Wireless Power Transmission (WPT) is a technology that enables the transfer of electrical energy from a power source to an electrical load without the use of physical connectors or wires. It is achieved through various methods, such as inductive coupling, resonant inductive coupling, capacitive coupling, microwave, and laser transmission. The technology allows to charge devices, such as smartphones, laptops, and electric vehicles without the hassle of wires and plugs. With continuous advancements and more the advent of refined techniques, there has been a significant rise in the adoption of wireless power transmission as it holds the potential to revolutionize our daily interactions with electronic devices and reshape our energy infrastructure.

Significant growth in the field of power transmission majorly drives the global market. This can be supported by the ever-growing global demand for electricity, fueled by increasing population, urbanization, and industrialization, particularly in developing nations. As economies evolve and grow, there has been a considerable increase in the need for reliable, efficient, and power transmission systems. Along with this, the development of new power transmission infrastructures due to the emerging trend of sustainability is supporting the market. In confluence with this, significant investments in modernization and upgrades are positively influencing the demand. Apart from this, the implementation of regulatory policies and government initiatives for promoting energy efficiency and supporting infrastructure development are contributing to the market. Furthermore, extensive research and development (R&D) activities conducted by key players are creating a positive market outlook.

Wireless Power Transmission Market Trends/Drivers

Increasing Adoption of Wireless Devices

The proliferation of wireless devices, such as smartphones, wearables, electric toothbrushes, and smartwatches, is acting as a major market driver. As more devices incorporate wireless charging capabilities, the demand for wireless power transmission infrastructure and compatible charging solutions grows. The ability to charge multiple devices simultaneously without the need for individual chargers is further fueling the demand. Since wireless power transmission eliminates the need for physical cables and connectors, providing convenience and ease of use for charging or powering devices. Users simply place their devices on a charging pad or within a certain range to initiate charging, eliminating the hassle of dealing with tangled cords and limited power outlets. This factor is a significant driver for wireless power transmission, especially in consumer electronics and smart home applications.Rapid Electrification of Remote Locations

In areas with limited power infrastructure or in remote locations, wireless power transmission offers an alternative solution for providing electricity. By enabling power transmission over longer distances without the need for extensive cabling or infrastructure development, wireless power transmission helps address the challenges associated with expanding power distribution networks, especially in developing regions. Wireless charging provides a seamless integration and power supply solution, eliminating the need for frequent battery replacements and simplifying deployment in smart homes, smart cities, and industrial IoT applications. This makes wireless charging a preferred option in rugged environments, industrial settings, and medical applications where safety and reliability are critical.Technological Advancements and Brand Differentiation

Companies are recognizing the value of wireless power transmission in enhancing the overall user experience and differentiating their products or services. Incorporating wireless charging capabilities help attract customers, improve customer satisfaction, and build brand loyalty. As wireless power transmission becomes more prevalent, companies are heavily investing in improving wireless charging options. In addition, continuous technological advancements in wireless power transmission, such as resonant inductive coupling and radio frequency (RF) technologies, have increased efficiency, extended transmission ranges, and reduced costs. Besides this, standardization efforts by organizations is establishing standards for different wireless charging technologies, enabling seamless compatibility between devices and charging stations, thus contributing to the demand.Wireless Power Transmission Industry Segmentation

This report provides an analysis of the key trends in each segment of the global wireless power transmission market report, along with forecasts at the global, regional and country levels from 2025-2033. The report has categorized the market based on type, technology, implementation, receiver application, and end-use industry.Breakup by Type

- Devices With Battery

- Devices Without Battery

The report has provided a detailed breakup and analysis of the wireless power transmission market based on the type. This includes devices with battery and devices without battery. According to the report, devices with battery represented the largest segment.

