Infections transmitted from an infected person to an uninfected person through sexual intercourse are known as sexually transmitted diseases (STDs). Vaginal, oral, or anal sex are the most common forms of sexual contacts through which STDs get transmitted. Additionally, these diseases can spread through other forms of intimate physical contact also. This is due to the fact that some STDs, such as herpes and HPV, are spread through skin-to-skin contact since some of them are caused by Bacteria, viruses, or parasites. Gonorrhea, genital herpes, human papillomavirus infection, HIV/AIDS, chlamydia, and syphilis are only a few examples of STDs.

HIV/AIDS has consistently rated among the top ten leading causes of death for decades. In developed countries, testing and treatment have considerably reduced the disease's impact and prevalence. However, among younger groups, there has been a substantial increase in infection rates.

COVID-19 Impact Analysis

The COVID-19 pandemic is a public health disaster that has a negative impact on the STD testing market. Sexually transmitted infection cases were high prior to the pandemic, but following the pandemic, STD testing cases have reduced. Due to difficulties in health care and sexually transmitted infection testing services during the early months of the COVID-19 pandemic, testing reports of sexually transmitted infections were declined.

Due to a scarcity of intensive care resources, efforts were concentrated on ensuring the availability of critical care services. In addition, the imposition of restrictions like the ban on imports & exports and disruption in the supply chain have hampered the demand for STD testing kits and hence, hinder the growth of the STD testing market in the upcoming years.

Market Growth Factors:

Increasing awareness among population

There are many governments across developed and developing nations who are trying to aware people regarding the importance of early testing of STDs. For this, government and other healthcare authorities have strategized various campaigns for creating awareness among people regarding STDs. For example, CDC has initiated STD Awareness Week, which held in the second week of April. Also, many other renowned healthcare organizations are running campaigns for the same in their respective regions or even worldwide.Rising government investments or funds

Several government authorities are increasing their investment in the development of fast and effective STD testing since it helps them to control the cases of STDs by providing correct medications at the correct time. The death rate of people having STDs is significantly high because patients do not get tested with correct measures at right time, which makes their condition more vulnerable and difficult to treat.Marketing Restraining Factor:

Weak health services for screening and curing STDs

People seeking STI testing and treatment face numerous issues. Limited resources, poor service quality, and little or no sexual partner follow-up are among them. STI services are given independently in many countries and are not included in primary health care, family planning, or other regular health treatments. Because of a shortage of qualified employees, laboratory capacity, and adequate supply of relevant medicines, many services are unable to perform screening for asymptomatic infections.Disease Type Outlook

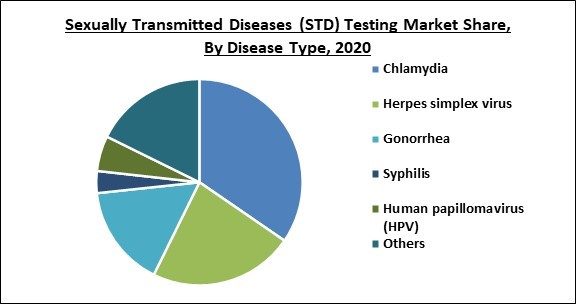

Based on Disease Type, the market is segmented into Chlamydia, Herpes simplex, Gonorrhea, Syphilis, Human papillomavirus (HPV), and Other Disease. Gonorrhea segment is estimated to garner a substantial share in the market during the forecast period. The bacteria Neisseria gonorrhoeae causes gonorrhoea, which is a sexually transmitted illness (STD).

Location of Testing Outlook

Based on the Location of Testing, the market is segmented into Laboratory Testing and Point of care (POC) Testing. Point of care testing refers to the medical diagnostic testing done in the nearby care center. People who have not undergone professional laboratory training can also undertake POC testing.

Regional Outlook

Based on Regions, the market is segmented into North America, Europe, Asia Pacific, and Latin America, Middle East & Africa. Asia-Pacific emerged as the leading region in the sexually transmitted diseases market with the largest revenue share and is projected to continue this trend during the forecast period. This is due to an increase in the number of cases of sexually transmitted illnesses in developing countries like China and Japan.

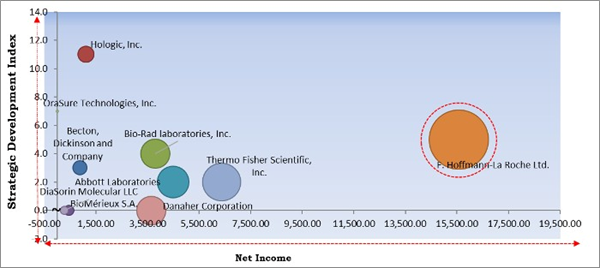

Cardinal Matrix - Sexually Transmitted Diseases (STD) Testing Market Competition Analysis

The major strategies followed by the market participants are Product Launches. Based on the Analysis presented in the Cardinal matrix; F. Hoffmann-La Roche Ltd. is the major forerunner in the Sexually Transmitted Diseases (STD) Testing Market. Companies such as Abbott Laboratories, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc. are some of the key innovators in the Market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include BioMérieux S.A., Abbott Laboratories, Becton, Dickinson and Company, Hologic, Inc., Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche Ltd., DiaSorin Molecular LLC, Danaher Corporation, Bio-Rad Laboratories, Inc., and OraSure Technologies, Inc.

Recent Strategies Deployed in Sexually Transmitted Diseases (STD) Testing Market

» Partnerships, Collaborations and Agreements:

- Jun-2020: Roche formed a partnership with SpeeDx, a developer of innovative molecular diagnostic solutions. This partnership aimed to enable Roche Diagnostics to offer clinicians critical and advanced tools for the detection of antibiotic resistance in patients with sexually transmitted infections.

- Apr-2017: Thermo Fisher Scientific entered into a partnership with SpeeDx, a provider of innovative multiplex and isothermal amplification solutions for clinical diagnostics. This partnership aimed to get FDA clearance of the Australian developer’s ResistancePlus MG molecular diagnostic for the sexually transmitted infection, which is constantly developing into an antibiotic-resistant superbug.

» Product Launches and Product Expansions:

- Dec-2021: Becton, Dickinson, and Company (BD) expanded its BD COR System to involve the latest MX instrument for high-throughput infectious diseases testing. This accessibility of the MX instrument is expected to expand the usage of the platform and automate testing for an expanding list of high-demand, important assays for women’s health & STI testing utilizing multiplex PCR assay design, beginning with BD’s CTGCTV2 test.

- Dec-2021: Hologic unveiled Panther Trax that presents the new addition to the Panther Scalable Solutions (PSS) portfolio of products. This product is expected to offer advancement in lab automation by physically connecting various Panther instruments together into one, powerful work cell, which is expected to enable labs to boost testing volumes without raising the number of staff.

- Sep-2020: Roche released the Elecsys HIV Duo immunoassay in the U.S., which has received FDA approval. By this separate measurement of the anti-HIV antibodies (caused by immune reaction) and HIV p24 antigen (the virus), this test can be used to identify an acute HIV infection prior to their existing methods.

- Oct-2019: Novosanis, a subsidiary of OraSure Technologies released two variants of its urine-capturing device, Colli-Pee. The latest variants enable the collection of smaller and bigger amounts of first-void urine in comparison to the original 20 mL device, which is expected to provide additional applications in the area of uro-oncology, infectious disease, and beyond.

» Acquisitions and Mergers:

- Mar-2021: Hologic took over Diagenode, a privately held, European developer and manufacturer of molecular diagnostic assays and epigenetics products. This acquisition aimed to strengthen its molecular diagnostics business by expanding its international capabilities, enhancing its regional time-to-market, and enabling the company to provide a wider, more differentiated test menu.

- Feb-2020: Bio-Rad Laboratories acquired Exact Diagnostics, developer of various diagnostic products. This acquisition aimed to access a complete catalog of molecular quality control products in the field of respiratory, transplant, virology, sexually transmitted infections, microbiology, and vector-borne diseases.

- Jan-2019: OraSure Technologies completed the acquisition of Novosanis, a privately-held, Belgian company. The acquisition aimed to represent a clear fit in its stated ‘core growth strategy for the Molecular business in order to expand its portfolio of collection products beyond oral samples by leveraging its expertise in stabilization and collection tools & technologies, which is utilized at home or in the clinic.

» Approvals and Trials:

- May-2019: Hologic got the FDA clearance for its new Aptima BV and Aptima CV/TV assays. This clearance is expected to offer a precise and objective way for diagnosing vaginitis, which is a very common and complicated health issue affecting millions of women every year.

- Mar-2019: Abbott received CE Mark for its Alinity m diagnostics system and assays. This latest technology is expected to assist in keeping up with the rising demand for infectious disease testing. Alinity m provides initial assays that include virologic testing for human immunodeficiency virus type 1 (HIV-1), sexual health-related testing for Chlamydia trachomatis, Trichomonas vaginalis, Neisseria gonorrhoeae, and Mycoplasma genitalium or CT/NG/TV/MG panel; hepatitis B virus (HBV) and hepatitis C virus (HCV); and high-risk human papillomavirus (HPV) testing.

- Jan-2019: Hologic received clearance from the U.S. Food and Drug Administration (FDA) for its Aptima Mycoplasma genitalium assay. This essay is the first and only FDA-cleared test to identify the under-recognized as well as highly common sexually transmitted infection (STI). The launch of the Aptima Mycoplasma genitalium assay is expected to provide healthcare professionals the opportunity to offer optimal care for their patients and support Hologic’s mission to develop advanced solutions that fulfill the emerging public health threats.

Scope of the Study

Market Segments Covered in the Report:

By Disease Type

- Chlamydia

- Herpes simplex

- Gonorrhea

- Syphilis

- Human papillomavirus (HPV)

- Other Disease

By Location of Testing

- Laboratory Testing

- Point of care (POC) Testing

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- BioMérieux S.A.

- Abbott Laboratories

- Becton, Dickinson and Company

- Hologic, Inc.

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- DiaSorin Molecular LLC

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- OraSure Technologies, Inc.

Unique Offerings from the Publisher

- Exhaustive coverage

- The highest number of market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- BioMérieux S.A.

- Abbott Laboratories

- Becton, Dickinson and Company

- Hologic, Inc.

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- DiaSorin Molecular LLC

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- OraSure Technologies, Inc.