Surgical Imaging Market Analysis:

Major Market Drivers: The growing frequency of chronic diseases, the need for advanced diagnostic, surgical interventions, and technological advancements in imaging systems with 3D imaging and portable C-arm devices accommodate to the growing demand for minimally invasive surgeries.Key Market Trends: The union of artificial intelligence (AI) and machine learning (ML) in surgical imaging systems simplifies real-time imaging analytics, which supports surgeons in making informed decisions through procedures. As per the surgical imaging market overview, the adoption of hybrid operating rooms equipped with advanced imaging devices allows complex surgeries to be performed with high precision and safety.

Geographical Trends: The growth of North America is due to established healthcare infrastructure, elevated healthcare expenditure, and rapid adoption of advanced technologies. Also, the Asia-Pacific region is perceiving rapid growth owing to collective healthcare investments, emerging medical tourism, and intensifying access to healthcare facilities, particularly in countries such as China and India.

Competitive Landscape: Some of the surgical imaging companies include Canon Medical Systems Corporation, General Electric Company, Geonoray Co. Ltd., Hologic Inc., Koninklijke Philips N.V., Medtronic Plc, Primax International Srl, Prognosys Medical Systems Private Limited, Shimadzu Corporation, Siemens Aktiengesellschaft, Trivitron Healthcare Pvt. Ltd, Whale Imaging Inc., and Ziehm Imaging GmbH (Aton GmbH), among many others.

Challenges and Opportunities: The elevated costs linked with advanced imaging technologies and stringent regulatory requirements pose challenges to market development limiting availability in lower-income provinces. As per the surgical imaging market recent opportunities lie in the expansion of applications for surgical imaging systems beyond traditional fields into areas like sports medicine and rheumatology.

Surgical Imaging Market Trends:

Increasing Surgical Procedures

The surgical procedures globally serve as a pivotal catalyst for the growth of the surgical imaging market. With advancements in medical technology and increasing access to healthcare services, more individuals are undergoing surgical interventions to address various medical conditions. For instance, in the fiscal year 2023-24, the number of surgeries performed exceeded the previous record set in 2022-23 by almost 6,000. There is a distinguished focus on hip and knee replacement surgeries, which rank among the highest-volume procedures in Saskatchewan, Canada. Explicitly, the annual volumes for hip and knee replacements rose from nearly 6,300 in the preceding year to almost 7,100 in 2023-2024. The size of joint substitute procedures conducted during this fiscal year April 1, 2023, to March 31, 2024, was 50% higher than the yearly size before the COVID-19 pandemic, recorded in 2019-20. On April 1, 2023, and March 31, 2024, 95,700 surgeries were efficiently supervised marking the most excessive annual surgical size ever documented. Also, the budget for 2024-2025 offers an additional investment of $2.28 million for increasing surgical capacities and diminishing wait times. Hence, the expanding healthcare organization contributes to the rise in surgical imaging market growth.Prevalence of Chronic Diseases

The prevalence of chronic diseases significantly drives the need for surgical interventions. Conditions such as cardiovascular diseases, cancer, and neurological disorders require surgical procedures for diagnosis, treatment, or symptom management. As lifestyles change, populations age and environmental factors contribute to disease burden, the incidence of chronic illnesses continues to rise. For instance, as per the BRITISH HEART FOUNDATION in January 2024, in the UK, approximately 7.6 million individuals are afflicted with heart and circulatory diseases. This number is poised to increase due to an aging population and better survival rates following heart and circulatory incidents. It also reveals about 4 million men and 3.6 million women are affected by heart and circulatory diseases. It is projected that over half of the UK, population will experience a heart or circulatory disease at some point in their lives. Notably, heart and circulatory diseases are responsible for about 27% of all UK deaths annually, translating to more than 170,000 deaths or roughly 480 daily, amounting to one death every 3 minutes. Furthermore, heart and circulatory diseases claim nearly 49,000 lives under 75 years old annually in the UK. Besides this, the projected increase in cardiovascular disease (CVD) cases will continue to increase surgical imaging market demand.Adoption of Hybrid Operating Rooms

