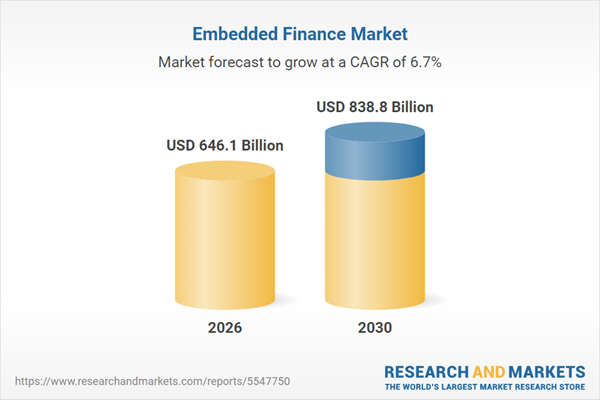

The global embedded finance market has experienced robust growth during 2021-2025, achieving a CAGR of 13.0%. This upward trajectory is expected to continue, with the market forecast to grow at a CAGR of 6.7% from 2026 to 2030. By the end of 2030, the embedded finance market is projected to expand from its 2024 value of US$591.1 billion to approximately US$838.8 billion.

Key Trends and Drivers Shaping the Global Embedded Finance Market

The global embedded finance market is undergoing structural transformation across both mature and emerging regions, driven by ecosystem partnerships, enabling infrastructure, and supportive regulation. While sector-specific dynamics (e.g., B2B credit, gig insurance, superapps) vary by geography, the overarching trend is toward embedded financial services becoming core infrastructure in digital platforms. Over the next 2-4 years, this trend is expected to deepen, with growing specialization in embedded credit, insurance, and payments across verticals. The evolution will be shaped by regional regulatory shifts, the maturity of BaaS ecosystems, and the ability of platforms to balance financial services integration with risk, compliance, and user trust.Banking-as-a-Service Platforms Are Expanding Beyond Traditional Verticals

- Embedded finance is increasingly being enabled through Banking-as-a-Service (BaaS) platforms, which allow non-financial companies to offer financial services - such as bank accounts, cards, or credit - within their native ecosystems. BaaS providers like Solaris (Europe), Unit (U.S.), and Weavr (UK/Singapore) are powering fintech capabilities across sectors like e-commerce, healthtech, and logistics, reducing time-to-market for embedded products.

- Regulatory enablers (e.g., PSD2 in Europe), demand for contextual finance, and rising enterprise digitalization are pushing BaaS adoption. In the U.S., Unit has partnered with platforms like AngelList to launch financial products for startups, while in Southeast Asia, Weavr is enabling digital health platforms to integrate patient financing. These partnerships eliminate the need for enterprises to become licensed financial institutions themselves.

- This trend is expected to intensify as infrastructure providers expand API capabilities, integrate risk management tools, and attract funding. Cross-border BaaS models are likely to emerge, especially in Southeast Asia and Latin America, where local fintechs are leveraging regional BaaS rails to scale. Regulatory scrutiny may increase, but modular BaaS offerings will become the foundation for embedded finance across multiple industries.

Ecosystem-Oriented Superapps Are Driving Embedded Finance Uptake in Asia and Africa

- Superapps and platform ecosystems - such as Grab (Southeast Asia), Gojek (Indonesia), and M-Pesa (Kenya) - are embedding payments, lending, and insurance directly into daily-use platforms. These players are integrating multiple financial services under one roof, turning customer engagement into a monetizable fintech layer.

- In emerging markets, limited banking penetration and high mobile usage are catalyzing superapp adoption. Grab Financial Group offers microloans, insurance, and BNPL across Southeast Asia. Similarly, Safaricom’s M-Pesa ecosystem in Kenya enables merchants to access working capital and users to purchase insurance - fully integrated within mobile usage flows.

- The trend will deepen as more superapps formalize fintech offerings via licensed subsidiaries or partnerships with financial institutions. Expect to see growth in embedded wealth and insurance services beyond core payments. However, regulation around data sharing and interoperability may impact how rapidly superapps can expand their embedded finance layers.

