The growing emphasis on digital transformation and secure online transactions has further propelled the adoption of AES, making it a preferred choice for businesses that seek a reliable yet flexible electronic signing solution. The high revenue share attributed to AES demonstrates the market's confidence in its capability to safeguard digital documents while maintaining operational efficiency.

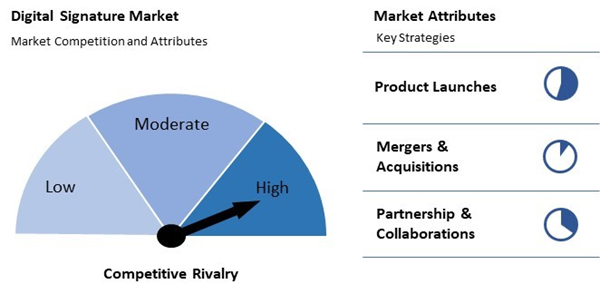

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2025, DocuSign, Inc. launched a new Partner Program to accelerate growth in eSignature and Intelligent Agreement Management. With specializations, tailored tracks, and go-to-market support, the program empowers partners to deliver greater customer value across digital signature and agreement management solutions. Moreover, In October, 2024, GMO GlobalSign Pte. Ltd. has expanded its capabilities by integrating its Digital Signing Solution with Inspire-Tech’s EasiShare, enhancing document workflows in highly regulated industries. This expansion improves security, ensures compliance, boosts efficiency through automated digital signatures, reduces costs, and safeguards document integrity.

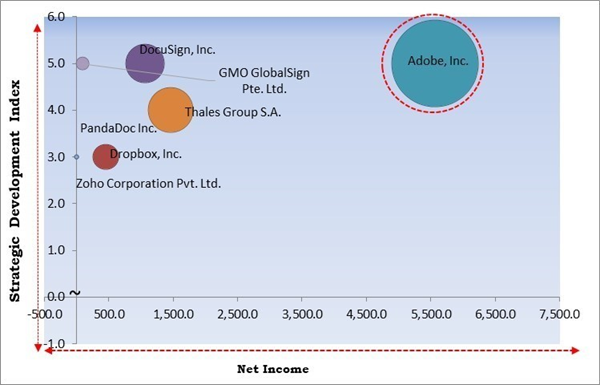

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Adobe, Inc. is the forerunners in the Digital Signature Market. In December 2024, Adobe, Inc. launched a next-generation Acrobat Sign experience, featuring native PDF rendering, improved navigation, real-time progress tracking, and enhanced accessibility. These updates streamline e-signature workflows across desktop and mobile, boosting agreement completion rates and delivering a more intuitive, user-friendly signing process. Companies such as Thales Group S.A. and DocuSign, Inc. are some of the key innovators in Digital Signature Market.

COVID-19 Impact Analysis

During the COVID-19 pandemic, the global shift towards remote work environments led to a significant surge in demand for secure and efficient digital transaction solutions. Organizations across sectors adopted digital signatures to authenticate documents without the need for physical presence, ensuring continuity of business operations even during lockdowns. The pandemic accelerated digital transformation initiatives for both private and public sector organizations. Many businesses and government agencies fast-tracked the adoption of digital solutions, including digital signatures, to facilitate remote onboarding, contract management, and approvals. This transition not only increased operational efficiency but also reduced dependency on manual paperwork. Governments and regulatory authorities around the world recognized the need for secure digital interactions. As a result, there was a notable relaxation and clarification of regulations around the use of digital and electronic signatures. Thus, the COVID-19 pandemic had a positive impact on the market.Driving and Restraining Factors

