Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

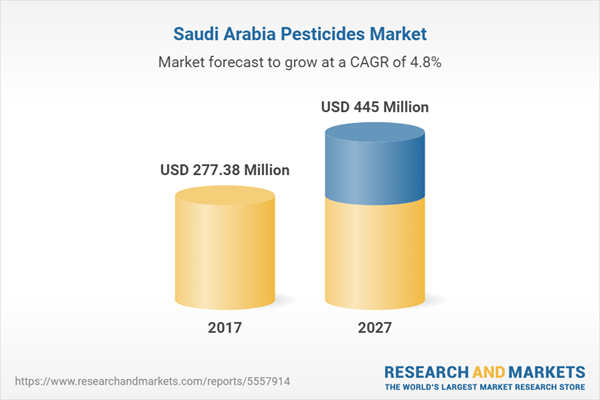

The pesticides market in Saudi Arabia has been witnessing significant growth over recent years. This growth can be attributed to a number of factors including the expansion of agricultural activities, the need for increased crop yield due to a growing population, and the heightened awareness of the threats posed by pests. In particular, Saudi Arabia's focus on achieving food security has led to an increased demand for pesticides to safeguard crop health and productivity. The market comprises a range of products including insecticides, herbicides, fungicides, and rodenticides, catering to a variety of crop protection needs. However, the region's pesticides market also faces challenges, particularly in terms of managing the environmental and health impacts of pesticide use.

Key Market Drivers

Surge in Agricultural Expansion & Crop Protection Need

One of the primary drivers propelling the Saudi Arabia Pesticides Market is the continuous expansion of agricultural activities in the country. As Saudi Arabia strives to enhance food security and reduce dependence on imports, there is a growing focus on increasing domestic agricultural production. The expansion of cultivated areas and the introduction of new crops create a heightened demand for effective pest control measures to protect crops from various pests and diseases.Pesticides play a crucial role in safeguarding crops and ensuring optimal yields. As the agricultural sector expands to meet the demands of a growing population, the need for effective pesticides becomes increasingly important. Pesticides not only protect crops from pests, pathogens, and weeds, but they also contribute to food security and sustainable agriculture practices. In the context of the Saudi Arabia Pesticides Market, the use of pesticides is a fundamental driver to ensure the productivity and profitability of the agricultural industry in the country. By employing innovative and sustainable pesticide solutions, Saudi Arabia can enhance crop protection, mitigate risks, and support the overall agricultural development in the region.

Changing Pest Dynamics & Emerging Threats

The evolving dynamics of pest populations and the emergence of new threats contribute to the demand for innovative and effective pesticide solutions in Saudi Arabia. Changes in climate, global trade patterns, and agricultural practices can lead to the introduction of new pests and diseases, posing challenges to existing pest management strategies.The need to address the rapidly changing dynamics and combat emerging threats drives continuous research and development in the pesticide industry. With the ever-evolving pest pressures and the urgent need to protect crops effectively, farmers are seeking innovative solutions. This has led to the introduction of novel pesticides that not only offer enhanced efficacy but also provide a higher level of specificity, targeting specific pests while minimizing potential harm to beneficial organisms. By embracing these advancements, farmers are able to adapt to the evolving challenges and safeguard their crops more effectively, ensuring sustainable agricultural practices for the future.

Adoption of Integrated Pest Management (IPM) Practices

The adoption of Integrated Pest Management (IPM) practices is a driving force in the Saudi Arabia Pesticides Market. IPM involves a holistic and sustainable approach to pest control, combining biological, cultural, physical, and chemical control methods. The emphasis on reducing reliance on chemical pesticides and incorporating environmentally friendly alternatives aligns with global trends in sustainable agriculture.Farmers in Saudi Arabia are increasingly recognizing the long-term benefits of Integrated Pest Management (IPM). By implementing IPM practices, they not only preserve beneficial insects but also reduce the environmental impact caused by excessive pesticide use. IPM helps minimize pesticide resistance, ensuring the effectiveness of pest management strategies in the long run. This shift towards integrated approaches in pest management has led to a growing demand for a diverse range of pesticides, including biopesticides and other environmentally friendly solutions. These innovative solutions are playing a crucial role in promoting sustainable agriculture and ensuring the well-being of both farmers and the environment.

