The healthcare system had witnessed enormous challenges as a result of the COVID-19 pandemic. All outpatient treatments were postponed or restricted during the COVID-19 pandemic to reduce the risk of viral transmission, as most chronic therapies were regarded as non-urgent. It was observed that cardiovascular care delivery during the COVID-19 pandemic period was significantly reduced due to the lag in elective diagnostic testing and face-to-face patient care, as per the article published by the Radiology Cardiothoracic Imaging Society in August 2020. The fractional flow reserve (FFR) measures the ratio of the maximal myocardial blood flow in the presence of a stenosis, helping interventional cardiologists to determine the appropriate use of angioplasty and stenting. Thus, the reduction in cardiovascular services and procedures during the COVID-19 pandemic significantly affected the market's growth. However, cardiovascular patients were recommended to maintain their FFR therapy in order to improve their chances of survival and better control their immune system's capacity to resist the SARS-CoV-2 virus. Such instances bolstered the growth of the market amid the pandemic and are expected to continue the same trend over the next few years, as per the analysis.

The major factors contributing to the market's growth include the higher prevalence of cardiovascular diseases and technological advancements in FFR products.

The wide prevalence of heart diseases in the world is expected to propel the growth of the market over the forecast period. In the year 2020-21, over 14,849 people in the United Kingdom were admitted to hospitals due to heart and circulatory diseases, as per the data published by the British Heart Foundation in February 2022. Likewise, according to the CDC’s article titled 'Heart Disease Facts' updated in February 2022, heart disease is one of the leading causes of death in the United States. The same source also reports that every year about 659,000 Americans have a heart attack. Thus, the large prevalence of cardiovascular cases around the world creates the need for fractional flow reserves for the diagnosis of coronary artery pressure differences, in turn boosting the market growth. Furthermore, low- and middle-income countries are also witnessing an upsurge in the prevalence of cardiovascular diseases due to a lack of primary healthcare programs that offer early detection and treatment of cardiovascular disorders, according to the data published by the WHO in June 2021. Hence, the market demand for FFR products is likely to increase in these regions over the coming years.

Moreover, the increase in research on the improvisation of fractional flow reserve products is contributing to market growth. For instance, a group of researchers from the United Kingdom and Italy evaluated a clinical solution to improve the fractional flow reserve pullback for the assessment of stenosis in the event of serial disease, as per the data published by the Journal of Invasive Cardiology in July 2021. Such studies regarding the newer inventions related to fractional flow reserves are expected to significantly boost the market's growth over the forecast period.

However, the stringent regulatory framework for fractional flow reserve technologies is expected to slow down the growth of the studied market over the study period.

Fractional Flow Reserve Market Trends

Guidewires Segment is Expected to Hold a Major Market Share in the Fractional Flow Reserve Market

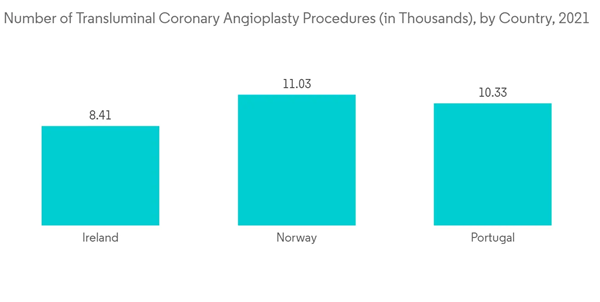

The guidewires segment is expected to grow significantly over the forecast period. Pressure guidewires are used in procedures to determine if any surgery is required in the vessels or arteries of the heart. It also acts as a navigator's tool to reach the lesion. The growing popularity of angiography and its unique characteristics are expected to have a positive influence on this market segment.The increase in the number of cardiac-related surgeries that require the use of guidewires is expected to boost the growth of the studied segment over the forecast period. For instance, as per the OECD statistics published in November 2022, around 11,029 transluminal coronary angioplasty surgeries were performed in Norway in the year 2021, and nearly 10,330 procedures were performed in Portugal. Thus, the large number of angioplasty procedures is expected to increase the demand for guidewires, which in turn is expected to propel the growth of the market segment over the forecast period.