The rapid adoption of hybrid operating rooms represents a paradigm shift in surgical practice, integrating advanced imaging technologies into surgical environments. Additonally, hybrid operating rooms combine traditional surgical equipment with state-of-the-art imaging systems such as angiography and MRI machines. It enables real-time visualization of anatomical structures and surgical progress, enhancing procedural accuracy and patient safety. The growing demand for minimally invasive procedures and complex interventions drives the expansion of hybrid operating room facilities worldwide. To state an instance, in 2023, the size of the global hybrid operating room market amounted to US$ 1.19 billion. Moving ahead, the analyst anticipates the hybrid operating room market to achieve US$ 2.75 billion by 2032, showcasing a compound annual growth rate (CAGR) of 9.42% from 2024 to 2032. As the hybrid operating room market continues to grow due to technological advancements and increasing demand for sophisticated surgical interventions it is creating a favorable surgical imaging market outlook.Surgical Imaging Market Segmentation:

This report provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. The report categorizes the market based on technology type, modality type, application, and end user.Breakup by Technology Type:

- Image Intensifier

- Flat Panel Detector (FPD)

Flat panel detector (FPD) accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the technology type. This includes an image intensifier, and flat panel detector (FPD). According to the report, flat panel detector (FPD) represented the largest segment.Flat panel detectors (FPD) are highly favored in surgical imaging due to their superior image quality, lower radiation exposure, and greater durability compared to other imaging technologies. These detectors are extensively used in various surgical procedures, including orthopedic, cardiovascular, and neuro surgeries, driving their high adoption rate. For instance, on 6 July 2023, Shimadzu Medical Systems USA, a division of Shimadzu Corporation introduced the new V series Glass-Free Flat Panel Detectors (FPD), now integrated with general radiography platforms. These innovative glass-free FPD detectors feature a 99-micron pixel pitch for capturing highly detailed X-ray images. Additionally, their lightweight construction eases the workload on radiology technologists and increases durability against drops. It is available in three dimensions such as 17”x17”, 14”x17”, and 10”x12” that are compatible with RADspeed Pro style edition V series and MobileDaRt Evolution MX8 V type systems. Thus, FPD continues to dominate the market, due to the ongoing advancements and increasing demand for minimally invasive surgeries.

Breakup by Modality Type:

- Mobile C-Arms

- Mini C-Arms

- Others

Mobile C-Arms are versatile imaging devices used extensively in operating rooms for a variety of diagnostic and interventional procedures. Their design allows for greater flexibility and mobility, making them ideal for surgeries requiring real-time imaging feedback such as orthopedics, cardiology, and vascular surgery. These systems provide high-resolution X-ray images, enabling precise placement of surgical instruments and implants. For instance, on 13 September 2023, Philips, a prominent leader in health technology, expanded its mobile C-arm lineup with the introduction of the Zenition 30, enhancing the capabilities of surgical teams by allowing surgeons more customization and autonomy in their use. It enhances the operational flexibility and customization for surgeons in C-arm usage and image capture, reducing the need for extensive technician assistance across various minimally invasive surgeries. The system is equipped with advanced imaging algorithms that ensure superior image quality and efficient dosage use. Thus, the demand for mobile C-Arms is increasing owing to their capability to facilitate quicker, more accurate surgical outcomes which is generating a surgical imaging market revenue.

Besides this, Mini C-Arms are compact, portable imaging devices specifically suited for extremity imaging, particularly in orthopedic and podiatric surgeries. These smaller versions of the traditional C-Arm are preferred for outpatient settings and smaller clinics due to their reduced size and ease of use. They are particularly valuable in sports medicine, pediatric applications, and intraoperative imaging where space and quick setup are crucial. Apart from this, mini C-Arms are also cost-effective, which makes them an attractive option for facilities with limited budgets or those that require a device dedicated to specific types of surgical procedures.

