The outbreak of the Covid-19 pandemic had a significant impact on the ceramic tiles market in Poland. With the pandemic causing economic uncertainty, many consumers had cut back on their spending. This resulted in a decline in demand for ceramic tiles, often seen as luxury items. The pandemic disrupted supply chains worldwide, causing delays and shortages of raw materials and finished products. This resulted in higher prices and longer lead times for ceramic tiles in Poland. The lockdowns and restrictions on movement to control the spread of the virus resulted in the closure of many construction sites in Poland. This directly impacted the demand for ceramic tiles, which were often used in construction projects.

Poland is one of the largest producers of ceramic tiles in the European Union, next to Italy and Spain, and one of the leading ceramic tiles exporting companies worldwide. With properties such as ease of cleaning and a simple installation procedure, ceramic tiles have been used in Europe for a long time. Durability is associated with the aesthetic enhancements made by ceramic tiles to use widely in residential and commercial applications like hotels, shopping malls, hospitals, laboratories, etc., in places where hygiene is maintained in commercial and residential buildings, apart from decoration. The ceramic tiles market in Poland is projected to witness relatively moderate market growth rates during the forecast period, owing to the stringent environmental framework for operations related to the production and manufacturing of building materials. The growing construction industry across the globe, especially the growing demand for the commercial segment, is forecasted to drive the demand for Poland ceramic tiles.

Poland Ceramic Tiles Market Trends

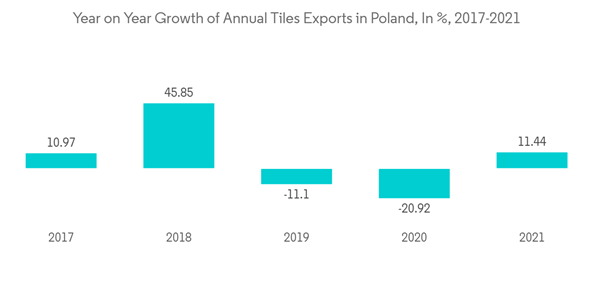

Poland Ceramic Tiles Exports

Poland's exports accounted for around 30% of the total percentage of ceramic tiles exported in 2021. A rising trend in developed economies of adopting protectionist business policies might impact imports and lead to a rise in the prices of raw materials and finished goods that are to be exported, thus impacting the export revenue of the market. The key manufacturers are increasingly focusing on improving technology adoption to improve total production by improving energy-saving and environmental sustainability procedures and are utilizing artificial intelligence tools to analyze market scenarios to increase the total ceramic tiles manufactured and exported.Glazed Segment of Poland Ceramic Tiles Market is Gaining More Significance

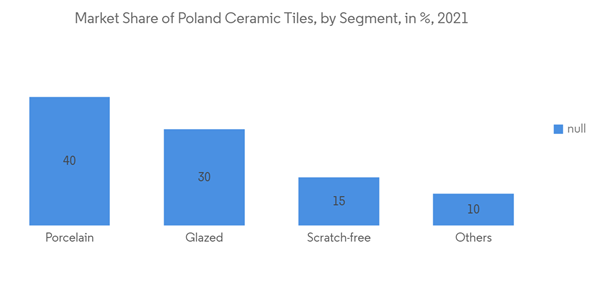

Porcelain tiles have been witnessing a considerable market share during the study period. The glazed segment of the ceramic tiles market is anticipated to hold a significant market share in the forecast period owing to the relatively low selling price, easy installation, and maintenance it holds. Glazed Tile is resistant to water and stains because of the glaze. It has an attractive look, as a wide variety of colors and designs can be created with glaze, with finishes ranging from extremely glossy to extremely glossy matte; the demand for this product is growing. The growing construction sector in the country, along with considerable improvement in living standards and affordability, are projected to drive the demand for this segment of the market.Poland Ceramic Tiles Industry Overview

Poland Ceramic Tiles Market is moderately consolidated in nature, with few players occupying most market share. The ceramic tiles market is transforming with many technological advancements through product innovation and process automation. The key market players are focusing on improving their production capacity, which will help them to increase exports. Some of the major players in this market are Paradyz Group, Ceramic Eva, Cerrad, Dagma, and Ceramika Konskie.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Paradyz Group

- Ceramic Eva

- Ceramika Konskie Sp Zoo

- Opoczno

- Cerrad

- Dagma

- Villeroy & Boch Polska

- Cersanit

- Nowa Gala

- Fea Ceramics*