Amidst the outbreak of the COVID-19 pandemic, there has been a rise in other health complications that rose with COVID-19 infections. According to a report by the Surveillance Epidemiology of Coronavirus Under Research Exclusion (SECURE-IBD) database in January 2022, adverse COVID-19 outcomes were associated with age and other co-morbidities among patients with IBD. The novel severe acute respiratory syndrome-related coronavirus initiates activation of innate and adaptive immune responses upon entering the gastrointestinal tract. The onset of inflammatory reactions can supposedly induce intestinal damage in IBD patients. As per a review article in the World Journal of Gastroenterology in October 2020, it was comprehended that many COVID-19 patients were found to develop gastrointestinal complaints. Thus, there is an increasing demand for bowel management systems to manage further complications that could develop due to COVID-19 infection. However, the relaxation of the lockdown restrictions during the post-pandemic period is expected to drive the demand for the bowel management system due to the lifting of lockdowns across the world.

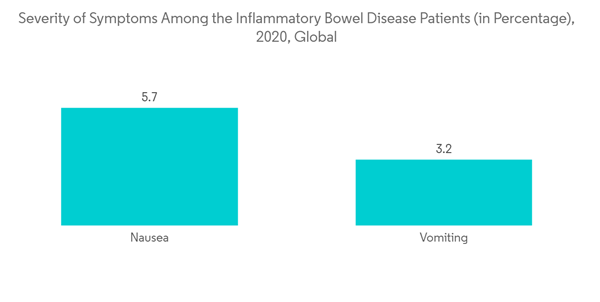

The significant factor attributing to the market's growth is the rising incidence of inflammatory bowel diseases and increasing technological advancement. The increasing geriatric population across the world is found to be more prone to constipation, diarrhea, and other bowel conditions that help to drive the bowel management systems market. For instance, according to a report by the CDC, published in April 2021 on World IBD Day (May 19), the number of people affected by IBD around the world was approximately 7 million in 2020.

The prevalence of chronic health conditions, such as cancer, arthritis, migraine, and other cardiovascular, respiratory, kidney, and liver diseases, are higher in IBD patients than in non-IBD patients. As per the source mentioned above, in the older population (above 64 years), patients with IBD were more susceptible to hospitalization for hip fractures. Also, they were found to have 30-day readmissions and longer hospital stays. Hence, the readmission risks among the elderly population are expected to drive the demand for bowel management systems, thereby contributing to the market's growth over the forecast period.

It also indicated the efficacy of bowel management systems in people with neurological disorders, such as spinal cord injury, multiple sclerosis, Parkinson's disease, Alzheimer's disease, brain tumors, chronic constipation, bedridden patients, and children unable to pass stool regularly, and properly, are expected to boost the growth of the market.

Thus, the above-mentioned factors are expected to drive the market's growth during the forecast period.

Bowel Management Systems Market Trends

Colostomy Bags Segment is Expected to Hold the Largest Market Share in the Bowel Management Systems Market

The colostomy bags segment is expected to hold the dominant share in the market, owing to the factors such as high incidence rates and health complications associated with bowel diseases, such as irritable bowel syndrome, multiple sclerosis, Crohn's disease, and cancer. The market for colostomy bags is therefore expected to be driven by the rising incidence of chronic diseases.Crohn's disease is a form of inflammatory bowel disease (IBD) that can impact any portion from the mouth to the anus of the gastrointestinal tract, which boosts the colostomy bag segment. As per the article published in 2022 by Crohn's and Colitis Organization, one in every 123 people in the United Kingdom has had Crohn's disease annually.

Also, the increasing product developments and clinical trials are expected to contribute to the growing demand for colostomy bags, thereby boosting the growth of the studied segment. For instance, in December 2021, Coloplast launched a clinical trial to test the effect of its ostomy product, Heylo, a product that uses sensors to warn patients with colostomy bags about leakage and advise them about how to prevent it.

Thus, the above-mentioned factors are expected to drive the growth of the studied segment during the forecast period.

North America is Expected to Dominate the Market and is Expected to do Same in the Forecast Period

North America is expected to dominate the bowel management systems market over the forecast period. This is owing to factors such as the rising prevalence of colorectal cancer and the growing geriatric population. However, according to the American Cancer Society, in January 2022, about one in 23 males was at a lifetime risk of developing colorectal cancer, and the risk factor among women was one in 25. Additionally, increased patient awareness, rising adoption rates of intestinal management systems, increasing investments in product development, excellently-established healthcare infrastructure, and strong acceptance of developed products are also some of the key factors ensuring the dominance of the region.For instance, in July 2021, the Ostomy Specialist Trio Healthcare secured a second round of funding from US finance company SWK Holdings corporation of approximately USD 10 million in total for manufacturing Trio's stoma bags, Genii.

Thus, the above-mentioned factors are expected to drive the growth of the region during the forecast period.

Bowel Management Systems Market Competitor Analysis

The bowel management systems market is considerably fragmented in nature due to the presence of several companies operating globally as well as regionally. In terms of market share, a few of the major players are currently dominating the market. Some of the companies, which are currently dominating the market, are Medtronic PLC, Becton Dickinson and Company, B. Braun Melsungen AG, Coloplast Pty Ltd, and ConvaTec Inc.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Medtronic PLC

- Becton, Dickinson and Company

- B. Braun Melsungen AG

- Coloplast Pty Ltd

- ConvaTec Group PLC

- Consure Medical Pvt. Ltd

- Cogentix Medical

- Hollister Incorporated

- ABC Medical Supply Inc.

- Laborie Inc.