The cooling tower refers to a heat elimination device that transfers heat to the atmosphere by cooling the water stream to a lower temperature. These devices are developed with benefits and challenges across industrial applications like oil & gas, power generation, pharmaceuticals, HVAC, and others. Factors such as the fast pace of industrialization and growing installation of different kinds of devices for cooling towers to minimize wear & tear are acting as growth catalysts for the cooling tower market. Additionally, industries like manufacturing, HVAC, cold storage, renewable energy power plant, and others are increasingly adopting cooling towers.

Cooling towers find potential applications in power plants, specifically in thermoelectric power plants to eliminate extra heat from the plant. The number of power plants is directly proportional to the global demand for electricity, hence opening new growth avenues for the cooling towers market. In addition, the growth for cooling towers is expected to unlock growth prospects due to the increasing number of construction activities across the residential as well as commercial sectors in emerging nations. Moreover, the market growth is further fueled by the high pace of global industrialization.

COVID-19 Impact Analysis

The cooling tower market had suffered a drastic downfall due to the global pandemic and the resulting restrictions & disruptions in supply chain and production activities across a multitude of different industries. Many industries and other market verticals that use cooling towers had witnessed a declined demand for cooling towers. The deployment of cooling towers had significantly reduced by the revenue loss of HVAC and the power generation industries in 2020.

The outbreak of the COVID-19 pandemic has negatively impacted the sales of equipment and machinery during the first quarter of 2020 and is expected to cause an adverse impact on the growth of the market during the year. Major manufacturing economies like the US, China, Italy, Germany, and the UK have the maximum demand for equipment and machinery but these countries were hit hard by the global pandemic which had declined the demand for equipment and machinery.

Market Growth Factors:

The emerging trend of eco-friendly products

One of the key market trends is the growing transition to eco-friendly products due to the rise in environmental concerns. In addition, the changing scenario of government regulations and norms is leading to creating products that cause minimum harm to the environment. For example, in December 2018, the latest requirements under an amendment by the NSW Public Health Regulation 2012 were introduced in order to support the law to effectively manage cooling water systems to avoid the transmission ad growth of the Legionella bacteria. Hence, manufacturers are striving and working towards developing sustainable products.

The advent of modern technologies in cooling towers and growing construction activities

The demand for heating, ventilation, cooling, and refrigeration (HVAC) systems is directly proportional to the rise in construction activities in well-established and emerging countries. This eventually creates the demand for cooling towers, thereby helping the market to expand further. The arrival of the latest technologies in cooling like crossflow designs enables the flexible flow of operation and because of this the water flow rate and energy consumption during cool months is significantly reduced.

Marketing Restraining Factor:

Corrosion and scaling may lead to lower deployment of cooling tower

One of the major concerns among the end-use industries of cooling towers is the issue of corrosion in these towers, which may negatively impact the demand & growth of cooling towers during the forecast period. Water supply often has thick chemicals that could lead to corrosion, hence hampering the efficiency and safety of the equipment. In addition, one of the major obstacles to the growth of the cooling tower market is the massive cost of deployment, repairs, and regular maintenance of the cooling tower.

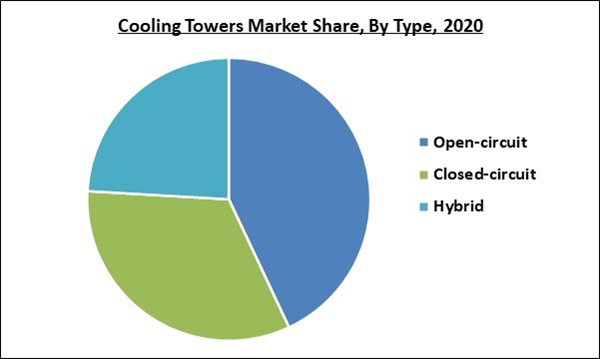

Type Outlook

Based on Type, the Cooling Tower market is segregated into Open-circuit, Closed-circuit, and Hybrid. In 2020, the open-circuit segment procured the maximum revenue share of the cooling tower market. Open-circuit cooling towers have a larger surface area exposed to the atmosphere to boost rapid evaporation and provide a superior cooling effect. These cooling towers provide a high heat rejection capability and hence, are well-suited for cooling large facilities.