Drivers

- Accelerating Digital Transformation And Paperless Initiatives

- Growing Legal Recognition And Regulatory Support

- Increasing Security And Fraud Prevention Requirements

- Expansion Of Remote Work And Globalization Of Business

Restraints

- Regulatory And Legal Uncertainties Across Regions

- Concerns Regarding Security And Authentication

- Limited Awareness And Resistance To Change Among End-Users

Opportunities

- Rising Adoption Of Digital Transformation Initiatives Across Sectors

- Expansion In Regulated And High-Security Industries

- Emergence Of New Use Cases With Advanced Technologies

Challenges

- Evolving Cybersecurity Threats And Trust Deficit

- Interoperability And Standardization Complexities

- User Experience, Accessibility, And Change Management Issues

Market Growth Factors

In the modern business environment, organizations across sectors are rapidly embracing digital transformation to streamline operations, increase efficiency, and stay competitive. One of the central aspects of this transformation is the move toward paperless workflows. The adoption of digital signatures is instrumental in this journey, allowing enterprises to replace traditional ink-based signatures with electronic alternatives that are not only secure but also easily integrated into digital platforms. Digital signatures enable organizations to digitize contract management, approval processes, and document workflows, drastically reducing reliance on paper. In conclusion, the accelerating shift toward digital transformation and paperless initiatives is a primary driver for the digital signature market.Additionally, the expansion of legal frameworks and regulatory support for digital signatures is another crucial driver of the market. Over the past decade, governments around the world have enacted laws and standards that grant digital signatures the same legal standing as handwritten ones, provided certain conditions are met. This legal recognition is a pivotal enabler, reassuring businesses and individuals that digital agreements are enforceable and trustworthy. Thus, growing legal recognition and regulatory support are foundational drivers of the digital signature market.

Market Restraining Factors

The digital signature market, while enjoying widespread adoption in several developed economies, continues to be hampered by a lack of uniformity and clarity in regulatory and legal frameworks across different countries and regions. In many jurisdictions, laws governing the validity, usage, and enforcement of digital signatures remain ambiguous or are still evolving. Some countries have robust e-signature laws that recognize digital signatures as equivalent to handwritten ones, such as the eIDAS regulation in the European Union and the ESIGN Act in the United States. In summary, the lack of standardized and clearly defined regulatory frameworks across regions remains a primary barrier to the seamless adoption of digital signature solutions, forcing businesses to navigate a complex legal landscape that discourages large-scale implementation and stifles innovation.Value Chain Analysis

The Digital Signature market value chain begins with technology development and standards formation, laying the groundwork for secure solutions. Product design and software development follow, integrating Certificate Authority (CA) services and identity provisioning to ensure trust and authenticity. The process continues with integration and deployment, supported by user education and training to maximize adoption. Post-deployment monitoring and support ensure ongoing reliability, while compliance and legal frameworks uphold regulatory alignment. Finally, marketing and sales strategies, product innovation, and partnerships drive growth and ecosystem expansion, creating a continuous improvement loop.

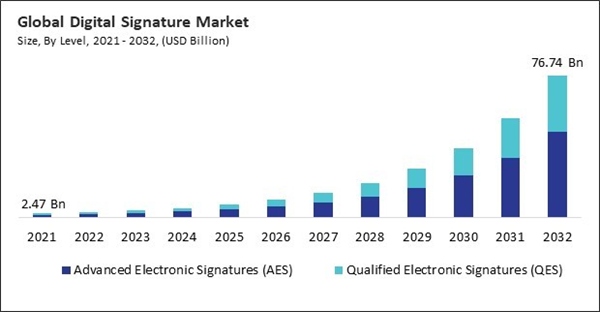

Level Outlook

Based on level, the market is characterized into advanced electronic signatures (AES) and qualified electronic signatures (QES). The qualified electronic signatures (QES) segment procured 37% revenue share in the market in 2024. QES is typically used in contexts governed by strict regulations, such as public sector transactions, legal agreements, and cross-border operations within regions that enforce eIDAS or similar standards. The deployment of QES often involves rigorous identity verification procedures and the use of secure signature creation devices, ensuring that the signatory’s identity is beyond dispute.Component Outlook

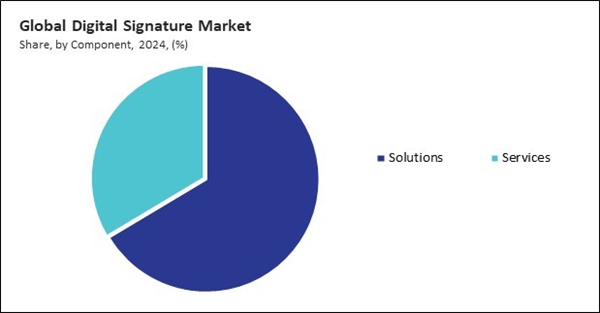

On the basis of component, the market is classified into solutions and services. The services segment recorded 34% revenue share in the market in 2024. Digital signature services typically include consulting, integration, deployment, training, and support services that help organizations effectively implement and manage digital signature technologies. These services are crucial for businesses seeking tailored solutions, seamless integration with existing systems, and ongoing technical support.Deployment Model Outlook

By deployment model, the digital signature market is divided into cloud and on-premise. The on-premise segment garnered 28% revenue share in the digital signature market in 2024. On-premise digital signature solutions are installed and managed within a company’s own IT infrastructure, offering greater control over data and system configurations. This model is often favored by institutions operating in highly regulated industries such as banking, government, and healthcare, where stringent data privacy and compliance standards must be met.End Use Outlook

