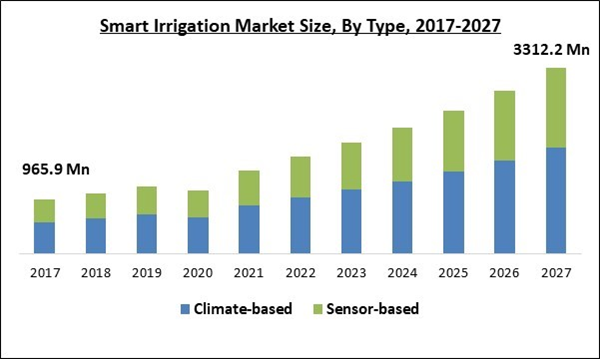

The Global Smart Irrigation Market size is expected to reach $3,312.2 million by 2027, rising at a market growth of 14.3% CAGR during the forecast period.

Irrigation is one of the crucial processes in agriculture, in which farmers manage the amount of water given to the plants at a fixed interval of time. With the advancement in agricultural technologies, many advanced agricultural systems and solutions are introduced to the market, which save the time and efforts of the farmers. One such solution is smart irrigation that provides efficient and timely management of different kinds of irrigation systems like drip, sprinkler, surface, pivot, center, and manual to help in the conservation of time and water resources.

Smart irrigation systems are the integration of numerous advanced solutions that helps farmers for remote supervision and automation of the irrigation procedure. These systems generally consist of controllers, sensor-based sprinklers, and water meters to evaluate soil nutrient content, moisture, humidity, and salinity levels.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic has negatively impacted the smart irrigation market. Various sectors of the economy including the agricultural sector have witnessed severe disruption in its demand and growth. However, the pandemic has created more awareness among farmers about the prevalence and operations of different smart technologies and systems, which is escalating the requirement for automation technologies & systems in agriculture sector like temperature sensors, rain sensors, soil moisture sensors, climate sensors, and fertigation sensors.

In addition, the capability of irrigation controllers to remotely access and monitor fields along with getting adequate inputs from the farms is expected to support the growth of the smart irrigation market in the post-COVID-19 period.

Market Growth Factors:

Increase in the number of smart cities along with the high requirement for effective irrigation systems

Smart irrigation systems are widely used in building smart cities in order to conserve water. The concept of a smart city is gaining more momentum across various nations of the world since this concept focuses on the sustainable management of water in commercial and residential spaces. The growing urbanization is leading to the reduction in the green cover to make a pathway for concrete infrastructure, which makes it essential to manage the green balance and thus, implement smart irrigation concept for it.

Improvements in technologies and the emergence of 5G network

With the introduction of 5G network, companies are highly inclining towards making their products more advances and easier to utilize, which is benefitting farmers and residential users. In the past few years, conventional hardwire systems are improved and updated to wireless data communication systems. These advanced wireless sensors provide convenience & mobility and the introduction of radiofrequency technology in irrigation with wireless signal communication systems is expected to offer better connectivity.

Market Restraining Factor:

The huge cost attached to smart irrigation systems

Smart irrigation systems have a high cost of implementation, which restricts many farmers from its adoption and thus, hinders the growth of the smart irrigation market in the upcoming years. In addition, this high cost is expected to limit the access of the latest technology to big and industrialized farms, and thus, hamper the growth of the smart irrigation market. At present, numerous advantages of information & communications technology integrated with irrigation systems are highly restricted to advanced nations with an aim at the production of widely used and grown crops like maize, wheat, and rice.

Type Outlook

Based on type, the market is segmented into Climate based and Sensor based. The sensor-based system segment is projected to display the highest CAGR over the forecast period. It is due to the growing adoption of sensor-based systems in the agricultural sector in order to conserve water and improve crop yield.