Breakup by Application:

- Neurosurgery

- Orthopedic and Trauma Surgery

- Cardiovascular

- General Surgery

- Others

Orthopedic and trauma surgery represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes neurosurgery, orthopedic and trauma surgery, cardiovascular, general surgery, and others. According to the report, orthopedic and trauma surgery represented the largest segment.Orthopedic and trauma surgery is leading the market due to the increasing incidence of bone-related injuries and the rising demand for precise real-time imaging during complex orthopedic surgeries. Surgical imaging devices such as mobile C-arms have become essential in ensuring high accuracy and better outcomes in these procedures. The technological advancements in imaging technologies that offer enhanced image clarity and reduced exposure to radiation are further making them indispensable in today's orthopedic and trauma surgical practices, thus creating the surgical imaging market recent opportunities across the globe.

Breakup by End User:

- Hospitals

- Surgery Centers and Clinics

Hospitals exhibit a clear dominance in the market

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, surgery centers and clinics. According to the report, hospitals accounted for the largest market share.Hospitals are driven by the high volume of complex surgeries, which necessitate advanced imaging technologies for accurate diagnostics and procedural guidance. It also has greater financial capabilities to invest in sophisticated surgical imaging systems compared to smaller clinics or diagnostic centers. Moreover, the push toward minimally invasive procedures, which require precise imaging for successful outcomes, further boosts the demand for high-end surgical imaging equipment within hospital settings. This trend is expected to continue as hospitals expand their technological capabilities to enhance surgical outcomes and patient care. Thus, in July 2021, the Government of Ontario allocated as much as $324 million to support Ontario’s hospitals and community health sectors. This investment was designed to increase the capacity for more surgeries, MRI and CT scans, and other medical procedures, including during evenings and weekends. It is part of a broader, detailed plan aimed at improving surgical recovery and ensuring patients receive the necessary care. It allowed up to 67,000 extra surgeries and procedures. It provided up to 135,000 additional hours of diagnostic imaging which reduced wait times for medical procedures, enhanced access to healthcare services, and fulfilled the government's pledge to eliminate healthcare services in hallways.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest surgical imaging market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for surgical imaging.The market in North America is leading due to advanced healthcare infrastructure, high adoption rates of cutting-edge medical technologies, and significant investments in research and development thus creating a positive surgical imaging market forecast. The region benefits from a robust regulatory framework that supports rapid approvals of innovative imaging technologies, facilitating their integration into surgical practices. For instance, in January 2024, Shimadzu Medical Systems USA, a branch of Shimadzu Corporation, achieved HCAI Special Seismic Certification preapproval for its FLUOROspeed X1 model. This certification confirms the system's ability to withstand earthquakes, enabling the deployment of this advanced patient-side conventional RF table system in California's healthcare settings. The FLUOROspeed X1, featuring patient-side table controls for easier operation, includes a 17""x17"" dynamic digital X-ray detector (FPD) embedded in the table bucky, suitable for fluoroscopy and radiographic examinations. Its 31.5-inch gap between the tabletop and deck makes it an excellent digital RF system for imaging patients in wheelchairs and fits well in smaller spaces.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the surgical imaging industry include Canon Medical Systems Corporation, General Electric Company, Geonoray Co. Ltd., Hologic Inc., Koninklijke Philips N.V., Medtronic Plc, Primax International Srl, Prognosys Medical Systems Private Limited, Shimadzu Corporation, Siemens Aktiengesellschaft, Trivitron Healthcare Pvt. Ltd, Whale Imaging Inc., and Ziehm Imaging GmbH (Aton GmbH).(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

At present, the surgical imaging market recent developments by key players include innovation and expansion of product portfolios to meet the diverse needs of modern healthcare. These companies focus on developing advanced imaging technologies that offer clearer, more precise visuals to support complex surgical procedures. Many are also forging strategic partnerships and acquisitions to enhance their market reach and technological capabilities. Additionally, they invest heavily in research and development to introduce AI-driven and minimally invasive imaging solutions, aimed at improving patient outcomes and operational efficiency in hospitals and surgical centers. This strategic focus ensures their strong position in the competitive landscape. On 28 August 2022, Siemens Healthineers disclosed that the ARTIS icono ceiling, a ceiling-mounted angiography system, has received clearance from the Food and Drug Administration (FDA). This system is tailored to accommodate a broad spectrum of routine and advanced procedures in interventional radiology (IR) and cardiology. Moreover, its notable mechanical flexibility renders it applicable for various surgical interventions as well.

Surgical Imaging Market News:

On 21 March 2024, Siemens Healthineers received approval from the Food and Drug Administration (FDA) for its CIARTIC Move, a mobile C-arm equipped with autonomous driving features. This system enhances the efficiency and standardization of 2D fluoroscopic imaging and 3D cone-beam CT scans for surgical teams in hospital and outpatient settings. By automating workflows, the CIARTIC Move streamlines the imaging process during surgeries, thereby improving consistency and reducing operation times. It is specifically designed for use in orthopedic, trauma, and spine surgeries and is adaptable for use in thoracic, vascular, cardiovascular, general surgeries, urology, and interventional pulmonology.On 28 February 2024, Royal Philips, a prominent health technology company, introduced the Philips Image Guided Therapy Mobile C-arm System 9000 Zenition 90 Motorized. This new mobile C-arm is engineered to support surgeons in providing top-tier care to an increased number of patients. The system, enhanced to handle complex vascular conditions and various clinical operations such as cardiac procedures, pain management, and urology, is set to be commercially available starting in the second quarter of 2024. The automated processes enhance the flexibility and autonomy of surgeons, and intuitive motorization delivers enhanced control, while high-power (25 kW) capabilities support exceptional image quality, meeting the demands of complex vascular requirements and various clinical procedures.

Key Questions Answered in This Report

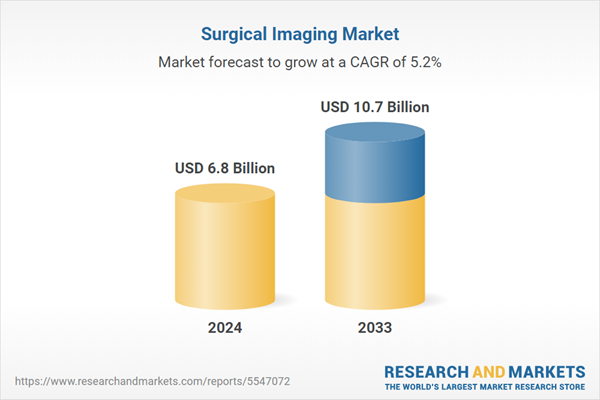

1. What was the size of the global surgical imaging market in 2024?2. What is the expected growth rate of the global surgical imaging market during 2025-2033?

3. What are the key factors driving the global surgical imaging market?

4. What has been the impact of COVID-19 on the global surgical imaging market?

5. What is the breakup of the global surgical imaging market based on the technology type?

6. What is the breakup of the global surgical imaging market based on the application?

7. What is the breakup of the global surgical imaging market based on end user?

8. What are the key regions in the global surgical imaging market?

9. Who are the key players/companies in the global surgical imaging market?

Table of Contents

Companies Mentioned

- Canon Medical Systems Corporation

- General Electric Company

- Geonoray Co. Ltd.

- Hologic Inc.

- Koninklijke Philips N.V.

- Medtronic Plc

- Primax International Srl

- Prognosys Medical Systems Private Limited

- Shimadzu Corporation

- Siemens Aktiengesellschaft

- Trivitron Healthcare Pvt. Ltd

- Whale Imaging Inc.

- Ziehm Imaging GmbH (Aton GmbH)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 139 |

| Published | May 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 6.8 Billion |

| Forecasted Market Value ( USD | $ 10.7 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |