The COVID-19 pandemic significantly impacted the morphine market. As per the World Health Organization (WHO), chronic pain was one of the hardest-hit areas affected by the COVID-19 pandemic, leaving many patients overburdened with their chronic pain and delays in their ongoing treatments. According to a study published in Nature Journal in January 2021, opioid drug demand during the pandemic increased by approximately 84%.

Hence, the demand for pain medications, such as opioid drugs, including morphine, greatly increased over the pandemic. Thus, COVID-19 had a significant impact on the studied market's growth. However, the market is currently recovering well owing to the resumption of manufacturing plants, and it is expected to witness a similar trend over the coming years.

The major factors contributing to the growth of the market are the rising prevalence of orthopedic diseases and chronic pain, the increase in palliative care facilities, and the rise in the usage of morphine for pain management.

Morphine is considered one of the most effective drugs for the management of pain. Moreover, their use in the management of severe pain and chronic pain, which are associated with advanced medical illnesses, is considered standard practice in most parts of the world. Furthermore, the rising occurrence of orthopedic disorders, such as arthritis, elbow pain, fibromyalgia, and osteoporosis, is the primary factor responsible for the rising growth of the morphine market.

According to WHO data updated in July 2022, musculoskeletal diseases (MSD) are the main cause of disability across the globe, having affected 1.71 billion people globally in 2021. Musculoskeletal conditions are one of the leading contributors to disability worldwide, thereby driving the need for its therapeutics, which in turn is boosting the morphine market towards growth during the study period.

Further, the elderly population is more susceptible to osteoarthritis diseases and chronic pain, and an increasingly elderly population is expected to propel the growth of the market. The United States accounts for the increasing number of individuals suffering from pain. For instance, the Journal of Pain and Palliative Therapy, 2021 accounts that approximately 20.28% of the United States population is suffering from chronic pain and 5% of this population comprises adults who are suffering from high-impact chronic pain. Therefore, with the increasing prevalence of the population suffering from chronic pain in the United States rapidly drives its market for morphine over the forecast period.

Moreover, the growing geriatric population are further expected to increase the demand for morphine globally due to high prevalence of musculoskeletal and other pain related disorders in elderly population. For instance, according to the World Population Prospectus 2022 report published by the United Nations in 2022, the share of people aged 65 years and more in the global population was projected to increase from 10% in 2022 to over 16% by 2050. Also, as per the same source, population growth at older ages is driven by lower mortality and increased survival, and a sustained drop in the fertility level causes an upward shift in the population age distribution.

Thus, due to the above-mentioned factors, the studied market is expected to be significantly driven during the study period. However, prescription drug abuse and risk factors associated with morphine are expected to hinder the growth of the studied market during the study period.

Morphine Market Trends

Pain Management Segment is Dominating the Morphine Market

Morphine is used to relieve moderate to severe pain. Morphine extended-release tablets and capsules are only used to relieve severe pain that cannot be controlled by the use of other pain medications. Opioids play a vital role in acute post-operative settings to provide adequate analgesia. The rising prevalence of chronic diseases such as arthritis, cancer, and other diseases is expected to increase the demand for morphine solutions for relieving pain. This will drive the pain management segment's growth in the studied market during the study period.According to an article published by PubMed Central in September 2022, osteoarthritis is a significant cause of disability. It is the most common type of arthritis, affecting almost 10% of the global population aged 60 years and older. Additionally, according to the data published by the Arthritis Society of Canada in September 2021, more than 4 million Canadians were diagnosed with osteoarthritis and about 1 in 7 Canadian adults live with the impact of osteoarthritis. This may cause pain, aching, stiffness, and swelling around the joints. People might find it difficult to walk. Hence, there is an increased demand for morphine as a pain reliever. This will also positively contribute to segment growth.

Furthermore, morphine is the most commonly used opioid for severe cancer-related pain. and hence an increase in cancer cases is expected to drive segment growth. As per the American Cancer Society Report published in January 2023, it is estimated that over 1.98 million people will be affected by cancer during the year 2023.

Thus, owing to the above-mentioned factors, the studied segment is expected to boost segment growth during the study period.

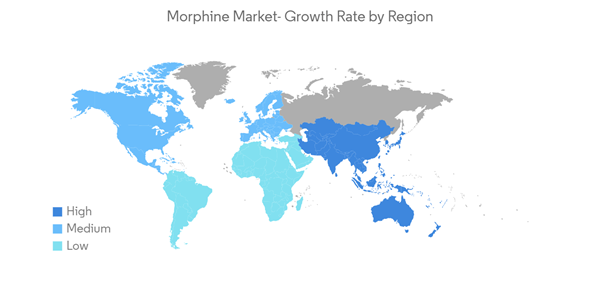

North America Holds Significant Share in the Market and Expected to Grow in Forecast Period

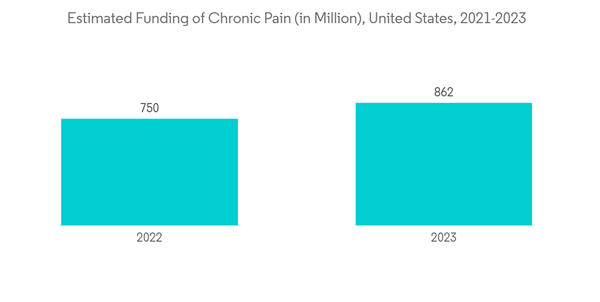

North America is expected to witness growth in the morphine market during the forecast period. The market's growth is due to factors such as the presence of key players, the high prevalence of chronic diseases in the region, and established healthcare infrastructure, which is some of the key factors responsible for its large share of the market. Furthermore, beneficial government initiatives and an increase in the number of research partnerships are some of the factors driving the market growth. In this region, the United States has the largest share due to supportive healthcare policies, a high number of patients, and a developed healthcare market.As per the Centers for Disease Control and Prevention's October 2021 estimates, about 1 in 4 United States adults (23.7%), or about 58.5 million people, have doctor-diagnosed arthritis, and this is expected to reach 78 million by 2045. Opioid therapy, such as morphine, is the mainstay of orthopedic treatment for patients with moderate to severe pain, and this helps drive the overall growth of the market.

According to the article published in Science Daily Journal in August 2021, chronic pain is among the most common chronic conditions in the United States. Approximately 50.2 million (20.5 percent) of adult United States citizens experience chronic pain. The estimated total value of lost productivity due to chronic pain is nearly USD 300 billion annually. Further, as per the data published by the Government of Canada, in 2021, the overall number of people who experience chronic pain would rise by 17.5% between 2019 and 2030, and by 2025 there might be 8.3 million Canadians suffering from chronic pain, and by 2030 there could be 9.0 million. Therefore, the rising burden of chronic pain in the country and the burden on the healthcare infrastructure are expected to drive the studied market in the region during the study period.

Therefore, along with the above-mentioned factors, the awareness initiatives for chronic pain management will boost the demand for morphine in the region during the study period.

Morphine Industry Overview

The morphine market is moderately competitive and consists of several major players. The strategies such as partnerships and acquisitions are readily adopted by market players for global expansion. Some of the companies currently dominating the market are Mallinckrodt Pharmaceuticals, Pfizer Inc., Sun Pharmaceutical Industries Ltd, Verve Health Care Ltd, and AbbVie Inc., among others.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.