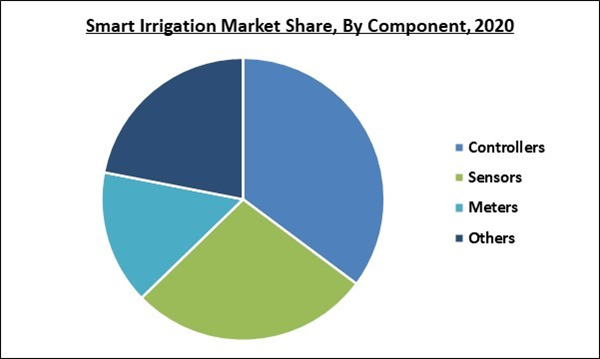

Component Outlook

Based on Component, the market is segmented into controllers, sensors, Meters, and Others. Among these, the sensor-based irrigation controller segment is estimated to record the fastest growth rate over the forecast period. This growth is attributed to the aspects like shifting climatic conditions, an increase in the number of strict environmental regulations, and rising requirements for enhancing crop productivity.

End Use Outlook

Based on End Use, the market is segmented into agricultural, Golf Course, Residential, and Others. The residential segment is estimated to witness a significant growth due to the increasing construction activities of homes and development of various smart city projects across the globe. Along with that, the growing rate of changing traditional timer-based controllers with the latest smart irrigation controllers by residential homeowners & contractors is expected to support the growth of the segment.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. The Asia Pacific region is estimated to showcase the fastest growth rate in the smart irrigation market over the forecast period. It is due to the aspects like the high adoption of smart devices, which can control the smart irrigation systems remotely to get the access of field information, increase in adoption of IoT-based irrigation systems across nations like China and India, and rise in investments in the ag-tech industry of the region.

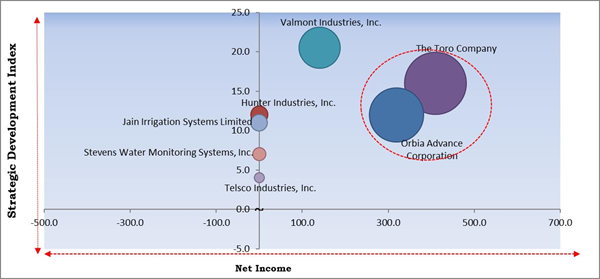

Cardinal Matrix - Smart Irrigation Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the analysis presented in the Cardinal matrix; The Toro Company and Orbia Advance Corporation are the forerunners in the Smart Irrigation Market. Companies such as Hunter Industries, Inc., Jain Irrigation Systems Limited and Stevens Water Monitoring Systems, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include The Toro Company, Valmont Industries, Inc., Orbia Advance Corporation (Netafilm Ltd.), Hunter Industries, Inc., Jain Irrigation Systems Limited, Galcon Ltd., Telsco Industries, Inc. (Weathermatic), Stevens Water Monitoring Systems, Inc., Banyan Water, Inc., and AquaSpy, Inc.

Recent Strategies Deployed in Onion Oil Market

Partnerships, Collaborations and Agreements:

- Aug-2021: Jain Irrigation Systems and its subsidiary, NaanDanJain Irrigation, collaborated with The Consulate General of Israel to South India and the United Planters’ Association of Southern India (UPASI). Through this collaboration, the entities released a smart IoT irrigation project in a tea plantation, near Ooty. Smart IoT irrigation is an advanced technique that originates from Israel and uses water smartly and assists the farmers to attain higher crop production to less amount of water.

- Apr-2021: The Toro Company partnered with M. H. Al Mahroos, a construction & industrial equipment trading company. Through this partnership, The Toro Company is expected to offer a variety of next-generation irrigation equipment and the latest associated technologies to M. H. Al Mahroos.

- Jul-2020: Netafim collaborated with Sentek, a Leader in soil sensor technologies. Under this collaboration, Netafim aimed to improve its digital farming solution portfolio into Industry-Leading Soil Sensor Technology of Sentek. In addition, the two companies is expected to provide the ability to farmers to tailor their digital farming solutions as per their requirements.

- Mar-2020: Netafim entered into collaboration with FluroSat, a leader in remote field sensing and analytics. The collaboration aimed to integrate NetBeat, automated irrigation and fertigation cloud-based platform of Netafim, into the data of FluroSat. Through this collaboration, the customers of Netafim is expected to get access to next-generation crop monitoring instruments as an independent monitoring and analysis service or directly integrated into NetBeat.

