The COVID-19 pandemic had an unimaginable impact on the world and has altered almost every aspect of the healthcare industry. The pandemic has also had a complex and unprecedented effect on the ultrasound market. Lung ultrasound became an essential tool for rapid bedside assessment in critically unwell patients, proving helpful in the assessment of COVID-19 due to the logistics of cross-sectional imaging. For instance, according to an article published by the Journal of Ultrasound in June 2022, CEUS had the benefit of being cheap, radiation-free, without risk of nephrotoxicity, and could be performed at the bedside. Thus, the prognosis and treatment were positively influenced by lung CEUS during COVID-19, thereby increasing its demand and driving the market growth.

Furthermore, in a study published by BMJ Publishing Group Ltd & British Society of Gastroenterology, in April 2022, elective cancer surgeries continued in various hospitals and clinics without any delays or with minimal impact of the pandemic. This implies an increasing use of CEUS for better diagnosis of liver cancers or tumors during the pandemic as well. However, as the COVID-19 cases started to decline, the market started to show normal pre-pandemic level growth and is likely to continue its significant growth rate during the forecast period.

Factors such as the rising prevalence of long-term diseases and comorbidities among the population, technological advancements, and rising expenditure on product development by the government and major companies are expected to fuel the growth of the market over the forecast period. For instance, according to the data updated by the American Cancer Society in March 2022, approximately 800,000 people are diagnosed with liver cancer each year, globally and nearly 41,260 new cases of liver cancer were estimated to be diagnosed in the United States in 2022. In this context, several research suggests that CEUS is exceptionally well-suited for liver imaging because of the liver's unique dual blood supply system. Additionally, CEUS improves the ability to characterize focal liver lesions (FLLs), detect liver cancer, provide advice for interventional treatments, and assess the effectiveness of local therapy. Thus, due to the benefits of CEUS in liver cancer diagnosis, the demand for CEUS is expected to increase thereby driving the market growth.

Furthermore, an increase in research and development (R&D) activities, collaborations, product approvals, and launches are garnering market growth. For instance, in October 2021, ultrasound experts urged the healthcare community to work to expand the utilization of ultrasound contrast agents (UCAs) to offer patients broader access to low-cost, safe, and reliable diagnostic imaging. This is further expected to create opportunities for the CEUS, driving market growth.

However, the high costs and shortage of helium are likely to hinder the market's growth.

Contrast-Enhanced Ultrasound Market Trends

Contrast Agent Segment is Expected to Grow During the Forecast Period

Contrast agents (CA), also called contrast media, change how electromagnetic radiation or ultrasonic waves flow through the body, increasing the radiodensity of a specific tissue. The patient may get these medications orally, rectally, or intravenously. In addition, a microbubble-containing intravenous drug is used in CEUS, which can aid in the detection of numerous diseases and ailments. The CA used in CEUS improves visualization, making it easier for medical personnel to see the blood flow via patients’ organs and blood vessels. Thus, the need for CA is increasing due to the advantages of contrast agents (CA) used in CEUS and an increase in complex comorbidities, thereby driving the segment growth.For instance, according to Cleveland Clinic data updated in April 2022, the CA used in CEUS has tiny microbubbles loaded with gas. The contrast bubbles vibrate and significantly reflect the sound waves when the ultrasound's sound waves collide with them. As a result, the area in the photograph becomes incredibly light. Also, CEUS demonstrates how blood flows in organs and blood arteries since the contrast enters the body through a vein. Hence, the specialist can visualize and locate the area of concern and gather baseline images.

In addition, as per a research article published by Ultrasound in Medicine and Biology, in March 2021, ultrasound contrast agents (UCAs) are generally safer and more tolerable than the CAs used in computed tomography (CECT) and magnetic resonance imaging (CEMRI) in terms of their effects on liver and kidney function. The research also suggested that with the use of sonazoid (SZ) CA, CEUS can also be used to determine the presence of “perfusion defects” during the post-vascular phase (PVP), which occurs about 10 min after injection. It also stated that in diagnostic sensitivity and accuracy of liver malignancies, SZ-CEUS performs better than CECT. Thus, owing to the advantages mentioned above, the demand for advanced contrast agents is increasing, hence, fueling the segmental growth.

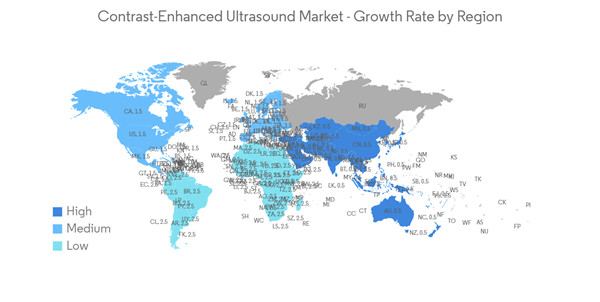

North America is Expected to show a Significant growth in the Market during the Forecast Period

The North American region is expected to contribute significantly to the market growth during the study period. Factors such as the increasing prevalence of long-term diseases and complex comorbidities and the increase in private and government expenditures are predicted to fuel market growth in the region. For instance, according to the data updated by the Centers for Disease Control and Prevention (CDC) in January 2021, approximately 25,000 men and 11,000 women are diagnosed with liver cancer every year in the United States. As per the statistics above, there is a risk of liver cancer among the target population in the region. In this context, according to the American Cancer Society data revised in March 2022, liver cancer incidence rates have more than tripled in past decades, and the 5-year relative survival rate for localized liver cancer is 35%, and for regional, 12%. This implies a disease burden in the country. This is anticipated to create demand for CEUS for disease diagnosis and treatment.In addition, as per a research article published by the National Library of Medicine in December 2021, the classification of liver disease is accomplished via the CEUS imaging-based classification and diagnosis system. A few researchers have used 2D-CEUS to monitor patients with liver cancer following surgery, and as 3D-CEUS continues to advance, imaging tests are being used to diagnose the microcirculation system.

Additionally, the American Hospital Association (AHA)’s “Fast Facts on U.S. Hospitals, 2022”, shows that the number of active hospitals in the United States increased from 5,534 in 2016 to 6,093 in 2022. Thus, a steep rise in the volume of hospitals and increasing hospital admissions is expected to increase the surgical procedures and availability of devices used for the same. This drives higher demand for the availability of CEUS in hospital settings.

Contrast-Enhanced Ultrasound Market Competitor Analysis

The contrast-enhanced ultrasound market is moderate due to the presence of companies operating globally and regionally. The competitive landscape includes an analysis of international and local companies that hold market shares and are well-known, including BK Medical Holding Company Inc., Bracco Diagnostic Inc., Daiichi Sankyo Company Limited, GE Healthcare, Koninklijke Philips NV, Lantheus Medical Imaging Inc., and Siemens Healthineers AG, among others.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Bracco Diagnostic Inc.

- Daiichi Sankyo Company Limited

- GE Healthcare

- Koninklijke Philips NV

- Lantheus Medical Imaging Inc.

- Siemens Healthineers AG

- Leriva

- Esaote SPA

- Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

- nanoPET Pharma GmbH

- Trivitron Healthcare Pvt. Ltd.

- Samsung Healthcare