This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Aluminium is the world’s most abundant metal and is the third most common element comprising 8% of the earth’s crust. The versatility of aluminium makes it the most widely used metal after steel. China dominates production as well as consumption of aluminium accounting for nearly half of the global production and consumption. The market is segmented on the basis of production and consumption. Further, the Chinese aluminium consumption is bifurcated into construction, transportation, packaging, electrical, machinery & equipment, consumer durables and other end-users, in terms of end-users. The construction sector would remain the major driver of the aluminium market trends owing to surging expenditure on infrastructure and residential development projects in the region as well as increasing shift towards green construction technology, where aluminium fabrications, aluminium castings, aluminium extrusions, and aluminium profiles are key components of construction materials.

Scope of the report:

- The report provides a comprehensive analysis of the China aluminium market with potential impact of COVID-19

- The market dynamics such as growth drivers, market trends and challenges are analyzed in-depth

- The competitive landscape of the market, along with the company profiles of leading players (Aluminum Corporation of China Limited, China Hongqiao Group Limited, Yunnan Aluminium Co., Ltd., Shandong Nanshan Aluminum Co., Ltd., China Zhongwang Holdings Limited and State Power Investment Corporation Limited) are also presented in detail

Key Target Audience:

- Aluminium Manufacturers

- Raw Material/Component Suppliers

- End Users (Construction Industry, Transportation Industry, Packaging Industry and Others)

- Organizations, Forums, and Alliances related to Aluminium

- Government Bodies & Regulating Authorities

Please note: 10% free customization equates to up to 3 hours of analyst time.

Table of Contents

1. Market Overview1.1 Introduction

1.2 Production Process of Aluminium

1.3 Standards of Aluminium

1.4 Physical Properties of Aluminium

1.5 Chemical Properties of Aluminium

1.6 Typical Forms of Aluminium Available

1.7 Applications of Aluminium

1.8 Effects of Aluminium on Environment

2. Impact of COVID-19

2.1 Decline in Industrial Production

2.2 Slowdown in the Automotive Industry

2.3 Varying Production of Primary Aluminium

2.4 Fluctuations in Semiconductor Sales

3. China Market Analysis

3.1 China Aluminium Market by Value

3.2 China Aluminium Market Forecast by Value

3.3 China Aluminium Production Volume

3.4 China Aluminium Production Volume Forecast

3.5 China Aluminium Consumption Volume

3.6 China Aluminium Consumption Volume Forecast

3.7 China Aluminium Consumption by End-User

3.7.1 China Aluminium Construction Consumption Volume

3.7.2 China Aluminium Construction Consumption Volume Forecast

3.7.3 China Aluminium Transportation Consumption Volume

3.7.4 China Aluminium Transportation Consumption Volume Forecast

3.7.5 China Aluminium Packaging Consumption Volume

3.7.6 China Aluminium Packaging Consumption Volume Forecast

3.7.7 China Aluminium Electrical Consumption Volume

3.7.8 China Aluminium Electrical Consumption Volume Forecast

3.7.9 China Aluminium Machinery & Equipment Consumption Volume

3.7.10 China Aluminium Machinery & Equipment Consumption Volume Forecast

3.7.11 China Aluminium Consumer Durables Consumption Volume

3.7.12 China Aluminium Consumer Durables Consumption Volume Forecast

4. Market Dynamics

4.1 Growth Drivers

4.1.1 Increasing Construction Activity

4.1.2 Rising Incorporation in Automotive & Transportation Industry

4.1.3 Expanding Urbanization

4.1.4 Accelerating Demand from Packaged Food Manufacturers

4.1.5 Surging Adoption in Electric Vehicles

4.2 Key Trends & Developments

4.2.1 Expansion of Electronics Manufacturing Market

4.2.2 Growing Application in Power Grid & Power Generation Industries

4.2.3 Escalating Popularity of Recycled Aluminium

4.3 Challenges

4.3.1 Implementation of Stringent Environmental Regulations

4.3.2 Slowdown in New Capacity Additions

4.3.3 Health Effects of Aluminium

5. Competitive Landscape

5.1 China Market

5.1.1 Revenue Comparison of Key Players

5.1.2 Market Capitalization Comparison of Key Players

5.1.3 R&D Comparison of Key Players

5.1.4 China Aluminium Market Share by Key Players

6. Company Profiles

6.1 Aluminum Corporation of China Limited (Chalco)

6.1.1 Business Overview

6.1.2 Financial Overview

6.1.3 Business Strategies

6.2 China Hongqiao Group Limited

6.2.1 Business Overview

6.2.2 Financial Overview

6.2.3 Business Strategies

6.3 Yunnan Aluminium Co., Ltd.

6.3.1 Business Overview

6.3.2 Financial Overview

6.3.3 Business Strategies

6.4 Shandong Nanshan Aluminum Co., Ltd.

6.4.1 Business Overview

6.4.2 Financial Overview

6.4.3 Business Strategies

6.5 China Zhongwang Holdings Limited

6.5.1 Business Overview

6.5.2 Financial Overview

6.5.3 Business Strategies

6.6 State Power Investment Corporation Limited

6.6.1 Business Overview

6.6.2 Business Strategies

List of Figures

- Production Process of Aluminium

- Physical Properties of Aluminium

- Chemical Properties of Aluminium

- Typical Forms of Aluminium Available

- Applications of Aluminium

- Decline in Chinese Industrial Production (2019 v/s 2020)

- Production of Cars in China (2017-2021)

- Year on Year Primary Aluminium Production Growth in China (2020)

- Semiconductor Sales in China, by Month (November 2019- November 2020)

- China Aluminium Market by Value (2017-2021)

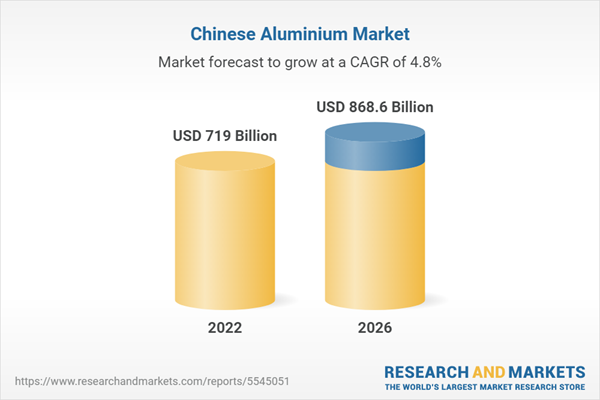

- China Aluminium Market Forecast by Value (2022-2026)

- China Aluminium Production Volume (2017-2021)

- China Aluminium Production Volume Forecast (2022-2026)

- China Aluminium Consumption Volume (2017-2021)

- China Aluminium Consumption Volume Forecast (2022-2026)

- China Aluminium Consumption by End-User (2021)

- China Aluminium Construction Consumption Volume (2017-2021)

- China Aluminium Construction Consumption Volume Forecast (2022-2026)

- China Aluminium Transportation Consumption Volume (2017-2021)

- China Aluminium Transportation Consumption Volume Forecast (2022-2026)

- China Aluminium Packaging Consumption Volume (2017-2021)

- China Aluminium Packaging Consumption Volume Forecast (2022-2026)

- China Aluminium Electrical Consumption Volume (2017-2021)

- China Aluminium Electrical Consumption Volume Forecast (2022-2026)

- China Aluminium Machinery & Equipment Consumption Volume (2017-2021)

- China Aluminium Machinery & Equipment Consumption Volume Forecast (2022-2026)

- China Aluminium Consumer Durables Consumption Volume (2017-2021)

- China Aluminium Consumer Durables Consumption Volume Forecast (2022-2026)

- China Construction Market (2018-2021)

- Production of Cars in China (2020-2021)

- Urban Population of China (2017-2021)

- Consumption of Food Packaging in China (2018-2023)

- Annual Sales of Plug-in Electric Passenger Cars in China (2017-2021)

- China Consumer Electronics Market (2020-2025)

- China Solar & Wind Power Capacity Forecast (2021-2025)

- Recycled Aluminium Demand in China (2020-2025)

- Carbon Dioxide Emissions in China (2017-2021)

- Aluminium Capacity Additions in China (2011-2025)

- China Aluminium Market Share by Key Players (2021)

- Aluminum Corporation of China Limited Revenue and Profit (2016-2020)

- Aluminum Corporation of China Limited Revenue by Segment (2020)

- Aluminum Corporation of China Limited Revenue by Region (2020)

- China Hongqiao Group Limited Revenue and Net Profit (2016-2020)

- China Hongqiao Group Limited Revenue by Region (2020)

- Yunnan Aluminium Co., Ltd. Revenue and Net Income (2016-2020)

- Yunnan Aluminium Co., Ltd. Revenue by Segment (2020)

- Yunnan Aluminium Co., Ltd. Revenue by Region (2020)

- Shandong Nanshan Aluminum Co., Ltd. Revenue and Net Income (2016-2020)

- China Zhongwang Holdings Limited Revenue and Profit (2016-2020)

- China Zhongwang Holdings Limited Revenue by Segment (2020)

- China Zhongwang Holdings Limited Revenue by Region (2020)

- EN Standards for Aluminium

- Revenue Comparison of Key Players (2020)

- Market Capitalization Comparison of Key Players (2022)

- R&D Comparison of Key Players (2020)

Companies Mentioned

- Aluminum Corporation of China Limited (Chalco)

- China Hongqiao Group Limited

- Yunnan Aluminium Co., Ltd.

- Shandong Nanshan Aluminum Co., Ltd.

- China Zhongwang Holdings Limited

- State Power Investment Corporation Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 93 |

| Published | February 2022 |

| Forecast Period | 2022 - 2026 |

| Estimated Market Value ( USD | $ 719 Billion |

| Forecasted Market Value ( USD | $ 868.6 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | China |

| No. of Companies Mentioned | 6 |