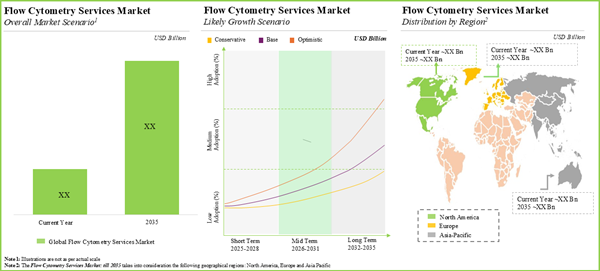

The global flow cytometry services market valued at USD 2.76 billion in 2025 is anticipated to grow at a CAGR of 9.73% during the forecast period, till 2035.

Flow Cytometry Services Market: Growth and Trends

Over time, flow cytometry has gained considerable attention as an analytical method in disease diagnosis and drug development. In biology and medicine, flow cytometry is known as a technique which is used to measure various physical and chemical characteristics of cells or particles as they pass through a laser beam when suspended in a fluid. Further, given the various limitations of conventional techniques, such as western blotting and immunohistochemistry, stakeholders are increasingly opting for innovative technologies, such as flow cytometry for clinical purposes. Conventional methods have low specificity and sensitivity, which may produce false results. Notably, flow cytometry techniques have the potential to overcome a number of these challenges.

Additionally, owing to the growing healthcare burden related to cancer and immunological disease conditions, and developments in immunological and biomedical research, the adoption of flow cytometry is expected to increase. This in turn will increase dependency on flow cytometry services providers to optimize process costs, overcome complexities associated with the process and improve process timelines.

Flow Cytometry Services Market: Key Insights

The report delves into the current state of the global flow cytometry services market and identifies potential growth opportunities within industry.

Some key findings from the report include:

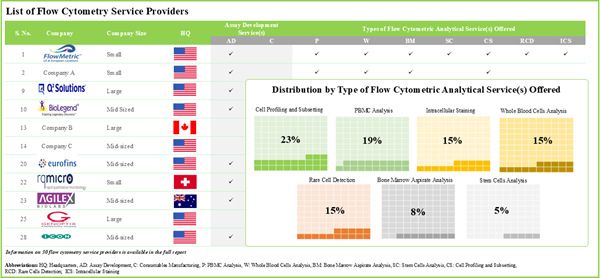

- 30 companies claim to offer various types of flow cytometry services; majority of these offer analysis-based flow cytometric services.

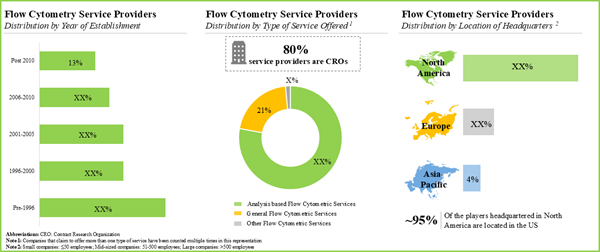

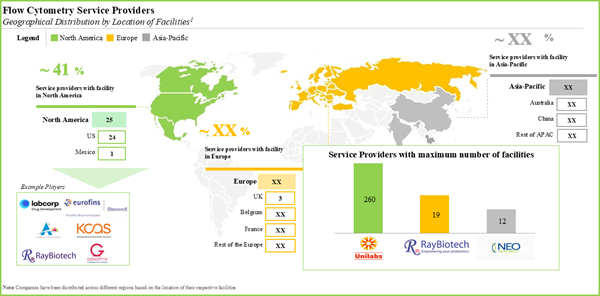

- The current market landscape features the presence of both well-established and new firms offering a wide range of flow cytometry services; a relatively large proportion of the players are based in North America.

- Examples of large flow cytometry services providers established post 2000 include Neo Genomics, Q2 Solutions, Cell Carta and ICON Speciality Labs.

- More than 70% of stakeholders claim to offer analysis-based flow cytometric services, followed by 21% of players offering general flow cytometric services.

- Close to 75% of players who are headquartered in the US are mid-sized players; the majority (around 80%) of these players claim to provide analysis-based flow cytometry services.

- Several players are also engaged in the manufacturing of different types of flow cytometers, including research flow cytometers and clinical flow cytometers for use across multiple application areas.

- More than 50% of the flow cytometers being manufactured are research flow cytometers; examples of players developing such systems include Becton Dickinson and Sysmex Partec.

- A large proportion (60%) of flow cytometers are manufactured using the cell-based technique; however, bead-based flow technique is also being employed by several players.

- With more than 100 facilities, flow cytometry service providers offer services across various regions around the world; majority of these facilities are established in emerging geographies.

- North America dominates the flow cytometry manufacturing market; examples of players based in this region include Agilent, Beckman Coulter and Thermofisher Scientific.

- In pursuit of a competitive edge, stakeholders are actively expanding their existing capabilities to enhance their respective offerings and comply with the evolving industry benchmarks.

- Over the past few years, there has been a significant increase in partnership activity in this domain; majority of the instances were related to mergers and acquisitions.

- The market is anticipated to grow at an annualized rate of ~9.73% till 2035; the future opportunity is expected to be well distributed across key geographical regions.

Report Scope:

Service

- Type of General Flow Cytometric Services

- Assay Development

- Consumables Manufacturing

- Type of Analysis based Flow Cytometric Services

- PBMC Analysis

- Whole Blood Cells Analysis

- Bone Marrow Aspirate Analysis

- Stem Cells Analysis

- Rare Cells Detection

- Cell Profiling and Subsetting

- Intracellular Staining

- Other Type of Flow Cytometric Services

Key Geographical Regions

- North America

- Europe

- Asia Pacific

- Rest of the World

Example Players in the Flow Cytometry Services Market, Profiled in the Report Include:

- FlowMetric Life Sciences

- Flow Contract Sites Laboratory

- Bio-Legend

- Q2 Solutions

- ProImmune

- MLM Medical Labs

- Unilabs

- Firalis

- Agilex Biolabs

Flow Cytometry Services Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the flow cytometry services market, focusing on key market segments, including service, number of facilities, key players and key geographical regions.

- Market Landscape: A comprehensive evaluation of the flow cytometry service providers, based on several relevant parameters, such as year of establishment, company size, location of headquarters, location of flow cytometry facilities, type of service(s) offered. Additionally, a comprehensive evaluation of manufacturers and the respective flow cytometry equipment developed / being developed by them.

- Company Competitiveness Analysis: A comprehensive competitive analysis of service providers in the flow cytometry industry, examining factors, such as service strength and supplier strength.

- Company Profiles: In-depth profiles of the companies offering services related to flow cytometry, focusing on overview of the company, financial information (if available), service portfolio, types of services offered, location of flow cytometry facilities and recent developments and an informed future outlook.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the flow cytometry services market, based on several parameters, such as year of partnership, type of partnership, type of partner, type of service offered, most active players (in terms of number of partnerships signed) and geography.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- FlowMetric Life Sciences

- Flow Contract Sites Laboratory

- Bio-Legend

- Q2 Solutions

- ProImmune

- MLM Medical Labs

- Unilabs

- Firalis

- Agilex Biolabs

Methodology

LOADING...