Material Outlook

Based on Material, the Cooling Tower market is segmented into Fiber Reinforced Plastic (FRP), Steel, Concrete, Wood, and High-Density Polyethylene (HDPE). The high-density polyethylene (HDPE) segment is likely to exhibit a prominent CAGR during the forecast period. HDPE cooling towers are less costly, have high resistance to corrosion, are lightweight, and thus easy to deploy and transport.

Application Outlook

Based on Application, the Cooling Tower market is classified into HVAC, Power Generation, Oil & Gas, and Industrial. The power generation segment acquired the maximum revenue share in 2020. The new power plants are being set up around the world in order to fulfill the growing demand for power coupled with rapid industrialization. Cooling towers are crucial in eliminating the excessive heat from power plants, thus creating growth possibilities for cooling towers during the forecast period.

Regional Outlook

Based on Region, the Cooling Tower market is analyzed across North America, Europe, APAC, and LAMEA. In 2020, the APAC emerged as the leading region by obtaining the maximum revenue share in the cooling tower market. Factors such as the rapid rate of industrialization and the surge in the number of manufacturing units are expected to create lucrative growth opportunities for the regional market. The adoption of cooling towers is expected to be driven by the rising number of government initiatives towards building nuclear power plants. Moreover, the growth of the regional market is expected to be further boosted by the thriving IT and telecommunications industry across this region.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Baltimore Aircoil Company Inc., ENEXIO Water Technologies GmbH, Hamon & CIE International SA, B&W Spig S.P.A., SPX Corporation, Paharpur Cooling Tower Limited, Brentwood Industries, Inc., Johnson Controls Inc., Engie Refrigeration GmbH, and EVAPCO, Inc.

Recent Strategies Deployed in Cooling Towers Market

Partnerships, Collaborations and Agreements:

- Oct-2021: Hamon signed an agreement with EEW Energy from Waste GmbH, a leader in the generation of electricity and heat from thermal waste treatment. Under this agreement, Hamon is expected to manufacture a 6-module Air Cooled Condenser including the steam duct and the required auxiliary equipment for the latest EEW 120 MW plant at the Stapelfeld site in Germany.

- May-2021: ENEXIO Water Technologies formed a partnership with Hagbros Precision, a company that manufactures machinery and offers services like machined components, welding, fabrication, coatings & design. The partnership aimed to boost ENEXIO Water Technologies’ growth in the U.S. market. Following the partnership, Hagbros is expected to become a leading maker of ENEXIO Water Technologies’ manufacturing, distribution, and installation of water treatment components in the USA.

- Oct-2020: Hamon entered into a partnership with ACCIONA Construction Australia, a global group that develops and manages sustainable infrastructure solutions. Through this partnership, Hamon is expected to design, supply, and deliver Air Cooled Condenser for the new Energy from Waste Plant in East Rockingham, Australia.

- Oct-2020: Babcock & Wilcox signed an agreement with a pulp mill operated by LD Celulose in the Triângulo Mineiro region in Brazil. Following the agreement, the B&W Environmental segment of Babcock & Wilcox is expected to design and supply its extremely effective SPIG cooling towers to this pulp mill. Moreover, specialized SPIG cooling solutions of B&W Environmental can be customized for the requirements of the pulp & paper industry and for soluble cellulose production,

- Sep-2020: Babcock & Wilcox came into a partnership with Naturgy Generación, a group that is engaged in the generation, distribution, and marketing of energy and services. Through this partnership, the B&W Environmental segment of Babcock & Wilcox deployed the latest cooling tower system for Naturgy Generación’s combined-cycle natural gas power plant in Puerto de Sagunto, Spain. This system is developed to decrease water usage and dependency on chemicals for water treatment.