Embedded Credit Is Gaining Traction in B2B and SME-Focused Segments

- B2B platforms are embedding credit solutions - such as invoice financing, working capital loans, and supplier credit - within procurement and supply chain workflows. In India, players like Rupifi and Veefin are enabling credit for small businesses within B2B marketplaces such as Udaan and Jumbotail. In the U.S., platforms like Resolve and Fundbox offer embedded net terms and trade credit.

- SMEs often lack formal access to credit due to weak financial documentation. Embedded finance allows B2B platforms to leverage transaction data for underwriting, while creating sticky use cases for the platform. The rise of vertical SaaS and digitized procurement ecosystems (e.g., in agriculture, pharma, and construction) is a key enabler.

- This trend will intensify as credit underwriting becomes more API-driven and alternative data models gain regulatory acceptance. Asia and Latin America are likely to see rapid expansion, particularly as embedded B2B credit becomes a strategic lever for platforms to improve monetization and retention.

Insurance-as-a-Feature Is Emerging as a Differentiator in Mobility, Travel, and Gig Economy Platforms

- Embedded insurance is transitioning from basic device protection to dynamic, usage-based insurance within platforms. Companies like Ola (India), Uber (globally), and Bolt (Europe) have embedded trip insurance, while Cover Genius and Zego are enabling contextual insurance for e-commerce and gig workers.

- Increasing participation in gig economy, rising demand for on-demand coverage, and platform accountability in user safety are key drivers. Embedded insurance improves trust while generating an ancillary revenue stream. In Brazil, bike-delivery app Rappi includes embedded accident and theft coverage for its riders via SURA.

- The trend is expected to stabilize, with growth concentrated in parametric, micro-duration, and pay-per-use products. Regulatory harmonization will be needed to support scalability across jurisdictions. Expect insurance to become a value-added feature for differentiation rather than a standalone monetization model.

Contextual Payments and Wallet Integrations Are Expanding Across Retail and SaaS

- Retailers and SaaS platforms are embedding wallets and payments directly into customer journeys, improving checkout efficiency and loyalty. Examples include Shopify Balance (U.S.), which provides merchants with integrated bank accounts and cards, and Mercado Pago in Latin America, which enables in-app payments across Mercado Libre’s ecosystem.

- The demand for frictionless experiences, increasing competition in merchant onboarding, and interchange revenue incentives are major drivers. The rise of vertical SaaS solutions (e.g., Toast in restaurants, Mindbody in wellness) is also fueling in-platform payment adoption.

- Contextual payment integrations will become standard across digital platforms, with payment acceptance, loyalty, and financing tightly bundled. In emerging markets, wallet-based systems will evolve to support embedded cross-border payments, driven by remittance needs and regional trade corridors.

Regulatory Sandboxes and API Mandates Are Accelerating Embedded Finance Adoption

- Governments and regulators are shaping the embedded finance landscape through open banking frameworks, digital license regimes, and fintech sandboxes. The EU’s PSD2 and upcoming PSD3 frameworks, Brazil’s Open Finance rollout, and Singapore’s digital banking license regime are all promoting embedded finance experimentation.

- A push to expand financial inclusion, increase competition, and reduce customer acquisition barriers for non-bank entities is central. Regulators are increasingly allowing controlled experimentation - e.g., South Africa’s Intergovernmental Fintech Working Group sandbox or the UAE’s Digital Sandbox program.

- Regulatory enablers will continue to support embedded finance scale, but with stricter oversight around data usage, risk sharing, and consumer protection. Embedded players will need to build robust compliance layers or partner with regulated financial entities to sustain growth across jurisdictions.

Competitive Landscape in the Global Embedded Finance Market

The global embedded finance market is characterized by a fragmented but rapidly converging competitive landscape. Large platform players, fintech enablers, and vertical specialists are all vying for position across geographies and financial service layers. Over the next 2-4 years, the landscape will likely shift from rapid expansion to consolidation, with regulatory pressure and infrastructure depth becoming decisive factors. Players with end-to-end risk management, strong compliance architecture, and embedded distribution channels will have the strategic advantage, while unlicensed or thinly integrated players may be forced to retrench or pivot. M&A activity and cross-border partnerships will remain high, particularly in BaaS, data orchestration, and embedded credit.Platform-Led Expansion Has Intensified Competitive Pressure Across Verticals

- Tech platforms, such as Shopify (U.S.), Mercado Libre (Latin America), and Grab (Southeast Asia), have evolved into multi-service ecosystems by embedding payments, credit, and insurance into their user flows. At the same time, SaaS players like Toast (hospitality, U.S.) and Lightspeed (retail, Canada/Europe) now offer in-platform financial tools, challenging traditional providers. This cross-sector competition is blurring industry boundaries and accelerating product commoditization.