Breakup by Technology

- Near-Field Technology

- Inductive

- Magnetic Resonance

- Capacitive Coupling/Conductive

- Far-Field Technology

- Microwave/RF

- Laser/Infrared

A detailed breakup and analysis of the wireless power transmission market based on the technology has also been provided in the report. This includes near-field technology (inductive, magnetic resonance, and capacitive coupling/conductive) and far-field technology (microwave/rf and laser/infrared). According to the report, near-field technology accounted for the largest market share.

Breakup by Implementation

- Aftermarket

- Integrated

The report has provided a detailed breakup and analysis of the wireless power transmission market based on the implementation. This includes aftermarket and integrated. According to the report, the aftermarket represented the largest segment.

Breakup by Receiver Application

- Smartphones

- Tablets

- Wearable Electronics

- Notebooks

- Electric Vehicles

- Robots

- Others

A detailed breakup and analysis of the wireless power transmission market based on the receiver application has also been provided in the report. This includes smartphones, tablets, wearable electronics, notebooks, electric vehicles, robots, and others. According to the report, smartphones accounted for the largest market share.

Breakup by End-Use Industry

- Consumer Electronics

- Automotive

- Healthcare

- Defense

- Power Generation

- Others

The report has provided a detailed breakup and analysis of the wireless power transmission market based on the end-use industry. This includes consumer electronics, automotive, healthcare, defense, power generation, and others. According to the report, consumer electronics represented the largest segment.

Breakup by Region

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa.

The report has provided a comprehensive analysis of the competitive landscape in the global wireless power transmission market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Energous Corporation

- Humavox Ltd.

- Integrated Device Technology Inc. (Renesas Electronics Corporation)

- Leggett & Platt

- Murata Manufacturing Co. Ltd.

- NuCurrent Inc.

- MothersonOssia

- Qualcomm Incorporated

- Samsung Electronics

- TDK Corporation

- Texas Instruments

- Wi-Charge Ltd.

- WiTricity Corporation

Key Questions Answered in This Report

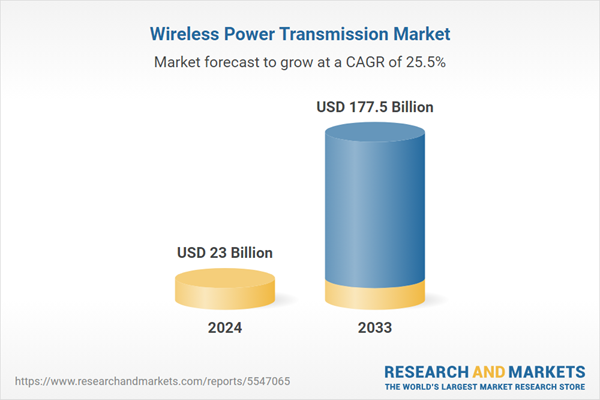

1. What was the size of the global wireless power transmission market in 2024?2. What is the expected growth rate of the global wireless power transmission market during 2025-2033?

3. What has been the impact of COVID-19 on the global wireless power transmission market?

4. What are the key factors driving the global wireless power transmission market?

5. What is the breakup of the global wireless power transmission market based on the type?

6. What is the breakup of the global wireless power transmission market based on the technology?

7. What is the breakup of the global wireless power transmission market based on implementation?

8. What is the breakup of the global wireless power transmission market based on the receiver application?

9. What is the breakup of the global wireless power transmission market based on the end-use industry?

10. What are the key regions in the global wireless power transmission market?

11. Who are the key players/companies in the global wireless power transmission market?

Table of Contents

Companies Mentioned

- Energous Corporation

- Humavox Ltd.

- Integrated Device Technology Inc. (Renesas Electronics Corporation)

- Leggett & Platt

- Murata Manufacturing Co. Ltd.

- NuCurrent Inc.

- MothersonOssia

- Qualcomm Incorporated

- Samsung Electronics

- TDK Corporation

- Texas Instruments

- Wi-Charge Ltd.

- WiTricity Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 137 |

| Published | February 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 23 Billion |

| Forecasted Market Value ( USD | $ 177.5 Billion |

| Compound Annual Growth Rate | 25.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |