The impact of the COVID-19 pandemic on the market is low. Although space launches have been delayed due to the pandemic, no major cancellations of space launches have been observed in the last two years. Furthermore, the R&D activities aimed at developing reusable launch vehicles have continued at a brisk pace in several countries across the world.

The demand for satellite networks and commercial and defense application services has increased. This has resulted in a rise in satellite launches for military surveillance, communication, navigation, earth observation, and scientific research, among others. Space agencies and private companies have been trying to reduce the costs of satellite launching systems over the past few years. Many market players have invested in developing reusable launch systems with the recovery of some or all of the component stages.

Key Market Trends

Growth in R&D Activities Related to The Reusable Launch Vehicles

The number of players investing in developing reusable launch vehicles is increasing. SpaceX is one of the first companies that achieved the first vertical soft landing of a reusable orbital rocket stage in 2015. The company currently routinely recovers and reuses the first stages of the rockets, with the intent of reusing fairings as well. The operational reusable orbital-class launch systems are Falcon 9 and Falcon Heavy. The company is also developing the fully-reusable Starship launch system. Many other prominent companies are also working towards developing similar technologies related to reusable launching vehicles. For instance, Blue Origin is developing the New Glenn partially-reusable orbital rocket, intending to recover and reuse only the first stage. Likewise, in January 2022, ArianeGroup unveiled its new Rocket family with a reusable mini rocket. The company announced that it is developing the concept of a new European launcher family with a reusable first stage and a new mini launcher called Maia. Government space agencies are also increasing their focus on building reusable launch vehicles for their space missions. The Indian Space Research Organisation, ISRO, is developing the Reusable Launch Vehicle-Technology Demonstrator or RLV-TD, an eventual two-stage-to-orbit (TSTO) reusable launch vehicle in a bid to lower the cost of access to space. The ISRO is currently using a hybrid design, which is between the Space Shuttle program of NASA and the reusable rockets of SpaceX. The organization plans to carry out a key landing experiment, RLV-LEX, in 2022 that will push it closer to an orbital re-entry experiment (ORE). Such developments are expected to drive market growth during the forecast period.Asia-Pacific is Expected to Grow With the Highest CAGR During the Forecast Period

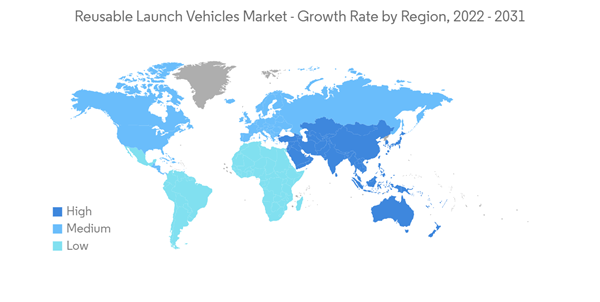

The countries in the Asia-Pacific region like China, India, and Japan, among others, have been rapidly increasing their investments in developing their space infrastructure to cater to the growing demand. Asia-Pacific is expected to dominate the market during the forecast period as several countries are investing in improving their space-related activities. In 2021, more than 40% of the global satellite launches were accounted for by China, India, and Japan. In addition, the countries are planning to further increase the satellite launch capacities in the coming years. According to the China National Space Administration, China plans to launch approximately 100 satellites by 2025. China-based iSpace company has gradually increased its investments towards developing advanced technology for reusable launch vehicles. The company is currently developing Hyperbola-2, a 28-meter-tall, 3.35-meter-diameter liquid oxygen-methane launcher capable of launching more than 1,100 kgs of payload into a 500-kilometer Sun-synchronous orbit (SSO) or 800 kgs of payload when the first stage is to be recovered and reused. China is now eyeing new milestones as it aims to develop reusable rockets like SpaceX’s Falcon-9. The next generation of launch vehicles will transport crew and cargo to the Tiangong space station. Japan’s aerospace industry has a strong international reputation, particularly in research and development (R&D). It has recently shifted its focus from R&D to commercializing space technology. Japan’s aerospace industry is constantly developing and promoting its satellite systems, space development initiatives, transportation programs, and focusing on reusable launch vehicles. The Indian Space Research Organization, ISRO, is developing RLV-TD, an eventual two-stage-to-orbit (TSTO) reusable launch vehicle, to lower the cost of access to space. Such developments are propelling the growth of the reusable launch vehicles market in the region.Competitive Landscape

ArianeGroup, Space Exploration Technologies Corp. (SpaceX), Indian Space Research Organisation (ISRO), United Launch Alliance LLC (ULA), and National Aeronautics and Space Administration (NASA) are some of the prominent players in the market. Players are expanding their geographical reach by winning worldwide contracts from emerging satellite operators. The market players are also investing significantly in the R&D of new RLVs. For instance, ISRO has been developing and testing its technologies through technology demonstrations like the Reusable Launch Vehicle Technology Demonstrator (RLV TD). The RLV TD is a hybrid vehicle that combines the technologies of an aircraft and launch vehicle, one on top of the other, to achieve a Two Stage to Orbit (TSTO) capability. Similarly, SpaceX is also developing a next-gen, fully reusable heavy-lift rocket, named Starship, to carry humans and 100 tons of cargo to the moon and Mars. Such developments are expected to help the growth of the players in the years to come.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ArianeGroup

- Space Exploration Technologies Corp.

- Indian Space Research Organisation (ISRO)

- United Launch Alliance, LLC

- National Aeronautics and Space Administration (NASA)

- Blue Origin Enterprises, L.P.

- Link Space

- China Aerospace Science and Technology Corp (CASC)

- German Aerospace Center