- Banking-as-a-Service (BaaS) providers such as Solaris (EU), Synapse (U.S., now undergoing restructuring), and M2P (India) have enabled rapid deployment of embedded products, but many face scale and compliance challenges. The result is a competitive environment with high product velocity but uneven infrastructure maturity across regions.

- Players with differentiated onboarding experiences, embedded risk management, and regulatory adaptability (e.g., partnerships with licensed entities) will gain ground. Infrastructure consolidation is expected, especially in BaaS and API orchestration layers.

Global Fintechs and Big Tech Platforms Are Consolidating Positions Across Regions

- Stripe (U.S.) continues to expand embedded payments and lending for SaaS platforms via Stripe Connect and Stripe Capital. In India, Razorpay has moved beyond payments into embedded payroll and credit. Apple and Google have embedded financial layers (Apple Card, Google Pay) into their device ecosystems, targeting both retail and small business segments.

- In Brazil, Mercado Pago (a unit of Mercado Libre) processed more than half of all Mercado Libre transactions in 2024 and is now expanding working capital credit. Amazon in the U.S. and India offers seller financing via embedded credit partnerships with fintechs and banks. These ecosystem-led players are leveraging user data and distribution advantage to expand financial products.

- Expect scrutiny from competition and financial regulators in markets like the EU, India, and the U.S. to limit vertical integration, requiring tech platforms to partner or spin out regulated subsidiaries.

Strategic Partnerships and M&A Activity Reflect Consolidation and Infrastructure Gaps

- In 2024, Mastercard acquired Baffin Bay Networks (Sweden-based cybersecurity firm) and partnered with Jumia (Africa) to strengthen embedded payment layers in underbanked markets. In the U.K., Weavr acquired Comma to integrate open banking with embedded finance flows for SMEs. These moves aim to plug capability gaps while accelerating product integration.

- With regulators increasingly scrutinizing embedded finance setups (especially BaaS providers), acquirers are prioritizing platforms with robust compliance-as-a-service and data security capabilities.

Regulatory Licensing and Sandbox Developments Are Redrawing Competitive Boundaries

- In India, embedded credit players must now comply with the Reserve Bank of India’s digital lending guidelines (effective from 2023-24), which prohibit unlicensed entities from extending credit directly. In the EU, PSD3 and the Financial Data Access (FIDA) framework, expected by 2026, will mandate broader access to customer data - benefiting licensed players but creating new compliance burdens.

- South Africa’s Intergovernmental Fintech Working Group continues to host use cases in embedded insurance and SME lending, while the UAE’s DIFC sandbox is supporting cross-border embedded finance pilots. However, failed or non-compliant experiments (e.g., U.S. scrutiny of Synapse-related outages) are pushing regulators to demand better risk segregation between infrastructure and distribution entities.

- This could bifurcate the market - players with licensing or bank partnerships may thrive, while unregulated distributors face tighter restrictions, especially in credit and insurance.

New Entrants and Vertical Specialists Are Creating Niche Disruption

- In Southeast Asia, Wagely (Indonesia) focuses on earned wage access embedded in HR tech platforms. In the U.S., providers like Tapcheck and Clair are expanding EWA solutions for gig and hourly workers. In Africa, PayHippo is offering embedded credit for SME platforms in logistics and distribution.

- They leverage sector-specific data (e.g., payroll systems, delivery volumes, ERP data) to offer contextual financing or insurance. In Latin America, Tribal is embedding credit for startups and digital-native exporters across procurement platforms.

The report offers segmentation by business models (platform-based, enabler, and regulatory entity), distribution models (own and third-party platforms), and end-use markets, including e-commerce, retail, healthcare, travel & hospitality, utilities, automotive, education, and the gig economy. Together, these datasets provide a comprehensive, quantifiable view of market size, operational efficiency, risk, customer behavior, and user experience in the embedded finance market.