Moreover, the recent studies focusing on the improvement of existing guidewires are expected to contribute to the growth of the studied segment over the forecast period. For example, a research study by a group of researchers from Egypt examined guidewire insertion in the fractional flow reserve. This study was published by Biomedical Engineering Online in September 2021 and offered a solution to reduce the errors caused by the insertion of fractional flow reserve guidewire. Hence, the rise in research studies focusing on the utilization of guidewires in fractional flow reserves is likely to add to the growth of the guidewires segment over the forecast period.

Several key market players have also played a major role in the growth of the studied segment. For instance, in October 2021, Baylis Medical Company Inc. was acquired by Boston Scientific Corporation for an upfront payment of USD 1.75 billion. The purpose of the acquisition was to increase Boston Scientific's structural heart and electrophysiology product portfolios by bringing in radiofrequency (RF) NRG and VersaCross transseptal platforms. Furthermore, the agreement will help the company acquire a variety of dilators, guidewires, and sheaths for improving healthcare efficiency.

Thus, the guidewires segment is expected to hold a significant market share during the forecast period.

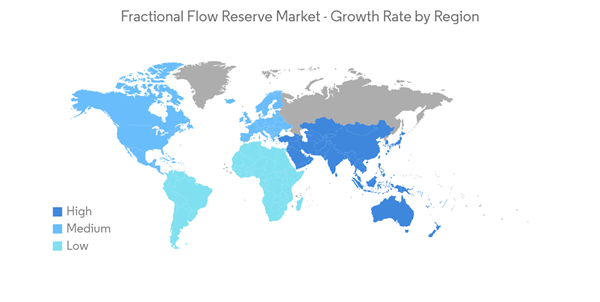

North America is Expected to Hold a Significant Share in the Market and Expected to do Same in the Forecast Period

North America is expected to hold a major market share in the fractional flow reserve market due to the increasing geriatric population linked with cardiovascular diseases and growing technological advancements in FFR monitoring devices.A large number of people in the region are affected by heart diseases, which is a major factor contributing to the market's growth over the forecast period. For instance, according to the CDC data updated in July 2022, coronary heart disease is the most common type of heart disease, and approximately 20.1 million adults age 20 and older have the disease in the United States. Additionally, as per the same source, every 40 seconds, one individual suffers from a heart attack, and nearly 805,000 people in the United States have a heart attack every year. According to the AHA, by 2035, around 45% of the United States population is likely to suffer from heart disease due to factors like high obesity, high smoking, and unhealthy lifestyles, which may lead to heart attacks and other related issues. The fractional flow reserve method is the most commonly used invasive standard for identifying stenosis in the coronary artery, and the large population affected by heart diseases in the region is likely to add to the growth of the fractional flow reserve market over the forecast period.

Furthermore, as per the study published in IJERPH in January 2022, the geriatric population is more susceptible to developing cardiovascular disease owing to the impairment of the optimal functionality of the cardiovascular system caused by aging. Also, the geriatric population in the United States has been increasing over the years. The number of people over the age of 65 in the United States is projected to reach 80.8 million by the year 2040, and the numbers are projected to rise to 94.7 million by the year 2060, according to the Administration for Community Living, May 2021. The number of people over the age of 85 is projected to be 14.4 million by the year 2040, increasing the demand for FFR products.

Additionally, in July 2021, one of the key players in the FFR market, HeartFlow, announced a merger with Longview Acquisition Corp. II in order to become a publicly traded company. When the proposed deal is completed, the merged company will conduct business as HeartFlow Group Inc. Thus, these aforementioned factors are altogether contributing to the growth of the market in the North American region.

Fractional Flow Reserve Market Competitor Analysis

The fractional flow reserve market is fragmented and consists of several major players. In terms of market share, a few of the major players are currently dominating the market. Strategic initiatives taken by companies to develop the product are expected to boost market growth. Some of the companies that are currently dominating the market are Opsens Medical, Abbott, Boston Scientific, GE Healthcare, Siemens Healthcare, Cathworks, Medis Medical Imaging System, Pie Medical Imaging BV, Heartflow Inc., and Koninklijke Philips NV.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott

- Boston Scientific Corporation

- Cathworks

- General Electric Company (GE Healthcare)

- Heartflow, Inc.

- Koninklijke Philips N.V.

- Medis Medical Imaging Systems B.V.

- OpSens Medical

- Pie Medical Imaging B.V.

- Siemens Healthcare GmbH