- Jan-2020: Netafim collaborated with Arable Labs, a leading innovative field sensing and Analytics Company. Through this collaboration, the company is expected to combine Arable's data into NetBeat, autonomous irrigation and fertigation cloud-based platform of Netafim. In addition, this integration is expected to offer simple, accurate, and trustable fertigation, irrigation, and crop management decisions.

Product Launches and Product Expansions:

- Jun-2021: Hunter industries integrated Wireless HC Flow Meter communication kit into Hydrawise. Through this integration, the company optimizes the time, material, and labor savings of any new installation and retrofit project.

- May-2021: Netafim rolled out the AlphaDisc filter. Through this launch, the company aimed to defend irrigation systems from clogging which is occurred due to organic contaminants, and allow the growers to more evenly irrigate the crops for improved productivity, and drive cost savings.

- Feb-2021: The Toro company introduced new improvements in Lynx central control system. Through this expansion, The Toro Company is expected to simplify irrigation management for course administrators by offering them a map view of their Precip Management Group and the planned amount of irrigation.

- Nov-2020: The Toro Company introduced more cloud-based functionalities in its Lynx Central Control System. Through this launch, The Toro Company is expected to offer the course superintendent higher control over the situation of the course.

- May-2020: Valley Irrigation unveiled Valley 365 Connected Crop Management. The new solution is expected to allow the growers to have the best technology. Moreover, the solution offers better efficiency, the knowledge to make informed decisions, and facilitates advancements in precision irrigation.

- Mar-2020: Jain Irrigation rolled out JAIN Unity, an automatic irrigation control system and environmental data services platform. Through this launch, the company aimed to provide direct access to its customers to monitor the requirement of water by the plant in their area, real-time visibility, and the efficiency of their irrigation system to minimize wastage of water.

Acquisitions and Mergers:

- May-2021: Valmont Industries completed the acquisition of Prospera Technologies, an Israeli crop analytics startup. Through this acquisition, Valmont industries aimed to strengthen and expand the overall addressable market. In addition, the acquisition is expected to enable the company’s growth in the future through data analytics and insights based on subscriptions.

- Apr-2021: Valley Irrigation acquired PivoTrac, an ag-tech company in Texas Panhandle. Through this acquisition, the company is expected to modernize its technology strategy and strengthen its rank by raising the number of connected agricultural instruments to above 123,000, the largest in the industry of irrigation.

- Mar-2021: The Toro Company acquired Left Hand Robotics, a provider of robotic solutions for mowing jobs. The acquisition aimed to strengthen the company’s portfolio in advanced technologies consisting of smart-connected, alternative power, and autonomous products.

- Feb-2021: The Toro Company took over TURFLYNX, a developer of autonomous mowing equipment. The acquisition aimed to improve the company’s offerings in three technology domains viz. alternate energy, smart-connected and autonomous products.

- Aug-2020: Valley Irrigation acquired PrecisionKing, an ag-tech company based in Mississippi. The acquisition strengthened the company's position in Missipissi and introduced additional methods of irrigation like a flood. In addition, the company extended its best-in-the-industry network of associated devices.

Scope of the Study

Market Segments Covered in the Report:

By Type

- Climate Based

- Sensor Based

By Component

- Controllers

- Sensors

- Meters

- Others

By End Use

- Agriculture

- Golf Course

- Residential

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- The Toro Company

- Valmont Industries, Inc.

- Orbia Advance Corporation (Netafilm Ltd.)

- Hunter Industries, Inc.

- Jain Irrigation Systems Limited

- Galcon Ltd.

- Telsco Industries, Inc. (Weathermatic)

- Stevens Water Monitoring Systems, Inc.

- Banyan Water, Inc.

- AquaSpy, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- The Toro Company

- Valmont Industries, Inc.

- Orbia Advance Corporation (Netafilm Ltd.)

- Hunter Industries, Inc.

- Jain Irrigation Systems Limited

- Galcon Ltd.

- Telsco Industries, Inc. (Weathermatic)

- Stevens Water Monitoring Systems, Inc.

- Banyan Water, Inc.

- AquaSpy, Inc.