PayNXT360 research methodology is based on industry best practices. Its unbiased analysis leverages a proprietary analytics platform to offer a detailed view of emerging business and investment market opportunities.

This title is a bundled offering, combining the following 21 reports, covering 3000+ tables and 4000+ figures:

1. Global Embedded Finance Business and Investment Opportunities Databook2. Argentina Embedded Finance Business and Investment Opportunities Databook

3. Australia Embedded Finance Business and Investment Opportunities Databook

4. Brazil Embedded Finance Business and Investment Opportunities Databook

5. Canada Embedded Finance Business and Investment Opportunities Databook

6. China Embedded Finance Business and Investment Opportunities Databook

7. France Embedded Finance Business and Investment Opportunities Databook

8. Germany Embedded Finance Business and Investment Opportunities Databook

9. India Embedded Finance Business and Investment Opportunities Databook

10. Indonesia Embedded Finance Business and Investment Opportunities Databook

11. Italy Embedded Finance Business and Investment Opportunities Databook

12. Kenya Embedded Finance Business and Investment Opportunities Databook

13. Mexico Embedded Finance Business and Investment Opportunities Databook

14. Nigeria Embedded Finance Business and Investment Opportunities Databook

15. Philippines Embedded Finance Business and Investment Opportunities Databook

16. Russia Embedded Finance Business and Investment Opportunities Databook

17. South Africa Embedded Finance Business and Investment Opportunities Databook

18. Thailand Embedded Finance Business and Investment Opportunities Databook

19. United Arab Emirates Embedded Finance Business and Investment Opportunities Databook

20. United Kingdom Embedded Finance Business and Investment Opportunities Databook

21. United States Embedded Finance Business and Investment Opportunities Databook

Scope

This report provides in-depth, data-centric analysis of the global embedded finance market, with exclusive coverage of B2C transactions and adoption metrics. Below is a summary of key market segments.Embedded Finance Market Size and Growth Dynamics

- Total Transaction Value

- Number of Transactions

- Average Value per Transaction

Embedded Finance Financial Performance Indicators

- Total Revenue

- Average Revenue per Transaction / Product

Embedded Finance Key Metrics

- Operational Efficiency Metrics: Transaction Success Rate, Automation Rate (Instant Decision %), Average Turnaround / Processing Time

- Quality & Risk Metrics: Fraud Rate, Error Rate

- Customer Behavior Metrics: Repeat Borrowing Rate, Customer Retention Rate, Churn Rate, Conversion Rate, Abandonment Rate, Cross-Sell / Upsell Rate

- User Experience Metrics: Average Transaction Speed, Average Order / Loan / Policy / Investment Size

Embedded Payments Market Size and Growth Dynamics

- Total Payment Value (TPV) and Growth Outlook

- Number of Transactions and Usage Trends

- Average Revenue per Transaction

Embedded Payments Key Metrics

- Transaction Metrics: Transaction Success Rate, Repeat Usage Rate

- Operational Efficiency Metrics: Chargeback Rate, Fraud Rate, Dispute / Resolution Rate

- Conversion & Retention Metrics: Conversion Rate, Abandonment Rate, Customer Retention Rate

- User Experience Metrics: Average Transaction Speed, Error Rate

Embedded Payments Market Segmentation by Business Models

- Platform-Based Model

- Enabler-Based Model

- Regulatory-Entity Model

Embedded Payments Market Segmentation by Distribution Models

- Own Platforms

- Third-Party Platforms

Embedded Payments Market Segmentation by End-Use Markets

- E-commerce & Retail

- Digital Products & Services

- Travel & Hospitality

- Leisure & Entertainment

- Health & Wellness

- Utility Bill Payments

- Other Sectors

Embedded Lending Market Size and Growth Dynamics

- Loan Disbursement Value

- Number of Loans Issued

- Average Loan Size

Embedded Lending Key Metrics

- Credit Quality & Risk Metrics: Delinquency Rate (30/60/90 Days), Approval Rate, Default Rate, Loss Given Default (LGD)

- Monetization & Unit Economics Metrics: Interest Revenue per Loan

- Adoption & Usage Metrics: Repeat Borrowing Rate

- Operational & Platform Efficiency Metrics: Loan Origination Time (TAT), Automation Rate (Instant Decision %)