Rising Awareness of Crop Quality and Export Standards

A notable driver influencing the Saudi Arabia Pesticides Market is the rising awareness of crop quality and adherence to international export standards. As the country seeks to expand its agricultural exports and increase participation in global markets, there is a heightened focus on ensuring that crops meet the required quality and safety standards.Pesticides play a critical role in achieving these standards by controlling pests and diseases that can compromise the quality of agricultural produce. The awareness among farmers about the importance of meeting international standards for pesticide residues and food safety acts as a driver for the adoption of effective and regulated pesticide solutions. The drivers of the Saudi Arabia Pesticides Market include the expansion of agricultural activities and crop protection needs, changing pest dynamics and emerging threats, government initiatives and agricultural policies, the adoption of Integrated Pest Management practices, and the rising awareness of crop quality and export standards. These drivers collectively shape the demand for pesticides in the country, reflecting the dynamic nature of the agricultural landscape in Saudi Arabia.

Key Market Challenges

Limited Adoption of Integrated Pest Management (IPM)

While the adoption of Integrated Pest Management (IPM) is recognized as a driver, the limited uptake of these practices represents a challenge for the Saudi Arabia Pesticides Market. IPM emphasizes a comprehensive and sustainable approach to pest control, incorporating biological, cultural, and mechanical methods alongside chemical control. However, widespread adoption of IPM requires a shift in traditional farming practices and increased awareness among farmers.One of the challenges in implementing integrated pest management (IPM) is the necessity of education and training programs to introduce farmers to IPM principles and practices. These programs aim to familiarize farmers with the benefits of IPM and provide them with the necessary knowledge and skills to adopt these practices effectively. However, a potential obstacle to the adoption of IPM is the resistance to change, which can stem from concerns about the initial investment required and the perceived complexity of implementing integrated approaches. To overcome these challenges, it is crucial to foster collaborative efforts between agricultural extension services, research institutions, and government agencies. By working together, these stakeholders can raise awareness about the advantages and feasibility of IPM, address misconceptions, and provide support and guidance to farmers as they transition to this sustainable and effective approach to pest management.

Resistance of Pesticides by Weeds & Pathogens

In addition to resistance challenges from insect pests, the Saudi Arabia Pesticides Market faces resistance issues with weeds and plant pathogens. Continuous use of herbicides and fungicides can lead to the development of resistance in weed and pathogen populations, compromising the effectiveness of these chemical controls.This challenge necessitates the development and adoption of new herbicide-tolerant crop varieties and the exploration of alternative weed and pathogen control methods. Crop rotation, the use of biological controls, and the integration of non-chemical management practices become essential components of a holistic strategy to combat resistance in weeds and pathogens.

Overcoming this challenge requires a proactive and diversified approach to pest and disease management in Saudi Arabia's agricultural systems. The challenges of the Saudi Arabia Pesticides Market include navigating the regulatory landscape, managing resistance in pests, addressing environmental and ecological concerns, promoting the adoption of Integrated Pest Management, and combating resistance in weeds and pathogens. Overcoming these challenges requires collaborative efforts from industry stakeholders, regulatory authorities, and farmers to foster sustainable and effective pest management practices in the Kingdom.

Key Market Trends

Growing Demand for Biopesticides

A prominent trend in the Saudi Arabia Pesticides Market is the increasing demand for biopesticides. Biopesticides are derived from natural sources such as bacteria, fungi, and botanical extracts, offering a more environmentally friendly alternative to conventional chemical pesticides. The growing awareness of environmental and health concerns associated with chemical pesticides has driven the adoption of biopesticides in Saudi Arabia.Biopesticides are increasingly being perceived as safer and more environmentally friendly options for pest management. With their reduced environmental impact, they have become attractive to farmers who are seeking sustainable solutions for pest control. The growing trend towards biopesticides also aligns with global efforts to promote integrated and eco-friendly pest control practices. By adopting these innovative approaches, farmers can contribute to the overall shift towards more sustainable agriculture in the Kingdom, ensuring the long-term health and productivity of their crops while minimizing harm to the environment.

Adoption of Precision Agriculture Technologies

The adoption of precision agriculture technologies is a transformative trend in the Saudi Arabia Pesticides Market. Precision agriculture involves the use of advanced technologies such as drones, satellite imaging, and sensor-based systems to optimize the application of pesticides. These technologies enable farmers to target specific areas with precision, reducing the overall quantity of pesticides used while enhancing efficacy.The growing trend towards precision agriculture in the Kingdom of Saudi Arabia is in perfect alignment with the government's steadfast focus on optimizing resource utilization, minimizing environmental impact, and enhancing overall agricultural efficiency. As farmers embrace the digital revolution, they are integrating advanced tools and technologies into their pest management strategies. This empowers them to engage in real-time monitoring, leverage data-driven decision-making processes, and achieve greater precision in the application of pesticides. By harnessing the power of digital solutions, farmers are able to maximize productivity while minimizing environmental harm, ultimately contributing to a more sustainable and prosperous agricultural sector.

Segmental Insights

Form Insights

Based on the Form, the Saudi Arabia Pesticides Market is currently experiencing a significant surge in demand for liquid pesticides. This preference for liquid form can be attributed to various factors. Liquid pesticides are known for their ease of application, making them convenient for farmers and pest control professionals. They offer higher efficacy, ensuring effective pest control and crop protection.On the other hand, dry pesticides also hold a substantial market presence. Despite their longer shelf-life and suitability for large-scale, commercial applications, they are still valued for their effectiveness. The extended shelf-life of dry pesticides provides flexibility for storage and transportation. The Saudi Arabia Pesticides Market is witnessing a growing demand for liquid pesticides, while also acknowledging the significance of dry pesticides in the industry. This diverse range of options allows for tailored pest management strategies, ensuring the highest level of effectiveness and efficiency in agricultural practices.

Regional Insights

The Western region of Saudi Arabia, encompassing the vibrant cities of Jeddah and Mecca, stands as a prominent player in the Saudi Arabian pesticides market. This remarkable position can be attributed to the region's rich agricultural practices, where the fertile lands beckon for meticulous care and attention. In this picturesque region, characterized by rolling hills and sprawling farmlands, the diligent farmers go to great lengths to protect their precious crop yields. Armed with their knowledge and experience, they embrace innovative techniques and the latest advancements in agricultural science. From precision irrigation systems to state-of-the-art monitoring technologies, these dedicated farmers leave no stone unturned in ensuring the optimal growth and health of their crops.The use of pesticides plays a crucial role in this agricultural landscape. The farmers in the Western region understand the delicate balance between pest control and environmental sustainability. Through judicious and responsible use of pesticides, they are able to safeguard their valuable crops from the threats posed by pests and diseases. By harnessing the power of these essential chemical solutions, they not only protect their harvests but also contribute to the overall agricultural success and prosperity of the region. The Western region's commitment to sustainable farming practices is evident in their adoption of organic and eco-friendly alternatives.

They strive to strike a balance between productivity and environmental stewardship, embracing methods that minimize the ecological footprint of their agricultural activities. With their unwavering dedication and adherence to best practices, the Western region of Saudi Arabia continues to solidify its position as a leader in the Saudi Arabian agricultural landscape. As their farms thrive and their yields flourish, they serve as a shining example of sustainable and prosperous farming for the entire nation.

Key Market Players

- BASF Saudi Arabia Co. Ltd.

- Bayer Saudi Arabia LLC

- Astra Industrial Complex Co. Ltd.

- Saudi Delta Company, Inc.

- The Arab Pesticides and Veterinary Drugs Mfg. Co (Mobedco)

- Alahmari Group

- Syngenta PPM Saudi Arabia

- Al Rowad Chemical Factory Company

- Saudi United Fertilizer Co. (Al-Asmida)

- SAMES Co. Ltd.

Report Scope:

In this report, the Saudi Arabia Pesticides Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Pesticides Market, By Type:

- Insecticides

- Fungicides

- Herbicides

- Others

Saudi Arabia Pesticides Market, By Form:

- Liquid

- Dry

Saudi Arabia Pesticides Market, By Product Type:

- Chemical

- Organic

Saudi Arabia Pesticides Market, By Crop Type:

- Oilseeds & Pulses

- Grains & Cereals

- Fruits & Vegetables

- Others

Saudi Arabia Pesticides Market, By Source:

- Import

- Domestic

Saudi Arabia Pesticides Market, By Region:

- Western Region

- Central Region

- Southern Region

- Eastern Region

- Northern Region

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Pesticides Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF Saudi Arabia Co. Ltd.

- Bayer Saudi Arabia LLC

- Astra Industrial Complex Co. Ltd.

- Saudi Delta Company, Inc.

- The Arab Pesticides and Veterinary Drugs Mfg. Co (Mobedco)

- Alahmari Group

- Syngenta PPM Saudi Arabia

- Al Rowad Chemical Factory Company

- Saudi United Fertilizer Co. (Al-Asmida)

- SAMES Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | November 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 80.64 Million |

| Forecasted Market Value ( USD | $ 115.25 Million |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 10 |