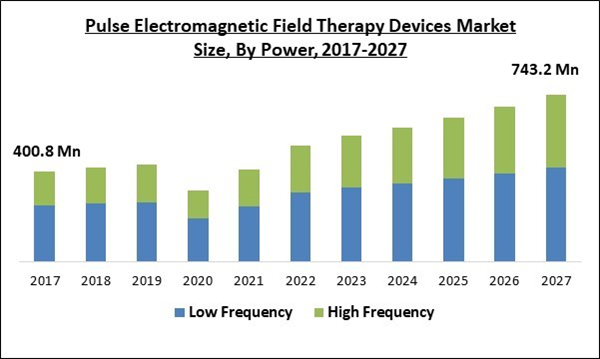

The Global Pulse Electromagnetic Field Therapy Devices Market size is expected to reach $743.21 million by 2027, rising at a market growth of 10.3% CAGR during the forecast period.

Pulse Electromagnetic Field (PEMF) therapy devices are popular for their secure and non-invasive nature with minimized side effects. Also, PEMF therapy offers a unique method for treating several types of musculoskeletal disorders. PEMF devices exhibit many advantages such as reducing chronic and severe pain associated with various connective tissues like ligaments, tendon, bone, cartilage injury, and edema & inflammation control. Therefore, the growth of the market is expected to be fuelled by the advantages offered by these devices.

Acute spinal injuries and delayed union & non-union fractures are caused by road accidents and trauma and these injuries need appropriate surgical procedures. Also, the PEMF therapy devices support the growth of bones throughout the treatment of delayed unions, new fractures, failed spinal fusions, and fracture non-union.

As per the recent findings of the World Health Organization, the number of people aged 60 years or above is expected to increase from 900 million to 2 billion from 2015 to 2050. This growing aging population is expected to require pulse electromagnetic field therapy devices, thereby creating lucrative growth opportunities for the players operating in the pulse electromagnetic field therapy devices market during the forecasting period.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic has created the need for non-clinical remote professionals. Along with this, the industry players in the pulse electromagnetic field therapy devices are increasing the supply via eCommerce platforms so as to continue to provide these pain-relief devices to the patients as well as the healthcare institutions.

However, the demand for these devices was also hampered during the pandemic as many people prefer to treat themselves at home due to the fear of getting infected by the deadly coronavirus. Additionally, the hospitals also eliminated non-urgent treatments including pain-relief procedures which hampered the demand for these devices in the market.

Market Growth Factors:

Growing incidences of fractures due to fall, accidents, and sports injuries

Around the world, a significant portion of the population is suffering from pain because of the fractures that occurred by sports injuries, accidents, falls from a specific height, and signs like arthritis, knee pain, and joint pain. According to the statistics of WHO, around 1.3 million deaths occur annually because of road traffic accidents. In addition, low- and middle-income countries witness a major portion of the global fatalities on the road.

Poor conditions of roads in various countries

Poorly maintained roads can cause different types of injuries and pain in various parts of the body. Factors such as potholes, uneven roads, broken surfaces, and cracking of the road can hurt a pedestrian which is expected to require medical attention. Also, the lack of focus of the governments to improve the road infrastructure increases the possibilities of accidents and other injuries which could cause severe pain, thus increasing the healthcare burden on the individuals.

Market Restraining Factor:

Risk of failure and product recall

With the low availability of suitable infrastructure needed for the utilization of these devices, there is an immense risk of failure of the devices. Lack of infrastructure means the absence of knowledge and resources required to operate the pulse electromagnetic field therapy devices. Instead of treating the pain, defective devices can increase the pain level which is expected to seriously hamper the growth of the pulse electromagnetic magnetic fields therapy devices market in the upcoming years.

Power Outlook

Based on power, the PEMF therapy devices market is segmented into low frequency and high frequency. In 2020, the low-frequency power segment acquired the maximum revenue share of the market. In addition, low-frequency PEMF devices are capable of delivering magnetic fields with generally medium-high intensities but at less frequency. Besides, these devices are utilized to treat delayed bone union and hard tissues.

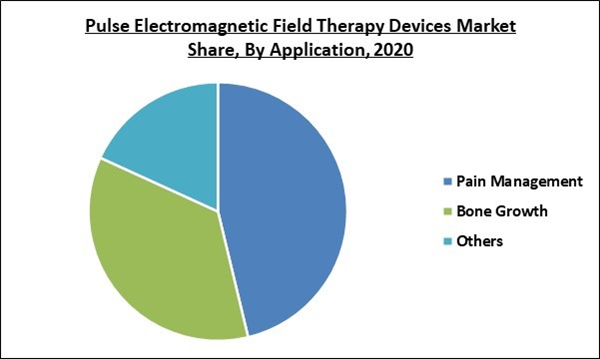

Application Outlook

Based on the Application, the Pulse Electromagnetic Field Therapy Devices Market is segregated into Pain Management, Bone Growth, and Others. The pain management segment procured the largest revenue share of the market. In addition, PEMF therapy devices offer an ideal magnetic field that can decrease pain by improving the expansion and contraction of cells and also by detoxicating and reproducing the harmed cells. Additionally, the cases of chronic diseases are constantly increasing around the world.

End Use Outlook

Based on End-use, the Pulse Electromagnetic Field Therapy Devices Market is segmented into Hospitals, Home Care Settings, and Others. The hospitals segment acquired the maximum revenue share of the market. Patients highly prefer to visit hospitals for the treatment of chronic pain and various bone diseases such as osteoporosis, osteoarthritis, and among others. Additionally, the growth of the segment is expected to witness bright prospects due to the rise in the number of hospital admissions of patients experiencing fractures, spinal injuries, road accidents, and traumatic injuries.

Regional Outlook

Based on the Region, the pulse electromagnetic field therapy devices market is analyzed across North America, Europe, APAC, and LAMEA. In 2020, North America emerged as the leading region of the market by obtaining the largest revenue share of the market. The demand for PEMF therapy devices in the region is expected to be driven by the growing cases of osteoarthritis and osteoporosis among the people in the region. Further, as the US is home to sophisticated Healthcare infrastructure, the demand and growth of PEMF therapy devices is expected to increase in the region over the forecast period.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Bedfont Scientific Ltd., Orthofix Medical, Inc., I-Tech Medical Division (I.A.C.E.R. Srl), Oska Wellness, Inc., Nuage Health Devices Pvt. Ltd., Sedona Wellness, Bemer USA, LLC, Pulsed Energy Technologies LLC, and HealthyLine.

Recent Strategies Deployed in Pulse Electromagnetic Field Therapy Devices Market

- Aug-2021: BEMER unveiled its latest Go-Edition to assist enhance health and well-being on the go. The new portable set utilizes a low intensity pulsed electromagnetic field (PEMF) to improve muscle conditioning, performance, strength, and recovery. Moreover, the Go-Edition is classified as a Class 11 approved FDA medical device.

- Apr-2021: Orthofix signed an agreement with IGEA S.p.A, a biomedical company and a world leader in biophysical therapies. Under this agreement, the two companies is expected to expand the range of bone, cartilage, and soft tissue stimulation products across the United States and Canada.

- Sep-2020: OSKA Wellness rolled out OSKA Pulse, it's PEMF (Pulsed-Electromagnetic-Field-Therapy) technology-enabled products in India. In addition, OSKA pulse utilizes PEMF technology, which is scientifically tested its efficiency in pain reduction and enhancement in functional movements along with exercises in Patients that face lower back pain, scapular dysfunction, and calf muscle pull.

- Feb-2020: Orthofix launched the next-generation of STIM onTrack, mobile app version 2.1 which is approved by the FDA. The new STIM onTrack mobile app version 2.1 is developed to enhance the treatment with the help of CervicalStim, SpinalStim, and PhysioStim bone growth stimulators by enabling patients to remotely share PROM data along with device usage data, with their treating physician.

- May-2019: Oska Wellness entered into a partnership with the South Dakota Association of Healthcare Organizations (SDAHO). Following the partnership, SDAHO is expected to help Oska Wellness to increase the accessibility of its drug-free wearable technology to everyone who is troubled with pain in South Dakota.

- Apr-2019: BEMER expanded its geographical reach by introducing BEMER Pulsed Electromagnetic Field (PEMF) technology across Canada. Through this, the company aimed to provide BEMER technology with an aim to enhance the health, well-being, and quality of life among Canadian citizens.

- Mar-2018: Orthofix received approval of the U.S. FDA and European CE Mark for its advanced PhysioStim bone growth stimulators. This PhysioStim device offers a non-surgical treatment alternative for patients having a nonunion fracture to an extreme extent that has displayed no apparent signs of healing.

- Jan-2017: Orthofix got the approval of the U.S. FDA and European CE Mark for its advanced CervicalStim and SpinalStim bone growth stimulators. These Class III medical devices utilize a low-level pulsed electromagnetic field (PEMF) developed to activate and accelerate the natural healing process of the body, offering patients a secure, non-invasive treatment option for supporting post-operative spinal fusion.

Scope of the Study

Market Segments Covered in the Report:

By Power

- Low Frequency

- High Frequency

By Application

- Pain Management

- Bone Growth

- Others

By End Use

- Hospitals

- Home Care Settings

- Other End uses

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Bedfont Scientific Ltd.

- Orthofix Medical, Inc.

- I-Tech Medical Division (I.A.C.E.R. Srl)

- Oska Wellness, Inc.

- Nuage Health Devices Pvt. Ltd.

- Sedona Wellness

- Bemer USA, LLC

- Pulsed Energy Technologies LLC

- HealthyLine

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Bedfont Scientific Ltd.

- Orthofix Medical, Inc.

- I-Tech Medical Division (I.A.C.E.R. Srl)

- Oska Wellness, Inc.

- Nuage Health Devices Pvt. Ltd.

- Sedona Wellness

- Bemer USA, LLC

- Pulsed Energy Technologies LLC

- HealthyLine