Embedded Lending Market Segmentation by Business Models

- Platform-Based Model

- Enabler-Based Model

- Regulatory-Entity Model

Embedded Lending Market Segmentation by Distribution Models

- Own Platforms

- Third-Party Platforms

Embedded Lending Market Segmentation by Product Types

- Buy Now, Pay Later (BNPL)

- Point-of-Sale (POS) Lending

- Personal Loans

- Gig Worker Income Advances

- Other Loan Types

Embedded Lending Market Segmentation by End-Use Markets

- E-commerce & Retail

- Gig Economy

- Travel & Hospitality

- Healthcare

- Education & EdTech

- Automotive & Mobility

- Other Sectors

Embedded Insurance Market Size and Premium Dynamics

- Gross Written Premium (GWP)

- Number of Policies Issued

- Average Premium per Policy

Embedded Insurance Key Metrics

- Policy & Premium Metrics: Renewal Rate

- Claims & Risk Performance Metrics: Claims Ratio (Loss Ratio), Claim Frequency, Claim Settlement Time, Fraud Rate

- Platform Monetization Metrics: Embedded Insurance Revenue per User (RIU)

- Distribution & Conversion Metrics: Attachment Rate, Quote-to-Bind Conversion Rate, Cross-Sell / Upsell Rate

Embedded Insurance Market Segmentation by Policy Type

- Life Insurance

- Non-Life Insurance (Motor Vehicle, Home/Property, Accident & Health, Others)

- Motor Vehicle

- Home/Property

- Accident & Health

Embedded Insurance Market Segmentation by Business Models

- Platform-Based Model

- Enabler-Based Model

- Regulatory-Entity Model

Embedded Insurance Market Segmentation by Distribution Models

- Own Platforms

- Third-Party Platforms

Embedded Insurance Market Segmentation by End-Use Markets

- E-commerce & Retail

- Travel & Hospitality

- Automotive & Mobility

- Healthcare

- Other Sectors

Embedded Banking Market Size and Account Dynamics

- Total Deposits / Inflows

- Account Fee Revenue

Embedded Banking Key Metrics

- Account Metrics: Account Churn Rate

- Risk & Compliance Metrics: Fraudulent Transaction Rate

Embedded Banking Distribution by End-Use Markets

- Gig & Freelance Platforms

- E-commerce & Marketplaces

- Fintech Apps & Neobanks

- Other Platforms

Embedded Investments & Wealth Market Size and User Dynamics

- Total Assets Under Management (AUM)

- Number of Investment Transactions

- Average Investment per User

Embedded Investments & Wealth Key Metrics

- Returns & Performance Metrics: Annualized Portfolio Return

- Retention Metrics: Account Churn Rate

Embedded Investments & Wealth Market Segmentation by Business Models

- Platform-Based Model

- Enabler-Based Model

- Regulatory-Entity Model

Embedded Investments & Wealth Market Segmentation by Distribution Models

- Own Platforms

- Third-Party Platforms

Embedded Investments & Wealth Market Segmentation by End-Use Markets

- Fintech & Neobank Apps

- E-commerce & Super Apps

- Gig & Freelancer Platforms

- Other Platforms

Reasons to buy

- Comprehensive KPI Coverage: Access over 100 key performance indicators (KPIs), including transaction value, transaction volume, revenue, and average transaction size.

- Complete Vertical Coverage: Structured datasets across all five embedded finance verticals - payments, lending, insurance, banking, and investments & wealth.

- Granular Market Segmentation: Detailed data by business models (platform-based, enabler, regulatory-entity), distribution models (own vs. third-party platforms), and product types.

- Sector-Level Data Tracking: Coverage across B2C end-use markets such as e-commerce, retail, healthcare, travel & hospitality, utilities, automotive, education, gig economy, and others.

- Operational & Performance Metrics: Provides data on efficiency, quality & risk, monetization, customer behavior, and user experience indicators for a rounded view of market performance.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 4830 |

| Published | October 2025 |

| Forecast Period | 2026 - 2030 |

| Estimated Market Value ( USD | $ 646.1 Billion |

| Forecasted Market Value ( USD | $ 838.8 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |