Rising Consumption of Energy Bars to Suppress Appetite Impelling Market Growth

Energy bars are capable of suppressing appetite for a long time due to the presence of various nutritious contents, such as nuts, dry fruits, rice, and quinoa crisps. They also contain dark chocolate, which is rich in copper, magnesium, zinc, and flavonoids and has anti-inflammatory and antioxidant properties. They are widely consumed by fitness enthusiasts to fulfill their sweet cravings and gain energy before working out. Furthermore, as energy bars come in convenient packaging and can be consumed on the go, their demand is increasing around the world.Increasing Construction of Hotels, Restaurants, and Cafes Driving Demand for Crunchy Chocolate

Hotels, restaurants, and cafes serve a wide variety of drinks, including shakes and smoothies, which require crunchy chocolate. Crunchy chocolate containing wafers, nuts, dry fruits, and rice crisps add the required grittiness to the drink and helps to thicken the consistency. It is often combined with ice cream, milk, cream, chocolate syrup, ice, coffee, and various types of fruits and blended to achieve a smooth consistency.Crunchy chocolate in dark variant are often added to protein shakes or healthy drinks to enhance their flavor. They also provide adequate amounts of energy to gymgoers and fitness enthusiasts for working out in the gym. Moreover, there is a rise in the trend of working from cafes or conducting meetups in restaurants. This, along with the increasing travel activities among the masses, is contributing to the growth of the crunchy chocolate market.

What is Crunchy Chocolate?

Crunchy chocolate is a dessert item that is shaped like a bar and manufactured by mixing melted chocolate with various other ingredients to provide a gritty texture. It comprises walnuts, almonds, peanuts, pecans, cashews, raisins, wafers, rice crisps, and chocolate chips to provide a crunchy texture. It is often mixed with various berries, such as blueberries, strawberries, and raspberries, to enhance their texture and add an innovative flavor. It is available in a wide variety of flavors, including honey, caramel, hazelnut, cinnamon, and butterscotch. It is consumed in bar forms or in small chunks, which are wrapped with aluminum foil paper to provide protection from dust, dirt, and microorganisms. It is also available in low-calorie variants wherein dark chocolate is used instead of sweetened milk chocolate. It can be easily prepared at home by melting sweetened or dark chocolate and combining it with any type of dry fruits or nuts, rice crisps, pieces of wafers, or quinoa crisps, followed by pouring the mixture into molds and freezing it to form bars. Crunchy chocolate is widely utilized in preparing smoothies, frappes, and various other sweet drinks, where they are crushed to thicken the consistency of the drinks. It is also used as toppings for a wide range of baked products, such as cakes, cupcakes, pastries, brownies, cheesecakes, and doughnuts. Furthermore, crunchy chocolate is often added to ice creams to improve their texture and flavor and used to make chocolate sandwiches.COVID-19 Impact:

The outbreak of COVID-19 negatively impacted the crunchy chocolate industry to a great extent as production and supply-chain facilities faced hindrances. During the onset of the pandemic, in-home consumption of crunchy chocolate witnessed a steep rise as individuals bought groceries and snacks in bulk from supermarkets and hypermarkets. However, various processing plants faced hindrances in their operations due to the unavailability of labor and raw material. There were complications associated with quality checks and certification, as the skilled workforce was unavailable. Supply chain and logistics also faced various complications due to the implementation of lockdowns around the world.Raw material and other necessary components were not available, as roads were closed, and social distancing was declared mandatory. Also, sales declined and this resulted in the reduced gifting and impulse buying among customers across the globe. Nonetheless, there were a number of sales taking place via e-commerce platforms from where customers were buying crunchy chocolates and getting them delivered to their doorstep. Towards the end of the pandemic, traveling activities also resumed, which enabled tourists to purchase chocolates from shops located in airports and also as souvenirs while traveling to places.