By end use, the digital signature market is categorized in the businesses, organizations, and individuals. The organizations segment acquired 25% revenue share in the digital signature market in 2024. This segment typically includes government bodies, non-profit organizations, and educational institutions that rely on digital signatures for secure, efficient, and transparent document management. Organizations benefit from using digital signatures to improve the traceability of approvals, protect sensitive information, and ensure compliance with both internal and external regulations.Industry Vertical Outlook

On the basis of industry vertical, the digital signature market is segmented into BFSI, healthcare & life sciences, IT & telecom, government, and retail. The healthcare & life sciences recorded 20% revenue share in the digital signature market in 2024. Hospitals, clinics, pharmaceutical companies, and research organizations are leveraging digital signatures to streamline patient onboarding, consent management, and the handling of sensitive medical records. The necessity to comply with regulations such as HIPAA and other data privacy standards has further driven the adoption of these solutions.Regional Outlook

Region-wise, the digital signature market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment recorded 36% revenue share in the digital signature market in 2024. The strong performance of this region can be attributed to the widespread adoption of advanced digital technologies, a robust regulatory framework supporting electronic signatures, and a highly developed digital infrastructure. Businesses and governments across the region are increasingly investing in secure authentication methods to facilitate seamless digital transactions, minimize fraud, and enhance customer trust.Market Competition and Attributes

The Digital Signature Market remains Highly competitive, driven by regional vendors and emerging startups offering affordable, compliant, and user-friendly solutions. These players cater to SMEs and niche sectors, focusing on innovation, integration capabilities, and data security. While lacking the scale of major firms, they contribute to a fragmented yet dynamic market with room for differentiation and growth.

Recent Strategies Deployed in the Market

- Mar-2025: DocuSign, Inc. has partnered with Algebrik AI to integrate its e-signature technology into Algebrik’s AI-driven loan origination system, enabling secure, automated, and real-time digital agreement workflows that enhance compliance, speed, and efficiency for digital lenders.

- Jan-2025: GlobalSign partners with Quantum PKI to resell its products and guide U.S. customers toward Post-Quantum Cryptography (PQC) solutions. The collaboration aims to enhance digital security, including digital signatures, addressing future challenges posed by quantum computing.

- Mar-2024: PandaDoc launched "Rooms," a centralized digital hub for organizing and sharing sales content, enhancing collaboration and buyer engagement. Integrated with its eSignature platform, Rooms accelerates deal cycles, streamlines decision-making, and supports personalized, secure, end-to-end document workflows for sales teams.

- Dec-2023: Thales Group S.A. has acquired Imperva, enhancing its cybersecurity portfolio. This move strengthens Thales' ability to protect applications, data, and identities, positioning it as a global leader in cybersecurity. The acquisition will foster growth and innovation in securing digital ecosystems.

- Mar-2023: Adobe, Inc. and BlackBerry partnered to offer a secure mobile solution enabling electronic signatures via Adobe Experience Manager Forms and BlackBerry UEM. This integration supports regulated industries by allowing secure, VPN-free document signing on mobile devices, enhancing productivity and digital workflow efficiency.

List of Key Companies Profiled

- DocuSign, Inc.

- Adobe, Inc.

- PandaDoc Inc.

- Dropbox, Inc.

- Zoho Corporation Pvt. Ltd.

- Thales Group S.A.

- GMO GlobalSign Pte. Ltd (GMO Internet Group, Inc.)

- IdenTrust, Inc. (HID Global Corporation)

- Sertifier INC.

- GetAccept, Inc.

Market Report Segmentation

By Level

- Advanced Electronic Signatures (AES)

- Qualified Electronic Signatures (QES)

By Component

- Solutions

- Services

By Deployment Model

- Cloud

- On-premise

By End Use

- Businesses

- Organizations

- Individuals

By Industry Vertical

- BFSI

- Healthcare & Life Sciences

- IT & Telecom

- Government

- Retail

- Other End User

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- DocuSign, Inc.

- Adobe, Inc.

- PandaDoc Inc.

- Dropbox, Inc.

- Zoho Corporation Pvt. Ltd.

- Thales Group S.A.

- GMO GlobalSign Pte. Ltd (GMO Internet Group, Inc. )

- IdenTrust, Inc. (HID Global Corporation)

- Sertifier INC.

- GetAccept, Inc.