The market is driven by the need for managing passengers, aircraft, and baggage on time at airports, the construction of new airports or terminals, and the increase in air passenger traffic. However, operational accidents and missing/loss of baggage remain concerns for the market.

The substantial rise in passenger traffic and increasing demand for air travel have led to a significant increase in the demand for efficient airport operations, which soars the procurement of new-generation equipment integrated with the Internet of Things (IoT), GPS, and sensors over the last decade. Airport equipment manufacturers are developing new models integrated with smart airport technologies. As a result, the emphasis on new technologies, like sensor-based products, connectivity, and IoT platforms, is increasing. Thus, these sorts of advancements will be fueling the growth of the market. However, high upgrade costs would hamper the growth of the market.

Airport Terminal Operations Market Trends

The Baggage Screening Segment is Anticipated to Dominate Market Share During the Forecast Period.

Major airports are focusing on minimizing passenger delays at checkpoints while maintaining an advanced level of security. The modernization of new airports and technological advancements fuel the market's growth.The increasing focus on improving operational efficiency at airports is expected to lead the market's growth in the coming years. Technological advancements, such as robot utilization for baggage handling processes and endeavors, including establishing new airports and expanding existing terminals, are expected to show a positive outlook for the growth of this segment.

The renovation of baggage screening systems at various airports will also lead to growth in the market. In addition, most global airport authorities are now investing in renewing airport infrastructure to offer better comfort and baggage handling experience. According to the International Air Transport Association (IATA), the global adoption of RFID can help the aviation industry save billions of dollars over the coming years. For instance, in March 2022, Analogic Corporation announced that the company's ConneCT computed tomography (CT) checkpoint security screening system had been deployed at a TSA checkpoint at the Plattsburgh International Airport (PBG) in the US. Integrating the new CT system is part of the TSA’s Checkpoint Property Screening Systems (CPSS) program, which will have Analogic install over 300 mid-size CPSS systems into airport security checkpoints around the country. Similar initiatives by airport operators in other regions are expected to propel segment growth during the forecast period.

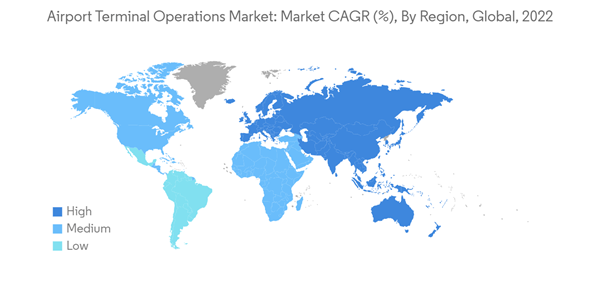

Asia-Pacific is Anticipated to Dominate the Market During the Forecast Period

Asia-Pacific is expected to dominate market share and witness the highest growth during the forecast period. This is primarily due to the construction of new airports and the modernization of the existing airport facilities, mostly in India, China, and some countries in Southeast Asia, like Vietnam and Thailand, to increase their passenger handling capacities. China had a total of more than 230 civil airports by 2018, and China is planning to have a total of 450 airports by 2035 by building around 220 new airports in the next 16 years to cater to the growing air passenger traffic demand. Also, in February 2022, Beijing Capital International Airport (BCIA) announced its intentions to offer a comfortable and efficient travel experience using integrated smart technologies, injecting smart technology into a variety of smart fields, from pandemic prevention and control to passenger service enhancement and airport operation efficiency improvement.Also, airport managers are replacing the old systems with newer ones so that screening can be done more quickly and efficiently. For example, in January 2022, the Perth Airport started a project called "Passenger Screening Reform (CT Upgrade)" to update the infrastructure for screening passengers in all terminals. Under the project, the airport will install new body scanners, explosive trace detection systems, walkthrough metal detectors, x-ray machines, and secondary viewing stations with explosive trace detectors at its terminals to boost domestic and international aviation security. Several such procurements are scheduled to materialize during the forecast period, and such procurements are anticipated to accelerate the growth of the market.

Airport Terminal Operations Industry Overview

The airport terminal operations market is fragmented, and the businesses are aligning their products and services to either be the best at one type of product or to become a full-service manufacturer and provider of security and detection products. Some major players in the airport passenger screening systems market are SITA, BEUMER Group GmbH & Co. K.G., ADELTE GROUP S.L., Smiths Group, and thyssenkrupp AG are some of the prominent players in the market studied.These companies have expanded their presence in various regions through partnerships with airport authorities and airlines. For instance, in December 2022, TSA launched a high-tech baggage handling system at Denver International Airport. The Checked Baggage Inspection System (CBIS) features a complicated network of conveyor belts that sort and track the luggage through the security screening process at a potential cost of USD 160 million. As the market demand improves with the growth in passenger traffic, it is expected that the smaller players are expected to gain a competitive advantage to cater to customers’ needs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.