Crunchy Chocolate Market Trends:

At present, the increasing demand for crunchy chocolate, as it is flavorful, convenient, and easily available, represents one of the primary factors influencing the growth of the market. Besides this, the rising consumption of energy bars or protein bars, which are composed of quinoa, rice crips, corn flakes, dry fruits, and dark chocolate, is contributing to the growth of the market. Apart from this, the increasing number of e-commerce brands selling organic chocolate and vegan chocolate made from cacao beans and free from any animal milk is supporting the growth of the market.Additionally, the rising construction of hotels, restaurants, cafes, and baristas serving coffee, smoothies, and shakes to customers is strengthening the growth of the market. Moreover, the wide availability of gluten-free and sugar-free premium quality crunchy chocolates through various supermarkets and hypermarkets is positively influencing the market. Furthermore, the increasing preferences for gifting premium chocolates for various occasions, such as birthdays, get-togethers, anniversaries, and weddings, is bolstering the growth of the market.

Key Market Segmentation:

The research provides an analysis of the key trends in each segment of the global crunchy chocolate market report, along with forecasts at the global and regional level from 2025-2033. Our report has categorized the market based on distribution channel.Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Non-Grocery Retailers

- Others

Supermarkets and hypermarkets are huge stores selling an extensive range of fast-moving consumer goods (FMCG) products. They also provide various offers and discounts on their products and conduct seasonal sales for their customers. They keep a wide range of chocolate products, including crunchy chocolate. They provide an abundant amount of variety in the crunchy chocolate section, along with various premium varieties, which enables customers to get something according to their preferences. They also sell vegan crunchy chocolates with low-calorie and sugar-free chocolates.

A convenience store is a small shop with a limited section of various items, such as snacks, packaged foods, and drugstore products, and it is open for long hours for the convenience of shoppers. It enables customers to purchase chocolates even late in the night and provide them with an ample amount of variety.

Non-grocery retailers consist of retail shops selling drugstore items and beauty products, pharmacies, and others who do not keep grocery items. However, they often keep a small section of snacks or convenient food products from where consumers can purchase crunchy chocolate while visiting their stores.

Other places selling chocolates include bakery and confectionary stores, premium chocolate shops in airports, and cafes and restaurants selling their own range of hand-made chocolates.

Regional Insights:

- Western Europe

- North America

- Eastern Europe

- Asia

- Latin America

- Middle East and Africa

- Australasia

Besides this, the rising popularity of Belgium chocolate around the world and the increasing integration of Belgium chocolate in ice creams, waffles, pancake mixes, and baked products are propelling the growth of the market in Western Europe. In addition, the increasing utilization of premium quality chocolates in preparing various European desserts is contributing to the growth of the market.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global crunchy chocolate market. Some of the companies covered in the report include:

- Mars Inc

- Mondelez International Inc

- Nestle SA

- Ferrero Group

- Hershey Foods Corp

- Grupo Arco.

Key Questions Answered in This Report

- What was the size of the global crunchy chocolate market in 2024?

- What is the expected growth rate of the global crunchy chocolate market during 2025-2033?

- What are the key factors driving the global crunchy chocolate market?

- What has been the impact of COVID-19 on the global crunchy chocolate market?

- What is the breakup of the global crunchy chocolate market based on the distribution channel?

- What are the major regions in the global crunchy chocolate market?

- Who are the key companies/players in the global crunchy chocolate market?

Table of Contents

Companies Mentioned

- Mars Inc

- Mondelez International Inc

- Nestle SA

- Ferrero Group

- Hershey Foods Corp

- Grupo Arcor

Table Information

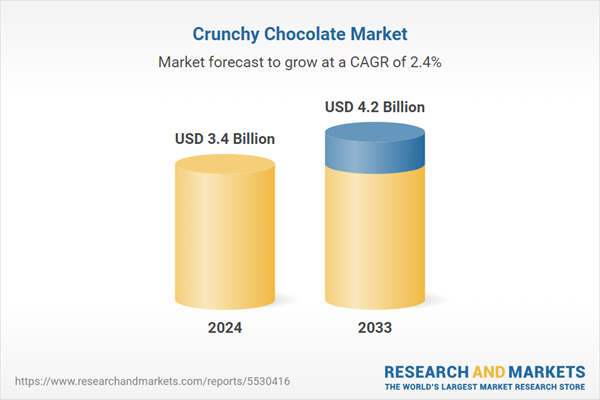

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 4.2 Billion |

| Compound Annual Growth Rate | 2.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 6 |