- Jan-2020: SPIG, a subsidiary of Babcock & Wilcox Enterprises signed a USD 1 million agreement with Hyundai Engineering, a major construction company in South Korea. The agreement aimed to develop and supply a seven-cell, fiberglass-reinforced plastic (FRP) cooling tower for a polypropylene manufacturing unit in Poland. The advanced cooling tower systems of SPIG are suitable for the demanding conditions found in petrochemical facilities.

Acquisitions and Mergers:

- Jul-2021: Baltimore Aircoil took over Eurocoil, a leading manufacturer of heat exchangers in Italy. The acquisition aimed to expand the manufacturing capabilities of Baltimore Aircoil in the country while integrating extra heat exchanger capabilities to BAC's current evaporative hybrid and adiabatic cooling products.

- Apr-2021: Hamon joined hands with ADC Energy, a leading company in providing EPC (Engineer, Procure and Construct) solutions for Industrial and Commercial Cooling, Heating, Refrigeration, and Energy Systems. Through this collaboration, Hamon is expected to offer a 30 module ACC that contributes to the World’s largest Energy from Waste Plant in Dubai, one of the several projects for the conservation of natural resources, rationalized consumption, and the inclusion of alternative and renewable energy resources in Dubai’s energy mix.

Product Launches and Product Expansions:

- Aug-2021: Brentwood rolled out ShockWave & ThermaCross, the two latest fill media products at POWER-GEN International. Through this launch, the company aimed to transform the respective markets of these products within the cooling tower industry. ShockWave is expected to become the latest standard for power plants and refineries, and ThermaCross becomes a true game-changer for cross-fluted, high-efficiency fills.

- Apr-2021: Brentwood unveiled its all-new separator system. This system is developed for utilization in counterflow and crossflow cooling tower applications. Moreover, the system supports a wide range of cooling tower products Brentwood supplies to the industry such as fills, drift eliminators, and inlet louvers.

- May-2020: Baltimore Aircoil introduced advancements in Nexus Modular Hybrid Cooler, the world’s first intelligent, plug-and-play, modular hybrid fluid cooler for HVAC and light industrial applications. The Nexus Cooler is known for minimum installation costs, maintenance costs, operating costs, and highest uptime. Moreover, the cooler is expected to offer optimal water quality using advanced water management.

Geographical Expansions:

- Jan-2021: Babcock & Wilcox expanded its reach in Asia and the Middle East by undertaking growth and expansion initiatives. Through this expansion, the company continues to leverage its industry-leading technologies and robust operational presence in Asia and the Middle East to offer sophisticated environmental solutions for its customers.

Scope of the Study

Market Segments Covered in the Report:

By Material

- Fiber Reinforced Plastic (FRP)

- High-Density Polyethylene (HDPE)

- Steel

- Concrete

- Others

By Type

- Open-circuit

- Closed-circuit

- Hybrid

By Application

- HVAC

- Power Generation

- Oil & Gas

- Industrial

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Baltimore Aircoil Company Inc.

- ENEXIO Water Technologies GmbH

- Hamon & CIE International SA

- B&W Spig S.P.A.

- SPX Corporation

- Paharpur Cooling Tower Limited

- Brentwood Industries, Inc.

- Johnson Controls Inc.

- Engie Refrigeration GmbH

- EVAPCO, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Baltimore Aircoil Company Inc.

- ENEXIO Water Technologies GmbH

- Hamon & CIE International SA

- B&W Spig S.P.A.

- SPX Corporation

- Paharpur Cooling Tower Limited

- Brentwood Industries, Inc.

- Johnson Controls Inc.

- Engie Refrigeration GmbH

- EVAPCO, Inc.